Lincoln Electric Announces New Share Repurchase Program and Declares Quarterly Dividend

April 20 2016 - 4:15PM

Lincoln Electric Holdings, Inc., (the "Company") (Nasdaq:LECO)

today announced that its Board of Directors has approved a new

share repurchase program authorizing the Company to repurchase, in

the aggregate, up to 10 million of its outstanding common stock.

The new program, in addition to the 2.8 million shares remaining

from the prior program, represents approximately 18% of the diluted

weighted average shares outstanding as of March 31, 2016.

Under the authorization program, Lincoln Electric may repurchase

shares on the open market or through privately negotiated

transactions from time to time, depending on market conditions and

subject to other factors.

Additionally, the board declared a quarterly cash dividend of

$0.32 per share, payable July 15, 2016, to holders of record as of

June 30, 2016.

“Our confidence in the Company’s strong cash flow generation and

balance sheet profile allows us to invest in growth and return cash

to shareholders through the cycle,” said Christopher L. Mapes,

Chairman, President and Chief Executive Officer. “In the last ten

years, we have returned over $1.6 billion in cash to shareholders

through dividends and share buybacks and have consecutively

increased our dividend payout rate for twenty years. This new

program provides flexibility in achieving our capital allocation

goals as part of our ‘2020 Vision and Strategy.’”

About Lincoln Electric

Lincoln Electric is the world leader in the design, development

and manufacture of arc welding products, robotic arc welding

systems, plasma and oxyfuel cutting equipment and has a leading

global position in the brazing and soldering alloys market.

Headquartered in Cleveland, Ohio, Lincoln has 48 manufacturing

locations, including operations and joint ventures in 19 countries

and a worldwide network of distributors and sales offices covering

more than 160 countries. For more information about Lincoln

Electric and its products and services, visit the Company’s website

at www.lincolnelectric.com.

Forward-Looking Statements

The Company’s expectations and beliefs concerning the future

contained in this news release are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements reflect management’s current expectations

and involve a number of risks and uncertainties. Forward-looking

statements generally can be identified by the use of words such as

“may,” “will,” “expect,” “intend,” “estimate,” “anticipate,”

“believe,” “forecast,” “guidance” or words of similar meaning.

Actual results may differ materially from such statements due to a

variety of factors that could adversely affect the Company’s

operating results. The factors include, but are not limited to:

general economic and market conditions; the effectiveness of

operating initiatives; completion of planned divestitures; interest

rates; disruptions, uncertainty or volatility in the credit markets

that may limit our access to capital; currency exchange rates and

devaluations, including in highly inflationary countries such as

Venezuela; adverse outcome of pending or potential litigation;

actual costs of the Company’s rationalization plans; possible

acquisitions; market risks and price fluctuations related to the

purchase of commodities and energy; global regulatory complexity;

and the possible effects of events beyond our control, such as

political unrest, acts of terror and natural disasters, on the

Company or its customers, suppliers and the economy in general. For

additional discussion, see “Item 1A. Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 31,

2015.

Contact

Amanda Butler

Director, Investor Relations

Tel: 216.383.2534

Email: Amanda_Butler@lincolnelectric.com

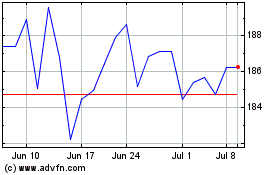

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

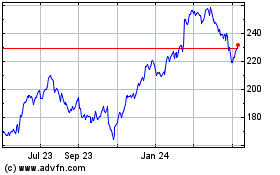

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024