UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 29, 2016

ImmunoGen, Inc.

(Exact name of registrant as specified in its charter)

|

Massachusetts |

|

0-17999 |

|

04-2726691 |

|

(State or other

jurisdiction of

incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

830 Winter Street, Waltham, MA 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 895-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 — RESULTS OF OPERATION AND FINANCIAL CONDITION

On January 29, 2016, ImmunoGen, Inc. (Nasdaq: IMGN) issued a press release to announce the company’s financial results for the quarter ended December 31, 2015. The press release announcing financial results for the quarter ended December 31, 2015 is included as Exhibit 99.1 and incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d): The following exhibit is being furnished herewith:

|

Exhibit No. |

|

Exhibit |

|

|

|

|

|

99.1 |

|

Press Release of ImmunoGen, Inc. dated January 29, 2016 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ImmunoGen, Inc. |

|

|

(Registrant) |

|

|

|

|

Date: January 29, 2016 |

/s/ David B. Johnston |

|

|

|

|

|

David B. Johnston |

|

|

Executive Vice President and Chief Financial Officer |

3

Exhibit 99.1

Contacts

|

For Investors:

ImmunoGen, Inc.

Carol Hausner, 781-895-0600

info@immunogen.com |

|

For Media:

Michael Lampe,

484-575-5040

michael@michaellampeconsulting.com |

ImmunoGen Reports Second Quarter Fiscal Year 2016 Financial Results

and Provides Corporate Update

– Conference Call Today at 8:00 am ET –

· Both ImmunoGen’s FORWARD I and FORWARD II clinical trials are open for patient enrollment. FORWARD I is designed to support an Accelerated Approval pathway for lead program mirvetuximab soravtansine and FORWARD II assesses this first-in-class folate receptor α (FRα)-targeting antibody-drug conjugate (ADC) in multiple combination regimens.

· Bayer has initiated a Phase 2 study designed to support registration of anetumab ravtansine, its mesothelin-targeting ADC. Anetumab ravtansine is the second partner ADC — after Roche’s Kadcyla® — with ImmunoGen technology to advance into potential registration testing. Roche expects findings from its KRISTINE neoadjuvant trial in 2016, a potential new use for Kadcyla.

WALTHAM, MA, January 29, 2016 — ImmunoGen, Inc. (Nasdaq: IMGN), a biotechnology company that develops targeted anticancer therapeutics using its proprietary ADC technology, today reported financial results for the three-month period ended December 31, 2015 — the second quarter of the Company’s 2016 fiscal year. ImmunoGen also provided an update on product programs and reiterated its 2016 fiscal year guidance.

“ImmunoGen is off to a strong start for 2016, with multiple clinical trial initiations underway,” commented Daniel Junius, President and CEO. “Of particular importance is the opening of our FORWARD I trial assessing mirvetuximab soravtansine as single-agent therapy for pretreated FRα-positive ovarian cancer, which we believe is the fastest path to registration for this promising ADC. We expect several presentations of mirvetuximab soravtansine data in 2016, including mature results from the 40-patient FRα-positive ovarian cancer Phase 1 cohort.”

Mr. Junius continued, “Our partners also are making meaningful progress. Of particular note is Bayer’s initiation of a Phase 2 trial designed to support registration of its anetumab ravtansine product candidate. Roche expects data to be reported from its trial assessing Kadcyla in the neoadjuvant setting this year and — if positive — to bring these to regulatory authorities for potential filing in 2016. A third partner compound is on track to advance into registration testing later this year.”

Update on Wholly Owned Product Programs

Mirvetuximab soravtansine — First FRα-targeting ADC is a potential new treatment for ovarian cancer and other FRα-positive solid tumors.

· Assessments as single-agent therapy for pretreated FRα-positive ovarian cancer:

· Updated Phase 1 findings were presented at the AACR-NCI-EORTC meeting in November for the dataset reported at ASCO in May (abstracts #C47 and #5518, respectively). These included that 35% (7/20) of patients with FRα-positive platinum-resistant disease treated had a confirmed objective response, with most (6/7) responders on mirvetuximab soravtansine for 6 months or longer. This compares with ImmunoGen’s target response rate of 30% or more to advance the ADC as monotherapy. Most of the patients and all of the responders had high or medium FRα levels on their tumors.

· Patient enrollment is open for the Company’s FORWARD I Phase 2 trial, which is designed to support an Accelerated Approval pathway for mirvetuximab soravtansine. FORWARD I is being conducted in partnership with the GOG Foundation, Inc. To qualify for enrollment, patients must have ovarian cancer with high or medium FRα expression that was previously treated with 3 or 4 regimens.

· Patient enrollment was completed in 4Q2015 in the 20-patient Phase 1 expansion cohort requiring biopsies. The Company intends to present initial biomarker data from this assessment at a medical meeting in 2Q2016 in addition to reporting mature data from the 40-patient Phase 1 cohort in this disease at the meeting.

· Assessments as combination therapy for FRα-positive ovarian cancer:

· Encouraging preclinical data with a range of combination regimens were presented at the AACR-NCI-EORTC meeting (abstract C170).

· In December, patient dosing began in the Phase 1b/2 trial, FORWARD II, assessing mirvetuximab soravtansine in combination with approved anticancer agents.

· Assessments for the treatment of other FRα-positive cancers:

· In 4Q2015, patient enrollment was completed in the 20-patient Phase 1 expansion cohort assessing the ADC for FRα-positive relapsed/refractory endometrial cancer. The Company expects to report findings from this assessment in 2H2016.

· Additional cancer types are being evaluated for FRα expression preclinically.

IMGN529 and coltuximab ravtansine — CD37- and CD19-targeting, respectively, ADCs for diffuse large B-cell lymphoma (DLBCL) and potentially other B-cell malignancies.

· Preclinical findings of strong synergy for IMGN529 used in combination with rituximab were reported at ASH (abstract #1548) in December.

· Patient enrollment in a Phase 2 trial assessing IMGN529 in combination with rituximab is expected to begin early this year. Enrollment in a Phase 2 trial assessing coltuximab ravtansine in a different combination regimen is expected to begin in 2H2016.

IMGN779 — First CD33-targeting ADC utilizing an IGN cancer-killing agent. IGNs are a

new class of DNA-acting agents invented by ImmunoGen.

· Mechanism of action data were reported at ASH (abstract #1366).

· ImmunoGen is preparing to initiate Phase 1 testing of IMGN779 for the treatment of acute myeloid leukemia in 1H2016.

Update on Partner Programs

Nine companies are advancing ADCs with ImmunoGen technology. Recent highlights include:

· Patient dosing has begun in Bayer’s global Phase 2 clinical trial designed to support registration of its mesothelin-targeting ADC, anetumab ravtansine. This event triggers a milestone payment to ImmunoGen that will be reflected in the Company’s 3QFY2016 financial results.

· Roche expects data from its KRISTINE trial assessing Kadcyla in the neoadjuvant setting for early HER2-positive breast cancer to be reported this year and, if positive, to bring these to regulatory authorities for potential filing in 2016.

· In December, Takeda took its first license for the exclusive right to develop ADCs to an undisclosed target using ImmunoGen technology.

· Also in December, CytomX announced it is advancing a novel anticancer agent targeting CD166 using its ProbodyTM technology and ImmunoGen’s ADC technology under a strategic collaboration established between the companies in early 2014.

Financial Results

For the Company’s quarter ended December 31, 2015 (2QFY2016), ImmunoGen reported a net loss of $(33.2) million, or $(0.38) per basic and diluted share, compared to net income of $13.6 million, or $0.16 per basic and diluted share, for the same quarter last year (2QFY2015).

Revenues for 2QFY2016 were $18.0 million, compared to $48.3 million for 2QFY2015. The current period includes $8.6 million of amortization of upfront fees previously received from Takeda and the prior year period includes $41.4 million of amortization of upfront fees previously received from Novartis and Lilly. The fees are recognized in their respective quarters due to the partner taking one or more licenses in the quarter. License and milestone fees for 2QFY2016 also include a $2 million milestone earned from Sanofi with the advancement of SAR428926 into clinical testing. Revenues in 2QFY2016 include $6.3 million of non-cash royalty revenues and $0.2 million of cash royalty revenues on Roche sales of Kadcyla for the three-months ended September 30, 2015, compared with $4.6 million in cash royalty revenues for the prior year period.

Operating expenses in 2QFY2016 were $46.3 million, compared to $34.5 million in 2QFY2015. Operating expenses in 2QFY2016 include research and development expenses of $38.2 million, compared to $27.6 million in 2QFY2015. This change is primarily due to increased third-party costs related to the advancement of our wholly owned product candidates, increased clinical trial costs, primarily related to our expansion of the mirvetuximab soravtansine development program, and increased

personnel expenses, principally due to recent hiring. Operating expenses include general and administrative expenses of $8.1 million in 2QFY2016, compared to $6.9 million in 2QFY2015. This increase is primarily due to increased personnel expenses and professional services.

ImmunoGen had approximately $212.3 million in cash and cash equivalents as of December 31, 2015, compared with $278.1 million as of June 30, 2015, and had no debt outstanding in either period. Cash used in operations was $63.0 million in the first six months of FY2016, compared with $34.4 million in the same period in FY2015. Capital expenditures were $7.6 million and $2.6 million for the first six months of FY2016 and FY2015, respectively.

Financial Guidance for Fiscal Year 2016

ImmunoGen’s financial guidance remains unchanged from that issued in July 2015. ImmunoGen expects: its revenues to be between $70 million and $80 million; its operating expenses to be between $175 million and $180 million; its net loss to be between $120 million and $125 million; its cash used in operations to be between $100 million and $105 million; and its capital expenditures to be between $13 million and $15 million. Cash and cash equivalents at June 30, 2016 are anticipated to be between $165 million and $170 million.

Conference Call Information

ImmunoGen is holding a conference call today at 8:00 am ET to discuss these results. To access the live call by phone, dial 913-312-0836; the conference ID is 5851737. The call also may be accessed through the Investors section of the Company’s website, www.immunogen.com. Following the live webcast, a replay of the call will be available at the same location through February 12, 2016.

About ImmunoGen, Inc.

ImmunoGen is a clinical-stage biotechnology company that develops targeted anticancer therapeutics with its proprietary ADC technology. The Company’s lead product candidate, mirvetuximab soravtansine, is a potential treatment for folate receptor α-positive ovarian cancers and other solid tumors. A number of major healthcare companies have licensed rights to use ImmunoGen’s ADC technology to develop novel anticancer therapies; it is used in Roche’s marketed product, Kadcyla®. More information about the Company can be found at www.immunogen.com.

Kadcyla® is a registered trademark of Genentech, a member of the Roche Group.

ProbodyTM is a trademark of CytomX Therapeutics, Inc.

This press release includes forward-looking statements based on management’s current expectations. These statements include, but are not limited to, ImmunoGen’s expectations related to: the Company’s revenues, operating expenses, net loss, cash used in operations and capital expenditures in its 2016 fiscal year; its cash and marketable securities as of

June 30, 2016; the occurrence, timing and outcome of potential pre-clinical, clinical and regulatory events related to the Company’s and its collaboration partners’ product programs; and the presentation of preclinical and clinical data on the Company’s and collaboration partners’ product candidates. For these statements, ImmunoGen claims the protection of the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Various factors could cause ImmunoGen’s actual results to differ materially from those discussed or implied in the forward-looking statements, and you are cautioned not to place undue reliance on these forward-looking statements, which are current only as of the date of this release. Factors that could cause future results to differ materially from such expectations include, but are not limited to: the timing and outcome of ImmunoGen’s and the Company’s collaboration partners’ research and clinical development processes; the difficulties inherent in the development of novel pharmaceuticals, including uncertainties as to the timing, expense and results of preclinical studies, clinical trials and regulatory processes; ImmunoGen’s ability to financially support its product programs; ImmunoGen’s dependence on collaborative partners; industry merger and acquisition activity; and other factors more fully described in ImmunoGen’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015 and other reports filed with the Securities and Exchange Commission.

-Financials Follow-

ImmunoGen, Inc. Reports Second Quarter Fiscal Year 2016 Financial Results

IMMUNOGEN, INC.

SELECTED FINANCIAL INFORMATION

(in thousands, except per share amounts)

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

December 31, |

|

June 30, |

|

|

|

|

2015 |

|

2015 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

212,283 |

|

$ |

278,109 |

|

|

Other assets |

|

39,297 |

|

35,714 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

251,580 |

|

$ |

313,823 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

43,900 |

|

$ |

35,810 |

|

|

Long-term portion of deferred revenue and other long-term liabilities |

|

224,366 |

|

242,909 |

|

|

Shareholders’ equity |

|

(16,686 |

) |

35,104 |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

251,580 |

|

$ |

313,823 |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

License and milestone fees |

|

$ |

10,692 |

|

$ |

41,417 |

|

$ |

16,762 |

|

$ |

47,651 |

|

|

Royalty revenue |

|

195 |

|

4,625 |

|

195 |

|

8,791 |

|

|

Non-cash royalty revenue |

|

6,291 |

|

— |

|

11,975 |

|

— |

|

|

Research and development support |

|

848 |

|

832 |

|

1,620 |

|

1,608 |

|

|

Clinical materials revenue |

|

3 |

|

1,426 |

|

2,328 |

|

3,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

18,029 |

|

48,300 |

|

32,880 |

|

61,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

38,199 |

|

27,647 |

|

73,331 |

|

55,665 |

|

|

General and administrative |

|

8,054 |

|

6,872 |

|

16,383 |

|

13,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

46,253 |

|

34,519 |

|

89,714 |

|

69,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations |

|

(28,224 |

) |

13,781 |

|

(56,834 |

) |

(8,129 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash interest expense on liability related to sale of future royalty |

|

(5,059 |

) |

— |

|

(10,202 |

) |

— |

|

|

Other income (loss), net |

|

56 |

|

(146 |

) |

69 |

|

(518 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(33,227 |

) |

$ |

13,635 |

|

$ |

(66,967 |

) |

$ |

(8,647 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share, basic and diluted |

|

$ |

(0.38 |

) |

$ |

0.16 |

|

$ |

(0.77 |

) |

$ |

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding, diluted |

|

86,970 |

|

86,665 |

|

86,904 |

|

85,904 |

|

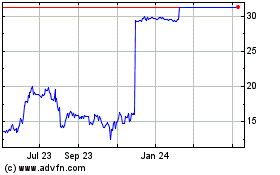

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024