Filed by Noble Energy, Inc.

(Commission File No. 001-07964)

Pursuant to Rule 425

Under the

Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Rosetta Resources, Inc.

Commission File No.: 000-51801

This filing

relates to the proposed merger of a subsidiary of Noble Energy with Rosetta pursuant to the terms of an Agreement and Plan of Merger, dated as of May 10, 2015 (the “Merger Agreement”), by and among Noble Energy, Rosetta and Bluebonnet

Merger Sub Inc. The Merger Agreement is on file with the Securities and Exchange Commission as an exhibit to the Current Report on Form 8-K filed by Noble Energy on May 11, 2015, and is incorporated by reference into this filing.

NBL

NE noble energy

Energizing the World,

Bettering People’s Lives

UBS Global Oil and Gas

Conference

May 2015

Global Portfolio

Diversified portfolio of premier assets

Focused on Material Core Areas With

Running Room

Onshore U.S. - DJ Basin and Marcellus Shale

Deepwater - GOM, Eastern Mediterranean and West Africa

Best-in-class Project Execution

Delivered multiple onshore and offshore major projects on schedule

Visible,

Long-term Growth Options

High-impact, Strategic Exploration Program

Two play

opening prospects in 2015

Operational Leadership in All Areas

Safety,

environment, and community

Core operating areas

New ventures

2014 Reserves 1.4 BBoe

2015 Production ~ 307 MBoe/d

34% Oil, 9% NGL, 57% Natural Gas

2015 Capex ~ $2.9 Bn

2 NBL

Financial Position

Focused on maintaining strength through the cycle

Proactive Financial

Management

$5.7 B in total liquidity* at end of 1Q 15

Current Net

Debt-to-Capital: 28%

No near-term debt maturities

Investment Grade Rating

Moody’s: Baa2

S&P: BBB

Strong 2015 Hedging Position

70% crude oil and 48% U.S. natural gas

Israel gas a natural hedge

* Liquidity defined as cash on hand plus unused credit capacity

Favorable Leverage

34% 37% 33% 35%

29% 28%

YE 2013 YE 2014 1Q 2015

Debt-to-Cap Net Debt-to-Cap

Well Managed Maturity Profile

$ MM

4,000

3,000

2,000

1,000

0

2015 2016 2017 2018 2019 2020 2021 2022+

3 NBL

Strong Performance Metrics

Demonstrated track record of success

Proved Reserves (MMBoe)

1,600

1,400

1,200

1,000

800

600

400

200

0

CAGR 9%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Funds From Operations ($MM)

3,500

3,000

2,500

2,000

1,500

1,000

500

0

CAGR 13%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Production (MBoe/d)

350

300

250

200

150

100

50

0

CAGR 10%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

2013 2014

Market Cap ($B)

30

25

20

15

10

5

0

CAGR 13%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

4

NBL

ROSE Acquisition

Compelling entry into two premier U.S. Onshore plays

Enhances NBL’s

Leading Onshore Unconventional Business

Impactful positions in Eagle Ford Shale and Permian

1,800 gross horizontal locations providing 1 BBoe net unrisked potential

Production CAGR of

more than 15% over next several years

Attractive Valuation Metrics

EV / 1Q

2015 Production - ~$58,500 per Boe/d

EV / Proved Reserves - ~$13.65 per Boe

Immediately Accretive to the Portfolio and Financial Measures

Neutral on key

credit metrics

Leverages Onshore Technical and Operational Expertise

Expect

to Close in 3Q 2015

Rosetta RESOURCES

5 NBL

New Positions in U.S. Unconventional Plays

Adds diversity and optionality to onshore portfolio

Permian

46,000 net acres Delaware Basin

10,000 net acres Midland Basin

Average WI ~72%

1,200 gross future locations

7 MBoe/d 1Q15 production

Eagle Ford

50,000 net acres, primarily in Dimmit & Webb counties

Average WI - 100%

640 gross future locations

59 MBoe/d 1Q15 production

Extensive Technical Review and Knowledge of Basins

Well-Positioned Acreage with Strong

Economics

60%+ total liquid component

Continued Well Performance Improvements

Moving into best areas

Modifying completion designs

Substantial Running Room

10+ year inventory in Eagle Ford

20+ year inventory in Permian

Multi-zone, stacked pay potential

6 NBL

Value Enhancing Opportunities

Leverage learnings from the DJ Basin and Marcellus

Improve Operational and Capital

Efficiencies

Focus on core acreage position

Extend lateral lengths

Optimize well spacing

Refine completion designs and technique

Anticipate Significant Well Cost Reductions

Establish stable drilling program

Reduce drill days and cycle times

Economies of scale

Development Plan Approach to Facilities and Infrastructure

NBL Financial Strength and

Flexibility

7 NBL

Material Volume Growth to NBL

Accelerating production to 100 MBoe/d by 2018

Substantial Long-Term Growth

Over 15% production CAGR through 2018

Near-term growth driven by Eagle Ford

Long-term upside through Permian

Operating Cash Flows* in Excess of Capital Investments

Annually

Current Production Equivalent to

NBL’s Third Largest Core Area

Increases reserves and production by ~ 20%

* Operating cash flows represents

total revenues (including hedges) less operating expenses, severance taxes, and allocated interest

Eagle Ford & Permian

Production Outlook

MBoe/d

100

75

50

25

2015E 2016E 2017E 2018E

8 NBL

DJ Basin 2015 Operations

Focus on enhancing core positions

$1.1B Capital Program Delivers Over 5%

Volume Growth

1Q15 total production of 116 MBoe/d

Current horizontal volume

up 250% versus 2012 avg.

Activity Focused in High-Value Areas (Wells Ranch and East Pony)

Currently operating 4 drilling rigs in basin

High liquids content (>70%), lower capital and

LOE

Optimizing well density and NPV per section

Increasing Value through Long

Laterals

Substantial cost efficiencies and enhanced recovery per lateral foot

Expanding Natural Gas Processing and Crude Oil Takeaway

Material compression

and processing adds in first half of 2015

WY NE

CO CO

N Colorado

Greater Wattenberg

NBL Interests CO

MBoe/d

Net DJ Horizontal Production

100

75

50

25

0

2011

2012

2013

2014

1Q15

9 NBL

Continued Drilling Efficiencies – DJ Basin

Delivering lower well costs and more completions

Accelerated Drilling Performance

Footage

1,750

1,500

1,250

1,000

750

500

1Q15 Avg

1,724

# of Days

12

9

6

3

0

2012

2013

2014

2015E

Total Footage Per Rig Per Day * Spud to Rig Release **

* Total vertical and horizontal footage

based on rig operating days per year (excluding rig move days)

** Spud to rig release timing based on standard lateral length (4,500 feet)

Drilling 70% of 2014 Total Footage* With 40% of Rigs

Retained most efficient rigs

2015 average lateral length up 20% from 2014

2015 Target Spud to Rig Release of Under 8 Days

(Standard Lateral Length)

1Q15 actual of approximately 7 days

Reduced

Drilling Times Delivering

Additional Well Completions in 2015

Deploying

additional frac crew in 2H15

Record Drilling Highlights

Recent 9,280 foot

lateral well in 7 days (spud to rig release)

10 NBL

Marcellus 2015 Operations

JV focused on optimal capital allocation

$700MM Capital Program Delivers Over

40% Volume Growth

1Q15 total production of 393 MMcfe/d

Current horizontal

volume up 330% versus 2012 avg.

Operated Program Reduced to 1 Horizontal Drilling Rig

2 to 3 non-operated rigs focused in dry gas areas

Maximizing Value Through Long Laterals and

Enhanced Completion Designs

Continued Performance Improvement

MMcfe/d

Net Marcellus Production

400

300

200

100

0

2011

2012

2013

2014

1Q15

OH PA

Majorsville

SW PA Dry

OPS

WV

PA

WV

Wet Gas Acreage

Dry Gas Acreage

11 NBL

Gulf of Mexico

Sustained

value creation with visibility for significant growth

Proven Track Record of Success

Leading-edge technology with disciplined processes

Exploration Successes Drive Near-term

Production Growth

Big Bend commence production in 4Q 2015, Dantzler by end of 2015

Gunflint online by mid-2016

Existing Infrastructure Leads to Short Project Cycle Times

Focus on high-value opportunities

Material Exploration Upside

Maturing exploration portfolio for future drilling readiness

NBL Interests Producing Under

development Discovery

Louisiana

Swordfish 85% WI

Galapagos 26% Avg WI

Raton / Raton South 67% / 79% WI

Lorien 60% WI

Katmai 50% WI

Ticonderoga 50% WI

Gunflint 31% WI

Dantzler 45% WI

Big Bend 54% WI

Troubadour 60% WI

12 NBL

Substantial GOM Growth

Delivering strong oil production exiting 2015

MBoe/d GOM Production

30 20 10 0

2013 2014 2015E 2016E

Existing Production

New Projects

2016 Average Production Estimated to Double 2015 Volume

Three Major Projects Online By

Mid-2016

Big Bend commence production in 4Q15, Dantzler by end of 2015

Gunflint online by mid-2016

NBL GOM Cash Margins Competitive With Onshore

U.S. Oil Plays

LLS pricing at a premium to U.S. resource plays

Attractive

cost structure

2016 Drilling Program Focused on Future Growth

Potential

Katmai appraisal

1 to 2 exploration wells planned

13 NBL

West Africa

Substantial

cash-flow with material upside

Innovative Approach to Value Creation

Liquids

and gas monetization with LPG, LNG and Methanol

Maximizing and Sustaining Current Production

Relatively shallow declines at Alba and Aseng

Recent production enhancements at Alen

Facility maintenance and project turnarounds in 1H 2015

Cameroon Exploration

Well Planned for Mid-2015

Cheetah gross mean resources in excess of 100 MMBoe

Results expected in 3Q 2015

Expanding Regional Position into Highly

Prospective Areas

Alba Field 34% WI

Cameroon

Equatorial Guinea

Alen 45% WI

Methanol Plant 45% WI

LPG Plant 28% WI

YoYo License 50% WI

Bioko Island

Aseng 38% WI

Cheetah Prospect

Tilapia PSC 47% WI

NBL Interests

Producing

Discovery

Exploration

14 NBL

Cameroon – Cheetah Prospect

First Cretaceous oil prospect in Douala Basin

Gross Mean Unrisked Resources in Excess of 100

MMBoe

WI 47%, NRI 35%

Well Summary

Water depth: 85 ft.

Total planned depth: 13,100 ft.

Prospect Characteristics

Multiple Upper Cretaceous targets

Primary risk: reservoir quality

4-way dip closed structure

Geologic chance of success 20-25%

Results Anticipated in 3Q 2015

NBL Interests

Producing

Discovery

Exploration

Alba

Equatorial Guinea

Alen

Aseng

Cheetah Prospect

Cameroon

Cheetah

Note: image represents one of multiple potential sand intervals

15 NBL

Eastern Mediterranean

World-class discoveries with world-class opportunities

Over 40 Tcf Gross

Resources

Discovered

Outstanding Operational Performance from Tamar

Averaging 750 MMcf/d since startup

Generating strong cash flow to support

future projects

Significant Domestic and Regional

Gas Demand

Working with Gov’t of Israel on

Roadmap to Sanction Developments

Regulatory clarity / fiscal stability

Material Remaining Exploration Potential

NBL Interests

Producing

Discovery

Cyprus 70% WI

Tamar 36% WI

Leviathan 40% WI

Tamar SW

36% WI

Tel Aviv

Ashdod

AOT

47% WI

Israel

Egypt

16

NBL

10 Tcf Tamar Field

Supplying growing domestic and regional demand

Outstanding Operational

Performance

Near 100% facility uptime

Current deliverability capacity of over

1.1 Bcf/d

Averaged 750 MMcf/d since startup

Onshore AOT Compression Project

on Schedule

Mid-2015 startup

Provides additional peak gas capacity

Additional Expansion of Deliverability

Requires Regulatory Certainty

Supported by domestic and regional export customers

Includes Tamar SW

development

17

NBL

Best-In-Class Exploration Results

Historical exploration success rate and discovery costs

Overall Success Rate

Commercial Success Rate

Success Rate

80%

60%

40%

20%

0%

Noble

Kosmos

Statoil

Eni

Tullow Oil

Murphy Oil

Marathon

RWE Dea

Hess

ExxonMobil

OMV

Pioneer

Chevron

PETRONAS

Apache

Total

Shell

BP

Anadarko

Santos

BG

Lundin

Occidental

Maersk

Premier Oil

Cairn Energy

Wintershall

Conoco

Woodside

BHP Billiton

Repsol

INPEX

Talisman

Petrobras

EOG

Devon

Chesapeake

10-Year

5-Year

Discovery Cost ($/Boe)

$6

$5

$4

$3

$2

$1

$0

Noble

Pioneer

Anadarko

Chesapeake

EOG

Eni

ExxonMobil

BG

Chevron

Occidental

Petrobras

Total

Conoco

Santos

Shell

Tullow

Devon

Apache

Murphy Oil

Marathon

Repsol

Hess

Statoil

PETRONAS

Woodside

BP

RWE Dea

OMV

Kosmos

Talisman

Lundin

Cairn

Wintershall

Maersk

INPEX

Premier Oil

BHP Billiton

18

NBL

Source: Wood Mackenzie

Falkland Islands

New

frontier with significant prospectivity

Over 10 MM Gross Acres

North Basin -

operated with 75% WI

South Basin - operated with 35% WI

Multi-billion barrel

gross unrisked resource potential

2,500 sq. miles 3D seismic acquired to date

Similar Geologic Plays to West Africa

Initial Operated Prospect to Spud by

End of 2Q15

Humpback, one of multiple stacked fan prospects

Acquisition of

Rhea Acreage

De-risked by nearby multiple discoveries including 400+ MMBoe Sea Lion

~ 250 MMBo prospect to spud by the end of 2015

Sea Lion Discovery

Rhea

North Basin

Falkland Islands

Humpback

South Basin

Darwin Discovery

NBL Interests

Basin Floor Fan

Slope Fan

Tilted Fault Block

19

NBL

Noble Energy

Designed to

succeed in any environment

Well-Balanced, Diversified Portfolio Provides Exceptional Optionality

Substantial proved reserves and unbooked resources

Crude oil and natural gas exposure

U.S. unconventional, global offshore and exploration

Disciplined and Prudent

Investment Approach

Focus on retaining strength through the cycle

Strong

Financial Capacity

Substantial existing liquidity

Commitment to investment

grade rating

Proficient Organizational Capability

Onshore and offshore

operations

Exploration and major project execution

20

NBL

Forward-looking Statements and Other Matters

This presentation contains certain “forward-looking statements” within the meaning of federal securities laws. Words such as “anticipates”,

“believes,” “expects”, “intends”, “will”, “should”, “may”, and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of

historical fact and reflect Noble Energy’s current views about future events. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Noble Energy and Rosetta, including

future financial and operating results, Noble Energy’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts, including estimates of oil and

natural gas reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results of operations, projected cash flow and liquidity, business strategy and other

plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this presentation will occur as projected and actual results may differ materially from those projected. Forward-looking

statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without

limitation, the ability to obtain the requisite Rosetta shareholder approval; the risk that Rosetta or Noble Energy may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory

approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger, the risk that a condition to closing of the merger may not be satisfied, the timing to consummate the proposed merger, the

risk that the businesses will not be integrated successfully, the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected, disruption from the transaction making

it more difficult to maintain relationships with customers, employees or suppliers, the diversion of management time on merger-related issues, the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of

estimated reserves, the ability to replace reserves, environmental risks, drilling and operating risks, exploration and development risks, competition, government regulation or other actions, the ability of management to execute its plans to meet

its goals and other risks inherent in Noble Energy’s and Rosetta’s businesses that are discussed in Noble Energy’s and Rosetta’s most recent annual reports on Form 10-K, respectively, and in other Noble Energy and Rosetta reports

on file with the Securities and Exchange Commission (the “SEC”). These reports are also available from the sources described above. Forward-looking statements are based on the estimates and opinions of management at the time the statements

are made. Noble Energy undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

This presentation also contains certain historical and forward-looking non-GAAP measures of financial performance that management believes are good tools for

internal use and the investment community in evaluating Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value and compare companies in the crude oil and natural gas industry. Please also see Noble

Energy’s website at http://www.nobleenergyinc.com under “Investors” for reconciliations of the differences between any historical non-GAAP measures used in this presentation and the most directly comparable GAAP financial measures.

The GAAP measures most comparable to the forward-looking non-GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort.

NBL

Forward-looking Statements and Other Matters

The Securities and Exchange Commission requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual

production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC permits the optional disclosure of probable and possible reserves, however, we have not disclosed our

probable and possible reserves in our filings with the SEC. We use certain terms in this presentation, such as “discovered unbooked resources”, “resources”, “risked resources”, “recoverable resources”,

“unrisked resources”, “unrisked exploration prospectivity” and “estimated ultimate recovery” (EUR). These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and

accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and risk

factors in our most recent Form 10-K and in other reports on file with the SEC, available from Noble Energy’s offices or website, http://www.nobleenergyinc.com.

Additional Information And Where To Find It

This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Noble Energy and Rosetta, Noble Energy will file with the SEC a Registration

Statement on Form S-4 that will include a proxy statement of Rosetta that also constitutes a prospectus of Noble Energy. Rosetta will mail the proxy statement/prospectus to its shareholders. This document is not a substitute for any prospectus,

proxy statement or any other document which Noble Energy or Rosetta may file with the SEC in connection with the proposed transaction. Noble Energy and Rosetta urge Rosetta investors and shareholders to read the proxy statement/prospectus regarding

the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at

the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Noble Energy’s website (www.nobleenergyinc.com) under the tab “Investors” and then under the heading “SEC Filings.” You may also

obtain these documents, free of charge, from Rosetta’s website (www.rosettaresources.com) under the tab “Investors” and then under the heading “SEC Filings.”

Participants In The Merger Solicitation

Noble Energy, Rosetta, and their respective directors,

executive officers and certain other members of management and employees may be soliciting proxies from Rosetta shareholders in favor of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed

participants in the solicitation of Rosetta shareholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Noble Energy’s executive officers

and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find information about Rosetta’s executive officers and directors in its definitive proxy statement filed with the SEC on March 26, 2015. Additional

information about Noble Energy’s executive officers and directors and Rosetta’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies

of these documents from Noble Energy and Rosetta using the contact information above.

NBL

NBL

ne

noble energy

Energizing the World,

Bettering People’s Lives®

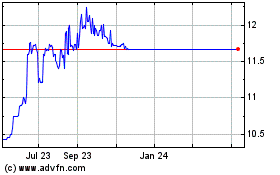

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Apr 2023 to Apr 2024