NCR Confirms $820 Million Blackstone Investment

November 12 2015 - 8:20AM

Dow Jones News

ATM maker NCR Corp. confirmed Thursday that Blackstone Group LP

will invest $820 million into the company after its effort to sell

itself foundered.

NCR said it plans to use Blackstone's investment, which will

give the private-equity firm a stake of about 17% in NCR, to buy up

to $1 billion of its shares starting Nov. 13.

The deal is expected to close by early December. The Wall Street

Journal reported the talks Wednesday.

Blackstone will receive convertible preferred shares that pay a

5.5% dividend. The preferred shares are convertible to regular

stock at $30. The firm will also get two board seats in exchange

for the investment.

NCR stock closed Wednesday at $26.78, giving the Duluth, Ga.,

company a market value of $4.5 billion.

The agreement comes after Blackstone and other private-equity

firms vied for a possible leveraged buyout of NCR, which carried

more than $3 billion of debt as of September. That would have made

it one of the largest recent LBOs, the pace of which has been

slowed by regulatory and other headwinds.

NCR, founded in 1884, makes cash registers and other so-called

point-of-sale devices in addition to cash machines. The company has

struggled with lower demand as retail customers gravitate toward

mobile-payment devices such as Apple Inc.'s Apple Pay. NCR stock

has lost more than half its value from a 2007 high.

Blackstone is betting in part on a revival in NCR's software

business, which powers kiosks that accept mobile payments and

self-checkout lanes at many retailers, people familiar with the

matter said.

The deal would be an example of a so-called private investment

in public equity. Known as PIPEs, they are sometimes used as a

fallback when a company strikes out on a full sale, and can serve

as a source of cash to help facilitate strategic or other changes.

In 2014, shoe maker Crocs Inc. took a $200 million investment from

Blackstone after abandoning an effort to sell itself.

The Wall Street Journal reported in April that NCR was exploring

strategic options including the spinoff or sale of assets or a

return of cash to investors through a dividend or share

buyback.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Access Investor Kit for "Apple, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0378331005

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 08:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

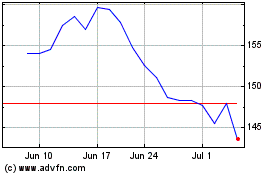

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Mar 2024 to Apr 2024

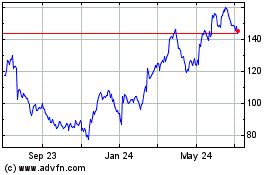

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Apr 2023 to Apr 2024