UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 23, 2016

Patterson-UTI Energy, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-22664 |

|

75-2504748 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 450 Gears Road, Suite 500, Houston, Texas |

|

|

|

77067 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: 281-765-7100

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

Patterson-UTI Energy, Inc. will deliver an investor presentation that

includes the slides attached as Exhibit 99.1 to this Current Report on Form 8-K, which are incorporated herein by reference.

The information furnished

pursuant to Item 7.01, including Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of these slides is not intended to constitute a

representation that such information is required by Regulation FD or that the materials they contain include material information that is not otherwise publicly available.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

99.1 Investor presentation slides.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Patterson-UTI Energy, Inc. |

|

|

|

|

| February 23, 2016 |

|

|

|

By: |

|

/s/John E. Vollmer III |

|

|

|

|

Name: |

|

John E. Vollmer III |

|

|

|

|

Title: |

|

Senior Vice President - Corporate Development, Chief Financial Officer and Treasurer |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor presentation slides. |

Credit Suisse 21st Annual Energy Summit

February 23-24, 2016 Exhibit 99.1

Forward Looking Statements This

material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s

or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact,

including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important

factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These

filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly

update or revise any forward-looking statement. Statements made in this presentation include non-GAAP financial measures. The required reconciliation to GAAP financial measures are included on our website and/or at the end of this presentation. The

Red Circular Rig Logo, the Universal Logo, and the terms PATTERSON UTI, and APEX are registered trademarks of Patterson–UTI Energy, Inc.

Scaling The Business Scaling our

business effectively is key to our success… …both in upturns and downturns Patterson-UTI U.S. rig count and U.S. drilling staff size through February 12, 2016

High Quality Drilling Rigs 161

APEX® Rigs

Modern Pumping Equipment Modern triplex

pumps defined as being placed in service within the last seven years.

Strong Financial Position 25% Debt/

Total Cap Stockholder’s Equity 4.97% Series A notes Due October 5, 2020 4.27% Series B notes Due June 14, 2022 Bank Term Loans Maturing September 27, 2017 * Debt and equity balances as of December 31, 2015. $255 million of bank term loans

includes quarterly principal payments totaling $64 million in 2016. Principal payments in 2017 include two quarterly payments totaling $47 million and payments at the maturity date of $144 million.

Why Invest in Patterson-UTI Energy?

High Quality Assets 161 APEX® rigs comprised primarily of 1500 horsepower and pad capable rigs Creating value through focus on well site execution Technology leader Leader in walking rigs for pad drilling Innovator in deploying latest

technologies for pressure pumping Financially flexible Strong balance sheet History of share buybacks Dividends Scalable business structure

Credit Suisse 21st Annual Energy Summit

February 23-24, 2016

Additional References

Contract Drilling High quality fleet

of land drilling rigs including 161 APEX® rigs Leader in walking rig technology for pad drilling applications Large footprint across North American drilling markets Patterson-UTI reported results for the year ended December 31, 2015

Pressure Pumping High quality fleet

of modern pressure pumping equipment Strong reputation for regional knowledge and efficient operations Concentrated footprint provides economies of scale Patterson-UTI reported results for the year ended December 31, 2015

Managing Supply Chain Sourcing and

Supply Security Negotiated critical cost elements for both Drilling and Pressure Pumping Solidified availability of strategic commodities Reduced Costs in 2015 Sand costs down 25% - 35% Sand hauling costs down 25% - 35% Pump parts costs down 15% -

20% Chemical costs down as much as 40%

Contract Drilling

Majority of Adjusted EBITDA from

APEX® Rigs *Adjusted EBITDA contribution by rig class excluding early termination revenues for the year ended December 31, 2015.

The APEX-XK® Enhanced X-Y

mobility Walk with full set-back of pipe in mast More efficient rig up / rig down Walking times average 45 minutes for 10’ – 15’ well spacing Advanced environmental spill control integrated into drilling floor Reduced number of

truck loads for rig moves 53 APEX-XK 1500® and four APEX-XK 1000 ® rigs in fleet http://patenergy.com/drilling/technology

APEX-XK® Integrated Walking

System

APEX-XK® Rig Walking on Pad

http://patenergy.com/drilling/technology/apexwalk/ Video of APEX-XK® Rig

West Texas 17 Rigs Large Geographic

Footprint PTEN’s Active Rig Count by Region as of February 19, 2016 Appalachia 23 Rigs East Texas 6 Rigs Mid-Continent 6 Rigs Rockies 2 Rigs South Texas 7 Rigs North Dakota 10 Rigs Canada 4 Rigs http://patenergy.com/

Pressure Pumping

Modern Pumping Equipment

Southwest Region: Northeast Region:

Fracturing horsepower: 663,800 Other horsepower: 32,165 Fracturing horsepower: 353,800 Other horsepower: 55,400 Market Concentration Provides Economies of Scale Pressure Pumping Areas Horsepower distribution as of December 31, 2015

Technology Focused PropLogic™

Sand Management System Fully enclosed well-site sand management system More accurate than conventional sand trailers/bins More efficient use of proppant as less sand is wasted

Technology Focused PowderStim®

Dry Friction Reducer System hydrates powder form of friction reducer directly into the fluid stream Logistically safer and more efficient compared to liquefied friction reducers Successful with both fresh water and heavy brines More cost effective

by utilizing produced water

Technology Focused Comprehensive Lab

Services Ability to test vendors’ chemicals enhances quality controls Unique in-house friction flow loop test assembly for faster test results In-house lab services are faster and more cost efficient than outsourcing

Strong Financial Position

Investing in Our Company Capital

Expenditures and Acquisitions ($ in millions) 2016 Capital expenditure forecast as of February 4, 2016

Total Liquidity * * Debt and equity

balances as of December 31, 2015. $255 million of bank term loans includes quarterly principal payments totaling $64 million in 2016. Principal payments in 2017 include two quarterly payments totaling $47 million and payments at the maturity date of

$144 million. $113 million cash $500 million revolver availability Of $855 million debt $255 million matures September 2017 $300 million matures October 2020 $300 million matures June 2022

Three Months Ended December

31, Twelve Months Ended December 31, 2015 2014 2015 2014 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net income (loss) $ (58,658) $ 57,583 $ (294,486) $ 162,664 Income tax expense (benefit)

(27,511) 41,216 (147,963) 91,619 Net interest expense 9,391 8,034 35,511 28,846 Depreciation, depletion, amortization and impairment 175,302 180,157 864,759 718,730 Impairment of goodwill - - 124,561 - Adjusted EBITDA $ 98,524 $ 286,990 $ 582,382 $

1,001,859 Total revenue $ 338,566 $901,219 $ 1,891,277 $3,182,291 Adjusted EBITDA margin 29.1% 31.8% 30.8% 31.5% Adjusted EBITDA by operating segment:

Contract drilling $ 95,681 $ 208,200 $ 527,204 $ 765,874 Pressure pumping 10,904 78,763 84,115 236,676 Oil and natural gas 1,184 7,671 13,431 37,094 Corporate and other (9,245) (7,644) (42,368) (37,785) Consolidated Adjusted

EBITDA $ 98,524 $ 286,990 $ 582,382 $ 1,001,859 (1) The company makes use of financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the assessment of ongoing

operating performance. These non-GAAP financial measures are reconciled to their most directly comparable GAAP measures in the tables above. We define Adjusted EBITDA as net income plus net interest expense, income tax expense and depreciation,

depletion, amortization and impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital

expenditures and working capital requirements. Adjusted EBITDA is not defined by GAAP and, as such, should not be construed as an alternative to net income (loss) or operating cash flow. We define margin as revenues less direct operating

costs. We present margin because we believe it to be the component of our earnings most impacted by the variability in our contract drilling and pressure pumping operations. Margin is not defined by GAAP and, as such, should not be construed

as an alternative to net income (loss). PATTERSON-UTI ENERGY, INC. Non-GAAP Financial Measures (Unaudited) (dollars in thousands) Non-GAAP Financial Measures

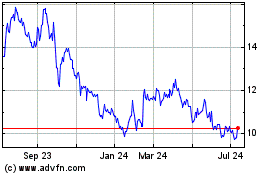

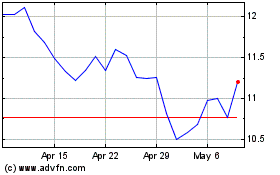

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024