Carolina Bank Holdings, Inc. Reports Fourth Quarter and Annual Results

January 31 2017 - 4:00PM

Carolina Bank Holdings, Inc. (Nasdaq:CLBH) today reported unaudited

fourth quarter and annual 2016 results with highlights as follows:

Fourth Quarter and Annual 2016 Financial

Highlights

- Net income increased to $1,204,000, or $0.24 per diluted common

share, in the fourth quarter of 2016 from $1,036,000, or $0.21 per

diluted common share in the fourth quarter of 2015.

- Net income available to common shareholders decreased to

$5,112,000, or $1.01 per diluted common share for the year ended

December 31, 2016 from $5,426,000 or $1.17 per diluted common share

in 2015.

- Merger expenses of $819,000 in 2016 resulted in an after-tax

reduction in net income of $718,000, or $0.14 per common

share.

- Book value per common share increased to $13.13 at December 31,

2016 from $12.18 at December 31, 2015.

- Loans held for investment increased 0.75% during the fourth

quarter of 2016 and 8.85% for the full year ended December 31,

2016.

- Average non-interest bearing demand deposits increased 17.58%

and 19.29% in the fourth quarter of 2016 and full year of 2016 from

the same periods in 2015, respectively.

- The net interest margin on a fully taxable basis decreased to

3.68% in the fourth quarter of 2016 and 3.66% for the full year of

2016 from 3.79% in the fourth quarter of 2015 and 3.73% for the

full year of 2015; however net interest income on a fully taxable

basis increased in both the fourth quarter and full year of 2016

from the same periods in 2015.

- Nonperforming assets declined to $7,396,000, or 1.05% of

assets, at December 31, 2016 from $7,702,000, or 1.10% of assets,

at December 31, 2015.

- Net loan loss charge-offs were $184,000 in 2016 compared to

$1,733,000 in 2015.

- The Commercial/Retail Bank segment which excludes the mortgage

division and the holding company realized net income of $6,010,000

in 2016 compared to $4,487,000 in 2015. The increase in 2016

resulted from higher net interest income, a lower provision for

loan losses, lower operating expenses, and higher gains from the

origination and sale of SBA loans.

- Carolina Bank Holdings, Inc. entered into a definitive merger

agreement with First Bancorp (Nasdaq:FBNC) on June 21, 2016. CLBH

stockholders are expected to receive either 1.002 shares of FBNC

common stock or $20 in cash for each share of CLBH common stock,

subject to total consideration being 75% stock/25% cash.

Robert T. Braswell, President and CEO, commented, “I am pleased

with our progress in building and improving our relationships with

customers as evidenced by our 8.85% growth in loans held for

investment during 2016 and 19.29% increase in average

non-interest-bearing deposits during 2016. We continued to improve

our credit quality as evidenced by lower non-performing and

classified assets and by a sharp reduction in loan charge-offs in

2016.”

“We are excited about our proposed merger with First Bancorp who

shares our philosophy of delivering unparalleled service and

financial solutions. As previously reported, our shareholders voted

overwhelmingly for the merger at our special meeting of

shareholders in December 2016. We are currently awaiting final

regulatory approval and hope to close the merger in the first

quarter of 2017,” said Braswell.

About the Company

Carolina Bank, the banking subsidiary of Carolina Bank Holdings,

Inc. began banking operations on November 25, 1996. The parent

company is a North Carolina corporation organized in 2000. The bank

is engaged in lending and deposit gathering activities in the

Piedmont Triad of North Carolina, with operations in four counties:

Guilford, Alamance, Forsyth and Randolph. The bank has eight

full-service banking locations, three in Greensboro, one in

Asheboro, one in High Point, one in Burlington, and two in

Winston-Salem. Residential mortgage loan production offices are

located in Burlington, Chapel Hill and Sanford in addition to a

wholesale residential mortgage operation in Greensboro. The

Company’s stock is listed on the NASDAQ Global Market under the

symbol CLBH. Further information is available on the Company’s web

site: www.carolinabank.com.

Caution Regarding Forward-Looking

Statements

This press release, in particular statements regarding the

proposed transaction between Carolina Bank Holdings, Inc. and First

Bancorp, the expected timetable for completing the transaction, and

any other statements about Carolina Bank Holdings, Inc. or First

Bancorp managements’ future expectations, beliefs, goals, plans or

prospects, includes forward-looking statements that are based on

certain beliefs and assumptions and reflect the current

expectations of Carolina Bank Holdings, Inc., First Bancorp, and

their respective management. Statements that are predictive in

nature, that depend on or relate to future events or conditions, or

that include words such as “believes,” “anticipates,” “expects,”

“continues,” “predict,” “potential,” “contemplates,” “may,” “will,”

“likely,” “could,” “should,” “estimates,” “intends,” “plans” and

other similar expressions are forward-looking statements. All

statements other than statements of historical fact are statements

that could be deemed forward-looking statements. Forward-looking

statements involve known and unknown risks, assumptions and

uncertainties that may cause actual results in future periods to

differ materially from those projected or contemplated in the

forward-looking statements, and you should not place undue reliance

on these statements. Some of the factors that could cause actual

results to differ materially from current expectations are: the

ability to consummate the proposed transaction; any conditions

imposed on the parties in connection with the consummation of the

proposed transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

agreement relating to the proposed transaction; Carolina Bank

Holdings, Inc.’s ability to maintain relationships with employees

and third parties following announcement of the proposed

transaction; the ability of the parties to satisfy the conditions

to the closing of the proposed transaction; the risk that the

proposed transaction may not be completed in the time frame

expected by the parties or at all; and the risks that are described

from time to time in Carolina Bank Holdings Inc.’s reports filed

with the SEC, including Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, and on

general industry and economic conditions. Carolina Bank Holdings,

Inc. disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Additional Information About the Proposed Merger with

First Bancorp and Where to Find It

This material contained in this press release is not a

substitute for the proxy statement/prospectus or any other

documents which First Bancorp and Carolina Bank Holdings may send

to their respective shareholders in connection with the proposed

merger. This communication does not constitute an offer to

sell or the solicitation of an offer to buy any securities.

In connection with the proposed transaction, First Bancorp has

filed with the SEC a Registration Statement on Form S-4 that

includes a proxy statement of Carolina Bank Holdings, Inc. and a

prospectus of First Bancorp, as well as other relevant documents

concerning the proposed transaction. Investors and security

holders are also urged to carefully review and consider each of

First Bancorp’s and Carolina Bank Holdings’ public filings with the

SEC, including but not limited to their Annual Reports on Form

10-K, their proxy statements, their Current Reports on Form 8-K and

their Quarterly Reports on Form 10-Q. BEFORE MAKING ANY INVESTMENT

DECISIONS, INVESTORS AND SHAREHOLDERS OF CAROLINA BANK HOLDINGS ARE

URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY

STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security

holders may obtain a free copy of the proxy statement/prospectus

and other filings containing information about First Bancorp and

Carolina Bank Holdings at the SEC’s website at www.sec.gov.

Investors and security holders may also obtain free copies of the

documents filed with the Securities and Exchange Commission by

First Bancorp on its website at http://www.localfirstbank.com and

by Carolina Bank Holdings, Inc. on its website at

http://www.carolinabank.com.

| |

Carolina Bank Holdings, Inc. and Subsidiary |

|

|

|

|

|

| |

Consolidated Balance

Sheets |

|

|

|

|

|

| |

|

|

|

|

December 31, |

|

December 31, |

|

| |

|

|

|

|

2016 |

|

2015 |

|

| |

|

|

|

|

(unaudited) |

|

|

|

|

|

| |

|

|

|

(in thousands, except share data) |

| |

Assets |

|

|

|

|

|

| |

Cash and

due from banks |

|

$ |

4,913 |

|

|

$ |

6,559 |

|

|

| |

Interest-bearing deposits with banks |

|

|

67,732 |

|

|

|

69,233 |

|

|

| |

Bank term

deposits |

|

|

11,305 |

|

|

|

16,604 |

|

|

| |

Securities

available-for-sale, at fair value |

|

|

37,491 |

|

|

|

47,360 |

|

|

| |

Securities held-to-maturity (fair values of $13,774 in 2016 and

$15,226 in 2015) |

|

13,715 |

|

|

|

14,954 |

|

|

| |

Loans held

for sale |

|

|

22,877 |

|

|

|

39,583 |

|

|

| |

Loans |

|

|

|

507,013 |

|

|

|

465,804 |

|

|

| |

Less

allowance for loan losses |

|

|

(5,688 |

) |

|

|

(5,872 |

) |

|

| |

|

|

Net loans |

|

|

501,325 |

|

|

|

459,932 |

|

|

| |

Premises

and equipment, net |

|

|

18,181 |

|

|

|

19,007 |

|

|

| |

Other real

estate owned |

|

|

3,655 |

|

|

|

4,592 |

|

|

| |

Bank-owned

life insurance |

|

|

12,212 |

|

|

|

11,843 |

|

|

| |

Other

assets |

|

|

11,924 |

|

|

|

11,131 |

|

|

| |

|

|

Total assets |

|

$ |

705,330 |

|

|

$ |

700,798 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Liabilities and Stockholders' Equity |

|

|

|

|

|

| |

Deposits |

|

|

|

|

|

| |

|

Non-interest bearing demand |

|

$ |

140,329 |

|

|

$ |

125,189 |

|

|

| |

|

NOW, money

market and savings |

|

|

359,150 |

|

|

|

349,815 |

|

|

| |

|

Time |

|

|

98,632 |

|

|

|

132,303 |

|

|

| |

|

|

Total deposits |

|

|

598,111 |

|

|

|

607,307 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Advances

from the Federal Home Loan Bank |

|

|

12,073 |

|

|

|

2,681 |

|

|

| |

Securities

sold under agreements to repurchase |

|

|

- |

|

|

|

47 |

|

|

| |

Subordinated debentures |

|

|

19,610 |

|

|

|

19,610 |

|

|

| |

Other

liabilities and accrued expenses |

|

|

9,221 |

|

|

|

10,014 |

|

|

| |

|

|

Total liabilities |

|

|

639,015 |

|

|

|

639,659 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Stockholders' equity |

|

|

|

|

|

| |

|

Preferred

stock, no par value, authorized 1,000,000 shares; |

|

|

|

|

|

| |

|

|

Series A preferred

stock - none issued and outstanding |

|

|

- |

|

|

|

- |

|

|

| |

|

|

Series B convertible

preferred stock - none issued and outstanding |

|

|

- |

|

|

|

- |

|

|

| |

|

Common

stock, $1 par value; authorized 20,000,000 shares; issued |

|

|

|

|

|

| |

|

|

and

outstanding 5,052,500 in 2016 and 5,021,330 in 2015 |

|

|

5,052 |

|

|

|

5,021 |

|

|

| |

|

Additional

paid-in capital |

|

|

29,577 |

|

|

|

29,234 |

|

|

| |

|

Retained

earnings |

|

|

31,286 |

|

|

|

26,174 |

|

|

| |

|

Stock in

directors' rabbi trust |

|

|

(2,156 |

) |

|

|

(1,831 |

) |

|

| |

|

Directors'

deferred fees obligation |

|

|

2,156 |

|

|

|

1,831 |

|

|

| |

|

Accumulated

other comprehensive income |

|

|

400 |

|

|

|

710 |

|

|

| |

|

|

Total stockholders’

equity |

|

|

66,315 |

|

|

|

61,139 |

|

|

| |

|

|

Total liabilities and

stockholders’ equity |

|

$ |

705,330 |

|

|

$ |

700,798 |

|

|

| |

|

|

|

|

|

|

|

|

|

Carolina Bank Holdings, Inc. and Subsidiary |

|

Consolidated Statements of Income (unaudited) |

|

|

| |

|

Three Months |

|

|

Years Ended |

| |

|

Ended December 31, |

|

|

December 31, |

| |

|

2016 |

|

2015 |

|

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(in thousands, except per share data) |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

6,176 |

|

$ |

6,235 |

|

|

$ |

24,222 |

|

$ |

24,314 |

|

| Investment securities, taxable |

|

|

281 |

|

|

325 |

|

|

|

1,304 |

|

|

1,310 |

|

| Investment securities, non taxable |

|

|

106 |

|

|

116 |

|

|

|

455 |

|

|

479 |

|

| Interest from deposits in banks |

|

|

124 |

|

|

84 |

|

|

|

530 |

|

|

267 |

|

| Total interest income |

|

|

6,687 |

|

|

6,760 |

|

|

|

26,511 |

|

|

26,370 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NOW, money market, savings |

|

|

239 |

|

|

240 |

|

|

|

939 |

|

|

953 |

|

| Time deposits |

|

|

193 |

|

|

266 |

|

|

|

924 |

|

|

1,142 |

|

| Other borrowed funds |

|

|

246 |

|

|

173 |

|

|

|

939 |

|

|

630 |

|

| Total interest expense |

|

|

678 |

|

|

679 |

|

|

|

2,802 |

|

|

2,725 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

interest income |

|

|

6,009 |

|

|

6,081 |

|

|

|

23,709 |

|

|

23,645 |

|

| Provision

for loan losses |

|

|

- |

|

|

(200 |

) |

|

|

- |

|

|

1,085 |

|

| Net

interest income after provision for loan losses |

|

|

6,009 |

|

|

6,281 |

|

|

|

23,709 |

|

|

22,560 |

|

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges |

|

|

314 |

|

|

313 |

|

|

|

1,230 |

|

|

1,232 |

|

| Mortgage banking income |

|

|

1,995 |

|

|

2,206 |

|

|

|

9,110 |

|

|

12,054 |

|

| Gain on sale of SBA loans |

|

|

- |

|

|

14 |

|

|

|

498 |

|

|

134 |

|

| Other |

|

|

84 |

|

|

58 |

|

|

|

295 |

|

|

223 |

|

| Total non-interest income |

|

|

2,393 |

|

|

2,591 |

|

|

|

11,133 |

|

|

13,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and benefits |

|

|

4,439 |

|

|

4,351 |

|

|

|

17,655 |

|

|

17,784 |

|

| Occupancy and equipment |

|

|

654 |

|

|

787 |

|

|

|

2,824 |

|

|

3,105 |

|

| Professional fees |

|

|

336 |

|

|

761 |

|

|

|

1,715 |

|

|

2,138 |

|

| Outside data processing |

|

|

328 |

|

|

270 |

|

|

|

1,159 |

|

|

1,079 |

|

| FDIC insurance |

|

|

79 |

|

|

105 |

|

|

|

389 |

|

|

498 |

|

| Advertising and promotion |

|

|

158 |

|

|

354 |

|

|

|

892 |

|

|

932 |

|

| Stationery, printing and supplies |

|

|

127 |

|

|

135 |

|

|

|

560 |

|

|

582 |

|

| Merger expense |

|

|

80 |

|

|

- |

|

|

|

819 |

|

|

- |

|

| Other |

|

|

490 |

|

|

513 |

|

|

|

1,685 |

|

|

1,816 |

|

| Total non-interest expense |

|

|

6,691 |

|

|

7,276 |

|

|

|

27,698 |

|

|

27,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

1,711 |

|

|

1,596 |

|

|

|

7,144 |

|

|

8,269 |

|

| Income tax

expense |

|

|

507 |

|

|

560 |

|

|

|

2,032 |

|

|

2,502 |

|

| Net

income |

|

|

1,204 |

|

|

1,036 |

|

|

|

5,112 |

|

|

5,767 |

|

| Dividends

and accretion on preferred stock |

|

|

- |

|

|

- |

|

|

|

- |

|

|

341 |

|

| Net

income available to common stockholders |

|

$ |

1,204 |

|

$ |

1,036 |

|

|

$ |

5,112 |

|

$ |

5,426 |

|

| Net

income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.24 |

|

$ |

0.21 |

|

|

$ |

1.01 |

|

$ |

1.24 |

|

| Diluted |

|

$ |

0.24 |

|

$ |

0.21 |

|

|

$ |

1.01 |

|

$ |

1.17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carolina

Bank Holdings, Inc. |

|

|

|

| Consolidated Financial

Highlights |

|

|

|

| Fourth Quarter 2016 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

Quarterly |

|

Years Ended |

| |

|

|

4th Qtr |

3rd Qtr |

2nd Qtr |

1st Qtr |

4th Qtr |

|

|

|

|

| ($ in

thousands except for share and per share data) |

|

|

2016 |

2016 |

2016 |

2016 |

2015 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

| Net

interest income |

|

$ |

6,009 |

|

5,900 |

|

6,029 |

|

5,771 |

|

6,081 |

|

|

23,709 |

|

|

23,645 |

|

| Provision

for loan losses |

|

$ |

- |

|

- |

|

- |

|

- |

|

(200 |

) |

|

- |

|

|

1,085 |

|

|

Non-interest income |

|

$ |

2,393 |

|

3,182 |

|

3,269 |

|

2,289 |

|

2,591 |

|

|

11,133 |

|

|

13,643 |

|

|

Non-interest expense |

|

$ |

6,691 |

|

6,923 |

|

7,454 |

|

6,630 |

|

7,276 |

|

|

27,698 |

|

|

27,934 |

|

| Net

income |

|

$ |

1,204 |

|

1,564 |

|

1,243 |

|

1,101 |

|

1,036 |

|

|

5,112 |

|

|

5,767 |

|

| Net

income available to common stockholders |

|

$ |

1,204 |

|

1,564 |

|

1,243 |

|

1,101 |

|

1,036 |

|

|

5,112 |

|

|

5,426 |

|

| Basic

earnings per common share |

|

$ |

0.24 |

|

0.31 |

|

0.25 |

|

0.22 |

|

0.21 |

|

|

1.01 |

|

|

1.24 |

|

| Diluted

earnings per common share |

|

$ |

0.24 |

|

0.31 |

|

0.25 |

|

0.22 |

|

0.21 |

|

|

1.01 |

|

|

1.17 |

|

| Average

common shares outstanding |

|

|

5,047,581 |

|

5,044,646 |

|

5,038,723 |

|

5,036,150 |

|

5,008,301 |

|

|

5,041,799 |

|

|

4,389,086 |

|

| Average

diluted common shares outstanding |

|

|

5,049,301 |

|

5,048,705 |

|

5,042,626 |

|

5,041,038 |

|

5,019,056 |

|

|

5,045,437 |

|

|

4,620,411 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

| Return on

average assets * |

|

|

0.67 |

% |

0.87 |

% |

0.71 |

% |

0.63 |

% |

0.59 |

% |

|

0.72 |

% |

|

0.84 |

% |

| Return on

average common equity * |

|

|

7.26 |

% |

9.59 |

% |

7.89 |

% |

7.14 |

% |

6.79 |

% |

|

7.98 |

% |

|

9.73 |

% |

| Net

interest margin (fully-tax equivalent) * |

|

|

3.68 |

% |

3.60 |

% |

3.73 |

% |

3.61 |

% |

3.79 |

% |

|

3.66 |

% |

|

3.73 |

% |

|

Efficiency ratio (excluding merger expenses) |

|

|

77.18 |

% |

73.22 |

% |

72.89 |

% |

80.98 |

% |

83.05 |

% |

|

75.88 |

% |

|

74.18 |

% |

|

Efficiency ratio (excluding mortgage div/merger X) |

|

|

67.65 |

% |

64.39 |

% |

67.83 |

% |

71.95 |

% |

75.06 |

% |

|

67.92 |

% |

|

71.72 |

% |

| #

full-time equivalent employees - period end |

|

|

165 |

|

177 |

|

187 |

|

190 |

|

192 |

|

|

165 |

|

|

192 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL |

|

|

|

|

|

|

|

|

|

|

|

| Equity to

period-end assets |

|

|

9.40 |

% |

9.25 |

% |

9.08 |

% |

8.88 |

% |

8.72 |

% |

|

9.40 |

% |

|

8.72 |

% |

| Common

tangible equity to assets |

|

|

9.40 |

% |

9.25 |

% |

9.08 |

% |

8.88 |

% |

8.72 |

% |

|

9.40 |

% |

|

8.72 |

% |

| Tier 1

leverage capital ratio - Bank |

|

|

10.30 |

% |

10.10 |

% |

9.94 |

% |

9.74 |

% |

9.71 |

% |

|

10.30 |

% |

|

9.71 |

% |

| Tier 1

risk-based capital ratio - Bank |

|

|

12.80 |

% |

12.35 |

% |

12.20 |

% |

12.62 |

% |

12.09 |

% |

|

12.80 |

% |

|

12.09 |

% |

| Total

risk-based capital ratio - Bank |

|

|

14.12 |

% |

13.98 |

% |

13.82 |

% |

14.40 |

% |

13.81 |

% |

|

14.12 |

% |

|

13.81 |

% |

| Book

value per common share |

|

$ |

13.13 |

|

13.00 |

|

12.71 |

|

12.45 |

|

12.18 |

|

|

13.13 |

|

|

12.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSET

QUALITY |

|

|

|

|

|

|

|

|

|

|

|

| Net loan

charge-offs (recoveries) |

|

$ |

76 |

|

(146 |

) |

351 |

|

(97 |

) |

1,495 |

|

|

184 |

|

|

1,733 |

|

| Net

charge-offs (recoveries) to average loans * |

|

|

0.06 |

% |

-0.12 |

% |

0.30 |

% |

-0.08 |

% |

1.29 |

% |

|

0.04 |

% |

|

0.37 |

% |

| Allowance

for loan losses |

|

$ |

5,688 |

|

5,764 |

|

5,618 |

|

5,969 |

|

5,872 |

|

|

5,688 |

|

|

5,872 |

|

| Allowance

for loan losses to loans held invst. |

|

|

1.12 |

% |

1.15 |

% |

1.18 |

% |

1.31 |

% |

1.26 |

% |

|

1.12 |

% |

|

1.26 |

% |

|

Nonperforming loans |

|

$ |

3,741 |

|

4,392 |

|

5,101 |

|

3,519 |

|

3,110 |

|

|

3,741 |

|

|

3,110 |

|

|

Performing restructured loans |

|

$ |

9,424 |

|

9,375 |

|

9,486 |

|

12,078 |

|

9,687 |

|

|

9,424 |

|

|

9,687 |

|

| Other

real estate owned |

|

$ |

3,655 |

|

3,914 |

|

4,212 |

|

4,587 |

|

4,592 |

|

|

3,655 |

|

|

4,592 |

|

|

Nonperforming loans to loans held for investment |

|

|

0.74 |

% |

0.87 |

% |

1.07 |

% |

0.77 |

% |

0.67 |

% |

|

0.74 |

% |

|

0.67 |

% |

|

Nonperforming assets to total assets |

|

|

1.05 |

% |

1.17 |

% |

1.32 |

% |

1.15 |

% |

1.10 |

% |

|

1.05 |

% |

|

1.10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| END OF PERIOD

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

705,330 |

|

708,890 |

|

706,495 |

|

705,704 |

|

700,798 |

|

|

705,330 |

|

|

700,798 |

|

| Total

loans held for investment |

|

$ |

507,013 |

|

503,226 |

|

476,783 |

|

455,139 |

|

465,804 |

|

|

507,013 |

|

|

465,804 |

|

| Total

deposits |

|

$ |

598,111 |

|

601,483 |

|

599,148 |

|

601,073 |

|

607,307 |

|

|

598,111 |

|

|

607,307 |

|

|

Stockholders' equity |

|

$ |

66,315 |

|

65,566 |

|

64,120 |

|

62,687 |

|

61,139 |

|

|

66,315 |

|

|

61,139 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

711,969 |

|

712,919 |

|

706,633 |

|

702,473 |

|

692,522 |

|

|

708,520 |

|

|

689,842 |

|

| Total

earning assets |

|

$ |

666,488 |

|

669,231 |

|

663,082 |

|

657,915 |

|

646,158 |

|

|

664,200 |

|

|

643,031 |

|

| Total

loans held for investment |

|

$ |

503,185 |

|

494,502 |

|

470,021 |

|

466,301 |

|

463,285 |

|

|

483,586 |

|

|

465,163 |

|

| Total non

interest-bearing demand deposits |

|

$ |

147,303 |

|

146,848 |

|

141,092 |

|

129,367 |

|

125,279 |

|

|

141,185 |

|

|

118,355 |

|

| Common

stockholders' equity |

|

$ |

66,018 |

|

64,855 |

|

63,349 |

|

61,979 |

|

60,522 |

|

|

64,058 |

|

|

54,479 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *

annualized for all periods presented |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Carolina Bank Holdings, Inc.

T. Allen Liles, EVP and CFO

Telephone: 336-286-8746

Email: a.liles@carolinabank.com

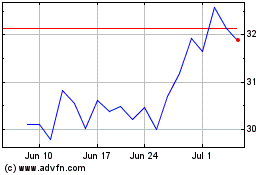

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

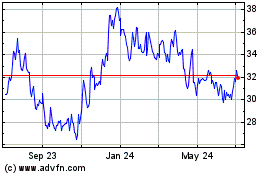

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024