UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

May 12, 2015

Date of Report (Date of earliest event reported)

Rentrak Corporation

(Exact name of Registrant as specified in its charter)

|

| | | | |

| | | | |

Oregon | | 000-15159 | | 93-0780536 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

7700 NE Ambassador Place

Portland, Oregon 97220

(Address of Principal Executive Offices and Zip Code)

503-284-7581

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¬ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¬ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¬ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¬ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On May 12, 2015, Rentrak Corporation issued a press release announcing preliminary revenue results for the three and twelve months ended March 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference. The information in this Form 8-K and the Exhibit attached hereto is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are furnished herewith and this list is intended to constitute the exhibit index:

|

| | |

| | |

99.1 | | Press release dated May 12, 2015 announcing Rentrak Corporation’s preliminary revenue results for its fourth fiscal quarter and fiscal year ended March 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 12, 2015

|

| | | | |

| | | | |

RENTRAK CORPORATION |

| |

By: | | /s/ David I. Chemerow |

| | Name: | | David I. Chemerow |

| | Title: | | Chief Operating Officer, Chief Financial Officer and Secretary |

EXHIBIT INDEX

|

| | |

| | |

Exhibit No. | | Description |

| |

99.1 | | Press release dated May 12, 2015 announcing Rentrak Corporation’s preliminary revenue results for its fourth fiscal quarter and fiscal year ended March 31, 2015.

|

CONTACT:

PondelWilkinson Inc.

Laurie Berman

310-279-5962

lberman@pondel.com

Rentrak Reports Revenue Results for Fiscal 2015 Fourth Quarter and Full Year;

Provides Fiscal 2016 Outlook

-- Signs Fourth Major Broadcast Network as Subscriber to Rentrak’s

Massive and Passive Advanced Demographics Ratings Service --

-- Company to Conduct Conference Call Today at 5:00 p.m. ET --

PORTLAND, OR (May 12, 2015) - Rentrak Corporation (Nasdaq: RENT), the leader in precisely measuring movies and TV everywhere, today announced revenue results for its fourth fiscal quarter and full year ended March 31, 2015.

Total company revenue1 grew to $28.5 million for the fourth quarter of fiscal 2015, a 32 percent increase from $21.6 million for the fourth quarter of fiscal 2014. For fiscal 2015, total company revenue1 grew to $102.9 million, a 36 percent increase from $75.6 million last year.

|

| | |

4Q FY15 ($ in millions)* | Revenue | % Change from 4Q FY14 |

TV Everywhere™ | $16.4 | 64% |

Movies Everywhere™ † | $7.6 | 10% |

OnDemand Everywhere® | $3.9 | 21% |

|

| | |

FY15 ($ in millions)* | Revenue | % Change from FY14 |

TV Everywhere™ | $55.0 | 76% |

Movies Everywhere™ † | $29.9 | 13% |

OnDemand Everywhere® | $14.3 | 11% |

| |

* | Amounts do not add to total company revenue due to presentation of Movies Everywhere™ contributions in constant currency, and not reporting contributions from Other services for the respective periods. |

| |

† | On a constant currency basis, assuming foreign exchange rates were held constant with exchange rates for fiscal 2014. On an as-reported basis, Movies Everywhere™ revenue was $7.4 million, an increase of 6 percent, and $29.5 million, an increase of 12 percent, respectively, for the three and twelve months ended March 31, 2015. |

“In the fourth quarter, we again saw very strong evidence that Rentrak continues to gain significant traction in the marketplace with our television ratings services,” said Bill Livek, Rentrak’s Vice Chairman and Chief Executive Officer. “We recently added our fourth major broadcast network as a Rentrak subscriber, entered into many additional TV measurement agreements, attracted new ad agencies and brand advertisers, expanded our relationships with several major television network groups, and grew the global footprint of our movie business. Our great clients now include four out of five major broadcast networks, Viacom, Discovery, ESPN, and others, as we continue to create tools to help advertisers better invest their television dollars through our Advanced Demographics and the most granular TV measurement available today.

1 Rentrak’s Pay Per Transaction® (PPT®) business is reflected in its entirety as discontinued operations and was sold as of Jan. 31, 2015. All periods presented have been revised to reflect this presentation. Unless otherwise noted, all discussions in this press release relate to continuing operations.

Rentrak Reports Revenue Results for Fiscal 2015 Fourth Quarter and Full Year

May 12, 2015

Page 2 of 3

“Over the coming months, we will monetize these achievements and further expand our customer base,” said Livek. “I believe Rentrak has reached an important inflection point, and we look forward to translating that into increasing value for all of our stakeholders.”

The company’s TV Everywhere™ business was affected by several new client agreements that closed later than expected in the fourth quarter. Rentrak’s Movies Everywhere™ business was impacted by foreign currency exchange rates. Rentrak’s OnDemand Everywhere® business, which performed better than expected, benefited from increased use of the company’s ratings information by ad agency holding companies, price increases and analytic work performed for clients.

Rentrak’s recent milestones include:

| |

• | Signing fourth major broadcast network as a subscriber to Rentrak’s Advanced Demographics Ratings Service. |

| |

• | Signing new contracts with numerous additional television networks, including: |

| |

• | Discovery Communications, owner of leading brands such as Discovery Channel, TLC and Animal Planet, which is subscribing to Rentrak’s TV ratings and automotive segmentation information for all 11 of its networks; |

| |

• | Viacom Media Networks, owner of leading brands such as Comedy Central, BET and MTV, which is subscribing to Rentrak’s TV ratings and complete suite of integrated purchase consumer information for all 17 of its networks; |

| |

• | ESPN, the leading multimedia sports entertainment company, which is subscribing to Rentrak's TV ratings; and |

| |

• | QVC, the world’s leading video and ecommerce retailer, which is also subscribing to Rentrak’s TV ratings. |

| |

• | Expanding agreements with several major TV station groups and signing agreements with additional station groups and independent TV stations, including: |

| |

• | CBS Television Stations in Chicago; |

| |

• | NBCUniversal Media in Washington, DC; |

| |

• | Gannett Broadcasting in Washington, DC for its CBS-affiliate; |

| |

• | Lilly Broadcasting for five stations in Erie, Pennsylvania and Elmira, New York; and |

| |

• | Independent stations in Los Angeles and Columbia, Missouri. |

| |

• | Attracting new, world-class brand advertisers including Target, which is using Rentrak to measure the effectiveness of its brand entertainment integration. |

| |

• | Gaining commitments from several 2016 presidential candidates who plan to use Rentrak’s TV ratings and advanced demographics to attract voters. |

| |

• | Signing an agreement with Google to help advertisers better connect the placement and timing of their television ads with search queries. Rentrak is the service of choice for understanding how the power of TV and digital platforms work together to generate results for advertisers. |

| |

• | Completing the integration of its measurement ratings into Mediaocean’s Spectra OX Spot and Network ad buying platforms, making it easier to use Rentrak for advertising guarantees. |

Rentrak’s cash and cash equivalents balance at March 31, 2015 was $84.0 million, with no debt.

Fiscal 2016 Business Outlook and Select Longer-Term Metrics

Rentrak provided its business outlook for fiscal 2016 including:

| |

• | Total company revenue growth of 36 percent to 39 percent. |

| |

• | TV Everywhere™ revenue growth of 55 percent to 65 percent. |

Rentrak also provided additional fiscal 2016 guidance:

| |

• | Movies Everywhere™ is expected to pick up in the second half of the fiscal year related to anticipated contract renewal increases for large domestic studios. The business will continue to be affected by foreign exchange movements. |

| |

• | Adjusted EBITDA before acquisition and reorganization costs of $22.7 million to $25.9 million, or 16 percent to 18 percent of revenues. |

| |

• | Longer-term adjusted EBITDA return on revenue target of 35%. |

| |

• | Tax expense of approximately $1.0 million per quarter, of which $900,000 is expected to be non-cash. |

| |

• | Approximately 16.4 million fully diluted weighted average shares outstanding. |

| |

• | Capital spending of approximately $13.0 million to $14.0 million. |

Rentrak Reports Revenue Results for Fiscal 2015 Fourth Quarter and Full Year

May 12, 2015

Page 3 of 3

Rentrak plans to report full results for the fiscal 2015 fourth quarter and year on May 27, 2015.

Conference Call

Rentrak will hold a conference call at 5:00 p.m. ET/2:00 p.m. PT today to discuss its fiscal 2015 fourth quarter revenue results. Interested parties may participate in the call by dialing 866-652-5200 from the U.S. or Canada, or 412-317-6060 from international locations. Participants should ask to be connected to the Rentrak Corporation call. This call is being webcast and can be accessed at Rentrak’s web site at www.rentrak.com, where it will be archived through May 12, 2016. An audio replay of the conference call will be available until May 20, 2015 by dialing 877-344-7529 from the U.S. or Canada, or 412-317-0088 from international locations, passcode 10065146.

About Rentrak Corporation

Rentrak (NASDAQ: RENT) is the entertainment and marketing industries’ premier provider of worldwide consumer viewership information, precisely measuring actual viewing behavior of movies and TV everywhere. Using our proprietary intelligence and technology, combined with Advanced Demographics, only Rentrak is the census currency for VOD and movies. Rentrak provides the stable and robust audience measurement services that movie, television and advertising professionals across the globe have come to rely on to better deliver their business goals and more precisely target advertising across numerous platforms including box office, multiscreen television and home video. For more information on Rentrak, please visit www.rentrak.com.

Adjusted EBITDA

From time to time, Rentrak may refer to Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-based Compensation) in its conference calls and discussions with investors and analysts in connection with the company’s reported historical financial results. Adjusted EBITDA does not represent cash flows from operations as defined by U.S. generally accepted accounting principles (“GAAP”), is not derived in accordance with GAAP and should not be considered by the reader as an alternative to net income (the most comparable GAAP financial measure to Adjusted EBITDA). Rentrak’s management believes that Adjusted EBITDA is helpful as an indicator of the current financial performance of the company and its capacity to operationally fund capital expenditures and working capital requirements. Due to the nature of the company’s internally-developed software policies and its use of stock-based compensation, Rentrak incurs significant non-cash charges for depreciation, amortization and stock-based compensation expense that may not be indicative of its operating performance from a cash perspective. Rentrak also adjusts for cash settled acquisition, reorganization and other non-recurring costs as Rentrak’s management believes these items are not representative of our ongoing operations and that Adjusted EBITDA provides a useful metric by which to compare the performance from period to period.

Safe Harbor Statement

The foregoing paragraphs contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may be identified by the use of forward-looking words such as “should,” “plan,” “believe,” “expects,” “anticipate,” target,” “outlook,” or “continues” or the negative thereof or variations thereon or comparable terminology. Forward-looking statements in this release include, without limitation, Rentrak’s ability to continue generating substantial growth in total company revenue and in its TV Everywhere™ product lines and expected rates of growth for its Movies Everywhere™ product lines, and expected revenue generating opportunities that exist by partnering with industry-leading businesses and other customers, and the timing of such opportunities. These forward-looking statements are based on Rentrak’s current expectations, estimates and projections about its business and industry, management’s beliefs, and certain assumptions, all of which are subject to change. Forward-looking statements are not guarantees of future performance and Rentrak’s actual results may differ significantly as a result of a number of factors, including the company’s ability to attract new customers and retain existing customers, the company’s success in maintaining its relationships with studios, ad agencies, brand advertisers and television network groups, the company’s ability to successfully develop and market new products to create new revenue streams and grow its existing revenue streams, foreign currency exchange rate fluctuations, its ability to successfully integrate acquired businesses, and Rentrak’s customers continuing to comply with the terms of their agreements. Additional factors that could affect Rentrak’s financial results are described in Rentrak’s reports on Form 10-K, 10-Q and other filings with the Securities and Exchange Commission. Results of operations in any past period should not be considered indicative of the results to be expected for future periods.

# # #

RENTF

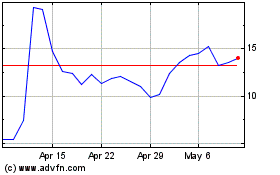

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Sep 2023 to Sep 2024