UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): November 12, 2015

Canterbury

Park Holding Corporation

(Exact

name of registrant as specified in its charter)

Minnesota

(State

or Other Jurisdiction of Incorporation)

|

001-31569

|

41-1775532

|

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

1100

Canterbury Road, Shakopee, Minnesota

|

|

55379

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

(952)

445-7223

(Registrant’s

telephone number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see

General

Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Section 2 - Financial Information

Item 2.02 - Results of

Operations and Financial Condition

On November 12, 2015, Canterbury Park Holding Corporation (the

“Company”) issued a press release regarding its results of operations

for the three months ended September 30, 2015. A copy of the press

release is furnished as Exhibit 99.1 to this Form 8-K.

The information provided pursuant to Item 2.02 of this Form 8-K is being

furnished and is not “filed” for purposes of Section 18 of the

Securities Act of 1934, nor may it be deemed incorporated by reference

in any filing under the Securities Act of 1933, except as expressly set

forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 -

Financial Statements and Exhibits

(d) Exhibits

The following are filed or furnished as Exhibits to this Report:

|

Exhibit

No.

|

Description of Exhibit

|

|

99.1

|

Press release dated November 12, 2015, reporting results for the

three months ended September 30, 2015.

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

CANTERBURY

PARK HOLDING CORPORATION

|

|

|

|

|

|

Dated:

|

November

12, 2015

|

By:

|

/s/

Randall D. Sampson

|

|

|

|

|

Randall

D. Sampson

|

|

|

|

|

Chief

Executive Officer

|

Exhibit 99.1

Canterbury

Park Holding Corporation Reports Financial Results for the Third Quarter

and First Nine Months of 2015

SHAKOPEE, Minn.--(BUSINESS WIRE)--November 12, 2015--Canterbury Park

Holding Corporation (NASDAQ:CPHC) today announced results for the third

quarter and nine months ended September 30, 2015.

Canterbury Park Holding Corporation (the “Company”) reported net income

of $813,059 on net revenues of $16,851,658 for the three months ended

September 30, 2015, compared to net income of $623,306 on net revenues

of $15,046,958 for the same period in 2014. For the nine months ended

September 30, 2015, net income was $1,773,313 on net revenues of

$41,580,773, compared to net income of $1,472,247 on net revenues of

$38,206,126 for the same period in 2014. Diluted income per share for

the 2015 third quarter was $.19 compared to $.15 per share for the same

period in 2014. Diluted income per share for the nine months ended

September 30, 2015 was $.42 compared $.35 per share for the same period

in 2014.

Our 12% increase in net revenues in the 2015 third quarter over the same

period in 2014 reflects the following business segment results:

-

Card Casino revenues increased 11% to $7,404,926 in the 2015 third

quarter from $6,645,197 in the 2014 third quarter, primarily due to a

19% increase in table games revenue. The strong increase in table

games revenue is largely due to the increased effectiveness of our

direct marketing programs driven by new CRM technology and a volume

increase due to live racing and event attendance.

-

Food & beverage revenue increased 12% to $3,299,659 in the 2015 third

quarter from $2,954,609 in the 2014 third quarter, primarily due to

increased sales during live racing and events.

-

Pari-mutuel revenues increased 1% to $3,887,494 in the 2015 third

quarter from $3,844,749 in the 2014 third quarter, reflecting the net

effect of a strong increase in out-of-state wagering on our live races

and a decline in on-track simulcast wagering.

For the nine months ended September 30, 2015, our $3,374,000, or 8%,

increase in net revenues compared to the same period in 2014 is

primarily attributable to increases in Card Casino and Concessions

revenues of 8% and 13%, respectively, offset by a 0.8% decrease in

Pari-mutuel revenues.

Operating expenses increased $1,482,000, or 11%, and increased

$2,866,000, or 13%, respectively, in the three and nine month periods

ended September 30, 2015 as compared to the same periods in 2014. These

changes are primarily due to increased wages and benefits expense and

professional fees related to recently announced corporate restructuring

and real estate development initiatives.

The Company generated adjusted EBITDA of $4,290,171 in the first nine

months of 2015, an increase of $207,995, or 5%, from the same period a

year ago.

Further detail regarding our results for the third quarter and first

nine months of 2015 is presented in the accompanying table, and

additional information regarding the Company’s financial results will be

presented in the Company’s Form 10-Q Report that will be filed with the

Securities and Exchange Commission on November 13, 2015.

Randy Sampson, Canterbury Park’s President and CEO commented: “We are

pleased with our third quarter and nine month results as they reflect a

return on investments made and growth initiatives in earlier periods.

Our Cooperative Marketing Agreement with the Shakopee Mdewakanton Sioux

Community has enabled us to improve our live horse racing product which

has led to improved attendance and substantially increased our

out-of-state live handle. Our investment in CRM technology has enabled

us to improve the effectiveness of our marketing to our Card Casino

customers and led to increased Card Casino patronage. Finally, our

investments in the new Expo Center and remodeled Triple Crown Club, both

well received additions to our property, are already generating

increases in catering and events revenues. While we face challenges

ahead, particularly in absorbing the impact of further minimum wage

increases, we are optimistic these investments and initiatives will lead

to further revenue increases and improved earnings in future periods.”

Mr. Sampson concluded: “We continue to pursue our previously announced

corporate restructuring and subdivision of our land as first steps

needed to give the Company the flexibility to develop our underutilized

land. While this process has taken longer, and has been more challenging

than anticipated, we are making good progress in this important strategy

to enhance shareholder value, as evidenced by our sale in October of an

approximately six acre parcel to the Minnesota Municipal Power Agency

for $1.43 million. As previously announced, our current focus is on

development opportunities that don’t require a major relocation of our

barn area. We are excited about the possibility for the first phase of

development of our underutilized properties to include a unique

multi-family residential community along with a business park and retail

opportunities including a hotel and restaurants.”

Use of Non-GAAP Financial Measures:

To supplement our

financial statements, we also provide investors with EBITDA (defined

below), which is a non-GAAP measure. Adjusted EBITDA represents earnings

before interest income, income tax expense, depreciation and

amortization and gains from insurance recoveries and disposal of assets.

EBITDA is not a measure of performance or liquidity calculated in

accordance with generally accepted accounting principles ("GAAP"), and

should not be considered an alternative to, or more meaningful than, net

income as an indicator of our operating performance, or cash flows from

operating activities as a measure of liquidity. EBITDA has been

presented as a supplemental disclosure because it is a widely used

measure of performance and basis for valuation of companies in our

industry. Moreover, other companies that provide EBITDA information may

calculate EBITDA differently than we do.

About Canterbury Park:

Canterbury Park Holding Corporation

owns and operates Canterbury Park Racetrack and Card Casino, Minnesota’s

only thoroughbred and quarter horse racing facility. The Company’s

annual live race meet generally begins in May and ends in September. In

addition, Canterbury Park’s Card Casino hosts “unbanked” card games 24

hours a day, seven days a week, offering both poker and table games. The

Company also conducts year-round wagering on simulcast horse racing and

hosts a variety of other entertainment and special events at its

facility in Shakopee, Minnesota. For more information about the Company,

please visit us at www.canterburypark.com.

Cautionary Statement:

From time to time, in press releases and

in other communications to shareholders or the investing public, the

Canterbury Park Holding Corporation may make forward-looking statements

concerning possible or anticipated future financial performance,

business activities or plans based on management’s beliefs and

assumptions. These forward looking statements are typically preceded by

the words such as "believes," "expects," "anticipates," "intends" or

similar expressions. Shareholders and the investing public should

understand that these forward-looking statements are subject to risks

and uncertainties, including those disclosed in our periodic filings

with the Securities and Exchange Commission, which could cause actual

performance, activities or plans after the date the statements are made

to differ significantly from those indicated in the forward-looking

statements when made.

|

|

|

CANTERBURY PARK HOLDING CORPORATION’S

|

|

SUMMARY OF OPERATING RESULTS

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

Three Months

|

|

|

Nine Months

|

|

|

Nine Months

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Revenues, (net)

|

|

|

$16,851,658

|

|

|

$15,046,958

|

|

|

$41,580,773

|

|

|

$38,206,126

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

$15,464,147

|

|

|

$13,982,105

|

|

|

$38,562,064

|

|

|

$35,696,560

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Operating Income, (net)

|

|

|

$348

|

|

|

$644

|

|

|

$1,653

|

|

|

$1,993

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before Income Taxes

|

|

|

$1,387,859

|

|

|

$1,065,497

|

|

|

$3,020,362

|

|

|

$2,511,559

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Expense

|

|

|

($574,800)

|

|

|

($442,191)

|

|

|

($1,247,049)

|

|

|

($1,039,312)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

|

$813,059

|

|

|

$623,306

|

|

|

$1,773,313

|

|

|

$1,472,247

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Net Income Per Common Share

|

|

|

$0.19

|

|

|

$0.15

|

|

|

$0.42

|

|

|

$0.35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Net Income Per Common Share

|

|

|

$0.19

|

|

|

$0.15

|

|

|

$0.42

|

|

|

$0.35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months

|

|

|

Nine Months

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

September 30, 2015

|

|

|

September 30, 2014

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

$

|

1,773,313

|

|

|

|

$

|

1,472,247

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

|

(1,653

|

)

|

|

|

|

(1,993

|

)

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

|

1,247,049

|

|

|

|

|

1,039,312

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

|

1,738,900

|

|

|

|

|

1,572,660

|

|

|

|

|

|

|

|

|

|

|

Gain(s) from Insurance and disposal

|

|

|

|

(467,438

|

)

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

|

$

|

4,290,171

|

|

|

|

$

|

4,082,226

|

|

|

|

|

|

|

|

|

|

CONTACT:

Canterbury Park Holding Corporation

Randy

Sampson, 952-445-7223

Canterbury Park (NASDAQ:CPHC)

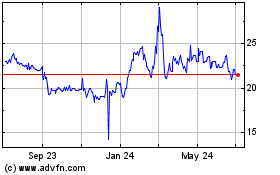

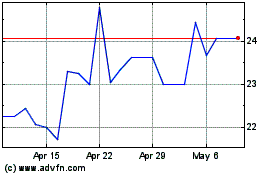

Historical Stock Chart

From Aug 2024 to Sep 2024

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Sep 2023 to Sep 2024