Amended Current Report Filing (8-k/a)

January 14 2016 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 16, 2015

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania |

|

0-31157 |

|

23-2507402 |

|

(State or other jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

720 Pennsylvania Drive

Exton, Pennsylvania 19341

(Address of principal executive offices) (Zip Code)

(610) 646-9800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

On December 16, 2015, Innovative Solutions and Support, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Initial 8-K”) with the Securities and Exchange Commission disclosing the Company’s financial results for its fourth quarter and year ended September 30, 2015. This Current Report on Form 8-K/A is being filed as an amendment to the Initial 8-K (this “Amendment”) to update the financial schedules furnished as part of Exhibit 99.1 to Item 2.02 of the Initial 8-K.

Any information required to be set forth in the Initial 8-K which is not being amended or supplemented pursuant to this Amendment is hereby incorporated by reference. Except as set forth herein, no modifications have been made to the information contained in the Initial 8-K and the Company has not updated any information contained therein to reflect events that have occurred since the date of the Initial 8-K. Accordingly, this Amendment should be read in conjunction with the Initial 8-K.

Item 2.02 Results of Operations and Financial Condition.

On December 16, 2015, the Company issued a press release announcing its financial results for its fourth quarter and year ended September 30, 2015. Included in that press release were certain financial schedules. Subsequent to filing the press release, the financial schedules included therein were revised to reflect an impairment charge of $1.3 million as a result of the termination of an agreement and replacement thereof with a new agreement executed January 13, 2016 with a customer to provide products and services with current technology. The Company expects that this agreement will result in approximately $1.2 million positive impact from a reversal of a total liability of $1.2 million comprised of deferred revenue and contract loss accrual to the statement of operations in Q2 2016 due to the extinguishment of the Company’s obligation to deliver certain products under the original contract. The Company also reclassified certain costs initially identified as research and development to engineering development cost of sales. Revised versions of the financial schedules are furnished as Exhibit 99.1 hereto and are incorporated herein by reference.

The information in this report (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

|

|

|

|

|

99.1 |

|

Updated financial schedules to press release, dated December 16, 2015, announcing financial results for the fourth quarter and year ended September 30, 2015 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

INNOVATIVE SOLUTIONS AND SUPPORT, INC. |

|

|

|

|

|

|

|

Date: January 14, 2016 |

By: |

/s/ Relland M. Winand |

|

|

|

Relland M. Winand |

|

|

|

Chief Financial Officer |

3

Exhibit 99.1

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets

(unaudited)

|

|

|

September

30, |

|

September

30, |

|

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,282,039 |

|

$ |

15,214,584 |

|

|

Accounts receivable |

|

2,394,695 |

|

4,419,863 |

|

|

Unbilled receivables, net |

|

3,920,209 |

|

7,425,728 |

|

|

Inventories |

|

4,597,316 |

|

5,470,786 |

|

|

Deferred income taxes |

|

933,499 |

|

3,245,223 |

|

|

Prepaid expenses and other current assets |

|

1,221,717 |

|

750,108 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

29,349,475 |

|

36,526,292 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

7,095,330 |

|

7,467,663 |

|

|

Non-current deferred income taxes |

|

— |

|

57,707 |

|

|

Other assets |

|

168,948 |

|

110,848 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

36,613,753 |

|

$ |

44,162,510 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,435,981 |

|

$ |

2,402,652 |

|

|

Accrued expenses |

|

2,568,531 |

|

4,077,290 |

|

|

Deferred revenue |

|

756,745 |

|

526,320 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

4,761,257 |

|

7,006,262 |

|

|

|

|

|

|

|

|

|

Non-current deferred income taxes |

|

507,184 |

|

132,999 |

|

|

Other liabilities |

|

2,826 |

|

11,725 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

5,271,267 |

|

7,150,986 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, 10,000,000 shares authorized, $.001 par value, of which 200,000 shares are authorized as Class A Convertible stock. No shares issued and outstanding at September 30, 2014 and 2013 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value: 75,000,000 shares authorized, 18,756,089 and 18,714,449 issued at September 30, 2015 and 2014, respectively |

|

18,756 |

|

18,715 |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

51,148,722 |

|

50,697,497 |

|

|

Retained earnings |

|

818,768 |

|

6,684,902 |

|

|

Treasury stock, at cost, 1,846,451 shares at September 30, 2015 and 1,756,807 at September 30, 2014 |

|

(20,643,760 |

) |

(20,389,590 |

) |

|

|

|

|

|

|

|

|

Total shareholders’ equity |

|

31,342,486 |

|

37,011,524 |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

36,613,753 |

|

$ |

44,162,510 |

|

Innovative Solutions and Support, Inc.

Consolidated Statements of Operations

(unaudited)

|

|

|

Three months ended |

|

Twelve months ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

3,137,089 |

|

$ |

9,918,221 |

|

$ |

20,067,084 |

|

$ |

44,095,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

2,482,200 |

|

7,059,709 |

|

13,135,349 |

|

30,508,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

654,889 |

|

2,858,512 |

|

6,931,735 |

|

13,586,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

603,395 |

|

682,361 |

|

2,705,208 |

|

2,618,054 |

|

|

Selling, general and administrative |

|

2,935,725 |

|

5,477,183 |

|

7,847,270 |

|

11,111,014 |

|

|

Total operating expenses |

|

3,539,120 |

|

6,159,544 |

|

10,552,478 |

|

13,729,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) |

|

(2,884,231 |

) |

(3,301,032 |

) |

(3,620,743 |

) |

(142,868 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

6,535 |

|

5,510 |

|

24,804 |

|

21,756 |

|

|

Other income |

|

1,878 |

|

10,451 |

|

33,283 |

|

37,758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) before income taxes |

|

(2,875,818 |

) |

(3,285,071 |

) |

(3,562,656 |

) |

(83,354 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

(312,006 |

) |

(1,195,496 |

) |

2,303,478 |

|

(283,622 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(2,563,812 |

) |

$ |

(2,089,575 |

) |

$ |

(5,866,134 |

) |

$ |

200,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.15 |

) |

$ |

(0.12 |

) |

$ |

(0.35 |

) |

$ |

0.01 |

|

|

Diluted |

|

$ |

(0.15 |

) |

$ |

(0.12 |

) |

$ |

(0.35 |

) |

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

16,905,526 |

|

16,956,247 |

|

16,924,189 |

|

16,927,879 |

|

|

Diluted |

|

16,905,526 |

|

17,171,828 |

|

16,924,189 |

|

17,149,106 |

|

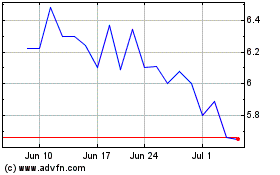

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Aug 2024 to Sep 2024

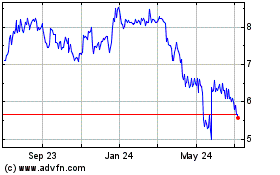

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Sep 2023 to Sep 2024