UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 3, 2016

ROYAL GOLD, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-13357 |

84-0835164 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

80202-1132 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

|

Item 2.02 |

Results of Operations and Financial Condition. |

On February 3, 2016, the

Company reported its second fiscal quarter 2016 financial results. A copy of the press release is furnished as Exhibit 99.1

to this Current Report on Form 8-K.

The information furnished

under this Item 2.02, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated February 3, 2016 regarding Second Fiscal Quarter 2016 Results. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

| |

(Registrant) |

| |

|

|

| Dated: February 4, 2016 |

By: |

/s/ Bruce C. Kirchhoff |

| |

|

Name: |

Bruce C. Kirchhoff |

| |

|

Title: |

Vice President, General Counsel and Secretary |

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated February 3, 2016 regarding Second Fiscal Quarter 2016 Results. |

EXHIBIT 99.1

Royal

Gold Reports Record Revenue of $98 Million

in

its Second Fiscal Quarter 2016

DENVER, COLORADO. FEBRUARY 3, 2016: ROYAL

GOLD, INC. (NASDAQ: RGLD; TSX: RGL) (together with its subsidiaries, “Royal Gold” or the “Company”)

reports results for its second quarter of fiscal 2016 (“second quarter”), including record revenue of $98.1 million,

up 60% from $61.3 million in the prior year quarter. Net income attributable to Royal Gold stockholders was $15.1 million, or $0.23

per share, as compared to a net loss attributable to Royal Gold stockholders of $6.5 million, or ($0.10) per share, for the prior

year quarter.

Second Quarter Highlights Compared with the Year-ago Quarter:

| · | Record revenue of $98.1 million, an increase

of 60% |

| · | Record volume of 88,700

Gold Equivalent Ounces (“GEOs”1),

an increase of 74% |

| · | Operating cash flow of $52.1 million,

an increase of 75% |

| · | Record dividends paid of $14.4 million,

or 28% of operating cash flow, yielding 3.0% at the current share price |

| · | Adjusted EBITDA of $70.0 million, an increase

of 46% |

“Increased production

from Mount Milligan and contributions from our recently acquired streams at Pueblo Viejo, Andacollo, Wassa and Prestea drove our

record performance in the second quarter as expected,” commented Tony Jensen, President and CEO. “Impressive volume

growth at these properties and stability within the rest of the portfolio are yielding solid financial results and generating strong

free cash flow.”

Second quarter revenue

was comprised of stream revenue of $67.3 million and royalty revenue of $30.8 million, at an average gold price of $1,106 per ounce.

Stream segment gold purchases totaled approximately 75,800 ounces in the second quarter. The Company sold approximately 61,600

ounces of gold from its stream segment, and had approximately 25,700 ounces in inventory at December 31, 2015, as previously guided,

up from 11,500 ounces at September 30, 2015.

Net income attributable

to Royal Gold stockholders was $15.1 million, or $0.23 per share, compared to a net loss attributable to Royal Gold stockholders

of $6.5 million, or ($0.10) per share for the prior year quarter. The increase in our earnings per share was primarily attributable

to an increase in our revenue. During the prior year quarter, the Company recognized impairment charges of $29.6 million on certain

non-principal royalty interests, which impacted earnings per share by $0.34 per share, after taxes.

| 1 | GEOs are calculated as revenue divided by the average quarterly price per ounce of gold. Net of

stream payments GEOs were 68,300 in the second quarter, compared with 45,900 net GEOs in the year-ago quarter, an increase of 49%. |

Cost of sales was approximately

$22.6 million for the second quarter, which equates to an average purchase price of $370 per stream ounce. This is compared to

$6.2 million, or $435 per stream ounce for the prior year quarter. The increased cost of sales is primarily attributable to higher

production at Mount Milligan and new stream production at Andacollo, Pueblo Viejo and Wassa/Prestea. Cost of sales is specific

to each of our stream agreements, where we purchase gold for a cash payment.

Adjusted EBITDA2

for the second quarter was $70.0 million ($1.08 per basic share), representing 71% of revenue, compared with Adjusted EBITDA of

$48.0 million ($0.74 per basic share), or 78% of revenue, for the year-ago quarter. Adjusted EBITDA as a percentage of revenue

declined due to increased contribution from the Company’s streaming segment, which includes a cost of sales.

We recognized income tax

expense totaling $4.7 million in the second quarter compared with an income tax benefit of $1.8 million during the prior year quarter.

This resulted in an effective tax rate of 25.4% in the current period, compared with 22.4% in the quarter ended December 31, 2014.

Depreciation, depletion

and amortization increased to $40.4 million for the quarter ended December 31, 2015, from $20.3 million for the quarter ended December

31, 2014, reflecting the ramp-up of production from Mount Milligan and new stream production.

Interest and other expense

increased to $8.9 million for the quarter ended December 31, 2015, from $6.4 million for the quarter ended December 31, 2014. This

was primarily due to an increase in interest expense associated with the outstanding balance on our revolving credit facility.

The Company had $350 million outstanding under the revolving credit facility as of December 31, 2015, and did not have any amounts

outstanding under the revolving credit facility during the quarter ended December 31, 2014.

Working capital totaled approximately $142.3 million at December

31, 2015. When combined with the $300 million of availability under our revolving credit facility, total liquidity at December

31, 2015, was approximately $442.3 million. Cash flow from operations was $52.1 million for the three months ended December 31,

2015.

RECENT DEVELOPMENTS

Amendment of Gold Stream at Wassa and Prestea

On December 30, 2015, RGLD

Gold AG (“RGLD Gold”), a wholly-owned subsidiary of the Company, amended its $130 million gold stream transaction with

a wholly-owned subsidiary of Golden Star Resources Ltd. (together “Golden Star”). The parties executed an amendment

providing for an additional $15 million investment (for a total investment of $145 million) by RGLD Gold. If Golden Star procures

a minimum of $5 million of third party investment, RGLD Gold will increase its investment by a further $5 million (for a total

investment of $150 million) subject to satisfaction of certain conditions.

| 2 | The Company defines Adjusted EBITDA, a non-GAAP financial measure, as net income plus depreciation,

depletion and amortization, non-cash charges, income tax expense, interest and other expense, and any impairment of mining assets,

less non-controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio

restructuring gains or losses (see Schedule A). |

As of December 31, 2015,

RGLD Gold has advanced $75 million, and has received 12,700 ounces of gold deliveries, resulting in $13.4 million in sales in just

two quarters. RGLD Gold expects to advance the balance of our commitment in four quarterly payments as follows: (i) $20 million

on each of April 1, July 1 and October 1, 2016, and (ii) $10 million on January 1, 2017; however funds will be advanced on a pro

rata basis with project development spending, subject to satisfaction of certain conditions. Golden Star will deliver to RGLD Gold

9.25% of gold produced from all their Ghanaian properties, until the earlier of (i) December 31, 2017 or (ii) the date at which

the Wassa and Prestea underground projects achieve commercial production. At that point, the stream percentage will increase to

10.5% (or to 10.9% if the total investment increases to $150 million) of gold produced until an aggregate 240,000 ounces have been

delivered (or 250,000 ounces if the total investment increases to $150 million). Once the applicable delivery threshold is met,

the stream percentage will decrease to 5.5% for all production thereafter.

RGLD Gold will pay Golden

Star a cash price equal to 20% of the spot price for each ounce of gold delivered at the time of delivery until the applicable

delivery threshold is met, and 30% of the spot price for each ounce of gold delivered thereafter.

Mount Milligan

Thompson Creek reported

production of 58,300 ounces of payable gold during the quarter, an increase of 42% over the prior year quarter. Mill throughput

averaged 48,176 tonnes per day for the quarter, an increase of 10% over the prior year quarter. Thompson Creek surpassed the mill

design capacity of 60,000 tonnes per day during the last week of December when mill throughput averaged 61,212 tonnes with highest

daily throughput in December of 64,478 tonnes. Thompson Creek continues to optimize the operation and expects to make a decision

on construction of the permanent secondary crusher during the March 2016 quarter.

Gold grades averaged 0.63

grams per tonne, an increase of 17% over the prior year quarter and gold recoveries averaged 67.3% for the quarter, an increase

of 11% over the prior year quarter.

For calendar 2016, Thompson

Creek forecasts annual gold payable production of 240,000 to 270,000 ounces, an increase of approximately 10% to 24% over calendar

year 2015 production of approximately 218,000 ounces.

Thompson Creek announced

that they have engaged Moelis & Company and BMO Capital Markets to assist them in evaluating strategic and financial alternatives,

including debt refinancing and restructuring, new capital transactions and asset sales. The Company continues to monitor Thompson

Creek’s financial situation and is working to ensure our interests at Mount Milligan are protected.

Phoenix Gold

On January 11, 2016, Rubicon

Minerals Corporation (“Rubicon”) provided an updated geological model and mineralized material statement for the Phoenix

Gold Project that included a significant reduction in mineralized material compared to previous statements provided by Rubicon.

Rubicon suspended activities related to their previously announced Phoenix Project Implementation Plan and has retained BMO

Capital Markets, TD Securities, and Stikeman Elliott LLP as advisors to assist in evaluating strategic alternatives available to

the Company.

Royal Gold anticipates that it will conclude

its technical evaluation of the revised geologic model and mineralized material statement prior to the release of our financial

results for the period ended March 31, 2016. Upon completion of our evaluation and upon consideration of any strategic developments

with Rubicon or the Phoenix Gold Project, the Company could determine that an impairment of its carrying value in the near future

is necessary. For the period ended December 31, 2015, the carrying value of the Phoenix Gold Project comprised approximately 2.5%

of the Company’s total royalty and stream interests, net.

Pueblo Viejo

In November 2015, Barrick

announced that two of three electric motors at the Pueblo Viejo oxygen plant experienced unexpected failures and were shipped to

the United States for repair. A comprehensive plan to mitigate the impact of the motor failure was implemented by Barrick in December

2015, which involved installing a number of portable compressors in December and early January. This restored mill production to

near full capacity during the second week in January. One of the two repaired motors has arrived in the Dominican Republic and

will be installed and tested by the end of January 2016. The second motor is due to arrive on-site in mid-February 2016.

Voisey’s Bay

Production attributable

to royalty revenue recognized at Voisey Bay during the second quarter was 15.2 million pounds of copper and 23.6 million pounds

of nickel. Vale reported that its new Long Harbour hydrometallurgical plant will begin processing only Voisey’s Bay concentrate

by the first calendar quarter of 2016. Vale has made clear its intention to deduct full Long Harbour operating costs, depreciation

and cost of capital from actual proceeds when calculating the net smelter return royalty which could have the effect of further

reducing or eliminating royalty payments. Royal Gold strongly disagrees with Vale’s position that operating costs, capital

costs and cost of capital are permissible net smelter return deductions pursuant to the royalty agreement and is aggressively pursuing

its legal remedies.

Wassa and Prestea Development

Golden Star reported that

the Wassa Underground project made substantial progress during calendar 2015, with stope development of the upper mineralization

is expected to commence in the June 2016 quarter and first ore production expected mid-calendar 2016. Infill drilling early

in calendar 2015 was successful in expanding the F Shoot target and further drilling will be conducted to determine additional

mineral potential in the area.

Golden Star also reported

work on the Prestea Underground project is progressing as scheduled with first ore production is expected in early calendar 2017.

PROPERTY HIGHLIGHTS

A summary of calendar year production estimates

versus actuals at certain producing properties can be found on Table 3. Highlights at certain of the Company’s principal

producing and development properties during the second quarter, compared with the prior fiscal year quarter ended December 31,

2014, are detailed in our form 10-Q. Production for our producing properties reflects the actual production subject to our interests

reported to us by the various operators or from the operator’s publicly available information.

CORPORATE PROFILE

Royal Gold is a precious metals royalty and stream company engaged

in the acquisition and management of precious metal royalties, streams, and similar production based interests. The Company owns

interests on 195 properties on six continents, including interests on 38 producing mines and 24 development stage projects. Royal

Gold is publicly traded on the NASDAQ Global Select Market under the symbol “RGLD,” and on the Toronto Stock Exchange

under the symbol “RGL.” The Company’s website is located at www.royalgold.com.

For further information, please contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Note: Management’s conference

call reviewing the second fiscal quarter results will be held Thursday, February 4, 2016 at 10:00 a.m. Mountain Standard Time (noon

Eastern Standard Time) and will be available by calling (855) 209-8260 (North America) or (412) 542-4106 (international), conference

title “Royal Gold.” The call will be simultaneously broadcast on the Company’s website at www.royalgold.com

under the “Presentations” section. A replay of this webcast will be available on the Company’s website approximately

two hours after the call ends.

Cautionary “Safe Harbor” Statement

Under the Private Securities Litigation Reform Act of 1995: With the exception of historical matters, the matters discussed

in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results to differ

materially from projections or estimates contained herein. Such forward-looking statements include statements about the Company’s

ability to invest in additional quality properties; operators’ expectations about construction, ramp up, production, and

mine life; resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay);

statements about the amended streaming agreements at Wassa and Prestea, and expectations concerning near-term growth; and statements

about development, ramp-up, production and mine life at all the operations which are subject to our streaming agreements, including

without limitation Wassa, Prestea, Andacollo, Holt, Pueblo Viejo, Mount Milligan and Phoenix Gold. Factors that could cause

actual results to differ materially from the projections include, among others, precious metals, copper and nickel prices; performance

of and production at the Company's royalty and stream properties; the ability of operators of development properties to finance

project construction to completion and bring projects into production as expected; delays in securing or inability to secure necessary

governmental permits; decisions and activities of the operators of the Company's royalty and stream properties; unanticipated grade,

environmental, geological, seismic, metallurgical, processing, liquidity or other problems the operators of the mining properties

may encounter; completion of feasibility studies; changes in operators’ project parameters as plans continue to be refined;

changes in estimates of reserves and mineralization by the operators of the Company’s royalty and stream properties; contests

to the Company’s royalty and stream interests and title and other defects to the Company’s royalty and stream properties;

errors or disputes in calculating royalty and stream payments, or payments not made in accordance with royalty and stream agreements;

economic and market conditions; risks associated with conducting business in foreign countries; changes in laws governing the Company

and its royalty and stream properties or the operators of such properties; and other subsequent events; as well as other factors

described in the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the Securities and

Exchange Commission. Most of these factors are beyond the Company’s ability to predict or control. The Company disclaims

any obligation to update any forward-looking statement made herein. Readers are cautioned not to put undue reliance on forward-looking

statements.

TABLE 1

Second Quarter Fiscal 2016

Revenue and Reported Production for Principal

Royalty and Stream Interests

Three Months Ended December 31, 2015 and

December 31, 2014

(In thousands, except reported production

in oz. and lbs.)

| |

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

|

|

December 31, 2015 |

|

|

December 31, 2014 |

|

| Royalty/Stream |

|

Metal(s) |

|

Revenue |

|

|

Reported

Production1 |

|

|

Revenue |

|

|

Reported

Production1 |

|

| Stream: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mount Milligan |

|

Gold |

|

$ |

42,294 |

|

|

|

38,700 |

oz. |

|

|

$ |

17,318 |

|

|

|

14,300 |

oz. |

|

| Wassa/Prestea |

|

Gold |

|

$ |

9,776 |

|

|

|

8,800 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Pueblo Viejo |

|

Gold |

|

$ |

9,400 |

|

|

|

8,800 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Andacollo |

|

Gold |

|

$ |

5,718 |

|

|

|

5,200 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Other |

|

Gold |

|

$ |

124 |

|

|

|

100 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Royalty: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Peñasquito |

|

|

|

$ |

6,952 |

|

|

|

|

|

|

|

$ |

5,573 |

|

|

|

|

|

|

| |

|

Gold |

|

|

|

|

|

|

195,400 |

oz. |

|

|

|

|

|

|

|

125,000 |

oz. |

|

| |

|

Silver |

|

|

|

|

|

|

6.8 |

Moz. |

|

|

|

|

|

|

|

5.1 |

Moz. |

|

| |

|

Lead |

|

|

|

|

|

|

41.7 |

Mlbs. |

|

|

|

|

|

|

|

29.5 |

Mlbs. |

|

| |

|

Zinc |

|

|

|

|

|

|

98.0 |

Mlbs. |

|

|

|

|

|

|

|

84.0 |

Mlbs. |

|

| Voisey's Bay |

|

|

|

$ |

2,822 |

|

|

|

|

|

|

|

$ |

6,117 |

|

|

|

|

|

|

| |

|

Nickel |

|

|

|

|

|

|

23.6 |

Mlbs. |

|

|

|

|

|

|

|

19.6 |

Mlbs. |

|

| |

|

Copper |

|

|

|

|

|

|

15.2 |

Mlbs. |

|

|

|

|

|

|

|

30.1 |

Mlbs. |

|

| Holt |

|

Gold |

|

$ |

2,391 |

|

|

|

15,000 |

oz. |

|

|

$ |

2,676 |

|

|

|

14,300 |

oz. |

|

| Cortez |

|

Gold |

|

$ |

1,175 |

|

|

|

17,000 |

oz. |

|

|

$ |

5,001 |

|

|

|

60,400 |

oz. |

|

| Andacollo |

|

Gold |

|

$ |

- |

|

|

|

- |

oz. |

|

|

$ |

9,594 |

|

|

|

10,500 |

oz. |

|

| Other |

|

Various |

|

$ |

17,466 |

|

|

|

N/A |

|

|

|

$ |

15,025 |

|

|

|

N/A |

|

|

| Total Revenue |

|

|

|

$ |

98,118 |

|

|

|

|

|

|

|

$ |

61,304 |

|

|

|

|

|

|

TABLE 1

Second Quarter Fiscal 2016

Revenue and Reported Production for Principal

Royalty and Stream Interests

Six Months Ended December 31, 2015 and December

31, 2014

(In thousands, except reported production

in oz. and lbs.)

| |

|

|

|

Six Months Ended |

|

|

Six Months Ended |

|

| |

|

|

|

December 31, 2015 |

|

|

December 31, 2014 |

|

| Royalty/Stream |

|

Metal(s) |

|

Revenue |

|

|

Reported

Production1 |

|

|

Revenue |

|

|

Reported

Production1 |

|

| Stream: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mount Milligan |

|

Gold |

|

$ |

65,758 |

|

|

|

59,600 |

oz. |

|

|

$ |

36,975 |

|

|

|

29,700 |

oz. |

|

| Andacollo |

|

Gold |

|

$ |

16,433 |

|

|

|

14,700 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Wassa/Prestea |

|

Gold |

|

$ |

13,400 |

|

|

|

12,000 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Pueblo Viejo |

|

Gold |

|

$ |

9,400 |

|

|

|

8,800 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Other |

|

Gold |

|

$ |

177 |

|

|

|

200 |

oz. |

|

|

|

N/A |

|

|

|

N/A |

|

|

| Royalty: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Peñasquito |

|

|

|

$ |

14,998 |

|

|

|

|

|

|

|

$ |

12,684 |

|

|

|

|

|

|

| |

|

Gold |

|

|

|

|

|

|

421,900 |

oz. |

|

|

|

|

|

|

|

268,100 |

oz. |

|

| |

|

Silver |

|

|

|

|

|

|

14.1 |

Moz. |

|

|

|

|

|

|

|

11.6 |

Moz. |

|

| |

|

Lead |

|

|

|

|

|

|

90.8 |

Mlbs. |

|

|

|

|

|

|

|

70.8 |

Mlbs. |

|

| |

|

Zinc |

|

|

|

|

|

|

216.7 |

Mlbs. |

|

|

|

|

|

|

|

169.4 |

Mlbs. |

|

| Voisey's Bay |

|

|

|

$ |

8,266 |

|

|

|

|

|

|

|

$ |

11,726 |

|

|

|

|

|

|

| |

|

Nickel |

|

|

|

|

|

|

61.4 |

Mlbs. |

|

|

|

|

|

|

|

36.7 |

Mlbs. |

|

| |

|

Copper |

|

|

|

|

|

|

16.9 |

Mlbs. |

|

|

|

|

|

|

|

52.1 |

Mlbs. |

|

| Holt |

|

Gold |

|

$ |

5,069 |

|

|

|

31,300 |

oz. |

|

|

$ |

5,835 |

|

|

|

29,100 |

oz. |

|

| Cortez |

|

Gold |

|

$ |

2,987 |

|

|

|

39,600 |

oz. |

|

|

$ |

9,736 |

|

|

|

119,900 |

oz. |

|

| Andacollo |

|

Gold |

|

$ |

- |

|

|

|

- |

oz. |

|

|

$ |

20,093 |

|

|

|

21,500 |

oz. |

|

| Other |

|

Various |

|

$ |

35,685 |

|

|

|

N/A |

|

|

|

$ |

33,281 |

|

|

|

N/A |

|

|

| Total Revenue |

|

|

|

$ |

172,173 |

|

|

|

|

|

|

|

$ |

130,330 |

|

|

|

|

|

|

TABLE 2

Historical Production

| |

|

|

|

|

|

|

|

Reported

Production For The Quarter Ended1 |

|

| Property |

|

Royalty/Stream |

|

Operator |

|

Metal(s) |

|

Dec.

31, 2015 |

|

|

Sep.

30, 2015 |

|

|

Jun.

30, 2015 |

|

|

Mar.

31, 2015 |

|

|

Dec.

31, 2014 |

|

| Stream: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andacollo |

|

100% of gold produced |

|

Teck |

|

Gold |

|

|

5,200 |

oz. |

|

|

|

9,500 |

oz. |

|

|

|

N/A |

|

|

|

|

N/A |

|

|

|

|

N/A |

|

|

| Mount Milligan |

|

52.25% of payable gold |

|

Thompson Creek |

|

Gold |

|

|

38,700 |

oz. |

|

|

|

21,000 |

oz. |

|

|

|

23,000 |

oz. |

|

|

|

24,200 |

oz. |

|

|

|

14,300 |

oz. |

|

| Pueblo Viejo |

|

7.5% of gold produced up to 990,000 ounces; 3.75%

therafter |

|

Barrick (60%) |

|

Gold |

|

|

8,800 |

oz. |

|

|

|

N/A |

|

|

|

|

N/A |

|

|

|

|

N/A |

|

|

|

|

N/A |

|

|

| Wassa/Prestea |

|

8.5% of gold produced up to 185,000 ounces; 5.0%

therafter |

|

Golden Star |

|

Gold |

|

|

8,800 |

oz. |

|

|

|

3,200 |

oz. |

|

|

|

N/A |

|

|

|

|

N/A |

|

|

|

|

N/A |

|

|

| Royalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andacollo2 |

|

75% |

|

Teck |

|

Gold |

|

|

N/A |

|

|

|

|

N/A |

|

|

|

|

10,500 |

oz. |

|

|

|

9,500 |

oz. |

|

|

|

10,500 |

oz. |

|

| Cortez |

|

GSR1 and GSR2, GSR3, NVR1 |

|

Barrick |

|

Gold |

|

|

17,000 |

oz. |

|

|

|

22,600 |

oz. |

|

|

|

43,900 |

oz. |

|

|

|

65,200 |

oz. |

|

|

|

60,400 |

oz. |

|

| Holt |

|

0.00013 x quarterly average gold price |

|

St Andrew Goldfields |

|

Gold |

|

|

15,000 |

oz. |

|

|

|

16,300 |

oz. |

|

|

|

15,800 |

oz. |

|

|

|

16,700 |

oz. |

|

|

|

14,300 |

oz. |

|

| Peñasquito |

|

2.0% NSR |

|

Goldcorp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Gold |

|

|

195,400 |

oz. |

|

|

|

226,500 |

oz. |

|

|

|

296,900 |

oz. |

|

|

|

177,200 |

oz. |

|

|

|

125,000 |

oz. |

|

| |

|

|

|

|

|

Silver |

|

|

6.8 |

Moz. |

|

|

|

7.3 |

Moz. |

|

|

|

7.0 |

Moz. |

|

|

|

6.0 |

Moz. |

|

|

|

5.1 |

Moz. |

|

| |

|

|

|

|

|

Lead |

|

|

41.7 |

Mlbs. |

|

|

|

49.1 |

Mlbs. |

|

|

|

48.2 |

Mlbs. |

|

|

|

39.5 |

Mlbs. |

|

|

|

29.5 |

Mlbs. |

|

| |

|

|

|

|

|

Zinc |

|

|

98.0 |

Mlbs. |

|

|

|

118.7 |

Mlbs. |

|

|

|

88.9 |

Mlbs. |

|

|

|

82.6 |

Mlbs. |

|

|

|

84.0 |

Mlbs. |

|

| Voisey's Bay |

|

2.7% NSR |

|

Vale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Nickel |

|

|

23.6 |

Mlbs. |

|

|

|

37.8 |

Mlbs. |

|

|

|

9.0 |

Mlbs. |

|

|

|

17.2 |

Mlbs. |

|

|

|

19.6 |

Mlbs. |

|

| |

|

|

|

|

|

Copper |

|

|

15.2 |

Mlbs. |

|

|

|

1.7 |

Mlbs. |

|

|

|

20.8 |

Mlbs. |

|

|

|

N/A |

Mlbs. |

|

|

|

30.1 |

Mlbs. |

|

FOOTNOTES

Tables 1 and 2

| 1 | Reported production relates to the amount of metal sales that are subject to our royalty and stream interests for the stated

period, as reported to us by operators of the mines. |

| 2 | This royalty was terminated effective July 1, 2015. |

TABLE 3

Calendar 2015 Operators’ Production

Estimate

| | |

Calendar

2015 Operator’s Production Estimate1,2 | | |

Calendar

2015 Operator's Production

Actual3.4 | |

| | |

Gold | | |

Silver | | |

Base Metals | | |

Gold | | |

Silver | | |

Base Metals | |

| Royalty/Stream | |

(oz.) | | |

(oz.) | | |

(lbs.) | | |

(oz.) | | |

(oz.) | | |

(lbs.) | |

| Andacollo5 | |

| 52,200 | | |

| - | | |

| - | | |

| 47,600 | | |

| - | | |

| - | |

| Cortez GSR1 | |

| 104,100 | | |

| - | | |

| - | | |

| 113,700 | | |

| - | | |

| - | |

| Cortez GSR2 | |

| 27,900 | | |

| - | | |

| - | | |

| 35,000 | | |

| - | | |

| - | |

| Cortez GSR3 | |

| 132,000 | | |

| - | | |

| - | | |

| 148,700 | | |

| - | | |

| - | |

| Cortez NVR1 | |

| 97,200 | | |

| - | | |

| - | | |

| 110,100 | | |

| - | | |

| - | |

| Holt | |

| 64,000 | | |

| - | | |

| - | | |

| 63,000 | | |

| - | | |

| - | |

| Mount Milligan6 | |

| 200,000-220,000 | | |

| - | | |

| - | | |

| 218,100 | | |

| - | | |

| - | |

| Penasquito | |

| 700,000-750,000 | | |

| 24-26

million | | |

| - | | |

| 690,400 | | |

| 19.5

million | | |

| - | |

| Lead7,8 | |

| | | |

| | | |

| 175-185

million | | |

| | | |

| | | |

| 133.4

million | |

| Zinc7,8 | |

| | | |

| | | |

| 400-415

million | | |

| | | |

| | | |

| 299.5

million | |

| Pueblo Viejo9 | |

| 625,000-675,000 | | |

| | | |

| | | |

| 572,000 | | |

| - | | |

| - | |

| Wassa/Prestea10 | |

| 205,000-215,000 | | |

| | | |

| | | |

| 222,400 | | |

| | | |

| | |

| 1 | Production estimates received from our operators are for calendar 2015, except for Peñasquito

and Pueblo Viejo. There can be no assurance that production estimates received from our operators will be achieved. Please refer

to our cautionary language regarding forward looking statements preceding Table 1 above, as well as the Risk Factors identified

in Part I, Item 1A, of our Fiscal 2015 10-K for information regarding factors that could affect actual results. |

| 2 | The operator of our Voisey’s Bay interest did not release public production guidance for

calendar 2015, thus estimated and actual production information is not shown in the table. |

| 3 | Actual production figures shown are for the period January 1, 2015 through December 31, 2015, unless

otherwise noted. |

| 4 | Actual production figures for Andacollo and Cortez are based on information provided to us by the

operators, and actual production figures for Holt, Mount Milligan, Peñasquito (gold), Wassa and Prestea are the operators’

publicly reported figures. |

| 5 | The estimated and actual production figures shown for Andacollo are contained gold in concentrate. |

| 6 | The estimated and actual production figures shown for Mount Milligan are payable gold in concentrate. |

| 7 | The estimated gold and silver production figures reflect payable gold and silver in concentrate

and doré, while the estimated lead and zinc production figures reflect payable metal in concentrate. |

| 8 | The actual gold production figure for gold reflects payable gold in concentrate and doré

as reported by the operator through September 30, 2015. The actual production for silver, lead and zinc were not publicly available.

The Company’s royalty interest at Peñasquito includes gold, silver, lead and zinc. |

| 9 | The gold and silver stream at Pueblo Viejo was acquired during the quarter ended September 30,

2015 and the first gold delivery was received in December 2015 for the period July 1 – November 30, 2015. The estimated and

actual production figures shown are payable gold in doré and represent Barrick’s 60% interest in Pueblo Viejo. |

| 10 | The gold streams at Wassa and Prestea were acquired during the quarter ended September 30, 2015.

The estimated production figure shown is payable gold in doré. |

TABLE 4

Stream Summary

| | |

Three

months ended December 31, 2015 | | |

Three

months ended December 31, 2014 | | |

As of

December

31, 2015 | |

| Stream | |

Gold

ounces

purchased | | |

Gold

ounces

sold | | |

Average

realized gold

price/ounce | | |

Gold

ounces

purchased | | |

Gold

ounces sold | | |

Average

realized gold

price/ounce | | |

Gold

ounces in

inventory | |

| Mount Milligan | |

| 38,700 | | |

| 38,700 | | |

$ | 1,093 | | |

| 13,000 | | |

| 14,300 | | |

$ | 1,208 | | |

| 8,068 | |

| Wassa/Prestea | |

| 6,300 | | |

| 8,800 | | |

$ | 1,116 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 699 | |

| Pueblo Viejo | |

| 20,600 | | |

| 8,800 | | |

$ | 1,068 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 11,769 | |

| Andacollo | |

| 10,100 | | |

| 5,200 | | |

$ | 1,102 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 5,152 | |

| Phoenix Gold | |

| 100 | | |

| 100 | | |

$ | 1,126 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| - | |

| Total | |

| 75,800 | | |

| 61,600 | | |

$ | 1,094 | | |

| 13,000 | | |

| 14,300 | | |

$ | 1,208 | | |

| 25,688 | |

| | |

Six months ended December 31, 2015 | | |

Six months ended December 31, 2014 | | |

As of

December

31, 2015 | |

| Stream | |

Gold

ounces

purchased | | |

Gold

ounces

sold | | |

Average

realized gold

price/ounce | | |

Gold

ounces

purchased | | |

Gold

ounces sold | | |

Average

realized gold

price/ounce | | |

Gold

ounces in

inventory | |

| Mount Milligan | |

| 62,400 | | |

| 59,600 | | |

$ | 1,103 | | |

| 26,600 | | |

| 29,700 | | |

$ | 1,246 | | |

| 8,068 | |

| Andacollo | |

| 19,800 | | |

| 14,700 | | |

$ | 1,118 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 5,152 | |

| Wassa/Prestea | |

| 12,700 | | |

| 12,000 | | |

$ | 1,116 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 699 | |

| Pueblo Viejo | |

| 20,600 | | |

| 8,800 | | |

$ | 1,068 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| 11,769 | |

| Phoenix Gold | |

| 200 | | |

| 200 | | |

$ | 1,128 | | |

| N/A | | |

| N/A | | |

| N/A | | |

| - | |

| Total | |

| 115,700 | | |

| 95,300 | | |

$ | 1,104 | | |

| 26,600 | | |

| 29,700 | | |

$ | 1,246 | | |

| 25,688 | |

ROYAL GOLD, INC.

Consolidated Balance Sheets

(In thousands except share data)

| | |

December 31, 2015 | | |

June 30, 2015 | |

| ASSETS | |

| | | |

| | |

| Cash and equivalents | |

$ | 117,600 | | |

$ | 742,849 | |

| Royalty receivables | |

| 22,913 | | |

| 37,681 | |

| Income tax receivable | |

| 12,828 | | |

| 6,422 | |

| Stream inventory | |

| 8,289 | | |

| 2,287 | |

| Prepaid expenses and other | |

| 1,230 | | |

| 1,511 | |

| Total current assets | |

| 162,860 | | |

| 790,750 | |

| | |

| | | |

| | |

| Royalty and stream interests, net | |

| 2,996,421 | | |

| 2,083,608 | |

| Available-for-sale securities | |

| 8,411 | | |

| 6,273 | |

| Other assets | |

| 55,576 | | |

| 44,801 | |

| Total assets | |

$ | 3,223,268 | | |

$ | 2,925,432 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Accounts payable | |

| 2,781 | | |

| 4,911 | |

| Dividends payable | |

| 15,010 | | |

| 14,341 | |

| Foreign withholding taxes payable | |

| - | | |

| 199 | |

| Other current liabilities | |

| 2,727 | | |

| 5,522 | |

| Total current liabilities | |

| 20,518 | | |

| 24,973 | |

| | |

| | | |

| | |

| Debt | |

| 677,494 | | |

| 322,110 | |

| Deferred tax liabilities | |

| 140,614 | | |

| 146,603 | |

| Uncertain tax positions | |

| 15,935 | | |

| 15,130 | |

| Other long-term liabilities | |

| 6,489 | | |

| 689 | |

| Total liabilities | |

| 861,050 | | |

| 509,505 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| EQUITY | |

| | | |

| | |

| Preferred stock, $.01 par value, authorized 10,000,000 shares authorized; and 0 shares issued | |

| - | | |

| - | |

| Common stock, $.01 par value, 100,000,000 shares authorized; and 65,082,861 and 65,033,547 shares outstanding, respectively | |

| 651 | | |

| 650 | |

| Additional paid-in capital | |

| 2,175,845 | | |

| 2,170,643 | |

| Accumulated other comprehensive loss | |

| (1,154 | ) | |

| (3,292 | ) |

| Accumulated earnings | |

| 125,821 | | |

| 185,121 | |

| Total Royal Gold stockholders’ equity | |

| 2,301,163 | | |

| 2,353,122 | |

| Non-controlling interests | |

| 61,055 | | |

| 62,805 | |

| Total equity | |

| 2,362,218 | | |

| 2,415,927 | |

| Total liabilities and equity | |

$ | 3,223,268 | | |

$ | 2,925,432 | |

ROYAL GOLD, INC.

Consolidated Statements of Operations and Comprehensive

Income (Loss)

(In thousands except for per share data)

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenue | |

$ | 98,118 | | |

$ | 61,304 | | |

$ | 172,173 | | |

$ | 130,330 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 22,572 | | |

| 6,236 | | |

| 34,038 | | |

| 12,910 | |

| General and administrative | |

| 5,841 | | |

| 8,511 | | |

| 15,352 | | |

| 15,652 | |

| Production taxes | |

| 996 | | |

| 1,731 | | |

| 2,588 | | |

| 3,421 | |

| Exploration costs | |

| 1,129 | | |

| - | | |

| 4,285 | | |

| - | |

| Depreciation, depletion and amortization | |

| 40,407 | | |

| 20,278 | | |

| 67,555 | | |

| 42,490 | |

| Impairment of royalty and stream interests | |

| - | | |

| 26,570 | | |

| - | | |

| 28,339 | |

| Total costs and expenses | |

| 70,945 | | |

| 63,326 | | |

| 123,818 | | |

| 102,812 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| 27,173 | | |

| (2,022 | ) | |

| 48,355 | | |

| 27,518 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest and other income | |

| 386 | | |

| 228 | | |

| 615 | | |

| 279 | |

| Interest and other expense | |

| (8,899 | ) | |

| (6,358 | ) | |

| (16,076 | ) | |

| (13,070 | ) |

| Income (loss) before income taxes | |

| 18,660 | | |

| (8,152 | ) | |

| 32,894 | | |

| 14,727 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax (expense) benefit | |

| (4,740 | ) | |

| 1,827 | | |

| (63,917 | ) | |

| (2,131 | ) |

| Net income (loss) | |

| 13,920 | | |

| (6,325 | ) | |

| (31,023 | ) | |

| 12,596 | |

| Net loss (income) attributable to non-controlling interests | |

| 1,194 | | |

| (223 | ) | |

| 1,090 | | |

| (462 | ) |

| Net income (loss) attributable to Royal Gold common stockholders | |

$ | 15,114 | | |

$ | (6,548 | ) | |

| (29,933 | ) | |

$ | 12,134 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 13,920 | | |

$ | (6,325 | ) | |

$ | (31,023 | ) | |

$ | 12,596 | |

| Adjustments to comprehensive income (loss) , net of tax | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Unrealized change in market value of available-for-sale securities | |

| 2,587 | | |

| (481 | ) | |

| 2,138 | | |

| (1,820 | ) |

| Comprehensive income (loss) | |

| 16,507 | | |

| (6,806 | ) | |

| (28,885 | ) | |

| 10,776 | |

| Comprehensive loss (income) attributable to non-controlling interests | |

| 1,194 | | |

| (223 | ) | |

| 1,090 | | |

| (462 | ) |

| Comprehensive income (loss) attributable to Royal Gold stockholders | |

$ | 17,701 | | |

$ | (7,029 | ) | |

$ | (27,795 | ) | |

$ | 10,314 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share available to Royal Gold common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share | |

$ | 0.23 | | |

$ | (0.10 | ) | |

$ | (0.46 | ) | |

$ | 0.19 | |

| Basic weighted average shares outstanding | |

| 65,073,678 | | |

| 65,002,307 | | |

| 65,061,059 | | |

| 64,982,595 | |

| Diluted earnings (loss) per share | |

$ | 0.23 | | |

$ | (0.10 | ) | |

$ | (0.46 | ) | |

$ | 0.19 | |

| Diluted weighted average shares outstanding | |

| 65,121,744 | | |

| 65,002,307 | | |

| 65,061,059 | | |

| 65,122,185 | |

| Cash dividends declared per common share | |

$ | 0.23 | | |

$ | 0.22 | | |

$ | 0.45 | | |

$ | 0.43 | |

ROYAL GOLD, INC.

Consolidated Statements of Cash Flows

(In Thousands)

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 13,920 | | |

$ | (6,325 | ) | |

$ | (31,023 | ) | |

$ | 12,596 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation, depletion and amortization | |

| 40,407 | | |

| 20,278 | | |

| 67,555 | | |

| 42,490 | |

| Non-cash employee stock compensation expense | |

| 1,222 | | |

| 375 | | |

| 5,449 | | |

| 2,824 | |

| Amortization of debt discount | |

| 2,713 | | |

| 2,540 | | |

| 5,383 | | |

| 5,013 | |

| Impairment of royalty and stream interests | |

| - | | |

| 26,570 | | |

| - | | |

| 28,339 | |

| Tax expense (benefit) of stock-based compensation exercises | |

| 97 | | |

| (377 | ) | |

| 247 | | |

| (74 | ) |

| Deferred tax benefit | |

| - | | |

| (11,729 | ) | |

| (11,767 | ) | |

| (17,103 | ) |

| Other | |

| - | | |

| - | | |

| (390 | ) | |

| - | |

| Changes in assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Royalty receivables | |

| 1,626 | | |

| 5,913 | | |

| 14,768 | | |

| 9,340 | |

| Stream inventory | |

| (4,021 | ) | |

| 565 | | |

| (6,002 | ) | |

| 1,308 | |

| Prepaid expenses and other assets | |

| 5,255 | | |

| 632 | | |

| 3,100 | | |

| 2,036 | |

| Accounts payable | |

| (5,358 | ) | |

| 388 | | |

| (2,092 | ) | |

| (1,182 | ) |

| Foreign withholding taxes payable | |

| - | | |

| (679 | ) | |

| (199 | ) | |

| (1,999 | ) |

| Income taxes receivable | |

| (2,812 | ) | |

| (7,151 | ) | |

| 3,530 | | |

| (1,778 | ) |

| Uncertain tax positions | |

| 729 | | |

| 544 | | |

| 806 | | |

| 1,027 | |

| Other liabilities | |

| (1,673 | ) | |

| (1,728 | ) | |

| 5,231 | | |

| (563 | ) |

| Net cash provided by operating activities | |

$ | 52,105 | | |

$ | 29,816 | | |

$ | 54,596 | | |

$ | 82,274 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Acquisition of royalty and stream interests | |

| (24,103 | ) | |

| (32,525 | ) | |

| (1,324,984 | ) | |

| (38,734 | ) |

| Andacollo royalty termination | |

| - | | |

| - | | |

| 345,000 | | |

| - | |

| Golden Star term loan | |

| - | | |

| - | | |

| (20,000 | ) | |

| - | |

| Other | |

| (43 | ) | |

| (390 | ) | |

| (271 | ) | |

| (517 | ) |

| Net cash used in investing activities | |

$ | (24,146 | ) | |

$ | (32,915 | ) | |

$ | (1,000,255 | ) | |

$ | (39,251 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Borrowings from revolving credit facility | |

| - | | |

| - | | |

| 350,000 | | |

| - | |

| Net proceeds from issuance of common stock | |

| - | | |

| 576 | | |

| - | | |

| 775 | |

| Common stock dividends | |

| (14,358 | ) | |

| (13,691 | ) | |

| (28,699 | ) | |

| (27,369 | ) |

| Distribution to non-controlling interests | |

| (214 | ) | |

| (446 | ) | |

| (636 | ) | |

| (911 | ) |

| Tax (benefit) expense of stock-based compensation exercises | |

| (97 | ) | |

| 377 | | |

| (247 | ) | |

| 74 | |

| Other | |

| - | | |

| - | | |

| (8 | ) | |

| - | |

| Net cash (used in) provided by financing activities | |

$ | (14,669 | ) | |

$ | (13,184 | ) | |

$ | 320,410 | | |

$ | (27,431 | ) |

| Net increase (decrease) in cash and equivalents | |

| 13,290 | | |

| (16,283 | ) | |

| (625,249 | ) | |

| 15,592 | |

| Cash and equivalents at beginning of period | |

| 104,310 | | |

| 691,411 | | |

| 742,849 | | |

| 659,536 | |

| Cash and equivalents at end of period | |

$ | 117,600 | | |

$ | 675,128 | | |

$ | 117,600 | | |

$ | 675,128 | |

SCHEDULE A

Non-GAAP Financial Measures

The Company computes and discloses Adjusted

EBITDA. Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is defined by the Company as net (loss) income plus depreciation,

depletion and amortization, non-cash charges, income tax expense, interest and other expense, and any impairment of mining assets,

less non-controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio

restructuring gains or losses. Other companies may define and calculate this measure differently. Management believes that Adjusted

EBITDA is a useful measure of the performance of our royalty and stream portfolio. Adjusted EBITDA identifies the cash generated

in a given period that will be available to fund the Company's future operations, growth opportunities, shareholder dividends and

to service the Company's debt obligations. This information differs from measures of performance determined in accordance with

U.S. generally accepted accounting principles (“GAAP”) and should not be considered in isolation or as a substitute

for measures of performance determined in accordance with U.S. GAAP. Below is a reconciliation of net income to Adjusted EBITDA.

ROYAL GOLD, INC.

Adjusted EBITDA Reconciliation

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

(Unaudited, in thousands) | | |

(Unaudited, in thousands) | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Net income (loss) | |

$ | 13,920 | | |

$ | (6,325 | ) | |

$ | (31,023 | ) | |

$ | 12,596 | |

| Depreciation, depletion and amortization | |

| 40,407 | | |

| 20,278 | | |

| 67,555 | | |

| 42,490 | |

| Non-cash employee stock compensation | |

| 1,222 | | |

| 375 | | |

| 5,449 | | |

| 2,824 | |

| Allowance for uncollectible royalty receivables | |

| - | | |

| 2,997 | | |

| - | | |

| 2,997 | |

| Impairment of royalty and stream interests | |

| - | | |

| 26,570 | | |

| - | | |

| 28,339 | |

| Interest and other income | |

| (386 | ) | |

| (228 | ) | |

| (615 | ) | |

| (279 | ) |

| Interest and other expense | |

| 8,899 | | |

| 6,358 | | |

| 16,076 | | |

| 13,070 | |

| Income tax expense (benefit) | |

| 4,740 | | |

| (1,827 | ) | |

| 63,917 | | |

| 2,131 | |

| Non-controlling interests in operating loss (income) of consolidated subsidiaries | |

| 1,194 | | |

| (223 | ) | |

| 1,090 | | |

| (462 | ) |

| Adjusted EBITDA | |

$ | 69,996 | | |

$ | 47,975 | | |

$ | 122,449 | | |

$ | 103,706 | |

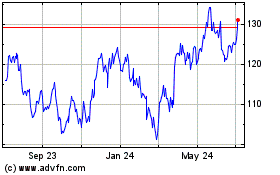

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024