UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 19, 2016

INTERACTIVE BROKERS GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-33440

|

30-0390693

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

| |

|

|

One Pickwick Plaza, Greenwich, CT 06830

(Address of Principal Executive Offices) (Zip Code)

(203) 618-5800

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition.

On January 19, 2016, the Registrant issued a press release reporting its financial results for the fourth quarter ended December 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

All of the information furnished in this report (including Exhibit 99.1 hereto) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and unless expressly set forth by specific reference in such filings, shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, whether made before or after the date hereof and regardless of any general incorporation language in such filings.

Item 8.02. Other Events.

On January 19, 2016, Interactive Brokers Group, Inc. (the “Company”) declared a quarterly cash dividend of $0.10 per share on the Company’s common stock. The Company’s Board of Directors has declared that the dividend will be paid on March 14, 2016 to shareholders of record as of March 1, 2016.

Item 9.01. Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

99.1

|

Press Release dated January 19, 2016.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 19, 2016

| |

INTERACTIVE BROKERS GROUP, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Paul J. Brody |

| |

Name:

|

Paul J. Brody

|

| |

Title:

|

Chief Financial Officer, Treasurer

and Secretary

|

EXHIBIT INDEX

|

99.1

|

Press Release dated January 19, 2016.

|

Exhibit 99.1

INTERACTIVE BROKERS GROUP ANNOUNCES 2015 RESULTS

— — —

REPORTS COMPREHENSIVE EARNINGS PER SHARE OF $0.62,

INCOME BEFORE TAXES OF $458 MILLION ON $1,189 MILLION IN NET REVENUES,

AND EARNINGS PER SHARE ON NET INCOME OF $0.78.

DECLARES QUARTERLY DIVIDEND OF $0.10 PER SHARE.

GREENWICH, CONN, January 19, 2016 — Interactive Brokers Group, Inc. (NASDAQ GS: IBKR) an automated global electronic broker and market maker, today reported diluted earnings per share on a comprehensive basis of $0.62 for the year ended December 31, 2015, compared to diluted earnings per share on a comprehensive basis of $0.51 for 2014.

Excluding other comprehensive income, the Company reported diluted earnings per share of $0.78 for the year ended December 31, 2015, compared to diluted earnings per share of $0.77 for 2014.

Net revenues were $1,189 million and income before income taxes was $458 million for the year, compared to net revenues of $1,043 million and income before income taxes of $506 million in 2014.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on March 14, 2016 to shareholders of record as of March 1, 2016.

Business Highlights

|

·

|

39% pretax profit margin for 2015.

|

|

·

|

49% Electronic Brokerage pretax profit margin for 2015.

|

|

·

|

44% Market Making pretax profit margin for 2015.

|

|

·

|

Customer equity grew 19% from 2014 to $67.4 billion.

|

|

·

|

Customer accounts increased 18% in 2015 to 331 thousand.

|

|

·

|

Total DARTs increased 14% from 2014 to 647 thousand.

|

|

·

|

Brokerage segment equity was $3.5 billion. Total equity was $5.3 billion.

|

Segment Overview

Electronic Brokerage

Electronic Brokerage segment income before income taxes decreased 9%, to $536 million, in 2015, due to unsecured customer losses caused by the sudden, large move in the value of the Swiss franc as further described below. Net revenues increased 15% to $1.1 billion on higher commissions revenue and net interest income. Excluding the impact of this unusual item, segment income before taxes grew to a record $655 million, an 11% increase over 2014. Customer accounts grew 18% to 331 thousand and customer equity increased 19% to $67.4 billion compared to 2014.

Commissions and execution fees increased 13% in 2015, to $618 million and net interest income grew 24%, to $400 million. Pretax profit margin was 49% in 2015, down from 62% in 2014.

Total DARTs(1) for cleared and execution-only customers increased 14% to 647 thousand in 2015, compared to 566 thousand during 2014. Cleared DARTs were 589 thousand, 14% higher than in 2014.

Market Making

Market Making segment income before income taxes increased 14%, to $130 million in 2015, driven by higher market volatility and periods of higher trading activity during 2015. Pretax profit margin increased to 44% in 2015 from 40% in 2014.

Sudden Move in the Value of the Swiss Franc

On January 15, 2015, due to the sudden, large move in the value of the Swiss franc that followed an unprecedented action by the Swiss National Bank, which removed a previously instituted and repeatedly reconfirmed cap of the currency relative to the Euro, several of our customers who held currency futures and spot positions suffered losses in excess of their deposits with us. We took immediate action to hedge our exposure to the foreign currency receivables from these customers. During 2015, we incurred losses, net of hedging activity and debt collection efforts, of $119 million. We continue to actively pursue collection of these debts. The ultimate effect of this incident on our results will depend upon the outcome of our debt collection efforts.

Effects of Foreign Currency Diversification

In connection with our currency strategy, we have determined to base our net worth in GLOBALs, a basket of 16 major currencies in which we hold our equity. In 2015, our currency diversification strategy decreased our comprehensive earnings by $269 million, as the U.S. dollar value of the GLOBAL decreased by approximately 5%. The effects of the currency diversification strategy are reported as components of (1) Other Income in the Corporate segment and (2) Other Comprehensive Income (“OCI”). As previously disclosed, certain reclassifications have been made to previously reported amounts to conform to the current presentation of currency translation gains and losses related to our currency diversification strategy.

(1) Daily average revenue trades (DARTs) are based on customer orders.

_____________________

Conference Call Information:

Interactive Brokers Group will hold a conference call with investors today, January 19, 2016, at 4:30 p.m. ET to discuss its quarterly results. Investors who would like to listen to the conference call live should dial 877-324-1965 (U.S. domestic) and 631-291-4512 (international). The number should be dialed approximately ten minutes prior to the start of the conference call. Ask for the “Interactive Brokers Conference Call.”

The conference call will also be accessible simultaneously, and through replays, as an audio webcast through the Investor Relations section of the Interactive Brokers web site, www.interactivebrokers.com/ir.

About Interactive Brokers Group, Inc.:

Interactive Brokers Group, Inc., together with its subsidiaries, is an automated global electronic broker that specializes in catering to financial professionals by offering state-of-the-art trading technology, superior execution capabilities, worldwide electronic access, and sophisticated risk management tools at exceptionally low costs. The brokerage trading platform utilizes the same innovative technology as the Company’s market making business, which specializes in routing orders and executing and processing trades in securities, futures, foreign exchange instruments, bonds and funds on more than 100 electronic exchanges and trading venues around the world. As a market maker, we provide liquidity at these marketplaces and, as a broker, we provide professional traders and investors with electronic access to stocks, options, futures, forex, bonds and mutual funds from a single IB Universal AccountSM. Employing proprietary software on a global communications network, Interactive Brokers is continuously integrating its software with a growing number of exchanges and trading venues into one automatically functioning, computerized platform that requires minimal human intervention.

Cautionary Note Regarding Forward-Looking Statements:

The foregoing information contains certain forward-looking statements that reflect the Company’s current views with respect to certain current and future events and financial performance. These forward-looking statements are and will be, as the case may be, subject to many risks, uncertainties and factors relating to the Company’s operations and business environment which may cause the Company’s actual results to be materially different from any future results, expressed or implied, in these forward-looking statements. Any forward-looking statements in this release are based upon information available to the company on the date of this release. The company does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any statements expressed or implied therein will not be realized. Additional information on risk factors that could potentially affect the Company’s financial results may be found in the Company’s filings with the Securities and Exchange Commission.

For Interactive Brokers Group, Inc. Media: Caitlin Duffy, 203-913-1369 or Investors: Patrick Brennan, 203-618-4070.

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

OPERATING DATA

TRADE VOLUMES:

(in 000's, except %)

| |

|

|

|

|

|

|

|

|

|

Brokerage

|

|

|

|

|

|

|

|

|

| |

|

Market

|

|

|

|

Brokerage

|

|

|

|

Non

|

|

|

|

|

|

|

|

Avg. Trades

|

| |

|

Making

|

|

%

|

|

Cleared

|

|

%

|

|

Cleared

|

|

%

|

|

Total

|

|

%

|

|

per U.S.

|

|

Period

|

|

Trades

|

|

Change

|

|

Trades

|

|

Change

|

|

Trades

|

|

Change

|

|

Trades

|

|

Change

|

|

Trading Day

|

|

2013

|

|

65,320

|

|

|

|

173,849

|

|

|

|

18,489

|

|

|

|

257,658

|

|

|

|

1,029

|

|

2014

|

|

64,530

|

|

-1%

|

|

206,759

|

|

19%

|

|

18,055

|

|

-2%

|

|

289,344

|

|

12%

|

|

1,155

|

|

2015

|

|

65,937

|

|

2%

|

|

242,846

|

|

17%

|

|

18,769

|

|

4%

|

|

327,553

|

|

13%

|

|

1,305

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q2014

|

|

16,126

|

|

|

|

57,773

|

|

|

|

4,621

|

|

|

|

78,520

|

|

|

|

1,246

|

|

4Q2015

|

|

16,985

|

|

5%

|

|

60,848

|

|

5%

|

|

4,863

|

|

5%

|

|

82,696

|

|

5%

|

|

1,313

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q2015

|

|

18,696

|

|

|

|

65,333

|

|

|

|

5,266

|

|

|

|

89,295

|

|

|

|

1,395

|

|

4Q2015

|

|

16,985

|

|

-9%

|

|

60,848

|

|

-7%

|

|

4,863

|

|

-8%

|

|

82,696

|

|

-7%

|

|

1,313

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTRACT AND SHARE VOLUMES:

(in 000's, except %)

TOTAL

| |

|

Options

|

|

%

|

|

Futures*

|

|

%

|

|

Stocks

|

|

%

|

|

Period

|

|

(contracts)

|

|

Change

|

|

(contracts)

|

|

Change

|

|

(shares)

|

|

Change

|

|

2013

|

|

659,673

|

|

|

|

121,776

|

|

|

|

95,479,739

|

|

|

|

2014

|

|

631,265

|

|

-4%

|

|

123,048

|

|

1%

|

|

153,613,174

|

|

61%

|

|

2015

|

|

634,388

|

|

0%

|

|

140,668

|

|

14%

|

|

172,742,520

|

|

12%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q2014

|

|

173,284

|

|

|

|

34,259

|

|

|

|

36,973,639

|

|

|

|

4Q2015

|

|

156,125

|

|

-10%

|

|

33,436

|

|

-2%

|

|

35,150,818

|

|

-5%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q2015

|

|

179,786

|

|

|

|

38,960

|

|

|

|

41,999,917

|

|

|

|

4Q2015

|

|

156,125

|

|

-13%

|

|

33,436

|

|

-14%

|

|

35,150,818

|

|

-16%

|

MARKET MAKING

| |

|

Options

|

|

%

|

|

Futures*

|

|

%

|

|

Stocks

|

|

%

|

|

Period

|

|

(contracts)

|

|

Change

|

|

(contracts)

|

|

Change

|

|

(shares)

|

|

Change

|

|

2013

|

|

404,490

|

|

|

|

18,184

|

|

|

|

12,849,729

|

|

|

|

2014

|

|

344,741

|

|

-15%

|

|

15,668

|

|

-14%

|

|

12,025,822

|

|

-6%

|

|

2015

|

|

335,406

|

|

-3%

|

|

14,975

|

|

-4%

|

|

15,376,076

|

|

28%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q2014

|

|

95,625

|

|

|

|

3,462

|

|

|

|

3,093,170

|

|

|

|

4Q2015

|

|

82,106

|

|

-14%

|

|

4,047

|

|

17%

|

|

3,677,274

|

|

19%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q2015

|

|

95,754

|

|

|

|

3,868

|

|

|

|

4,458,343

|

|

|

|

4Q2015

|

|

82,106

|

|

-14%

|

|

4,047

|

|

5%

|

|

3,677,274

|

|

-18%

|

BROKERAGE TOTAL

| |

|

Options

|

|

%

|

|

Futures*

|

|

%

|

|

Stocks

|

|

%

|

|

Period

|

|

(contracts)

|

|

Change

|

|

(contracts)

|

|

Change

|

|

(shares)

|

|

Change

|

|

2013

|

|

255,183

|

|

|

|

103,592

|

|

|

|

82,630,010

|

|

|

|

2014

|

|

286,524

|

|

12%

|

|

107,380

|

|

4%

|

|

141,587,352

|

|

71%

|

|

2015

|

|

298,982

|

|

4%

|

|

125,693

|

|

17%

|

|

157,366,444

|

|

11%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q2014

|

|

77,659

|

|

|

|

30,797

|

|

|

|

33,880,469

|

|

|

|

4Q2015

|

|

74,019

|

|

-5%

|

|

29,389

|

|

-5%

|

|

31,473,544

|

|

-7%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q2015

|

|

84,032

|

|

|

|

35,092

|

|

|

|

37,541,574

|

|

|

|

4Q2015

|

|

74,019

|

|

-12%

|

|

29,389

|

|

-16%

|

|

31,473,544

|

|

-16%

|

* Includes options on futures

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

OPERATING DATA, CONTINUED

BROKERAGE CLEARED

| |

|

Options

|

|

%

|

|

Futures*

|

|

%

|

|

Stocks

|

|

%

|

|

Period

|

|

(contracts)

|

|

Change

|

|

(contracts)

|

|

Change

|

|

(shares)

|

|

Change

|

|

2013

|

|

180,660

|

|

|

|

101,732

|

|

|

|

78,829,785

|

|

|

|

2014

|

|

225,662

|

|

25%

|

|

106,074

|

|

4%

|

|

137,153,132

|

|

74%

|

|

2015

|

|

244,356

|

|

8%

|

|

124,206

|

|

17%

|

|

153,443,988

|

|

12%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q2014

|

|

63,739

|

|

|

|

30,559

|

|

|

|

32,720,100

|

|

|

|

4Q2015

|

|

59,934

|

|

-6%

|

|

29,030

|

|

-5%

|

|

30,405,179

|

|

-7%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q2015

|

|

68,018

|

|

|

|

34,635

|

|

|

|

36,475,917

|

|

|

|

4Q2015

|

|

59,934

|

|

-12%

|

|

29,030

|

|

-16%

|

|

30,405,179

|

|

-17%

|

* Includes options on futures

BROKERAGE STATISTICS

(in 000's, except % and where noted)

|

Year over Year

|

4Q2015

|

|

4Q2014

|

|

% Change

|

|

Total Accounts

|

|

331

|

|

|

281

|

|

18%

|

|

Customer Equity (in billions) *

|

$

|

67.4

|

|

$

|

56.7

|

|

19%

|

| |

|

|

|

|

|

|

|

|

Cleared DARTs

|

|

582

|

|

|

564

|

|

3%

|

|

Total Customer DARTs

|

|

641

|

|

|

619

|

|

4%

|

| |

|

|

|

|

|

|

|

|

Cleared Customers (in $'s, except DART per account)

|

|

|

|

|

|

|

|

|

Commission per DART

|

$

|

3.81

|

|

$

|

4.28

|

|

-11%

|

|

DART per Avg. Account (Annualized)

|

|

447

|

|

|

511

|

|

-13%

|

|

Net Revenue per Avg. Account (Annualized)**

|

$

|

3,239

|

|

$

|

3,622

|

|

-11%

|

| |

|

|

|

|

|

|

|

|

Consecutive Quarters

|

4Q2015

|

|

3Q2015

|

|

% Change

|

|

Total Accounts

|

|

331

|

|

|

322

|

|

3%

|

|

Customer Equity (in billions) *

|

$

|

67.4

|

|

$

|

62.1

|

|

9%

|

| |

|

|

|

|

|

|

|

|

Cleared DARTs

|

|

582

|

|

|

620

|

|

-6%

|

|

Total Customer DARTs

|

|

641

|

|

|

683

|

|

-6%

|

| |

|

|

|

|

|

|

|

|

Cleared Customers (in $'s, except DART per account)

|

|

|

|

|

|

|

|

|

Commission per DART

|

$

|

3.81

|

|

$

|

4.10

|

|

-7%

|

|

DART per Avg. Account (Annualized)

|

|

447

|

|

|

493

|

|

-9%

|

|

Net Revenue per Avg. Account (Annualized)**

|

$

|

3,239

|

|

$

|

3,584

|

|

-10%

|

* Excludes non-customers.

** The calculation has been revised to exclude components of other income that are not direct revenues from customers. Prior period amounts have been recalculated to conform to the current methodology.

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

SEGMENT FINANCIAL INFORMATION

(UNAUDITED)

| |

|

|

Three Months

|

|

Twelve Months

|

| |

|

|

Ended December 31,

|

|

Ended December 31,

|

| |

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

| |

|

|

(in millions) |

| |

|

|

|

|

Electronic Brokerage

|

Net revenues

|

|

$

|

219

|

|

$

|

261

|

|

$

|

1,097

|

|

$

|

952

|

| |

Non-interest expenses

|

|

|

106

|

|

|

94

|

|

|

561

|

|

|

363

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income before income taxes

|

|

$

|

113

|

|

$

|

167

|

|

$

|

536

|

|

$

|

589

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pre-tax profit margin

|

|

|

52%

|

|

|

64%

|

|

|

49%

|

|

|

62%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Making

|

Net revenues

|

|

$

|

69

|

|

$

|

53

|

|

$

|

298

|

|

$

|

284

|

| |

Non-interest expenses

|

|

|

42

|

|

|

38

|

|

|

168

|

|

|

170

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income before income taxes

|

|

$

|

27

|

|

$

|

15

|

|

$

|

130

|

|

$

|

114

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pre-tax profit margin

|

|

|

39%

|

|

|

28%

|

|

|

44%

|

|

|

40%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate (1)

|

Net revenues

|

|

$

|

(17)

|

|

$

|

(106)

|

|

$

|

(206)

|

|

$

|

(193)

|

| |

Non-interest expenses

|

|

|

(4)

|

|

|

2

|

|

|

2

|

|

|

4

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income (loss) before income taxes

|

|

$

|

(13)

|

|

$

|

(108)

|

|

$

|

(208)

|

|

$

|

(197)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

Net revenues

|

|

$

|

271

|

|

$

|

208

|

|

$

|

1,189

|

|

$

|

1,043

|

| |

Non-interest expenses

|

|

|

144

|

|

|

134

|

|

|

731

|

|

|

537

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income before income taxes

|

|

$

|

127

|

|

$

|

74

|

|

$

|

458

|

|

$

|

506

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pre-tax profit margin

|

|

|

47%

|

|

|

36%

|

|

|

39%

|

|

|

49%

|

|

(1)

|

Corporate includes corporate related activities as well as inter-segment eliminations and gains and losses on positions held as part of our overall currency diversification strategy.

|

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

| |

|

|

|

Three Months |

|

Twelve Months |

| |

|

|

|

Ended December 31, |

|

Ended December 31, |

| |

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

| |

|

|

|

|

(in millions, except share and per share data)

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Trading gains

|

|

$

|

53

|

|

$

|

50

|

|

$

|

269

|

|

$

|

261

|

| |

Commissions and execution fees

|

|

|

144

|

|

|

155

|

|

|

617

|

|

|

549

|

| |

Interest income

|

|

|

136

|

|

|

110

|

|

|

492

|

|

|

416

|

| |

Other income (loss)

|

|

|

(44)

|

|

|

(86)

|

|

|

(122)

|

|

|

(111)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total revenues

|

|

|

289

|

|

|

229

|

|

|

1,256

|

|

|

1,115

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest expense

|

|

|

18

|

|

|

21

|

|

|

67

|

|

|

72

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total net revenues

|

|

|

271

|

|

|

208

|

|

|

1,189

|

|

|

1,043

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Execution and clearing

|

|

|

54

|

|

|

54

|

|

|

231

|

|

|

212

|

| |

Employee compensation and benefits

|

|

|

56

|

|

|

49

|

|

|

227

|

|

|

205

|

| |

Occupancy, depreciation and amortization

|

|

|

11

|

|

|

10

|

|

|

44

|

|

|

39

|

| |

Communications

|

|

|

6

|

|

|

6

|

|

|

25

|

|

|

24

|

| |

General and administrative

|

|

|

16

|

|

|

14

|

|

|

58

|

|

|

54

|

| |

Customer bad debt

|

|

|

1

|

|

|

1

|

|

|

146

|

|

|

3

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total non-interest expenses

|

|

|

144

|

|

|

134

|

|

|

731

|

|

|

537

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

127

|

|

|

74

|

|

|

458

|

|

|

506

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

6

|

|

|

8

|

|

|

43

|

|

|

47

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

121

|

|

|

66

|

|

|

415

|

|

|

459

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interests

|

|

|

104

|

|

|

58

|

|

|

366

|

|

|

414

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available for common stockholders

|

|

$

|

17

|

|

$

|

8

|

|

$

|

49

|

|

$

|

45

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share :

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic

|

|

$

|

0.26

|

|

$

|

0.12

|

|

$

|

0.80

|

|

$

|

0.79

|

| |

Diluted

|

|

$

|

0.25

|

|

$

|

0.12

|

|

$

|

0.78

|

|

$

|

0.77

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic

|

|

|

63,685,671

|

|

|

58,124,119

|

|

|

61,043,071

|

|

|

56,492,381

|

| |

Diluted

|

|

|

64,898,144

|

|

|

59,274,773

|

|

|

62,466,991

|

|

|

57,709,668

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income available for common stockholders

|

|

$

|

17

|

|

$

|

8

|

|

$

|

49

|

|

$

|

45

|

| |

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cumulative translation adjustment, before income taxes

|

|

|

(5)

|

|

|

(6)

|

|

|

(10)

|

|

|

(15)

|

| |

|

Income taxes related to items of other comprehensive income

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

| |

Other comprehensive loss, net of tax

|

|

|

(5)

|

|

|

(6)

|

|

|

(10)

|

|

|

(15)

|

|

Comprehensive income available for common stockholders

|

|

$

|

12

|

|

$

|

2

|

|

$

|

39

|

|

$

|

30

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to noncontrolling interests:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interests

|

|

$

|

104

|

|

$

|

58

|

|

$

|

366

|

|

$

|

414

|

|

Other comprehensive income - cumulative translation adjustment

|

|

|

(24)

|

|

|

(38)

|

|

|

(53)

|

|

|

(92)

|

|

Comprehensive income attributable to noncontrolling interests

|

|

$

|

80

|

|

$

|

20

|

|

$

|

313

|

|

$

|

322

|

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| |

|

|

|

|

|

December 31,

2015

|

|

|

December 31,

2014

|

| |

|

|

|

|

|

(in millions) |

|

Assets

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

$

|

1,631

|

|

$

|

1,269

|

|

Cash and securities - segregated for regulatory purposes

|

|

|

|

|

21,309

|

|

|

15,404

|

|

Securities borrowed

|

|

|

|

|

|

3,924

|

|

|

3,660

|

|

Securities purchased under agreements to resell

|

|

|

|

|

|

195

|

|

|

386

|

|

Trading assets, at fair value

|

|

|

|

|

|

3,420

|

|

|

3,978

|

|

Receivables from customers, net of allowance

|

|

|

|

|

|

17,049

|

|

|

17,051

|

|

Receivables from brokers, dealers and clearing organizations

|

|

|

|

|

663

|

|

|

1,131

|

|

Other assets

|

|

|

|

|

|

543

|

|

|

506

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total assets

|

|

|

|

|

$

|

48,734

|

|

$

|

43,385

|

| |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

Short-term borrowings

|

|

|

|

|

$

|

-

|

|

$

|

34

|

|

Securities loaned

|

|

|

|

|

|

2,894

|

|

|

3,199

|

|

Trading liabilities - financial instruments sold but not yet purchased, at fair value

|

|

|

2,617

|

|

|

2,569

|

|

Other payables:

|

|

|

|

|

|

|

|

|

|

| |

Customers

|

|

|

|

|

|

37,084

|

|

|

31,796

|

| |

Brokers, dealers and clearing organizations

|

|

|

|

|

|

423

|

|

|

234

|

| |

Other payables

|

|

|

|

|

|

372

|

|

|

368

|

| |

|

|

|

|

|

|

37,879

|

|

|

32,398

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities

|

|

|

|

|

|

43,390

|

|

|

38,200

|

| |

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

|

|

|

863

|

|

|

766

|

|

Noncontrolling interests

|

|

|

|

|

|

4,481

|

|

|

4,419

|

| |

Total equity

|

|

|

|

|

|

5,344

|

|

|

5,185

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities and equity

|

|

|

|

|

$

|

48,734

|

|

$

|

43,385

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2015

|

|

|

December 31, 2014

|

|

Ownership of IBG LLC Membership Interests

|

Interests

|

|

%

|

|

|

Interests

|

|

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

IBG, Inc.

|

63,991,705

|

|

15.7%

|

|

|

58,473,186

|

|

|

14.5%

|

|

Noncontrolling interests (IBG Holdings LLC)

|

343,040,504

|

|

84.3%

|

|

|

346,062,282

|

|

|

85.5%

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total IBG LLC membership interests

|

407,032,209

|

|

100.0%

|

|

|

404,535,468

|

|

|

100.0%

|

INTERACTIVE BROKERS GROUP, INC. AND SUBSIDIARIES

EARNINGS PER SHARE ON COMPREHENSIVE INCOME

(UNAUDITED)

| |

|

|

|

Three Months |

|

Twelve Months

|

| |

|

|

|

Ended December 31, |

|

Ended December 31, |

| |

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

| |

|

|

|

|

(in millions, except share and per share data)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income available for common stockholders, net of tax

|

$

|

12

|

|

$

|

2

|

|

$

|

39

|

|

$

|

30

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic

|

|

$

|

0.18

|

|

$

|

0.02

|

|

$

|

0.64

|

|

$

|

0.52

|

| |

Diluted

|

|

$

|

0.18

|

|

$

|

0.02

|

|

$

|

0.62

|

|

$

|

0.51

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic

|

|

|

63,685,671

|

|

|

58,124,119

|

|

|

61,043,071

|

|

|

56,492,381

|

| |

Diluted

|

|

|

64,898,144

|

|

|

59,274,773

|

|

|

62,466,991

|

|

|

57,709,668

|

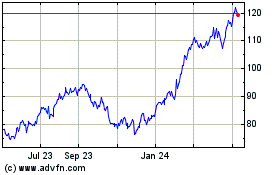

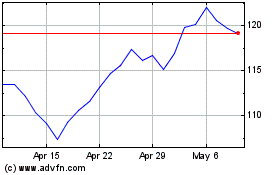

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Sep 2023 to Sep 2024