Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

September 30 2015 - 2:33PM

Edgar (US Regulatory)

Filed by Rentrak Corporation

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Rentrak Corporation

Commission File No.: 000-15159

Date:

September 30, 2015

comScore-Rentrak All-Hands Call

Introduction

| |

• |

|

Good morning everyone. Thanks for joining me. |

| |

• |

|

I’m here today to share some very exciting news about the future of Rentrak. |

| |

• |

|

As you saw earlier this afternoon, we announced that Rentrak and comScore will unite through a merger. The industry has been asking for a single source of multiplatform measurement for years, and our union will satisfy

this need. Together, Rentrak and comScore will be able to provide the industry with a single source of truly comprehensive and precise multiplatform measurement that addresses the way people watch TV, digital and movie content today, and in the

future. |

| |

• |

|

For those of you who may be unfamiliar with comScore, they are the industry leader in providing media and advertising analytics for digital content. Rentrak and comScore have long been partners in many ways throughout

the years, and I am convinced that the similarities in our goals and cultures will make this a great fit for everyone here. |

Transaction

| |

• |

|

This merger is a bringing together two equals. Two companies that are leaders in their respective areas and that share a common mission: the creation of a single cross-platform measurement currency that accounts for all

the ways people consume media. Whether it be in the theater; on live or time-shifted TV; video on demand; or streamed or downloaded on a personal computer, tablet, mobile or over-the-top device, we will now be able to provide clients with a holistic

view of the consumer, whenever and wherever content is consumed. |

| |

• |

|

Whenever there is a merger of this kind, especially when both companies are publicly traded, one of those companies must integrate the other. In this case, Rentrak will be operating under the comScore umbrella, so

Rentrak will no longer be traded on Nasdaq under our current ticker symbol. The combined company, which will be called comScore, will continue to be traded under comScore’s current stock symbol. |

| |

• |

|

The transaction will be accomplished through the exchange of Rentrak stock for comScore stock, which means that all of you that are Rentrak stockholders will become comScore stockholders when the merger is complete. The

technical details are in the press release, but in simple terms, for every one share of Rentrak you own, you will receive 1.15 shares of comScore stock. |

| |

• |

|

We arrived at this valuation by looking at a wide range of factors that our Board and financial advisors deemed relevant, including the relative values of the two companies, our expectations for the future, the dynamics

of the markets that we operate in, and our anticipation of the synergies that will be achieved by our combination. |

| |

• |

|

We anticipate closing the merger in early next year. There are regulatory and shareholder approvals to gain, but we don’t see any major hurdles to getting the deal done. |

| |

• |

|

Rest assured, however, that Rentrak will not lose its identity, nor will we lose the robust brand equity that all of you have worked so hard to build. Rentrak will always be known as a leader in precisely measuring

movies and TV everywhere. |

| |

• |

|

Furthermore, I will remain with the combined company. We will draw on the collective talent at both companies to harness the experience and expertise of each organization to redefine the future of measurement.

|

Employees

| |

• |

|

This merger will be great for the employees of both companies. You will have increased opportunities to advance your careers across a larger, more diversified business. |

| |

• |

|

Because there is very little overlap between what the two companies measure, we do not expect there to be any significant changes in how Rentrak operates. It’s business as usual as we continue to provide clients

with the best way to understand and monetize viewership. |

| |

• |

|

The CEO of the combined company will be Serge Matta, comScore’s current CEO. Magid Abraham, comScore’s Executive Chairman of the Board, will retain that title as well. I will become the combined company’s

Executive Vice Chairman of the Board & President. David will serve as a strategic advisor to Serge, focused on the successful integration of the two companies. |

Next Steps

| |

• |

|

As I mentioned, we expect the transaction to close early next year. |

| |

• |

|

Until then, Rentrak and comScore will operate as separate companies. |

| |

• |

|

In the coming weeks, we will be forming integration teams made up of leadership from both companies to plan for the integration of our two companies. |

Business as Usual

| |

• |

|

As we move forward, I am counting on each of you to remain focused on our business objectives and day-to-day responsibilities. |

| |

• |

|

Our clients are counting on us to continue delivering the very best products and services to them, as we always have. |

| |

• |

|

As I mentioned in my memo, today’s announcement may generate interest from the media and other third parties. In addition to needing to speak in one voice, we are regulated in what we can say by the Securities and

Exchange Commission, so it’s very important that you refer all calls you may receive to Angie Fenske. |

| |

• |

|

Please be patient with the process and try to avoid speculation. We will openly communicate our plans as much as possible and as quickly as possible. |

| |

• |

|

Our goal is to make the integration process as seamless as possible for all of you. If you have any questions about the integration, please feel free to call me. |

| |

• |

|

Thank you again for your hard work and dedication to Rentrak. This is an exciting time for us and the best is yet to come. |

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform

Act of 1995, including with respect to the anticipated timing, completion and effects of the proposed merger between comScore and Rentrak. These statements are based on management’s current expectations and beliefs, and are subject to a number

of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These forward-looking statements include statements about future financial and operating results; benefits of

the transaction to customers, shareholders and employees; potential synergies and cost savings; the ability of the combined company to drive growth and expand customer and partner relationships; and other statements regarding the proposed

transaction. Forward-looking statements may contain words such as “will be,” “will,” “expected,” “anticipate,” “continue,” or similar expressions, and include the assumptions that underlie such

statements. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: failure of the comScore stockholders or Rentrak shareholders to approve the proposed merger;

failure to achieve regulatory approval; the challenges and costs of closing, integrating, restructuring and achieving anticipated synergies; the ability to retain key employees, customers and suppliers; and other factors, including those set forth

in the most current Annual Report on Form 10-K, Quarterly Report on Form 10-Q and Current Reports on Form 8-K reports filed by comScore and Rentrak with the SEC. All forward-looking statements are based on management’s estimates, projections

and assumptions as of the date hereof, and comScore and Rentrak are under no obligation (and expressly disclaim any such obligation) to update or revise their forward-looking statements whether as a result of new information, future events, or

otherwise.

No Offer or Solicitation

This

communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find It

In connection with the proposed merger, comScore intends to file a registration statement on Form S-4, which will include a preliminary prospectus

and related materials to register the shares of comScore common stock to be issued in the merger, and comScore and Rentrak intend to file a joint proxy statement/prospectus and other documents concerning the proposed merger with the SEC. INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT COMSCORE, RENTRAK, AND THE PROPOSED MERGER. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when they are available) and any other documents filed by

comScore and Rentrak with the SEC at the SEC’s website

at www.sec.gov. They may also be obtained for free by contacting comScore Investor Relations by mail at comScore, Inc., 11950 Democracy Drive, Suite 600, Reston, Virginia 20190, Attention:

Investor Relations, by telephone at (310) 279-5980, or by going to comScore’s Investor Relations page on its corporate web site at www.comscore.com, or by contacting Rentrak Investor Relations by mail at Rentrak Corporation, 7700 N.E.

Ambassador Place, Portland, Oregon 97220, Attention: Investor Relations, by telephone at (503) 284-7581, or by going to Rentrak’s Investor Relations page on its corporate web site at www.rentrak.com. The contents of the websites referenced

above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus.

Participants in the

Solicitation

Each of Rentrak and comScore and their respective executive officers and directors may be deemed to be participants in the

solicitation of proxies from their respective shareholders or stockholders with respect to the transactions contemplated by the merger agreement. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the

solicitation of comScore or Rentrak security holders in connection with the proposed merger will be set forth in the registration statement and the joint proxy statement/prospectus when filed with the SEC. Information regarding Rentrak’s

executive officers and directors is included in Rentrak’s Proxy Statement for its 2015 Annual Meeting of Shareholders, filed with the SEC on July 9, 2015, and information regarding comScore’s executive officers and directors is

included in comScore’ Proxy Statement for its 2015 Annual Meeting of Stockholders, filed with the SEC on June 8, 2015. Copies of the foregoing documents may be obtained as provided above. Certain executive officers and directors of

comScore and Rentrak have interests in the transaction that may differ from the interests of comScore stockholders and Rentrak shareholders generally. These interests will be described in the joint proxy statement/prospectus when it becomes

available.

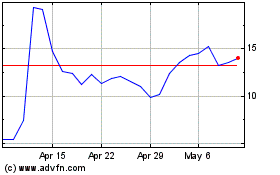

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Apr 2023 to Apr 2024