PayPal Strikes Partnership With Visa--Update

July 21 2016 - 6:23PM

Dow Jones News

By Telis Demos

PayPal Holdings Inc. is coming to the checkout line.

The online payments giant has struck a deal with Visa Inc.,

announced Thursday by the two firms, that will make paying with

PayPal an option when people pay in stores with their

smartphones.

It also will now be possible for users of PayPal's popular

mobile apps, including Venmo, to instantly withdraw money they

receive through the peer-to-peer payments service, if they link it

to their Visa debit cards.

The deal ends a year of tense negotiation between the firms, and

removes uncertainty for PayPal about the fees it pays to Visa, with

higher fees being a major threat to its profitability.

It also gives PayPal another tool with which to fend off the

growing focus of banks on instant mobile-app payments between

individuals.

"This agreement opens new avenues for PayPal to collaborate,"

said Dan Schulman, PayPal chief executive, in a statement. PayPal

seeks to provide "new experiences for our joint customers wherever

they transact, " he said.

PayPal shares were up 2% in after-hours trading, to $40.95. Visa

shares were down 0.3% to $78.52. Both companies also released

earnings Thursday afternoon. As part of the deal, PayPal agreed to

stop steering customers to link directly to bank accounts, which

allows it to avoid paying fees to card networks such as Visa or

MasterCard Inc.

In exchange, Visa will make PayPal a part of its "digital

wallet" program, enabling it to be accepted when Visa partners with

stores and banks for "contactless" mobile taps at the checkout

line. PayPal agreed to share data with Visa about these

transactions.

As recently as May, Visa Chief Executive Charles Scharf at an

investor conference had described PayPal as a potential "foe," and

threatened to "compete with them in ways that people have never

seen before."

On Thursday, in a statement, Mr. Scharf said: "We are excited to

begin a new chapter with PayPal. Our agreement provides a framework

for our companies to work together collaboratively."

Visa also will provide "fee certainty" to PayPal, and will offer

it incentives based on volume. The exact terms weren't

disclosed.

Some analysts, who been speculating about a deal for weeks,

warned that Visa's fee incentives may not make up for PayPal moving

away from steering customers to low-cost bank links.

Craig Maurer, analyst at Autonomous Research, wrote in a note in

reaction to the deal: "Investors will likely react positively to

the announcement initially, but once they pore over the details, we

believe they will come to the conclusion that Visa came out far

ahead in this deal."

Meanwhile, PayPal also raised its annual revenue guidance to

between $10.75 billion and $10.85 billion, from $10.5 billion to

$10.7 billion previously. The company now expects adjusted earnings

on a per-share basis between $1.47 and $1.50, up from $1.45 to

$1.50 previously.

For the quarter, PayPal's earnings rose to $323 million, or 27

cents a share, from $305 million, or 25 cents a share, a year

earlier. Excluding certain items, the company posted per-share

earnings of 36 cents, up from 33 cents a year earlier, on a pro

forma basis, in line with the average analyst estimate of 36 cents,

according to Thomson Reuters. The company had forecast adjusted

earnings between 34 cents and 36 cents.

The San Jose, Calif., company said revenue rose 15% to $2.65

billion, above the average analyst estimate of $2.6 billion. The

company had projected quarterly revenue of $2.57 billion to $2.62

billion.

--Ezequiel Minaya contributed to this article

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

July 21, 2016 18:08 ET (22:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

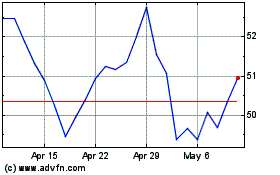

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

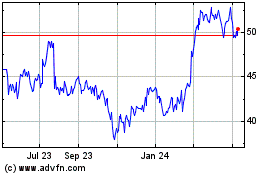

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024