Illumina, Inc. (NASDAQ:ILMN) today announced its full financial

results for the fourth quarter and fiscal year 2016.

Fourth quarter 2016 results:

- Revenue of $619 million, a 5% increase

compared to $592 million in the fourth quarter of 2015

- GAAP net income attributable to

Illumina stockholders for the quarter of $124 million, or $0.84 per

diluted share, compared to $104 million, or $0.70 per diluted

share, for the fourth quarter of 2015

- Non-GAAP net income attributable to

Illumina stockholders for the quarter of $126 million, or $0.85 per

diluted share, compared to $121 million, or $0.81 per diluted

share, for the fourth quarter of 2015 (see the table entitled

“Itemized Reconciliation Between GAAP and Non-GAAP Net Income

Attributable to Illumina Stockholders” for a reconciliation of

these GAAP and non-GAAP financial measures)

- Cash flow from operations of $280

million and free cash flow of $199 million for the quarter,

compared to $240 million and $205 million, respectively, in the

prior year period

Gross margin in the fourth quarter of 2016 was 67.7% compared to

69.4% in the prior year period. Excluding the effect of non-cash

stock compensation expense and amortization of acquired intangible

assets, non-GAAP gross margin was 69.9% for the fourth quarter of

2016 compared to 71.7% in the prior year period.

Research and development (R&D) expenses for the fourth

quarter of 2016 were $129.9 million, or 21.0% of revenue, compared

to $114.3 million, or 19.3% of revenue, in the prior year period.

R&D expenses included $9.4 million and $10.8 million of

non-cash stock compensation expense in the fourth quarters of 2016

and 2015, respectively. Excluding these charges and contingent

compensation, R&D expenses as a percentage of revenue were

19.5%, including 2.5% attributable to GRAIL and Helix. This

compares to 17.5% in the prior year period.

Selling, general and administrative (SG&A) expenses for the

fourth quarter of 2016 were $146.1 million, or 23.6% of revenue,

compared to $147.3 million, or 24.9% of revenue, in the prior year

period. SG&A expenses included $15.2 million and $21.4 million

of non-cash stock compensation expense in the fourth quarters of

2016 and 2015, respectively. Excluding these charges, amortization

of acquired intangible assets, and contingent compensation,

SG&A expenses as a percentage of revenue were 20.9%, including

1.6% attributable to GRAIL and Helix. This compares to 20.9% in the

prior year period.

Depreciation and amortization expenses were $37.4 million and

capital expenditures for free cash flow purposes were $81.5 million

during the fourth quarter of 2016, which excludes an increase

of $24.6 million in property and equipment recorded under

build-to-suit lease accounting since such expenses were paid for by

the landlord. At the close of the quarter, the company held $1.56

billion in cash, cash equivalents and short-term investments,

compared to $1.39 billion as of January 3, 2016.

Fiscal 2016 results:

- Revenue of $2,398 million, an 8%

increase compared to $2,220 million in fiscal 2015

- GAAP net income attributable to

Illumina stockholders of $463 million, or $3.07 per diluted share,

compared to $462 million, or $3.10 per diluted share, in fiscal

2015

- Non-GAAP net income attributable to

Illumina stockholders of $503 million, or $3.33 per diluted share,

compared to $495 million, or $3.32 per diluted share, in fiscal

2015 (see the table entitled “Itemized Reconciliation Between GAAP

and Non-GAAP Net Income Attributable to Illumina Stockholders” for

a reconciliation of these GAAP and non-GAAP financial

measures)

- Cash flow from operations of $687

million and free cash flow of $427 million for the fiscal year,

compared to $660 million and $517 million, respectively, in the

prior year

Gross margin for fiscal 2016 was 69.5% compared to 69.8% in the

prior year. Excluding the effect of non-cash stock compensation

expense and amortization of acquired intangible assets, non-GAAP

gross margin was 71.7% for fiscal 2016 compared to 72.4% in the

prior year period.

Research and development (R&D) expenses for fiscal 2016 were

$504.4 million compared to $401.5 million in the prior year.

R&D expenses included $42.3 million and $42.0 million of

non-cash stock compensation expense in fiscal 2016 and 2015,

respectively. Excluding these charges and contingent compensation,

R&D expenses as a percentage of revenue were 19.3%, including

1.8% attributable to GRAIL and Helix. This compares to 16.2% in the

prior year period.

Selling, general and administrative (SG&A) expenses for

fiscal 2016 were $583.0 million compared to $524.7 million in the

prior year. SG&A expenses included $76.1 million and $79.1

million of non-cash stock compensation expense in fiscal 2016 and

2015, respectively. Excluding these charges, amortization of

acquired intangible assets, and contingent compensation, SG&A

expenses as a percentage of revenue were 20.8%, including 1.2%

attributable to GRAIL and Helix. This compares to 19.8% in the

prior year period.

“We ended 2016 on a stronger note than we anticipated, with

robust performance across sequencing consumables and microarrays,”

stated Francis de Souza, President and CEO. “We also made

significant progress on key R&D programs as evidenced by the

launch of NovaSeq, a brand new architecture that delivers the most

powerful, flexible sequencer ever created, once again redefining

the trajectory of sequencing.”

Updates since our last earnings release:

- Launched the NovaSeq System™, an

entirely new scalable high throughput architecture designed to one

day usher in the $100 genome

- Announced the launch of

the Illumina® Bio-Rad® Single-Cell Sequencing Solution, the

first next-generation sequencing (NGS) workflow for single-cell

analysis

- Launched TruSight® Tumor 170, a 170

gene next-generation sequencing solution to support a multi-analyte

approach and provide a more thorough picture of a tumor’s genomic

landscape

- Applied the CE mark to our VeriSeq™

NIPT Analysis Software, designed for larger batches of 48

samples

- Entered into a strategic collaboration

with Philips to integrate Illumina’s sequencing systems for

large-scale analysis of genetic variation and function and Philips’

IntelliSpace Genomics clinical informatics platform

- Partnered with IBM to expand access to

genome data interpretation by integrating Watson for Genomics into

Illumina’s BaseSpace Sequence Hub and tumor sequencing process

- Announced that GRAIL has received

indications of interest to invest approximately $1B in its Series B

financing, which is intended to close prior to the end of the first

quarter

- Announced several key senior

appointments to our executive team: Garret Hampton as EVP, Clinical

Genomics Group, Sam Samad as Senior Vice President and Chief

Financial Officer, and Jonathan Seaton as Senior Vice President of

Corporate and Business Development

- Appointed Caroline Dorsa to the

company’s Board of Directors and the Audit Committee of the

Board

Financial outlook and guidance

The non-GAAP financial guidance discussed below reflects certain

pro forma adjustments to assist in analyzing and assessing our

operational performance. Please see our Reconciliation of Non-GAAP

Financial Guidance included in this release for a reconciliation of

the GAAP and non-GAAP financial measures.

For fiscal 2017, the company is projecting 10% to

12% revenue growth, GAAP earnings per diluted share

attributable to Illumina stockholders of $3.25 to $3.35 and

non-GAAP earnings per diluted share attributable to Illumina

stockholders of $3.60 to $3.70. Our annual guidance

assumes first quarter revenue of $580 million to $595 million, GAAP

earnings per diluted share attributable to Illumina stockholders of

$0.51 to $0.56 and non-GAAP earnings per diluted share attributable

to Illumina stockholders of $0.60 to $0.65.

All earnings per diluted share guidance includes the

consolidated results of GRAIL in the first quarter, with the

exception of any one-time items associated with the expected close

of the Series B financing.

Quarterly conference call information

The conference call will begin at 2:00 pm Pacific Time (5:00 pm

Eastern Time) on Tuesday, January 31, 2017. Interested parties may

listen to the call by dialing 888.771.4371 (passcode: 44094804), or

if outside North America by dialing +1.847.585.4405 (passcode:

44094804). Individuals may access the live teleconference in the

Investor Relations section of Illumina’s web site under the

“company” tab at www.illumina.com.

A replay of the conference call will be available from 4:30 pm

Pacific Time (7:30 pm Eastern Time) on January 31, 2017 through

February 7, 2017 by dialing 888.843.7419 (passcode: 44094804), or

if outside North America by dialing +1.630.652.3042 (passcode:

44094804).

Statement regarding use of non-GAAP financial

measures

The company reports non-GAAP results for diluted net income per

share, net income, gross margins, operating expenses, operating

margins, other income, and free cash flow in addition to, and not

as a substitute for, or superior to, financial measures calculated

in accordance with GAAP. The company’s financial measures under

GAAP include substantial charges such as stock compensation

expense, amortization of acquired intangible assets, non-cash

interest expense associated with the company’s convertible debt

instruments that may be settled in cash, and others that are listed

in the itemized reconciliations between GAAP and non-GAAP financial

measures included in this press release. Management has excluded

the effects of these items in non-GAAP measures to assist investors

in analyzing and assessing past and future operating performance.

Additionally, non-GAAP net income attributable to Illumina

stockholders and diluted earnings per share attributable to

Illumina stockholders are key components of the financial metrics

utilized by the company’s board of directors to measure, in part,

management’s performance and determine significant elements of

management’s compensation.

The company encourages investors to carefully consider its

results under GAAP, as well as its supplemental non-GAAP

information and the reconciliation between these presentations, to

more fully understand its business. Reconciliations between GAAP

and non-GAAP results are presented in the tables of this

release.

Use of forward-looking statements

This release contains forward-looking statements that involve

risks and uncertainties, such as Illumina’s expectations regarding

the launch of any products and the future cost of genome

sequencing. Among the important factors that could cause actual

results to differ materially from those in any forward-looking

statements are (i) our ability to further develop and commercialize

our instruments and consumables and to deploy new products,

services, and applications, and expand the markets, for our

technology platforms; (ii) our ability to manufacture robust

instrumentation and consumables; (iii) achievement and timing of

the planned deconsolidation of GRAIL, Inc.’s financial results in

our financial statements; (iv) our ability to successfully identify

and integrate acquired technologies, products, or businesses; (v)

our expectations and beliefs regarding future conduct and growth of

the business and the markets in which we operate; (vi) challenges

inherent in developing, manufacturing, and launching new products

and services, including the timing of customer orders and impact on

existing products and services; and (vii) the application of

generally accepted accounting principles, which are highly complex

and involve many subjective assumptions, estimates, and judgments,

together with other factors detailed in our filings with the

Securities and Exchange Commission, including our most recent

filings on Forms 10-K and 10-Q, or in information disclosed in

public conference calls, the date and time of which are released

beforehand. We undertake no obligation, and do not intend, to

update these forward-looking statements, to review or confirm

analysts’ expectations, or to provide interim reports or updates on

the progress of the current quarter.

About Illumina

Illumina is improving human health by unlocking the power of the

genome. Our focus on innovation has established us as the global

leader in DNA sequencing and array-based technologies, serving

customers in the research, clinical and applied markets. Our

products are used for applications in the life sciences, oncology,

reproductive health, agriculture and other emerging segments. To

learn more, visit www.illumina.com and follow

@illumina.

Illumina, Inc. Condensed Consolidated Balance Sheets

(In thousands) January 1, January

3, 2017 2016 ASSETS (unaudited)

Current assets: Cash and cash equivalents $ 734,516 $ 768,770

Short-term investments 824,208 617,450 Accounts receivable, net

381,316 385,529 Inventory 300,170 270,777 Prepaid expenses and

other current assets 77,881 54,297 Total current

assets 2,318,091 2,096,823 Property and equipment, net 713,334

342,694 Goodwill 775,995 752,629 Intangible assets, net 242,652

273,621 Deferred tax assets 123,317 134,515 Other assets

107,211 87,465 Total assets $ 4,280,600 $ 3,687,747

LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities:

Accounts payable $ 137,930 $ 139,226 Accrued liabilities 342,751

386,844 Build-to-suit lease liability 222,734 9,495 Long-term debt,

current portion 1,250 74,929 Total current

liabilities 704,665 610,494 Long-term debt 1,047,805 1,015,649

Other long-term liabilities 213,955 180,505 Redeemable

noncontrolling interests 43,940 32,546 Stockholders’ equity

2,270,235 1,848,553 Total liabilities and stockholders’

equity $ 4,280,600 $ 3,687,747

Illumina, Inc.

Condensed Consolidated Statements of Income (In

thousands, except per share amounts) (unaudited)

Three Months Ended Years Ended January

1, January 3, January 1, January

3, 2017 2016

2017 2016 Revenue: Product

revenue $ 525,581 $ 497,922 $ 2,031,997 $ 1,890,633 Service and

other revenue 93,766 93,626

366,376 329,129 Total revenue 619,347

591,548 2,398,373

2,219,762 Cost of revenue: Cost of product revenue

(a) 151,343 130,775 534,199 490,812 Cost of service and

other revenue

(a) 37,606 39,561 154,762 133,850 Amortization

of acquired intangible assets 10,959 10,853

42,964 45,810 Total cost of

revenue 199,908 181,189 731,925

670,472 Gross profit 419,439

410,359 1,666,448 1,549,290

Operating expense: Research and development

(a)

129,915 114,347 504,415 401,527 Selling, general and administrative

(a) 146,091 147,251 583,005 524,657 Legal contingencies —

4,000 (9,490 ) 19,000 Headquarter relocation 417 436 1,486 (2,611 )

Acquisition related expense (gain), net — 325

— (6,124 ) Total operating expense

276,423 266,359 1,079,416

936,449 Income from operations 143,016 144,000

587,032 612,841 Other expense, net (8,773 ) (8,993 )

(25,854 ) (29,699 ) Income before income taxes

134,243 135,007 561,178 583,142 Provision for income taxes

26,701 32,143 133,088

125,752 Consolidated net income 107,542 102,864 428,090

457,390 Add: Net loss attributable to noncontrolling interests

16,220 1,613 34,559

4,169 Net income attributable to Illumina

stockholders $ 123,762 $ 104,477 $ 462,649 $

461,559 Net income attributable to Illumina stockholders for

earnings per share

(b) $ 123,884 $ 104,477 $

454,106 $ 461,526 Earnings per share attributable to

Illumina stockholders: Basic $ 0.84 $ 0.72 $ 3.09 $ 3.19 Diluted $

0.84 $ 0.70 $ 3.07 $ 3.10 Shares used in computing earnings per

common share: Basic 146,804 145,963 146,788 144,826 Diluted 148,015

148,952 148,040 149,069

(a) Includes stock-based

compensation expense for stock-based awards:

Three Months

Ended Years Ended January 1, January 3,

January 1, January 3, 2017

2016 2017

2016 Cost of product revenue $ 3,121 $ 2,829 $ 9,070

$ 9,841 Cost of service and other revenue (530 ) 366 1,584 1,609

Research and development

(1) 9,406 10,849 42,295 42,001

Selling, general and administrative

(2) 15,223

21,445 76,116 79,142

Stock-based compensation expense before taxes $ 27,220 $

35,489 $ 129,065 $ 132,593

(1) Includes stock-based

compensation from GRAIL and Helix of $0.2 million and $0.7 million

for the three months and year ended January 1, 2017, respectively,

and stock-based compensation from Helix of $0.2 million for the

three months and year ended January 3, 2016.

(2) Includes stock-based

compensation from GRAIL and Helix of $0.3 million and $1.7 million

for the three months and year ended January 1, 2017, respectively,

and stock-based compensation from Helix of $0.3 million for the

three months and year ended January 3, 2016.

(b) Amount reflects the additional

losses attributable to the common shareholders of GRAIL and Helix

for earnings per share purposes. For the year ended January 1,

2017, the additional losses were partially offset by the net impact

of a deemed dividend from the company’s common to preferred share

exchange with GRAIL.

Illumina, Inc. Condensed Consolidated Statements

of Cash Flows (In thousands) (unaudited)

Three Months Ended Years Ended

January 1, January 3, January 1, January

3, 2017 2016

2017 2016 Net cash provided by

operating activities

(a) $ 280,153 $ 240,378 $ 687,238 $

659,596 Net cash (used in) provided by investing activities

(173,292 ) 229,398 (514,539 ) (106,146 ) Net cash used in financing

activities

(a) (163,492 ) (253,141 ) (204,713 ) (418,762 )

Effect of exchange rate changes on cash and cash equivalents

(3,550 ) 606 (2,240 ) (2,072 ) Net

(decrease) increase in cash and cash equivalents (60,181 ) 217,241

(34,254 ) 132,616 Cash and cash equivalents, beginning of period

794,697 551,529 768,770

636,154 Cash and cash equivalents, end of period $

734,516 $ 768,770 $ 734,516 $ 768,770

Calculation of free cash flow: Net cash provided by

operating activities

(a) $ 280,153 $ 240,378 $ 687,238 $

659,596 Purchases of property and equipment

(b)

(81,538 ) (35,486 ) (259,891 ) (142,847 ) Free

cash flow

(c) $ 198,615 $ 204,892 $ 427,347

$ 516,749

(a) Net cash provided by operating

activities excludes excess tax benefit related to stock-based

compensation of $91.3 million in fiscal 2016, of which $18.6

million was recorded as cash inflow from operating activities in

Q4. This compares to $126.7 million in fiscal 2015, of which $5.0

million was recorded in Q4. Net cash used in financing activities

reflects the excess tax benefit as a corresponding inflow in the

respective periods except Q4 2016 which is an outflow.

(b) Excludes property and equipment

recorded under build-to-suit lease accounting, which are non-cash

expenditures, of $193.4 million in fiscal 2016, of which $24.6

million was in Q4, and $9.5 million in fiscal 2015, all of which

was in Q4.

(c) Free cash flow, which is a

non-GAAP financial measure, is calculated as net cash provided by

operating activities reduced by purchases of property and

equipment. Free cash flow is useful to management as it is one of

the metrics used to evaluate our performance and to compare us with

other companies in our industry. However, our calculation of free

cash flow may not be comparable to similar measures used by other

companies.

Illumina, Inc. Results of Operations -

Non-GAAP (In thousands, except per share amounts)

(unaudited) ITEMIZED RECONCILIATION BETWEEN GAAP

AND NON-GAAP EARNINGS PER SHARE ATTRIBUTABLE TO ILLUMINA

STOCKHOLDERS: Three Months Ended Years

Ended January 1, January 3, January

1, January 3, 2017

2016 2017 2016

GAAP earnings per share attributable to Illumina

stockholders - diluted $ 0.84 $

0.70 $ 3.07 $ 3.10 Amortization

of acquired intangible assets 0.08 0.09 0.33 0.35 Non-cash interest

expense

(a) 0.05 0.06 0.20 0.26 Contingent compensation

(gain) expense

(b) — — 0.01 — Legal contingencies

(c)

— 0.03 (0.06 ) 0.13 Headquarter relocation — — 0.01 (0.02 ) Deemed

dividend

(d) — — (0.01 ) — Loss on extinguishment of debt —

— — 0.03 Acquisition related expense (gain), net

(e) — — —

(0.04 ) Cost-method investment gain, net

(f) — — — (0.10 )

Tax benefit related to cost-sharing arrangement

(g) (0.05 )

— (0.05 ) (0.17 ) Incremental non-GAAP tax expense

(h)

(0.07 ) (0.07 ) (0.17 ) (0.22 )

Non-GAAP earnings per share attributable to Illumina stockholders -

diluted

(i) $ 0.85 $ 0.81 $ 3.33 $ 3.32

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP

NET INCOME ATTRIBUTABLE TO ILLUMINA STOCKHOLDERS: GAAP net

income attributable to Illumina stockholders (j) $

123,762 $ 104,477 $ 462,649

$ 461,559 Amortization of acquired intangible assets

12,423 12,376 48,984 51,829 Non-cash interest expense

(a)

7,404 8,705 29,786 38,589 Headquarter relocation 417 436 1,486

(2,611 ) Contingent compensation (gain) expense

(b) (252 )

685 1,833 934 Legal contingencies

(c) — 4,000 (9,490 )

19,000 Loss on extinguishment of debt — 325 — 4,062 Acquisition

related expense (gain), net

(e) — 325 — (6,124 ) Cost-method

investment gain, net

(f) — (119 ) — (15,601 ) Tax benefit

related to cost-sharing arrangement

(g) (6,696 ) (56 )

(6,696 ) (24,813 ) Incremental non-GAAP tax expense

(h)

(10,625 ) (10,584 ) (25,320 ) (31,621 )

Non-GAAP net income attributable to Illumina stockholders

(i) $ 126,433 $ 120,570 $ 503,232 $

495,203

(a) Non-cash interest expense is

calculated in accordance with the authoritative accounting guidance

for convertible debt instruments that may be settled in cash.

(b) Contingent compensation (gain)

expense relates to contingent payments for post-combination

services associated with an acquisition.

(c) Legal contingencies in 2016

represent a reversal of prior year expense related to settlement of

patent litigation.

(d) Amount represents the impact of

a deemed dividend, net of Illumina’s portion of the losses incurred

by GRAIL’s common shareholders resulting from the company’s common

to preferred share exchange with GRAIL. The amount was added to net

income attributable to Illumina stockholders for purposes of

calculating Illumina’s consolidated earnings per share. The deemed

dividend, net of tax, was recorded through equity.

(e) Acquisition related expense

(gain), net consists of changes in fair value of contingent

consideration.

(f) Cost-method investment gain,

net consists primarily of a gain on the sale of a cost-method

investment.

(g) Tax benefit related to

cost-sharing arrangement refers to the exclusion of stock

compensation from prior period cost-sharing charges as a result of

a tax court ruling.

(h) Incremental non-GAAP tax

expense reflects the tax impact related to the non-GAAP adjustments

listed above.

(i) Non-GAAP net income

attributable to Illumina stockholders and diluted earnings per

share attributable to Illumina stockholders exclude the effect of

the pro forma adjustments as detailed above. Non-GAAP net income

attributable to Illumina stockholders and diluted earnings per

share attributable to Illumina stockholders are key components of

the financial metrics utilized by the company’s board of directors

to measure, in part, management’s performance and determine

significant elements of management’s compensation. Management has

excluded the effects of these items in these measures to assist

investors in analyzing and assessing our past and future core

operating performance.

(j) GAAP net income attributable to

Illumina stockholders excludes the net impact of the deemed

dividend as detailed in (d) above and the additional losses

attributable to common shareholders of GRAIL and Helix for earnings

per share purposes. These amounts are included in GAAP net income

attributable to Illumina stockholders for earnings per share of

$123.9 million and $454.1 million for the three months and year

ended January 1, 2017, respectively and $104.5 million and $461.5

million for the three months and year ended January 3, 2016,

respectively.

Illumina, Inc. Results of Operations - Non-GAAP

(continued) (Dollars in thousands) (unaudited)

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP RESULTS OF

OPERATIONS AS A PERCENT OF REVENUE: Three Months

Ended Years Ended January 1,

January 3, January 1, January 3,

2017 2016 2017 2016 GAAP gross

profit $ 419,439 67.7 %

$ 410,359 69.4 % $

1,666,448 69.5 % $

1,549,290 69.8 % Stock-based

compensation expense 2,591 0.4 % 3,195 0.5 % 10,654 0.4 % 11,450

0.5 % Amortization of acquired intangible assets 10,959

1.8 % 10,853 1.8 % 42,964 1.8 %

45,810 2.1 % Non-GAAP gross profit

(a) $

432,989 69.9 % $ 424,407 71.7 % $ 1,720,066

71.7 % $ 1,606,550 72.4 %

GAAP research and

development expense $ 129,915 21.0

% $ 114,347 19.3 % $

504,415 21.0 % $ 401,527

18.1 % Stock-based compensation expense (9,406 ) (1.5

)% (10,849 ) (1.8 )% (42,295 ) (1.7 )% (42,001 ) (1.9 )% Contingent

compensation gain (expense)

(b) 12 —

(83 ) — (313 ) — (127 ) —

Non-GAAP research and development expense $ 120,521 19.5 % $

103,415 17.5 % $ 461,807 19.3 % $ 359,399 16.2

%

GAAP selling, general and administrative expense

$ 146,091 23.6 % $

147,251 24.9 % $ 583,005

24.3 % $ 524,657 23.6 %

Stock-based compensation expense (15,223 ) (2.5 )% (21,445 ) (3.6

)% (76,116 ) (3.2 )% (79,142 ) (3.5 )% Amortization of acquired

intangible assets (1,464 ) (0.2 )% (1,523 ) (0.3 )% (6,020 ) (0.2

)% (6,019 ) (0.3 )% Contingent compensation gain (expense)

(b) 240 — (602 ) (0.1 )%

(1,520 ) (0.1 )% (807 ) — Non-GAAP selling, general

and administrative expense $ 129,644 20.9 % $ 123,681

20.9 % $ 499,349 20.8 % $ 438,689 19.8 %

GAAP operating profit $ 143,016 23.1

% $ 144,000 24.3 % $

587,032 24.5 % $ 612,841

27.6 % Stock-based compensation expense 27,220 4.4 %

35,489 6.0 % 129,065 5.3 % 132,593 5.9 % Amortization of acquired

intangible assets 12,423 2.0 % 12,376 2.1 % 48,984 2.0 % 51,829 2.4

% Headquarter relocation 417 — 436 0.1 % 1,486 0.1 % (2,611 ) (0.1

)% Contingent compensation (gain) expense

(b) (252 ) — 685

0.1 % 1,833 0.1 % 934 — Legal contingencies

(c) — — 4,000

0.7 % (9,490 ) (0.4 )% 19,000 0.9 % Acquisition related expense

(gain), net

(d) — — 325

0.1 % — — (6,124 ) (0.3 )% Non-GAAP

operating profit

(a) $ 182,824 29.5 % $ 197,311

33.4 % $ 758,910 31.6 % $ 808,462 36.4 %

GAAP other expense, net $ (8,773

) (1.4 )% $ (8,993 )

(1.5 )% $ (25,854 ) (1.1

)% $ (29,699 ) (1.3 )%

Non-cash interest expense

(e) 7,404 1.2 % 8,705 1.5 % 29,786

1.3 % 38,589 1.7 % Loss on extinguishment of debt — — 325 — — —

4,062 0.2 % Cost-method investment gain, net

(f) —

— (119 ) — — —

(15,601 ) (0.7 )% Non-GAAP other income (expense), net

(a) $ (1,369 ) (0.2 )% $ (82 ) — $ 3,932 0.2 %

$ (2,649 ) (0.1 )%

(a) Non-GAAP gross profit, included

within non-GAAP operating profit, is a key measure of the

effectiveness and efficiency of manufacturing processes, product

mix and the average selling prices of the company’s products and

services. Non-GAAP operating profit, and non-GAAP other income

(expense), net, exclude the effects of the pro forma adjustments as

detailed above. Management has excluded the effects of these items

in these measures to assist investors in analyzing and assessing

past and future operating performance.

(b) Contingent compensation

gain/expense relates to contingent payments for post-combination

services associated with an acquisition.

(c) Legal contingencies in 2016

represent a reversal of prior year expense related to settlement of

patent litigation.

(d) Acquisition related expense

(gain), net consists of changes in fair value of contingent

consideration.

(e) Non-cash interest expense is

calculated in accordance with the authoritative accounting guidance

for convertible debt instruments that may be settled in cash.

(f) Cost-method investment gain,

net consists primarily of a gain on the sale of a cost-method

investment.

Illumina, Inc. Reconciliation of Non-GAAP

Financial Guidance

The company’s future performance and

financial results are subject to risks and uncertainties, and

actual results could differ materially from the guidance set forth

below. Some of the factors that could affect the company’s

financial results are stated above in this press release. More

information on potential factors that could affect the company’s

financial results is included from time to time in the company’s

public reports filed with the Securities and Exchange Commission,

including the company’s Form 10-K for the fiscal year ended January

3, 2016, and the company’s Form 10-Q for the fiscal quarters ended

April 3, 2016, July 3, 2016, and October 2, 2016. The company

assumes no obligation to update any forward-looking statements or

information.

Fiscal Year 2017 GAAP diluted earnings per

share attributable to Illumina stockholders (a) $3.25 -

$3.35 Amortization of acquired intangible assets 0.31 Non-cash

interest expense

(b) 0.20 Incremental non-GAAP tax expense

(c) (0.16) Non-GAAP diluted earnings per share attributable

to Illumina stockholders

(a) $3.60 - $3.70

Q1

2017 GAAP diluted earnings per share attributable to

Illumina stockholders (a) $0.51- $0.56 Amortization of

acquired intangible assets 0.08 Non-cash interest expense

(b) 0.05 Incremental non-GAAP tax expense

(c) (0.04)

Non-GAAP diluted earnings per share attributable to Illumina

stockholders

(a) $0.60 - $0.65

(a) The company adopted Accounting

Standard Update (ASU) 2016-09, Compensation - Stock Compensation

(Topic 718) as of January 2, 2017. The impact of such adoption is

not included in the GAAP diluted net income per share attributable

to Illumina stockholders guidance for fiscal year 2017. The GAAP

diluted net income per share attributable to Illumina stockholders

guidance for fiscal year 2017 also excludes one-time items related

to the close of the GRAIL, Inc. Series B financing, which is

expected to occur prior to the end of the first quarter. Such

impacts will be recorded as incurred and excluded from non-GAAP

diluted net income per share attributable to Illumina

stockholders.

(b) Non-cash interest expense is

calculated in accordance with the authoritative accounting guidance

for convertible debt instruments that may be settled in cash.

(c) Incremental non-GAAP tax

expense reflects the tax impact related to the non-GAAP adjustments

listed above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170131006338/en/

Illumina, Inc.Investors:Rebecca

Chambers858.255.5243ir@illumina.comorMedia:Eric

Endicott858.882.6822pr@illumina.com

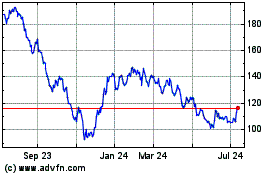

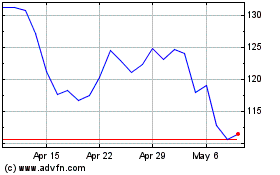

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2023 to Apr 2024