UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

July 27, 2015

MONOLITHIC POWER SYSTEMS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware |

000-51026 |

77-0466789 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

|

|

|

79 Great Oaks Boulevard, San Jose, CA 95119 |

|

(Address of principal executive offices) (Zip Code) |

|

|

|

(408) 826-0600 |

|

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 27, 2015, Monolithic Power Systems, Inc. (“MPS”) issued a press release regarding its financial results for the quarter ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The information under this Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “1934 Act”), nor shall they be deemed incorporated by reference in any filing with the Securities and Exchange Commission under the 1934 Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On July 27, 2015, MPS issued a press release announcing the Analyst Day on September 15, 2015. A copy of the press release is attached hereto as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

| |

|

|

|

99.1 |

|

Press release issued on July 27, 2015, announcing the financial results for the quarter ended June 30, 2015. |

| 99.2 |

|

Press release issued on July 27, 2015, announcing the Analyst Day on September 15, 2015. |

Index to Exhibits

|

Exhibit |

|

Description |

| |

|

|

|

99.1 |

|

Press release issued on July 27, 2015, announcing the financial results for the quarter ended June 30, 2015. |

| 99.2 |

|

Press release issued on July 27, 2015, announcing the Analyst Day on September 15, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: July 27, 2015 |

|

By: |

|

/s/ Meera Rao |

|

|

|

|

|

Meera Rao |

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

|

|

PRESS RELEASE

For Immediate Release |

Monolithic Power Systems, Inc.

79 Great Oaks Boulevard

San Jose, CA 95119 USA

T: 408-826-0600, F: 408-826-0601

www.monolithicpower.com

Monolithic Power Systems Announces

Results for the Second Quarter Ended June 30, 2015

SAN JOSE, California, July 27, 2015--Monolithic Power Systems (MPS) (Nasdaq: MPWR), a leading company in high performance power solutions, today announced financial results for the quarter ended June 30, 2015.

The results for the quarter ended June 30, 2015 are as follows:

| |

● |

Net revenue was $81.4 million, a 10.7% increase from $73.5 million in the first quarter of 2015 and a 19.0% increase from $68.4 million in the second quarter of 2014. |

| |

● |

GAAP gross margin was 54.2%, which included the impact of $0.3 million for stock-based compensation expense and $0.4 million for the amortization of acquisition-related intangible assets, compared with 54.2% in the second quarter of 2014, which included the impact of $0.2 million for stock-based compensation expense. |

| |

● |

Non-GAAP gross margin(1) was 55.0%, which excluded the impact of $0.3 million for stock-based compensation expense and $0.4 million for the amortization of acquisition-related intangible assets, compared with 54.5% in the second quarter of 2014, which excluded the impact of $0.2 million for stock-based compensation expense. |

| |

● |

GAAP operating expenses were $34.0 million, including $33.7 million for research and development (R&D) and selling, general and administrative (SG&A) expenses, which included $9.2 million for stock-based compensation expense and $0.2 million for deferred compensation plan income, and $0.3 million for litigation expenses. Comparatively, for the quarter ended June 30, 2014, GAAP operating expenses were $30.5 million, including $30.2 million for R&D and SG&A expense, which included $8.2 million for stock-based compensation expense and $0.5 million for acquisition-related expense, and a $0.3 million litigation expense. |

| |

● |

Non-GAAP(1) operating expenses were $25.0 million, excluding $9.2 million for stock-based compensation expense and $0.2 million for deferred compensation plan income, compared with $21.8 million, excluding $8.2 million for stock-based compensation expense and $0.5 million for acquisition-related expense, for the quarter ended June 30, 2014. |

| |

● |

GAAP operating income was $10.1 million, including $9.5 million for stock-based compensation expense, $0.4 million for the amortization of acquisition-related intangible assets, and $0.2 million for deferred compensation plan income. Comparatively, for the quarter ended June 30, 2014, GAAP operating income was $6.6 million, including $8.4 million for stock-based compensation expense and $0.5 million for acquisition-related expense. |

| |

● |

Non-GAAP(1) operating income was $19.8 million, excluding $9.5 million for stock-based compensation expense, $0.4 million for the amortization of acquisition-related intangible assets, and $0.2 million for deferred compensation plan income, compared with $15.5 million, excluding $8.4 million for stock-based compensation expense and $0.5 million for acquisition-related expense, for the quarter ended June 30, 2014. |

| |

● |

GAAP net income was $7.9 million and GAAP earnings per share were $0.19 per diluted share. Comparatively, GAAP net income was $6.4 million and GAAP earnings per share were $0.16 per diluted share for the quarter ended June 30, 2014. |

| |

● |

Non-GAAP(1) net income was $18.8 million and non-GAAP earnings per share were $0.46 per diluted share, excluding stock-based compensation expense, amortization of acquisition-related intangible assets, net deferred compensation plan expense and related tax effects, compared with non-GAAP net income of $14.6 million and non-GAAP earnings per share of $0.37 per diluted share, excluding stock-based compensation expense, acquisition-related expense and related tax effects, for the quarter ended June 30, 2014. |

The results for the six months ended June 30, 2015 are as follows:

| |

● |

Net revenue was $155.0 million, a 20.6% increase from $128.5 million for the six months ended June 30, 2014. |

| |

● |

GAAP gross margin was 54.1%, which included the impact of $0.5 million for stock-based compensation expense and $0.7 million for the amortization of acquisition-related intangible assets, compared with 53.9% for the six months ended June 30, 2014, which included the impact of $0.4 million for stock-based compensation expense. |

| |

● |

Non-GAAP gross margin(1) was 54.9%, which excluded the impact of $0.5 million for stock-based compensation expense and $0.7 million for the amortization of acquisition-related intangible assets, compared with 54.2% for the six months ended June 30, 2014, which excluded the impact of $0.4 million for stock-based compensation expense. |

| |

● |

GAAP operating expenses were $67.8 million, including $67.3 million for R&D and SG&A expenses, which included $18.2 million for stock-based compensation expense, and $0.5 million for litigation expenses. Comparatively, for the six months ended June 30, 2014, GAAP operating expenses were $53.5 million, including $61.9 million for R&D and SG&A expense, which included $15.6 million for stock-based compensation expense and $0.5 million for acquisition-related expense, and a $(8.4) million net litigation benefit. For the six months ended June 30, 2014, MPS recognized a one-time $9.5 million litigation benefit from the settlement of the O2 Micro lawsuit. |

| |

● |

Non-GAAP(1) operating expenses were $49.6 million, excluding $18.2 million for stock-based compensation expense, compared with $37.4 million, excluding $15.6 million for stock-based compensation expense and $0.5 million for acquisition-related expense, for the six months ended June 30, 2014. |

| |

● |

GAAP operating income was $16.0 million, including $18.7 million for stock-based compensation expense and $0.7 million for the amortization of acquisition-related intangible assets. Comparatively, for the six months ended June 30, 2014, GAAP operating income was $15.7 million, including $16.0 million for stock-based compensation expense and $0.5 million for acquisition-related expense. |

| |

● |

Non-GAAP(1) operating income was $35.4 million, excluding $18.7 million for stock-based compensation expense and $0.7 million for the amortization of acquisition-related intangible assets, compared with $32.2 million, excluding $16.0 million for stock-based compensation expense and $0.5 million for acquisition-related expense, for the six months ended June 30, 2014. |

| |

● |

GAAP net income was $13.9 million and GAAP earnings per share were $0.34 per diluted share. Comparatively, GAAP net income was $15.4 million and GAAP earnings per share were $0.39 per diluted share for the six months ended June 30, 2014. |

| |

● |

Non-GAAP(1) net income was $33.7 million and non-GAAP earnings per share were $0.83 per diluted share, excluding stock-based compensation expense, amortization of acquisition-related intangible assets, net deferred compensation plan expense and related tax effects, compared with non-GAAP net income of $30.2 million and non-GAAP earnings per share of $0.76 per diluted share, excluding stock-based compensation expense, acquisition-related expense and related tax effects, for the six months ended June 30, 2014. |

The following is a summary of revenue by end market for the periods indicated, estimated based on MPS’s assessment of available end market data (in millions):

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

End Market |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Communication |

|

$ |

17.1 |

|

|

$ |

17.0 |

|

|

$ |

34.4 |

|

|

$ |

30.6 |

|

|

Storage and Computing |

|

|

12.6 |

|

|

|

10.8 |

|

|

|

24.0 |

|

|

|

21.4 |

|

|

Consumer |

|

|

35.5 |

|

|

|

28.5 |

|

|

|

67.0 |

|

|

|

54.6 |

|

|

Industrial |

|

|

16.2 |

|

|

|

12.1 |

|

|

|

29.6 |

|

|

|

21.9 |

|

|

Total |

|

$ |

81.4 |

|

|

$ |

68.4 |

|

|

$ |

155.0 |

|

|

$ |

128.5 |

|

The following is a summary of revenue by product family for the periods indicated (in millions):

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

Product Family |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

DC to DC |

|

$ |

73.2 |

|

|

$ |

61.2 |

|

|

$ |

139.5 |

|

|

$ |

115.1 |

|

|

Lighting Control |

|

|

8.2 |

|

|

|

7.2 |

|

|

|

15.5 |

|

|

|

13.4 |

|

|

Total |

|

$ |

81.4 |

|

|

$ |

68.4 |

|

|

$ |

155.0 |

|

|

$ |

128.5 |

|

“This is the eighth consecutive quarter MPS has achieved double digit year-over-year revenue growth," said Michael Hsing, CEO and founder of MPS. “MPS continues to deliver.”

Business Outlook

The following are MPS’ financial targets for the third quarter ending September 30, 2015:

| |

● |

Revenue in the range of $89 million to $93 million. |

| |

● |

GAAP gross margin between 53.9% and 54.9%. Non-GAAP(1) gross margin between 54.6% and 55.6%. This excludes an estimated impact of stock-based compensation expenses of 0.3% and amortization of acquisition-related intangible assets of 0.4%. |

| |

● |

GAAP R&D and SG&A expenses between $34.6 million and $36.2 million. Non-GAAP(1) R&D and SG&A expenses between $25.8 million and $26.8 million. This excludes an estimate of stock-based compensation expenses in the range of $8.8 million to $9.4 million. |

| |

● |

Total stock-based compensation expense of $9.1 million to $9.7 million. |

| |

● |

Litigation expenses of $200,000 to $400,000. |

| |

● |

Other income of $200,000 to $300,000 before foreign exchange gains or losses. |

| |

● |

Fully diluted shares outstanding between 40.8 million and 41.4 million before shares buyback. |

(1) Non-GAAP net income, non-GAAP earnings per share, non-GAAP gross margin, non-GAAP operating expenses and non-GAAP operating income differ from net income, earnings per share, gross margin, operating expenses and operating income determined in accordance with GAAP (Generally Accepted Accounting Principles in the United States). Non-GAAP net income and non-GAAP earnings per share for the three and six months ended June 30, 2015 and 2014 exclude the effect of stock-based compensation expense, amortization of acquisition-related intangible assets, acquisition-related expense, deferred compensation plan income/expense and related tax effects. Non-GAAP gross margin for the three and six months ended June 30, 2015 and 2014 exclude the effect of stock-based compensation expense and amortization of acquisition-related intangible assets. Non-GAAP operating expenses for the three and six months ended June 30, 2015 and 2014 exclude the effect of stock-based compensation expense, acquisition-related expense and deferred compensation plan income/expense. Non-GAAP operating income for the three and six months ended June 30, 2015 and 2014 excludes the effect of stock-based compensation expense, amortization of acquisition-related intangible assets, acquisition-related expense and deferred compensation plan income/expense. Projected non-GAAP gross margin excludes the effect of stock-based compensation expense and amortization of acquisition-related intangible assets. Projected non-GAAP R&D and SG&A expenses exclude the effect of stock-based compensation expense. These non-GAAP financial measures are not prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. A schedule reconciling non-GAAP financial measures is included at the end of this press release. MPS utilizes both GAAP and non-GAAP financial measures to assess what it believes to be its core operating performance and to evaluate and manage its internal business and assist in making financial operating decisions. MPS believes that the inclusion of non-GAAP financial measures, together with GAAP measures, provides investors with an alternative presentation useful to investors' understanding of MPS’ core operating results and trends. Additionally, MPS believes that the inclusion of non-GAAP measures, together with GAAP measures, provides investors with an additional dimension of comparability to similar companies. However, investors should be aware that non-GAAP financial measures utilized by other companies are not likely to be comparable in most cases to the non-GAAP financial measures used by MPS.

Conference Call

MPS plans to conduct an investor teleconference covering its quarter ended June 30, 2015 results at 2:00 p.m. PT / 5:00 p.m. ET, July 27, 2015. To access the conference call and the following replay of the conference call, go to http://ir.monolithicpower.com and click on the webcast link. From this site, you can listen to the teleconference, assuming that your computer system is configured properly. In addition to the webcast replay, which will be archived for all investors for one year on the MPS website, a phone replay will be available for seven days after the live call at (404) 537-3406, code number 82729508. This press release and any other information related to the call will also be posted on the website.

Safe Harbor Statement

This press release contains, and statements that will be made during the accompanying teleconference will contain, forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including, among other things, (i) projected revenues, GAAP and non-GAAP gross margin, GAAP and non-GAAP R&D and SG&A expenses, stock-based compensation expenses, amortization of acquisition-related intangible assets, litigation expenses, other income and diluted shares outstanding for the quarter ending September 30, 2015, (ii) our outlook for the long-term prospects of the company, including our performance against our business plan, expected revenue growth and the prospects of our new product families, (iii) our ability to penetrate new markets and expand our market share, (iv) the seasonality of our business, (v) our ability to reduce our expenses, and (vi) statements of the assumptions underlying or relating to any statement described in (i), (ii), (iii), (iv), or (v). These forward-looking statements are not historical facts or guarantees of future performance or events, are based on current expectations, estimates, beliefs, assumptions, goals, and objectives, and involve significant known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from the results expressed by these statements. Readers of this press release and listeners to the accompanying conference call are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ include, but are not limited to, our ability to attract new customers and retain existing customers; acceptance of, or demand for, MPS’ products, in particular the new products launched within the past 18 months, being different than expected; competition generally and the increasingly competitive nature of our industry; any market disruptions or interruptions in MPS’ schedule of new product release development; adverse changes in production and testing efficiency of our products; our ability to realize the anticipated benefits of companies and products that we acquire, and our ability to effectively and efficiently integrate these acquired companies and products into our operations; our ability to manage our inventory levels; adverse changes in government regulations in foreign countries where MPS has offices or operations; the effect of catastrophic events; adequate supply of our products from our third-party manufacturing partners; the risks, uncertainties and costs of litigation in which we are involved; the outcome of any upcoming trials, hearings, motions and appeals; the adverse impact on MPS’ financial performance if its tax and litigation provisions are inadequate; adverse changes or developments in the semiconductor industry generally; difficulty in predicting or budgeting for future customer demand and channel inventories, expenses and financial contingencies; and other important risk factors identified in MPS’ Securities and Exchange Commission (SEC) filings, including, but not limited to, its quarterly report on Form 10-Q filed with the SEC on May 6, 2015.

The forward-looking statements in this press release represent MPS’ projections and current expectations, as of the date hereof, not predictions of actual performance. MPS assumes no obligation to update the information in this press release or in the accompanying conference call.

About Monolithic Power Systems

Monolithic Power Systems, Inc. (MPS) provides small, highly energy efficient, easy-to-use power solutions for systems found in industrial applications, telecom infrastructures, cloud computing, automotive, and consumer applications. MPS' mission is to reduce total energy consumption in its customers' systems with green, practical, compact solutions. The company was founded by Michael R. Hsing in 1997 and is headquartered in San Jose, CA. MPS can be contacted through its website at www.monolithicpower.com or its support offices around the world.

###

Monolithic Power Systems, MPS, and the MPS logo are registered trademarks of Monolithic Power Systems, Inc. in the U.S. and trademarked in certain other countries.

Contact:

Meera Rao

Chief Financial Officer

Monolithic Power Systems, Inc.

408-826-0777

investors@monolithicpower.com

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except par value)

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

80,868 |

|

|

$ |

126,266 |

|

|

Short-term investments |

|

|

150,166 |

|

|

|

112,452 |

|

|

Accounts receivable, net |

|

|

26,765 |

|

|

|

25,630 |

|

|

Inventories |

|

|

64,964 |

|

|

|

40,918 |

|

|

Prepaid expenses and other current assets |

|

|

2,554 |

|

|

|

2,880 |

|

|

Total current assets |

|

|

325,317 |

|

|

|

308,146 |

|

|

Property and equipment, net |

|

|

62,163 |

|

|

|

62,942 |

|

|

Long-term investments |

|

|

5,375 |

|

|

|

5,389 |

|

|

Goodwill |

|

|

6,571 |

|

|

|

6,571 |

|

|

Acquisition-related intangible assets, net |

|

|

6,078 |

|

|

|

6,812 |

|

|

Deferred tax assets, net |

|

|

1,053 |

|

|

|

1,049 |

|

|

Other long-term assets |

|

|

11,066 |

|

|

|

8,457 |

|

|

Total assets |

|

$ |

417,623 |

|

|

$ |

399,366 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

16,596 |

|

|

$ |

13,138 |

|

|

Accrued compensation and related benefits |

|

|

11,236 |

|

|

|

9,020 |

|

|

Accrued liabilities |

|

|

18,402 |

|

|

|

14,703 |

|

|

Total current liabilities |

|

|

46,234 |

|

|

|

36,861 |

|

|

Deferred tax and other tax liabilities |

|

|

3,018 |

|

|

|

5,876 |

|

|

Other long-term liabilities |

|

|

13,609 |

|

|

|

10,204 |

|

|

Total liabilities |

|

|

62,861 |

|

|

|

52,941 |

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; shares authorized: 150,000; shares issued and outstanding: 39,617 and 38,832 as of June 30, 2015 and December 31, 2014, respectively |

|

|

251,553 |

|

|

|

240,500 |

|

|

Retained earnings |

|

|

97,023 |

|

|

|

100,114 |

|

|

Accumulated other comprehensive income |

|

|

6,186 |

|

|

|

5,811 |

|

|

Total stockholders’ equity |

|

|

354,762 |

|

|

|

346,425 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

417,623 |

|

|

$ |

399,366 |

|

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share amounts)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Revenue |

|

$ |

81,416 |

|

|

$ |

68,436 |

|

|

$ |

154,954 |

|

|

$ |

128,497 |

|

|

Cost of revenue |

|

|

37,287 |

|

|

|

31,337 |

|

|

|

71,142 |

|

|

|

59,301 |

|

|

Gross profit |

|

|

44,129 |

|

|

|

37,099 |

|

|

|

83,812 |

|

|

|

69,196 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

15,743 |

|

|

|

13,368 |

|

|

|

31,781 |

|

|

|

28,971 |

|

|

Selling, general and administrative |

|

|

17,964 |

|

|

|

16,853 |

|

|

|

35,482 |

|

|

|

32,962 |

|

|

Litigation expense (benefit), net |

|

|

311 |

|

|

|

274 |

|

|

|

581 |

|

|

|

(8,426 |

) |

|

Total operating expenses |

|

|

34,018 |

|

|

|

30,495 |

|

|

|

67,844 |

|

|

|

53,507 |

|

|

Income from operations |

|

|

10,111 |

|

|

|

6,604 |

|

|

|

15,968 |

|

|

|

15,689 |

|

|

Interest and other income, net |

|

|

235 |

|

|

|

295 |

|

|

|

877 |

|

|

|

485 |

|

|

Income before income taxes |

|

|

10,346 |

|

|

|

6,899 |

|

|

|

16,845 |

|

|

|

16,174 |

|

|

Income tax provision |

|

|

2,447 |

|

|

|

502 |

|

|

|

2,983 |

|

|

|

759 |

|

|

Net income |

|

$ |

7,899 |

|

|

$ |

6,397 |

|

|

$ |

13,862 |

|

|

$ |

15,415 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.20 |

|

|

$ |

0.17 |

|

|

$ |

0.35 |

|

|

$ |

0.40 |

|

|

Diluted |

|

$ |

0.19 |

|

|

$ |

0.16 |

|

|

$ |

0.34 |

|

|

$ |

0.39 |

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

39,570 |

|

|

|

38,684 |

|

|

|

39,337 |

|

|

|

38,577 |

|

|

Diluted |

|

|

40,745 |

|

|

|

39,608 |

|

|

|

40,670 |

|

|

|

39,563 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

|

$ |

0.20 |

|

|

$ |

0.15 |

|

|

$ |

0.40 |

|

|

$ |

0.15 |

|

SUPPLEMENTAL FINANCIAL INFORMATION

STOCK-BASED COMPENSATION EXPENSE

(Unaudited, in thousands)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Cost of revenue |

|

$ |

284 |

|

|

$ |

219 |

|

|

$ |

526 |

|

|

$ |

424 |

|

|

Research and development |

|

|

2,503 |

|

|

|

2,245 |

|

|

|

5,123 |

|

|

|

4,250 |

|

|

Selling, general and administrative |

|

|

6,710 |

|

|

|

5,951 |

|

|

|

13,067 |

|

|

|

11,339 |

|

|

Total stock-based compensation expense |

|

$ |

9,497 |

|

|

$ |

8,415 |

|

|

$ |

18,716 |

|

|

$ |

16,013 |

|

RECONCILIATION OF NET INCOME TO NON-GAAP NET INCOME

(Unaudited, in thousands, except per share amounts)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Net income |

|

$ |

7,899 |

|

|

$ |

6,397 |

|

|

$ |

13,862 |

|

|

$ |

15,415 |

|

|

Net income as a percentage of revenue |

|

|

9.7 |

% |

|

|

9.3 |

% |

|

|

8.9 |

% |

|

|

12.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to non-GAAP net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

9,497 |

|

|

|

8,415 |

|

|

|

18,716 |

|

|

|

16,013 |

|

|

Amortization of acquisition-related intangible assets |

|

|

367 |

|

|

|

- |

|

|

|

733 |

|

|

|

- |

|

|

Acquisition-related expense |

|

|

- |

|

|

|

515 |

|

|

|

- |

|

|

|

515 |

|

|

Deferred compensation expense |

|

|

69 |

|

|

|

- |

|

|

|

109 |

|

|

|

- |

|

|

Tax effect |

|

|

926 |

|

|

|

(685 |

) |

|

|

253 |

|

|

|

(1,694 |

) |

|

Non-GAAP net income |

|

$ |

18,758 |

|

|

$ |

14,642 |

|

|

$ |

33,673 |

|

|

$ |

30,249 |

|

|

Non-GAAP net income as a percentage of revenue |

|

|

23.0 |

% |

|

|

21.4 |

% |

|

|

21.7 |

% |

|

|

23.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.47 |

|

|

$ |

0.38 |

|

|

$ |

0.86 |

|

|

$ |

0.78 |

|

|

Diluted |

|

$ |

0.46 |

|

|

$ |

0.37 |

|

|

$ |

0.83 |

|

|

$ |

0.76 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in the calculation of non-GAAP net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

39,570 |

|

|

|

38,684 |

|

|

|

39,337 |

|

|

|

38,577 |

|

|

Diluted |

|

|

40,745 |

|

|

|

39,608 |

|

|

|

40,670 |

|

|

|

39,563 |

|

RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN

(Unaudited, in thousands)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Gross profit |

|

$ |

44,129 |

|

|

$ |

37,099 |

|

|

$ |

83,812 |

|

|

$ |

69,196 |

|

|

Gross margin |

|

|

54.2 |

% |

|

|

54.2 |

% |

|

|

54.1 |

% |

|

|

53.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile gross profit to non-GAAP gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

284 |

|

|

|

219 |

|

|

|

526 |

|

|

|

424 |

|

|

Amortization of acquisition-related intangible assets |

|

|

367 |

|

|

|

- |

|

|

|

733 |

|

|

|

- |

|

|

Non-GAAP gross profit |

|

$ |

44,780 |

|

|

$ |

37,318 |

|

|

$ |

85,071 |

|

|

$ |

69,620 |

|

|

Non-GAAP gross margin |

|

|

55.0 |

% |

|

|

54.5 |

% |

|

|

54.9 |

% |

|

|

54.2 |

% |

RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES

(Unaudited, in thousands)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Total operating expenses |

|

$ |

34,018 |

|

|

$ |

30,495 |

|

|

$ |

67,844 |

|

|

$ |

53,507 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile total operating expenses to non-GAAP total operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

(9,213 |

) |

|

|

(8,196 |

) |

|

|

(18,190 |

) |

|

|

(15,589 |

) |

|

Acquisition-related expense |

|

|

- |

|

|

|

(515 |

) |

|

|

- |

|

|

|

(515 |

) |

|

Deferred compensation plan income (expense) |

|

|

146 |

|

|

|

- |

|

|

|

(20 |

) |

|

|

- |

|

|

Non-GAAP operating expenses |

|

$ |

24,951 |

|

|

$ |

21,784 |

|

|

$ |

49,634 |

|

|

$ |

37,403 |

|

RECONCILIATION OF OPERATING INCOME TO NON-GAAP OPERATING INCOME

(Unaudited, in thousands)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Total operating income |

|

$ |

10,111 |

|

|

$ |

6,604 |

|

|

$ |

15,968 |

|

|

$ |

15,689 |

|

|

Operating income as a percentage of revenue |

|

|

12.4 |

% |

|

|

9.6 |

% |

|

|

10.3 |

% |

|

|

12.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile total operating income to non-GAAP total operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

9,497 |

|

|

|

8,415 |

|

|

|

18,716 |

|

|

|

16,013 |

|

|

Amortization of acquisition-related intangible assets |

|

|

367 |

|

|

|

- |

|

|

|

733 |

|

|

|

- |

|

|

Acquisition-related expense |

|

|

- |

|

|

|

515 |

|

|

|

- |

|

|

|

515 |

|

|

Deferred compensation plan expense (income) |

|

|

(146 |

) |

|

|

- |

|

|

|

20 |

|

|

|

- |

|

|

Non-GAAP operating income |

|

$ |

19,829 |

|

|

$ |

15,534 |

|

|

$ |

35,437 |

|

|

$ |

32,217 |

|

|

Non-GAAP operating income as a percentage of revenue |

|

|

24.4 |

% |

|

|

22.7 |

% |

|

|

22.9 |

% |

|

|

25.1 |

% |

2015 THIRD QUARTER OUTLOOK

RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN

(Unaudited)

| |

|

Three Months Ending September 30, 2014 |

|

| |

|

September 30, 2015 |

|

| |

|

Low |

|

|

High |

|

|

Gross margin |

|

|

53.9 |

% |

|

|

54.9 |

% |

|

Adjustments to reconcile gross margin to non-GAAP gross margin: |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

0.3 |

% |

|

|

0.3 |

% |

|

Amortization of acquisition-related intangible assets |

|

|

0.4 |

% |

|

|

0.4 |

% |

|

Non-GAAP gross margin |

|

|

54.6 |

% |

|

|

55.6 |

% |

RECONCILIATION OF R&D AND SG&A EXPENSES TO NON-GAAP R&D AND SG&A EXPENSES

(Unaudited, in thousands)

| |

|

Three Months Ending September 30, 2014 |

|

| |

|

September 30, 2015 |

|

| |

|

Low |

|

|

High |

|

|

R&D and SG&A expense |

|

$ |

34,600 |

|

|

$ |

36,200 |

|

|

Adjustments to reconcile R&D and SG&A expense to non-GAAP R&D and SG&A expense: |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

(8,800 |

) |

|

|

(9,400 |

) |

|

Non-GAAP R&D and SG&A expense |

|

$ |

25,800 |

|

|

$ |

26,800 |

|

Exhibit 99.2

|

|

PRESS RELEASE

For Immediate Release |

Monolithic Power Systems, Inc.

79 Great Oaks Boulevard

San Jose, CA 95119 USA

T: 408-826-0600, F: 408-826-0601

www.monolithicpower.com

Monolithic Power Systems Announces

Analyst Day on September 15, 2015

SAN JOSE, California, July 27, 2015--Monolithic Power Systems (MPS) (Nasdaq: MPWR), a leading company in high performance power solutions, today announced the details of its 2015 Analyst Day. MPS will host the Analyst Day from 9 am to noon (PT) on Tuesday, September 15, 2015 at its headquarters in San Jose, California.

The event will include presentations from members of MPS’s management team, followed by a question and answer session. To RSVP for the event, please email investors@monolithicpower.com.

Parties not present at the event can view the presentation slides and listen to the live audio webcast through the Investor Relations page of the MPS website at http://ir.monolithicpower.com. An audio replay of the webcast will be available shortly after the end of the meeting for one year at the same location.

About Monolithic Power Systems

Monolithic Power Systems, Inc. (MPS) provides small, highly energy efficient, easy-to-use power solutions for systems found in industrial applications, telecom infrastructures, cloud computing, automotive, and consumer applications. MPS' mission is to reduce total energy consumption in its customers' systems with green, practical, compact solutions. The company was founded by Michael R. Hsing in 1997 and is headquartered in San Jose, CA. MPS can be contacted through its website at www.monolithicpower.com or its support offices around the world.

###

Monolithic Power Systems, MPS, and the MPS logo are registered trademarks of Monolithic Power Systems, Inc. in the U.S. and trademarked in certain other countries.

Contact:

Meera Rao

Chief Financial Officer

Monolithic Power Systems, Inc.

408-826-0777

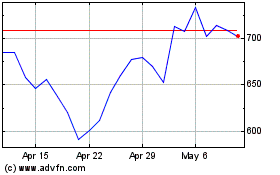

Monolithic Power Systems (NASDAQ:MPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

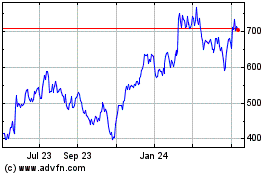

Monolithic Power Systems (NASDAQ:MPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024