UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Ohio | | 0-1402 | | 34-1860551 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

22801 St. Clair Avenue, Cleveland, Ohio | | 44117 |

(Address of principal executive offices) | | (Zip Code) |

|

|

Guy Cline, (216) 383-2564 |

(Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

INTRODUCTION

As used in this Form SD, the term "Company," except as otherwise indicated by the context, means Lincoln Electric Holdings, Inc. and its wholly-owned and majority-owned subsidiaries for which it has a controlling interest. The Company’s product portfolio is primarily grouped into welding consumables which include consumable electrodes, fluxes and brazing products and equipment consisting of arc welding power sources, wire feeding systems, robotic welding packages, fume extraction equipment, CNC plasma and oxy-fuel cutting systems.

The Company has, through wholly-owned subsidiaries or joint ventures, manufacturing facilities located in the United States, Brazil, Canada, China, Colombia, France, Germany, India, Indonesia, Italy, Mexico, the Netherlands, Poland, Portugal, Russia, Turkey, the United Kingdom and Venezuela. The principal raw materials essential to the Company's business are steel, electronic components, engines, brass, copper, silver, aluminum alloys and various chemicals, all of which are normally available for purchase in the open market.

The Company's Conflict Mineral Policy can be viewed on the its website at www.lincolnelectric.com.

SECTION 1 - CONFLICT MINERALS DISCLOSURE

Item 1.01 Conflict Minerals Disclosure and Report

The Company has conducted a good faith investigation in connection with the products it manufactured or contracted to be manufactured in the period from January 1 to December 31, 2014, to determine whether its products contain certain conflict minerals and their derivatives, including tin, tantalum, tungsten and gold which are commonly termed “3TG” (here forward “Conflict Minerals”) and whether the Conflict Minerals are necessary to the functionality or production of any of these products. As part of this investigation, the Company has conducted a good faith inquiry of its suppliers to determine whether any Conflict Minerals contained within its products originated in the Democratic Republic of the Congo or its surrounding areas (the “Covered Countries”) or were from recycled or scrapped sources.

For the Company's product groups defined above, corporate supply chain management and research and development in conjunction with local management reviewed the Company’s purchased raw materials and components. The purchased raw materials and components determined to contain Conflict Minerals were reviewed to determine the supplier(s) of the purchased item. Local management engaged identified suppliers, inquiring as to the purchased item’s country of origin, including whether any of their downstream suppliers are obtaining materials from the Covered Countries.

Refer to Exhibit 1.01 - Conflict Minerals Report incorporated herein for further detail on the Company's designed due diligence procedures and efforts in determining the origin of its products. This Form SD, including incorporated exhibits, can be obtained from the Company's website at www.lincolnelectric.com.

Item 1.02 Exhibit

The Company has included its Conflict Minerals Report as Exhibit 1.01 to this Form SD.

SECTION 2 - EXHIBITS

Item 2.01 Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | LINCOLN ELECTRIC HOLDINGS, INC. |

| | |

| | /s/ Frederick G. Stueber |

| | Frederick G. Stueber |

| | Executive Vice President, General Counsel & Secretary |

| | May 28, 2015 |

EXHIBIT 1.01

Lincoln Electric Holdings, Inc

Conflict Minerals Report

For the Year Ended December 31, 2014

General

As used in this report, the term "Company," except as otherwise indicated by the context, means Lincoln Electric Holdings, Inc. and its wholly-owned and majority-owned subsidiaries for which it has a controlling interest. The Company’s product portfolio is primarily grouped into welding consumables, which include consumable electrodes, fluxes and brazing products and equipment, consisting of arc welding power sources, wire feeding systems, robotic welding packages, fume extraction equipment, CNC plasma and oxy-fuel cutting systems.

The Company has, through wholly-owned subsidiaries or joint ventures, manufacturing facilities located in the United States, Brazil, Canada, China, Colombia, France, Germany, India, Indonesia, Italy, Mexico, the Netherlands, Poland, Portugal, Russia, Turkey, the United Kingdom and Venezuela. The principal raw materials essential to the Company's business are steel, electronic components, engines, brass, copper, silver, aluminum alloys and various chemicals, all of which are normally available for purchase in the open market.

Due Diligence Framework Design and Measures Performed

Design of Due Diligence Framework

The Company's due diligence framework has been designed to conform to the Organization for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Second Edition and the related supplements for conflict minerals and their derivatives, including tin, tantalum, tungsten and gold which are commonly termed “3TG” (here forward “Conflict Minerals”).

Description of Due Diligence Measures Performed

Management Systems

The Company established a Conflict Minerals Steering Committee (the "Committee") led by the Executive Vice President, General Counsel & Secretary and consisting of a cross functional team from legal, finance, information technology, supply chain management and research and development. The Committee developed the Company's Conflict Minerals policy, related procedures and compliance strategy.

Identify and Assess Risk in the Supply Chain

The purchased raw materials and components determined to contain Conflict Minerals were reviewed to determine the supplier(s) of the purchased item. Local management engaged identified suppliers, inquiring as to the purchased item’s country of origin, including whether any of their downstream suppliers obtained materials from the Democratic Republic of the Congo or its surrounding areas (the “Covered Countries”).

Local management monitored the completion of supplier inquiries including the review of received responses to ensure that they were complete and did not include what management has defined as inconsistencies. An incomplete or inconsistent response would require further follow-up.

All questionnaire responses and observations for each item were aggregated by local management and submitted to the Corporate Director of Environmental Health and Safety (the "EHS Director"). The EHS Director aggregated all inquiry responses and provided Corporate management a summary of the supplier engagement results.

Design and Implement a Strategy to Respond to Risks

As noted above, local management monitored the completion of supplier inquiries keeping track of those which were unresponsive, incomplete or inconsistent. Suppliers which were unresponsive, indicated that the origins of the Conflict Minerals were unknown or provided responses with inconsistencies, were flagged for subsequent follow-up.

The EHS Director aggregated all inquiry responses and provided Corporate management a summary of the supplier engagement results.

Carry Out Independent Third Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain

During the supplier inquiry response review, if a supplier provides the name of a smelter or source mine, the Company would compare the reply to the listing of smelters from the Conflict-Free Smelter Program thereby relying on the program's processes.

Report on Supply Chain Due Diligence

This report is available on the Company's website at www.lincolnelectric.com.

Results

The Company is many steps removed from the facilities used to process the Conflict Minerals used in its products and continues to work to identify these facilities and the country of origin of the minerals. The Company continues to engage with its suppliers in an effort to obtain this information, however it is unable to disclose the facilities that processed the Conflict Minerals in its products at this time.

Independent Audit

An independent private sector audit is not required at this time.

Additional Risk Mitigation

We intend to take the following additional steps in 2015 to further mitigate the risk that the Conflict Minerals used in the Company's products could benefit armed groups in the Covered Countries:

| |

A. | Further engage with suppliers to attempt to increase the response rate and the degree to which survey responses are complete. |

| |

B. | Include a Conflict Minerals provision in new or renewed supplier contracts. |

| |

C. | Analyze and review our current processes to improve their effectiveness and efficiency. |

Forward-looking Statements

The Company’s expectations and beliefs concerning the future contained in this report are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect management’s current expectations and involve a number of risks and uncertainties. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “forecast,” “guidance” or words of similar meaning. Actual results may differ materially from such statements due to a variety of factors that could adversely affect the Company’s operating results. The factors include, but are not limited to: general economic and market conditions; the effectiveness of operating initiatives; completion of planned divestitures; interest rates; disruptions, uncertainty or volatility in the credit markets that may limit our access to capital; currency exchange rates and devaluations, including in highly inflationary countries such as Venezuela; adverse outcome of pending or potential litigation; actual costs of the Company’s rationalization plans; possible acquisitions; market risks and price fluctuations related to the purchase of commodities and energy; global regulatory complexity; and the possible effects of events beyond our control, such as political unrest, acts of terror and natural disasters, on the Company or its customers, suppliers and the economy in general. For additional discussion, see “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

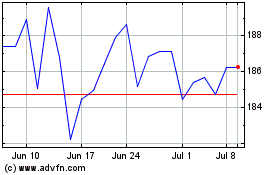

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

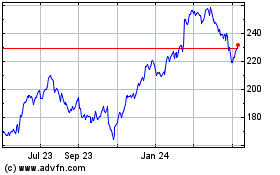

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024