Current Report Filing (8-k)

November 09 2016 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2016

MARVELL TECHNOLOGY GROUP LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Bermuda

|

|

0-30877

|

|

77-0481679

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

(Address of principal executive offices)

(441) 296-6395

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

At the Annual General Meeting of Shareholders of Marvell Technology Group Ltd., a Bermuda exempted company (the “Company”) held on November 8, 2016

(the “Annual Meeting”), shareholders whose shares were present either in person or by proxy voted upon the election of ten directors to the Board of Directors. The Bye-laws of the Company provide, as required by Bermuda law, that a

director nominee must receive the vote of a majority of the shares present either in person or by proxy in order to be elected as a director. If a majority vote is not obtained, the director nominee is not elected to the board.

Following the Annual General Meeting, the results of which are set forth below in Item 5.07, the terms of directors Sehat Sutardja, Weili Dai, Juergen

Groemer, John Kassakian and Arturo Krueger expired. Richard Hill, Chairman of the Board, expressed on behalf of the Company and its Board of Directors his appreciation for their many contributions and years of service to Marvell.

2

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

At the Annual Meeting held on November 8, 2016,

shareholders voted on the matters as set forth below. Each issued common share was entitled to one vote on the proposals voted on at the meeting.

|

1.

|

Seven of the ten nominees for election to the Board were elected, each for a term for a period beginning from their election until the 2017 annual general meeting of shareholders, based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-

Votes

|

|

|

Richard S. Hill

|

|

|

338,270,297

|

|

|

|

39,796,267

|

|

|

|

3,562,413

|

|

|

|

68,088,806

|

|

|

Matthew J. Murphy

|

|

|

379,964,573

|

|

|

|

1,449,443

|

|

|

|

214,916

|

|

|

|

68,088,806

|

|

|

Peter A. Feld

|

|

|

247,966,028

|

|

|

|

2,607,504

|

|

|

|

183,932

|

|

|

|

48,093,714

|

|

|

Juergen Gromer, Ph.D.

|

|

|

160,009,471

|

|

|

|

221,413,371

|

|

|

|

206,135

|

|

|

|

68,088,806

|

|

|

John G. Kassakian, Sc.D.

|

|

|

160,043,464

|

|

|

|

221,370,078

|

|

|

|

215,435

|

|

|

|

68,088,806

|

|

|

Oleg Khaykin

|

|

|

356,202,524

|

|

|

|

25,225,399

|

|

|

|

201,054

|

|

|

|

68,088,806

|

|

|

Arturo Krueger

|

|

|

176,676,994

|

|

|

|

204,727,919

|

|

|

|

224,064

|

|

|

|

68,088,806

|

|

|

Michael Strachan

|

|

|

358,538,059

|

|

|

|

22,860,983

|

|

|

|

229,935

|

|

|

|

68,088,806

|

|

|

Robert E. Switz

|

|

|

358,499,587

|

|

|

|

22,896,072

|

|

|

|

233,318

|

|

|

|

68,088,806

|

|

|

Randhir Thakur, Ph.D.

|

|

|

242,971,235

|

|

|

|

138,401,918

|

|

|

|

255,824

|

|

|

|

68,088,806

|

|

With respect to the election of each director, an “abstain” vote had the same effect as an “against” vote.

Please see Item 5.02 above for additional information regarding director nominees who did not receive sufficient votes to be elected to the Board.

|

2.

|

The proposal to approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

338,552,039

|

|

|

|

42,781,128

|

|

|

|

295,810

|

|

|

|

68,088,806

|

|

|

3.

|

The proposal to re-appoint Deloitte & Touche LLP as the Company’s auditors and independent registered public accounting firm, and authorize the audit committee, acting on behalf of the Board, to fix the

remuneration of the auditors and independent registered public accounting firm, in both cases for the Company’s fiscal year ending January

28, 2017, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

|

383,929,636

|

|

|

|

247,351

|

|

|

|

65,540,796

|

|

|

4.

|

The proposal to amend the Company’s existing Bye-laws to implement proxy access, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

274,796,167

|

|

|

|

41,340,431

|

|

|

|

65,492,379

|

|

|

|

68,088,806

|

|

|

5.

|

The proposal to amend the Company’s existing Bye-laws to amend procedures for advance notice of director nominations and other proposals at general meetings of shareholders, was approved based upon the following

votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

311,879,282

|

|

|

|

4,296,102

|

|

|

|

65,453,593

|

|

|

|

68,088,806

|

|

|

6.

|

The proposal to amend the Company’s existing Bye-laws to allow a majority vote of shareholders to amend the Company’s Bye-laws in all instances, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

314,921,295

|

|

|

|

1,274,634

|

|

|

|

63,433,048

|

|

|

|

68,088,806

|

|

3

|

7.

|

The proposal to amend the Company’s existing Bye-laws to allow a majority vote of shareholders to approve a business combination, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

314,326,981

|

|

|

|

1,876,345

|

|

|

|

65,425,651

|

|

|

|

68,088,806

|

|

|

8.

|

The proposal to amend the Company’s existing Bye-laws to expressly permit the Board of Directors to adopt a shareholder rights plan with a term of less than 12 months or that is submitted for a vote of

shareholders not more than 12 months following adoption of the plan, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

288,377,866

|

|

|

|

27,779,037

|

|

|

|

65,472,074

|

|

|

|

68,088,806

|

|

|

9.

|

The proposal to amend the Company’s existing Bye-laws to allow shareholders to remove a director with or without cause upon a majority vote and eliminate the limit on the number of directors that can be removed

at one time, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

|

380,394,595

|

|

|

|

2,836,702

|

|

|

|

66,486,486

|

|

|

10.

|

The proposal to amend the Company’s existing Bye-laws to provide for plurality voting in a contested election of directors, was approved based upon the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

310,015,151

|

|

|

|

6,134,543

|

|

|

|

65,479,283

|

|

|

|

68,088,806

|

|

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Dated: November 9, 2016

|

|

|

|

|

MARVELL TECHNOLOGY GROUP LTD.

|

|

|

|

|

By:

|

|

/s/ Jean Hu

|

|

|

|

Jean Hu

|

|

|

|

Chief Financial Officer

|

5

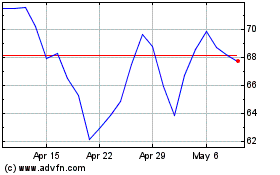

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024