UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 20, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-13357 |

|

84-0835164 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

|

80202-1132 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| | | |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

On July 20, 2015, Royal

Gold, Inc. (the “Company”) announced that its wholly owned subsidiary RGLD Gold AG (“RGLD Gold”) entered

into a $175 million gold and silver stream transaction with New Gold Inc. (“New Gold”), for a percentage of the gold

and silver production from its Rainy River Project in Ontario, Canada (the “Project”). The press release dated July

20, 2015 is furnished as Exhibit 99.1 hereto.

The information furnished

under this Item 7.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

As discussed above

under Item 7.01, RGLD Gold entered into a $175 million gold and silver stream transaction with New Gold on July 20, 2015. Pursuant

to the stream transaction and subject to certain conditions, RGLD Gold will make $175 million in advance payments to New Gold,

including a $100 million upfront payment which was paid on July 20, 2015, and the balance once New Gold’s capital spending

on the Project is sixty percent complete. New Gold will deliver to RGLD Gold 6.50% of gold produced from the Project until 230,000

ounces have been delivered, and 3.25% thereafter. New Gold will deliver to RGLD Gold 60.0% of silver produced from the Project,

until 3,100,000 ounces have been delivered, and 30.0% thereafter. Royal Gold will pay New Gold 25.0% of the spot price at the time

of delivery of such gold and silver.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated July 20, 2015 regarding New Gold Transaction. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

|

| |

(Registrant) |

|

| |

|

|

|

| Dated: July 21, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

|

| |

|

Name: |

Bruce C. Kirchhoff |

|

| |

|

Title: |

Vice President, General Counsel and Secretary |

|

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated July 20, 2015 regarding New Gold Transaction. |

.

Exhibit 99.1

Royal Gold Acquires Gold and Silver Stream

on

New Gold’s Rainy River Project

DENVER, COLORADO.

JULY 20, 2015: ROYAL GOLD, INC. (NASDAQ:RGLD; TSX: RGL) (“RGI”) announces that its wholly owned subsidiary

RGLD Gold AG (“Royal Gold” or the “Company”) entered into a $175 million Purchase and Sale Agreement

with New Gold, Inc. (“New Gold”), for a percentage of the gold and silver production from the Rainy River Project

in Ontario, Canada (“Rainy River” or the “Project”).

The Rainy River Project

is located 65 kilometers northwest of Fort Frances in western Ontario, Canada, just north of the Minnesota border. Over its first

nine years of full production, the 21,000 tonne per day, combined open pit-underground operation is scheduled to produce an average

of 325,000 ounces of gold per year. Permits to begin major earthworks construction are in place, and, as of mid-2015, detailed

engineering is 95% complete and 14% of the total development capital estimate of $877 million has been spent. Startup is projected

for mid-2017.

Tony Jensen, President

and Chief Executive Officer of Royal Gold, Inc. commented, “The Rainy River Project fits well into our high quality portfolio

and met all our criteria for new investments with nearly 4 million ounces of gold reserves, continued exploration upside and projected

cash costs below $600 per ounce. We are particularly pleased to add another piece of business in Canada and partner with New Gold—a

company that is well-known for its development track record and operational expertise.”

Stream Transaction Details

| · | Royal Gold will make 2 advance payments to New Gold, consisting of $100 million at closing

and $75 million once capital spending on the Project is sixty percent complete (currently expected by mid-2016) |

| · | New Gold will deliver to Royal Gold: |

| o | 6.5% of the gold produced at Rainy River until 230,000 ounces have been delivered, and 3.25% thereafter |

| o | 60% of the silver produced at Rainy River until 3.1 million ounces have been delivered, and 30%

thereafter |

| · | Royal Gold will pay New Gold 25% of the spot price per ounce of gold or silver |

Transaction Highlights for Royal

Gold

| · | Estimated annual gross gold deliveries of 20,000 ounces of gold during the first ten full years

of production, and approximately 17,000 gross ounces of gold during the life of mine |

| · | Estimated annual gross silver deliveries of 250,000 ounces of silver during the first ten full

years of production, and approximately 230,000 gross ounces of silver during the life of mine |

| · | Fourteen years of mine life based on current reserves, and an estimated startup of mid-2017 |

| · | Proven and probable gold reserves of 3.1 million contained ounces at 1.0 grams per tonne (“g/t”)

in the open pit, and 668,000 contained ounces grading 5.0 g/t in the underground deposit |

| · | Proven and probable silver reserves of 8.0 million contained ounces grading 2.5 g/t in the open

pit, and 1.39 million contained ounces grading 10.3 g/t in the underground deposit |

| · | Excellent exploration potential with: |

| o | 2.9 million contained ounces of measured and indicated gold resources grading 1.11 g/t across both

the open pit and underground |

| o | 10.0 million contained ounces of measured and indicated silver resources grading 3.8 g/t across

both the open pit and underground |

Under the terms

of the Purchase and Sale Agreement, New Gold will deliver gold and silver to Royal Gold on a monthly basis. Royal Gold plans to

sell the gold within a few weeks of receiving each delivery, and will recognize revenue from the sale of the delivered gold after

the sale has occurred.

CORPORATE PROFILE

Royal Gold, Inc. is

a precious metals royalty and stream company engaged in the acquisition and management of precious metal royalties, streams, and

similar production based interests. RGI owns interests on 196 properties on six continents, including interests on 37 producing

mines and 24 development stage projects. Royal Gold, Inc. is publicly traded on the NASDAQ Global Select Market under the

symbol “RGLD,” and on the Toronto Stock Exchange under the symbol “RGL.” RGI’s website is located

at www.royalgold.com.

About New Gold

New Gold is an intermediate

gold mining company. The company has a portfolio of four producing assets and three significant development projects. The New Afton

Mine in Canada, the Mesquite Mine in the United States, the Peak Mines in Australia and the Cerro San Pedro Mine in Mexico, provide

the company with its current production base. In addition, New Gold owns 100% of the Rainy River and Blackwater projects, both

in Canada, as well as an interest in the El Morro project located in Chile. New Gold’s objective is to be the leading intermediate

gold producer, focused on the environment and social responsibility. For further information on the company, please visit www.newgold.com

For further information, please

contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Cautionary

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: With the exception of historical

matters, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties that

could cause actual results to differ materially from projections or estimates contained herein. Such forward-looking statements

include statements about the stream and Royal Gold’s Purchase and Sale Agreement with New Gold, as well as expectations

concerning development, production and mine life at the Rainy River Project. Factors that could cause actual results to differ

materially from the projections include, among others, precious metals prices; actual tax rates; performance of and production

at the properties subject to our royalty and stream interests; decisions and activities of the operators of these properties;

operators’ delays in securing or inability to secure necessary governmental permits; changes in operators’ project

parameters and timelines as plans continue to be refined; economic and market conditions; unanticipated grade, geological, metallurgical,

processing, regulatory and legal or other problems that the operators of mining properties may encounter; completion of feasibility

studies; the ability of the various operators to bring projects into production as expected; and other subsequent events, as well

as other factors described in RGI's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the Securities

and Exchange Commission. Most of these factors are beyond RGI’s ability to predict or control. RGI disclaims any obligation

to update any forward-looking statement made herein. Readers are cautioned not to put undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors Concerning

Estimates of Proven and Probable Mineral Reserves and Measured and Indicated Mineral Resources: The

mineral reserve estimates reported by New Gold were prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum

Definition Standards for Mineral Resources and Mineral Reserves, as incorporated by reference in National Instrument 43-101. RGI

has not reconciled the reserve estimates provided by New Gold with definitions of reserves used by the U.S. Securities and Exchange

Commission.

While the terms “Mineral Resource,”

“Measured Mineral Resource” and “Indicated Mineral Resource” are recognized and required by Canadian securities

regulations, they are not defined terms under standards of the United States Securities and Exchange Commission. Under United States

standards, mineralization may not be classified as a “Reserve” unless the determination has been made that the mineralization

could be economically and legally produced or extracted at the time the reserve estimation is made. The mineral resources reported

herein are estimates previously disclosed by New Gold, without reference to the underlying data used to calculate the estimates.

Accordingly, RGI is not able to reconcile the estimates prepared in reliance on Canadian National Instrument 43-101 with terms

recognized by the United States Securities and Exchange Commission. Readers are cautioned not to assume that all or any part of

the measured or indicated mineral resources will ever be converted into mineral reserves.

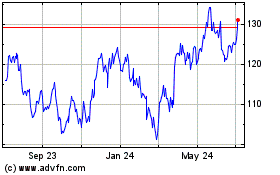

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024