Current Report Filing (8-k)

May 28 2015 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

| May 22, 2015 | |

Date of Report (Date of Earliest Event Reported) |

|

|

ITRON, INC. |

(Exact Name of Registrant as Specified in its Charter) |

|

| | | | |

Washington | | 000-22418 | | 91-1011792 |

(State or Other Jurisdiction of Incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

|

|

2111 N. Molter Road, Liberty Lake, WA 99019 |

(Address of Principal Executive Offices, Zip Code) |

|

|

(509) 924-9900 |

(Registrant's Telephone Number, Including Area Code) |

|

|

|

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On May 22, 2015, Itron, Inc. (Itron or the Company) concluded it was necessary to issue a product replacement notification to customers of its Water business line who had purchased certain communication modules, manufactured between July 2013 and December 2014. The Company determined that a component of the modules was failing prematurely.

As a result, Itron will recognize a pre-tax warranty charge estimated in the range of $22 to $25 million during the second quarter of 2015. A charge of $3.1 million (pre-tax) was recorded for this same matter in the first quarter of 2015. The amount of the first quarter charge was based on information available at that time.

Itron carries insurance for such matters and has filed a claim under the respective policies. Any recovery from the insurance would be recognized in the period in which proceeds are received or are determined to no longer be contingent. Under the insurance policies, the Company must bear the first $10 million of loss, and costs in excess of this amount may be recoverable. At this time, Itron cannot provide any assurance of recovery from insurance.

Itron will disclose to what extent, if at all, this warranty charge impacts the Company’s full year 2015 non-GAAP EPS guidance range when it reports its second quarter earnings results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

| | | |

| | ITRON, INC. |

| | | |

| | By: | /s/ W. MARK SCHMITZ |

Dated: May 28, 2015 | | | W. Mark Schmitz |

| | | Executive Vice President and Chief Financial Officer |

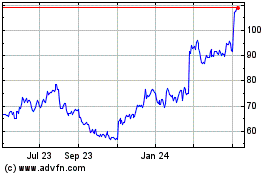

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Apr 2023 to Apr 2024