UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 7, 2016

LAKELAND BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| New Jersey |

|

000-17820 |

|

22-2953275 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 250 Oak Ridge Road, Oak Ridge, New Jersey |

|

07438 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (973) 697-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Upon the consummation of the acquisition by Lakeland Bancorp, Inc. (“Lakeland”) of Pascack Bancorp, Inc., a New Jersey corporation

(“Pascack”), which is described in Item 8.01 of this Current Report on Form 8-K, on January 7, 2016, Lawrence R. Inserra, Jr. was appointed to the Boards of Directors of Lakeland and Lakeland Bank, pursuant to the Agreement and

Plan of Merger, dated as of August 3, 2015, by and between Lakeland and Pascack (the “Merger Agreement”).

Mr. Inserra, age 58, is Chairman of the Board and CEO of Inserra Supermarkets, Inc., a family owned business founded in 1954 and one of

the largest supermarket chains in the metropolitan area, which owns and operates 22 ShopRite stores throughout New Jersey and New York. Mr. Inserra also holds a number of leadership positions, both professionally and philanthropically,

including board member and treasurer of Wakefern Food Corporation. In 2013, he was named Chairman of the Board of Governors at Hackensack University Medical Center (HUMC) after serving as first Vice Chairman and Chairman of the Human Resources

Committee at HUMC. Mr. Inserra received a Bachelor of Science in business and economics from Lehigh University.

Mr. Inserra

served as a director of Pascack from 2011 until the closing of the merger with Lakeland, and as a member of Pascack’s compliance committee.

It is expected that Lakeland’s Board will nominate Mr. Inserra to be elected by Lakeland’s shareholders at its 2016 annual

meeting for a term expiring in 2017. It is also expected that Mr. Inserra will serve on the Lakeland Board’s Directors Loan Review and Policy Committees.

In addition, Lakeland has established a Corporate Advisory Council, which will be chaired by Jon F. Hanson, the former Chairman of the Board

of Pascack. The Corporate Advisory Council will also be composed of the following three former directors of Pascack: Daniel J. Geltrude, Jerrold B. Grossman and Jerome J. Lombardo. The Advisory Council will provide guidance and advice to Lakeland

with respect to the business markets in the new areas Lakeland will serve as a result of its acquisition of Pascack.

On January 7, 2016 (the “Effective Time”), Lakeland

consummated its acquisition of Pascack pursuant to the Merger Agreement. At the Effective Time, Pascack merged with and into Lakeland, with Lakeland continuing as the surviving entity (the “Merger”), and shortly thereafter, Pascack

Community Bank, a New Jersey-chartered commercial bank and previously a wholly-owned subsidiary of Pascack (“Pascack Community Bank”), merged with and into Lakeland Bank, a New Jersey-chartered commercial bank and a wholly-owned subsidiary

of Lakeland (“Lakeland Bank”), with Lakeland Bank continuing as the surviving bank (the “Bank Merger” and, collectively, with the Merger, the “Mergers”).

-3-

Subject to the terms and conditions of the Merger Agreement, at the Effective Time, each share of

Pascack common stock issued and outstanding or issuable upon the conversion of Pascack preferred stock immediately prior to the Effective Time, was converted into and became the right to receive, at the election of the holder, either 0.9576 shares

of Lakeland common stock or $11.35 in cash, subject to proration as described in the Merger Agreement, so that 90% of the aggregate merger consideration consisted of shares of Lakeland common stock and 10% consisted of cash. Cash will be paid in

lieu of fractional shares. In the aggregate, Lakeland paid approximately 3,314,451 shares of Lakeland common stock and approximately $4.4 million in cash for the acquisition (excluding cash paid in connection with the cancellation of certain Pascack

stock options, as described below).

The election period during which the former shareholders of Pascack were invited to submit their

Election Forms specifying their preferences as to the form of consideration they would receive expired on December 9, 2015 (the “Election Deadline”), and American Stock Transfer & Trust Company (the “Exchange

Agent”) has now allocated the stock consideration and cash consideration among the former shareholders of Pascack pursuant to the Merger Agreement. Former shareholders of Pascack who did not submit Election Forms, or who became shareholders of

Pascack between the record date for the Pascack shareholders’ meeting at which the Merger was approved and the Effective Time of the Merger, will be receiving Letters of Transmittal pursuant to which they may tender their Pascack stock

certificates in exchange for their portion of the Merger consideration.

Pursuant to the terms of the Merger Agreement, all stock options

to purchase Pascack common stock outstanding at the Effective Time, which we refer to as “old stock options,” were forfeited or, if the holders executed and delivered prior to the Effective Time an option cancellation agreement, in form

and substance reasonably satisfactory to Lakeland, cancelled in exchange for a payment by Lakeland equal to the number of shares of Pascack common stock covered by the old stock options multiplied by the amount, if any, by which $11.35 exceeds the

exercise price of the old stock options. Lakeland is paying approximately $122,207 in the aggregate in connection with the cancellation of the old stock options.

On January 7, 2016, Lakeland disseminated a press release announcing the closing of the Mergers. A copy of the press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Cautionary Statements Regarding

Forward-Looking Information

This Current Report on Form 8-K (including Exhibit 99.1 hereto) contains forward-looking statements that

are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates”, “projects”, “intends”, “estimates”, “expects”,

“believes”, “plans”, “may”, “will”, “should”, “could” and other similar expressions are intended to identify such forward looking statements. These forward-looking statements are

necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. Actual results could differ materially from such forward-looking statements. The

following factors, among others,

-4-

could cause actual results to differ materially and adversely from such forward-looking statements: any

difficulties experienced by Lakeland in integrating Pascack’s business with its own; material adverse changes in the combined company’s operations or earnings; decline in the economy in the combined company’s primary market areas; as

well as the risk factors set forth in the proxy statement and prospectus filed by Lakeland with the Securities and Exchange Commission in connection with the Merger, and in Lakeland’s Annual Report on Form 10-K for the year ended

December 31, 2014 and other periodic filings made by Lakeland with the Commission. Lakeland assumes no obligation for updating any such forward-looking statements at any time.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit 99.1 |

|

Press Release of Lakeland Bancorp, Inc., dated January 7, 2016. |

-5-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

| LAKELAND BANCORP, INC. |

|

|

| By: |

|

/s/ Timothy J. Matteson |

| Name: |

|

Timothy J. Matteson |

| Title: |

|

Executive Vice President, General Counsel

and Corporate Secretary |

Dated: January 7, 2016

-6-

Exhibit Index

|

|

|

| Exhibit 99.1 |

|

Press Release of Lakeland Bancorp, Inc., dated January 7, 2016. |

-7-

Exhibit 99.1

Press Release

LAKELAND

BANCORP ANNOUNCES CLOSING OF

ACQUISITION OF PASCACK BANCORP

Oak Ridge, NJ—January 7, 2016. Lakeland Bancorp, Inc. (NASDAQ: LBAI) (“Lakeland Bancorp”), the parent company of Lakeland Bank,

announced that its acquisition by merger of Pascack Bancorp, Inc. (formerly OTCQX: PSBR), the parent company of Pascack Community Bank, closed today upon the filing of a Certificate of Merger with the New Jersey Department of Treasury. Shortly after

the merger of the holding companies, Pascack Community Bank merged with and into Lakeland Bank.

Following the merger, Lakeland Bancorp,

the holding company for Lakeland Bank, will have $4.3 billion in total assets and will operate 53 New Jersey branch offices in Bergen, Essex, Morris, Passaic, Somerset, Sussex, Union and Warren counties, five New Jersey regional

commercial lending centers in Bernardsville, Montville, Newton, Teaneck and Wyckoff/Waldwick and two commercial loan production offices serving Middlesex and Monmouth counties in New Jersey and the Hudson Valley region of New York.

Lakeland Bank offers an extensive array of consumer and commercial products and services, including online and mobile banking, localized commercial lending teams, and 24-hour or less turnaround time on consumer loan applications. For more

information about the full line of products and services, visit LakelandBank.com.

Forward Looking Statements

This communication contains forward-looking statements that are made in reliance upon the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. Lakeland Bancorp does not assume any obligation for

updating any such forward-looking statements at any time.

Contact:

Lakeland Bancorp, Inc.:

Thomas J. Shara

President & CEO

Joseph F. Hurley

EVP & CFO

973-697-2000

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

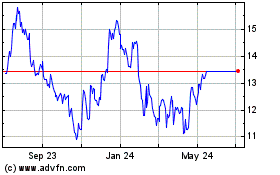

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Apr 2023 to Apr 2024