Lions Gate Stake Sale Gives More Control to John Malone

November 10 2015 - 12:10PM

Dow Jones News

Lions Gate Entertainment Corp., the movie company behind the

Hunger Games franchise, said Tuesday that it agreed to sell

separate 3.4% stakes to Liberty Global PLC and Discovery

Communications Inc., both of which are connected to cable mogul

John Malone.

Mr. Malone, who is Liberty Global's chairman and has a 29%

voting stake in Discovery Communications, already was a board

member at Lions Gate, where he owns 3% of the shares outstanding.

He has talked about consolidating studios and smaller channels to

better compete as the traditional TV bundle begins to unravel.

The sold stakes, which represent a total of 10 million shares,

will be purchased for $195 million each. The shares were slated to

be acquired from funds affiliated with MHR Fund Management LLC.

Additionally, Liberty Global CEO Mike Fries, Discovery CEO David

Zaslav and MHR's investment committee member Emily Fine will be

given seats on the Lions Gate board.

Lions Gate Entertainment Corp. swung to a loss for the quarter

ending in September, partly because of disappointing box-office

figures, but the company said it is positioned for a "very strong"

fiscal second half.

The television and film company posted a $7.2 million write-down

for the Vin Diesel movie "The Last Witch Hunter," which was

released after the end of the quarter. It also said "American

Ultra" underperformed. The studio only had two wide releases during

the quarter, American Ultra and "Shaun the Sheep."

Meanwhile, the shift of the wide release of "Sicario" to October

from September meant marketing costs were recorded in the quarter

without significant revenue benefit.

Liberty Global is a sprawling international basket of cable

operators that has scooped up assets across the world as it looks

to position itself as a media and content-distribution giant. It

has been on a buying spree in content over the past year, agreeing

to acquire Irish broadcaster TV3 and taking stakes in production

house All3Media and British broadcaster ITV.

Discovery, whose assets include its namesake station in addition

to Animal Planet and TLC, has been expanding overseas aggressively

in recent years. Last year, the company took a controlling stake in

the pan-European sports-network group Eurosport, and it operates

foreign-language channels including Giallo and Familia.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 11:55 ET (16:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

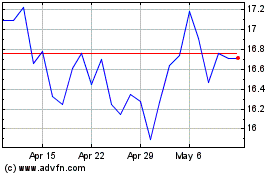

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

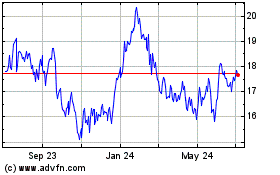

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024