Current Report Filing (8-k)

August 21 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2015

HERITAGE COMMERCE CORP

(Exact name of registrant as specified in its charter)

|

California |

|

000-23877 |

|

77-0469558 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

150 Almaden Boulevard, San Jose, CA |

|

95113 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 947-6900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01. Completion of Acquisition or Disposition of Assets.

On August 20, 2015, pursuant to the Agreement and Plan of Merger and Reorganization, dated as of April 23, 2015 (the “Merger Agreement”), by and between Heritage Commerce Corp, a California corporation (“Heritage”), Heritage Bank of Commerce, a California chartered bank and wholly owned subsidiary of Heritage (“HBC”), and Focus Business Bank, a California chartered bank (“Focus Bank”), Focus Bank merged with and into HBC with HBC continuing as the surviving bank (the “Merger”).

Pursuant to the terms of the Merger Agreement, each outstanding share of Focus Bank common stock, no par value per share (“Focus Bank Common Stock”) was converted into the right to receive 1.8235 shares of Heritage common stock, no par value per share (“Heritage Common Stock”). For each fractional share that would have otherwise been issued, Heritage will pay cash in an amount equal to such fraction of a share multiplied by $10.94, which was the volume weighted average of the closing prices for shares of Heritage Common Stock as quoted on the NASDAQ Global Select Market for the twenty consecutive trading days ending on August 13, 2015 (the “Weighted Average Closing Price”).

Immediately prior to the closing, each outstanding option to purchase shares of Focus Bank Common Stock, whether or not then vested and exercisable, was cancelled and the holder of the option was entitled to receive from Focus Bank, subject to any required tax withholding, an amount in cash, without interest, equal to the excess over the exercise price per share, if any, of 1.8235 multiplied by the Weighted Average Closing Price.

As a result of the Merger, Heritage will deliver approximately 5.47 million shares of Heritage Common Stock to the former holders of Focus Bank Common Stock. Former holders of Focus Bank Common Stock, as a group, have the right to receive shares of Heritage Common Stock in the Merger constituting approximately 14.6% of the outstanding shares of Heritage Common Stock immediately after the Merger (on a diluted basis that includes the conversion of the Heritage Series C convertible preferred stock). As a result, holders of Heritage Common Stock immediately prior to the Merger, as a group, own approximately 85.4% of the outstanding shares of Heritage Common Stock immediately after the Merger. Based on Heritage’s closing stock price of $10.68 on August 20, 2015, the merger consideration was valued at approximately $19.47 per Focus Bank share.

The foregoing description of the Merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, which was filed as Exhibit 2.1 to Heritage’s Current Report on Form 8-K filed on April 23, 2015, which is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the terms of the Merger Agreement, on August 20, 2015, two independent members of Focus Bank’s board of directors, J. Philip DiNapoli and Julianne Biagini-Komas, were appointed to the board of directors of Heritage and HBC, effective as of August 20, 2015, to serve until the annual meeting of shareholders of Heritage and HBC, at which time they will stand for re-election, subject to nomination by the Corporate Governance and Nominating Committee. The Heritage and HBC boards of directors increased their respective sizes by two from eleven to thirteen to create seats on the boards for these two individuals. Focus Bank’s remaining directors and executive officers ceased serving in such capacities effective as of the date of the Merger.

2

The Corporate Governance and Nominating Committee determined that each of Mr. DiNapoli and Ms. Biagini-Komas are independent directors under applicable rules and regulations. The Committee also appointed Mr. DiNapoli to the Strategic Planning Committee and Corporate Governance and Nominating Committee and Ms. Biagini-Komas to the Compensation Committee and the Audit Committee.

Item 8.01. Other Events.

On August 20, 2015, Heritage issued a press release announcing the completion of the Merger. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses acquired.

The Company intends to file the financial statements of Focus Business Bank under cover of Form 8-K/A no later than 71 calendar days after the date this Report is required to be filed.

(b) Pro forma financial information.

The Company intends to file pro forma financial information under cover of Form 8-K/A no later than 71 calendar days after the date this Report is required to be filed.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

2.1 |

|

Agreement and Plan of Merger and Reorganization, dated April 23, 2015, by and among Heritage Commerce Corp, Heritage Bank of Commerce and Focus Business Bank (incorporated by reference to the Registrant’s Current Report on Form 8-K filed April 23, 2015) |

|

|

|

|

|

99.1 |

|

Press Release, dated August 20, 2015 |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

HERITAGE COMMERCE CORP |

|

|

|

|

|

|

|

|

DATED: August 20, 2015 |

By: |

/s/ Walter T. Kaczmarek |

|

|

|

|

|

|

|

Walter T. Kaczmarek |

|

|

|

President and Chief Executive Officer |

4

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

2.1 |

|

Agreement and Plan of Merger and Reorganization, dated April 23, 2015, by and among Heritage Commerce Corp, Heritage Bank of Commerce and Focus Business Bank (incorporated by reference to the Registrant’s Current Report on Form 8-K filed April 23, 2015) |

|

|

|

|

|

99.1 |

|

Press Release, dated August 20, 2015 |

5

Exhibit 99.1

HERITAGE COMMERCE CORP ANNOUNCES THE COMPLETION OF ITS MERGER WITH FOCUS BUSINESS BANK

San Jose, California. — August 20, 2015. Heritage Commerce Corp (NASDAQ: HTBK, “Heritage”) today announced that on August 20, 2015, it completed its previously announced merger of its wholly-owned bank subsidiary Heritage Bank of Commerce with Focus Business Bank (“Focus Bank”). The merger, which was first announced on April 23, 2015, was concluded following receipt of approval from Heritage and Focus Business Bank shareholders and all required regulatory approvals. As of June 30, 2015, Focus Bank had $408 million in assets, $377 million in deposits, and $189 million in gross loans. The expected combined company will have in excess of $2.0 billion in assets.

Walter T. Kaczmarek, President and Chief Executive Officer of Heritage commented, “We are pleased to announce the completion of our merger with Focus Business Bank, uniting the only two independent banks headquartered in San Jose. We are excited about the increased capacity and market exposure created from this business combination, and look forward to taking advantage of the resulting opportunities.”

Under the terms of the merger agreement, Focus Bank shareholders received a fixed exchange ratio of 1.8235 shares of Heritage common stock in exchange for each share of Focus Bank common stock. Holders of Focus Bank common stock immediately prior to the merger, as a group, own approximately 14.6% of the outstanding shares of the Heritage common stock immediately after the merger. Based on Heritage’s closing stock price of $10.68 on August 20, 2015, the merger consideration was valued at approximately $19.47 per Focus Bank share. Immediately prior to the closing, Focus Bank option holders received cash, net of applicable taxes withheld, for the value of their unexercised stock options in an amount equal to the excess over the exercise price per share, if any, of 1.8235 multiplied by $10.94, which was the volume weighted average of the closing prices for shares of Heritage common stock as quoted on the NASDAQ Global Select Market for the twenty consecutive trading days ending on August 13, 2015.

Two independent members of Focus Bank’s board of directors were appointed to the board of directors of Heritage and Heritage Bank of Commerce: J. Philip Di Napoli and Julianne Biagini-Komas. In addition, Robert Gionfriddo and Teresa Powell, Focus Bank Executive Vice Presidents, will join Heritage as Executive Vice Presidents.

Richard Conniff, Chairman and Chief Executive Officer of Focus Bank stated, “The Focus Bank and Heritage combination presents an exciting strategic opportunity for our stakeholders. Our teams are working well together to provide for a smooth transition.”

Heritage was advised in this transaction by Keefe, Bruyette & Woods, a Stifel Company, as financial advisor and Buchalter Nemer, a professional corporation, as legal counsel. Focus Bank was advised by Sandler O’Neill + Partners, L.P., as financial advisor and Manatt, Phelps & Phillips, LLP, as legal counsel.

About Heritage Commerce Corp And Heritage Bank Of Commerce

Heritage Commerce Corp, a California corporation organized in 1998, is a bank holding company registered under the Bank Holding Company Act of 1956, as amended. Heritage provides a wide range of banking services through Heritage Bank of Commerce, a wholly-owned subsidiary. Heritage Bank of Commerce is a California state-chartered bank headquartered in San Jose, California and has been conducting business since 1994. Heritage is a multi-community independent bank that offers a full range of commercial banking services to small and medium-sized businesses and their owners and employees. Heritage operates through 11 full service branch offices located in the counties of Santa Clara, Alameda, Contra Costa, and San Benito, which are in the southern and eastern regions of the general San Francisco Bay Area of California. Our market includes the headquarters of a number of technology based companies in the region commonly known as “Silicon Valley.” In November 2014, Heritage Bank of Commerce acquired Bay View Funding which provides business essential working capital factoring financing to various industries throughout the United States.

Cautionary Note Regarding Forward-Looking Statements

Statements made in this release, other than those concerning historical financial information, may be considered forward-looking statements, which speak only as of the date of this release and are based on current expectations and involve a number of assumptions. These include statements as to the anticipated benefits of the merger, including future financial and operating results, cost savings and enhanced revenues that may be realized from the merger as well as other statements of expectations regarding the merger and any other statements regarding future results or expectations. Heritage intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of these safe harbor provisions. Heritage’s ability to predict results, and the actual effect of future plans or strategies, is inherently uncertain. Factors which could have a material effect on the operations and future prospects of Heritage, include but are not limited to: (1) the businesses of Heritage and Focus Business may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; (2) expected revenue synergies and cost savings from the merger may not be fully realized or realized within the expected time frame; (3) revenues following the merger may be lower than expected; (4) customer and employee relationships and business operations may be disrupted by the merger; (5) changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve; (6) the quality and composition of the loan and securities portfolios; (7) demand for loan products; (8) deposit flows; (9) competition; (10) demand for financial services in the companies’ respective market areas; (11) implementation of new technologies; (12) ability to develop and maintain secure and reliable electronic systems; (13) accounting principles, policies, and guidelines, and (14) other risk factors detailed from time to time in filings made by Heritage with the SEC. Heritage undertakes no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or otherwise.

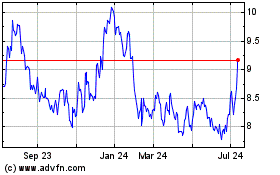

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

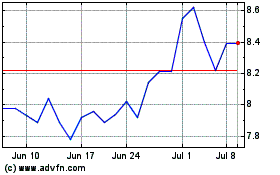

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Apr 2023 to Apr 2024