UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM SD

Specialized Disclosure Report

Mercury Systems, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

| | | | |

Massachusetts | | 000-23599 | | 04-2741391 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

201 Riverneck Road, Chelmsford, Massachusetts 01824

(Address of Principal Executive Offices) (Zip Code)

Gerald M. Haines II, (978) 256-1300

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| |

[X] | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

For calendar year 2014, Mercury Systems, Inc. (“we,” “us,” or “our”) conducted a reasonable country of origin inquiry and supply chain due diligence to determine whether our products contained any conflict minerals that originated from the Democratic Republic of the Congo or an adjoining country. A summary of our reasonable country of origin inquiry and due diligence is contained in our conflict minerals report filed as exhibit 1.01 to this report and is incorporated herein by reference.

In accordance with Rule 13p-1 under the Securities Exchange Act of 1934, as amended, we have filed this Specialized Disclosure Report on Form SD, and the conflict minerals report exhibit hereto, with the U.S. Securities and Exchange Commission and have posted such report on our website, www.mrcy.com, under the heading “Who We Are” and “Corporate Social Responsibility.” Information contained on our website does not constitute part of this report.

Item 1.01 Exhibit

A conflict minerals report covering calendar year 2014 has been filed as exhibit 1.01 to this Form SD.

Section 2 – Exhibits

Item 2.01 Exhibits

Exhibit 1.01 – Mercury Systems, Inc. Conflict Minerals Report for the Year Ended December 31, 2014

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

Dated: May 29, 2015 MERCURY SYSTEMS, INC.

By:_Gerald M. Haines II__________________

Gerald M. Haines II

Executive Vice President, Chief Financial Officer, and Treasurer

Exhibit Index

|

| |

Exhibit No. | Description |

1.01 | Mercury Systems, Inc. Conflict Minerals Report for the Year Ended December 31, 2014 |

Exhibit 1.01

Mercury Systems, Inc.

Conflict Minerals Report

For the Year Ended December 31, 2014

This conflict minerals report for the year ended December 31, 2014 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) issued Rule 13p-1 to implement the reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act. This report has been prepared based on Rule 13p-1 as further clarified by the SEC guidance issued on April 29, 2014 in response to the decision of the United States Court of Appeals for the District of Columbia Circuit in National Association of Manufacturers, et al. v. SEC, et al., No. 13-5252 (D.C. Cir. April 14, 2014). References in this report to “DRC” are to the Democratic Republic of the Congo and its adjoining countries (Tanzania, Zambia, Republic of Congo, Central African Republic, Angola, Uganda, Rwanda, South Sudan and Burundi). References in this report to “conflict minerals” are to cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which based on regulations from the SEC are limited to tin, tantalum, tungsten, and gold.

Our Products

Mercury Systems, Inc. (collectively with its subsidiaries, “we,” “us,” or “our”) is a leading high-tech commercial provider of more affordable secure and sensor processing subsystems designed and made in the U.S.A. for critical defense and intelligence applications. We operate across a broad spectrum of defense and intelligence programs and deliver our solutions and services via two business units: (i) Mercury Commercial Electronics (“MCE”) and (ii) Mercury Defense Systems (“MDS”).

In June 2014, we initiated a plan to divest our Mercury Intelligence Systems (“MIS”) operating segment based on our strategic direction and investment priorities focusing on our core business. On January 23, 2015, we completed the sale of the MIS operating segment. During calendar 2014, our MIS operating segment delivered its solutions as a service and did not manufacture or sell products, and accordingly the MIS operating segment is not discussed in this conflict minerals report.

During calendar 2014, our MCE and MDS business units manufactured and sold products as well as provided software and services. Manufacturing operations at MCE and MDS include manufacturing at our own facilities and by contract manufacturers using our design specifications.

MCE sells digital processing products, including embedded processing boards, digital receiver boards, and chassis-based systems, and radio frequency and microwave products, including tuners, converters, transceivers, switch filters, and power amplifiers and limiters. MDS utilizes commercially available technologies and solutions from our MCE business unit, as well as from other sources, to develop integrated sensor processing subsystems and capabilities for the C4ISR

(command, control, communications, computers, intelligence, surveillance and reconnaissance), electronic warfare, electronic counter measures, signals intelligence and radar test and simulation markets.

Conflict minerals, as defined by the regulations of the SEC (i.e., tin, tantalum, tungsten, and gold), are essential to the functionality of most electronic devices and their use is extensive in the electronics industry. Examples of the use of conflict minerals in electronics include: tin solders for joining circuits; tantalum in capacitors; tungsten in metal wires, electrodes, and electrical contacts; and gold in electric plating and circuit boards. We performed a review of our products in light of the SEC’s conflict minerals regulations and the vendors supplying the components and materials incorporated into our products. Our MCE and MDS products are digital and radio frequency/ microwave subsystems and components, incorporating multiple electronic components and connectors. Components and connectors of this type could contain conflict minerals as defined by the SEC, regardless of the country of origin of those minerals.

Our 2014 Reasonable Country of Origin Inquiry and Supply Chain Due Diligence

We do not engage in the extraction, transportation, handling, trading, processing, smelting, refining, or alloying of any conflict minerals and we do not acquire conflict minerals directly from any smelter or mine, regardless of country of origin. To the extent that conflict minerals may be incorporated into our products, they are acquired through our supply chain in the form of components, connectors, solder, and other materials that we or our contract manufacturers incorporate into our finished products. We designed our conflict minerals reasonable country of origin inquiry and supply chain due diligence around our MCE and MDS product manufacturing supply chains. We defined the scope of our conflict minerals inquiry by identifying and contacting the current suppliers on our approved vendor list that provide components or other materials that may contain conflict minerals. We rely upon our suppliers to provide information on the origin of the conflict minerals contained in materials supplied to us, including sources of conflict minerals that are supplied to them from sub-tier suppliers. We expect our suppliers to provide us with sourcing information per our conflict minerals policy.

Our Approved Vendor List

The approved vendor list (“AVL”) for our MCE and MDS business unit supply chains contained 816 third-party vendors from whom we and our contract manufacturers could source materials for the manufacture of our products that may contain conflict minerals. This group of vendors is exclusive of the vendors who provide us with services (but not materials) and the vendors who provide us with materials that are used in our business operations but no elements of which are found in our finished products (e.g. vendors providing office supplies, office equipment, etc.). In many cases, for a given component in one of our products, we have multiple vendors as a source for that component and each of those vendors is listed on our AVL. Our procedures for adding a vendor to our AVL include a review of the vendor’s conflict minerals status as part of the approval process.

The vendors on our AVL vary greatly in size and resources, from multi-national, publicly-traded companies that provide electronic components and materials to a wide industry segment down to local, family-owned businesses that provide us with custom fabricated components on a limited run basis. Some of our larger vendors have been preparing for conflict minerals disclosure for several years and have been participating in the development of industry standards for tracing conflict minerals while other smaller vendors first learned of conflict minerals disclosure in 2013 based on requirements from customers such as us.

Our Conflict Minerals Policy and Vendor Outreach

We adopted our conflict minerals policy in 2013 and posted that policy on our corporate website, www.mrcy.com, under the heading “Who We Are” and “Corporate Social Responsibility.” Our conflict minerals policy is attached as Appendix A to this report. Our 2013 conflict minerals due diligence process included the development of a conflict minerals policy, establishment of a cross-functional team, communication with vendors, gathering compliance data, creating a conflict minerals vendor database, and measuring and internally reporting our due diligence progress during the period. During 2013, we sent vendor notices summarizing our conflict minerals policy to all of the vendors on our AVL. In these notices, we requested responses from our vendors using the Electronic Industry Citizen Coalition Global e-Sustainability Initiative (EICC GeSI) reporting template.

Our 2014 conflict minerals due diligence process included ongoing communication with vendors, gathering compliance data, regularly updating our conflict minerals vendor database, and measuring and internally reporting our due diligence progress during the period. During 2014, we sent vendor notices summarizing our conflict minerals policy to all of the vendors on our AVL. In these notices, we requested responses from our vendors using the Electronic Industry Citizen Coalition Global e-Sustainability Initiative (EICC GeSI) reporting template. Throughout 2014 we sent periodic reminders to our vendors based on their prior responses, or lack of response, to our inquiries.

Responses from Our Vendors

We received responses from vendors in a variety of formats, primarily in the form of EICC GeSI reports, company compliance statements, and company conflict minerals policies. In addition, we also reviewed conflict minerals compliance data on our vendors available in the SiliconExpert Technologies electronic components database. We collected vendor responses, added them to our conflict minerals vendor database, and responded with further clarifying questions, as necessary, based on the form and content of the data provided by the vendors.

We sent conflict minerals inquiries to all 816 vendors on our AVL. We collected responses from our vendors during 2014 and through May 14, 2015. Of the vendors on our AVL, 725 (89%) responded and the remaining 91 vendors (11%) either did not respond to our conflict minerals inquiries or provided responses that did not contain sufficient information to categorize them as either DRC conflict free, DRC conflict undeterminable, or not DRC conflict free. Of the 89% of our vendors who responded to our conflict minerals inquiries, none indicated that their products

contained conflict minerals originating from mines in the DRC that benefit armed groups. We have relied on these suppliers’ responses to provide us with information about the source of the conflict minerals contained in the materials supplied to us. Our suppliers are similarly reliant upon information provided by their direct and indirect suppliers.

Third Party Audit

Based on the SEC guidance issued on April 29, 2014 in response to the decision of the United States Court of Appeals for the District of Columbia Circuit in National Association of Manufacturers, et al. v. SEC, et al., No. 13-5252 (D.C. Cir. April 14, 2014), we are not required to obtain an independent private sector audit of the design of our 2014 due diligence framework or the summary of our due diligence contained in this report.

Additional Actions For 2015

Due to the breadth and complexity of our products and manufacturing supply chain, it will take time for many of our vendors to verify the origin of the conflict minerals that they provide to us in their products. For 2015, using the baseline set of responses and metrics that we have aggregated from our 2014 conflict minerals reports from vendors, we plan to focus our due diligence efforts primarily on the companies who provided DRC conflict undetermined reports and the companies who did not provide any response. We continually refine our outreach process to achieve a higher level of response from our vendors for our conflict minerals report through a combination of: vendor outreach and conflict minerals communication and education; potential changes to the terms and conditions in purchase orders with our vendors; and cautionary notices to vendors that repeatedly fail to provide conflict minerals data, including the potential elimination of non-responsive vendors from our AVL if we have alternative sources for the same component. We believe that our conflict minerals policy statement, as well as our approach to our vendors and our conflict minerals inquiries to our vendors, will tend to minimize or eliminate the incorporation into our products of conflict minerals originating from the DRC that benefit armed groups.

Appendix A

Conflict Minerals Statement

August 19, 2013

Mercury Systems, Inc. and its subsidiaries (collectively, “Mercury”) are committed to ethical business conduct and the responsible sourcing of materials through our global supply chain. In 2012, the U.S. Securities and Exchange Commission (“SEC”) issued final rules implementing the conflict minerals disclosure provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Under these rules, U.S. publicly traded companies must report annually on their use of conflict minerals (tantalum, tin, tungsten, and gold) from the Democratic Republic of Congo (“DRC”) or adjoining countries. Conflict minerals from the DRC or adjoining countries may be mined and sold by armed groups to finance civil war. The minerals can make their way into various supply chains and are commonly used in electronics and other products.

We share the concerns regarding conflict minerals that finance or benefit armed groups in the DRC or adjoining countries. Mercury is committed to sourcing components and materials from companies that share our values and comply with the SEC’s conflict minerals legislation. We are focusing our efforts on the following areas:

1. Tracing the Conflict Minerals Used in Our Products: Mercury is conducting a reasonable country of origin inquiry with our supply base as part of our due diligence process using a coordinated, risk based approach. As part of this process, it is our intention to collect and evaluate supplier responses to an industry established conflict minerals reporting template (EICC template).

2. Working to Validate Conflict-Free Sources: Mercury intends to work with multi-industry consortia to validate smelter compliance with the law. This engagement with a broad coalition of affected industries regarding the complexities of conflict minerals allows us to look at the associated issues more strategically and holistically than as an individual company.

3. Validating and Reporting our Results: Mercury will engage, as appropriate, independent auditors to conduct an audit of our conflict minerals approach and processes as well as review our final report before it is filed with the SEC.

The global supply chain for these minerals is complex and the tracing of them is challenging. Mercury is in the process of implementing new processes to meet the regulatory guidelines for conflict minerals. Mercury intends to fully disclose and comply with all reporting requirements.

Sincerely,

/s/ Stephen Anderson

Stephen Anderson

Vice President, Enterprise Operations

Mercury Systems, Inc.

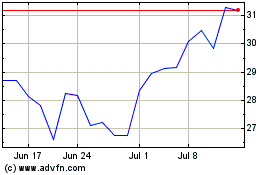

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Apr 2023 to Apr 2024