Charter Rejects Melrose's Improved GBP1.4 Billion Takeover Bid

July 15 2011 - 10:15AM

Dow Jones News

Engineering firm Charter International PLC (CHTR.LN) said Friday

that it had rejected an improved GBP1.4 billion takeover bid from

Melrose PLC (MRO.LN), saying it still believes the industrial

turnaround specialist's approach is "opportunistic."

Melrose had returned with a 840 pence-a-share indicative

proposal for the company on July 11, besting its 780 pence-a-share

offer from late last month, but Charter again dismissed the

cash-and-share bid as undervaluing the company and its

prospects.

Charter said that the revised proposal did not reflect its

belief that the market was undervaluing the company's prospects

after it issued a profit warning last month because of the poor

performance of ESAB, one of its core businesses.

Charter said the bid failed to reflect its confidence that ESAB,

a specialist in welding, cutting and automation, would see

substantial operational improvement under its new management

team.

Charter added that the bid also didn't take into account the

strong performance and growth prospects of its other core business,

air and gas handling firm Howden.

Melrose, which looks to acquire and turnaround underperforming

engineering businesses before selling them on, has been circling

Charter because of its recent difficulties, which included the

resignation of its Chief Executive Michael Foster.

Melrose said Thursday its approach was in the best interests of

Charter shareholders as it "delivers a proven management team with

a demonstrable track record in creating value... along with an

immediate 40% premium [compared to the day before its original

approach]."

Jo Reedman, analyst at Singer Capital Markets, said earlier

Friday said that "Melrose's approach is not necessarily a knock-out

bid," and suggested a maximum price of around 950 pence-a-share if

Charter were to become the subject of a competitive auction.

"We would expect the management of both Lincoln Electric

Holdings Inc. (LECO) and Illinois Tool Works Inc.'s (ITW) welding

businesses to be concerned about the prospect of ESAB being

acquired by Melrose," Reedman added.

At 1335 GMT, Charter shares were up 0.1% to 830 pence, while

Melrose shares were up 0.1% at 360 pence.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

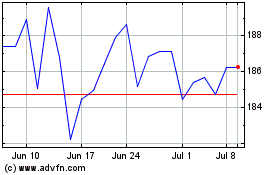

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

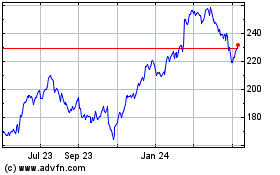

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024