Current Report Filing (8-k)

January 13 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

January 12, 2015 |

Corinthian Colleges, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

0-25283 |

33-0717312 |

|

_____________________

(State or other jurisdiction |

_____________

(Commission |

______________

(I.R.S. Employer |

|

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

6 Hutton Centre Drive, Suite 400, Santa Ana, California |

|

92707 |

|

_________________________________

(Address of principal executive offices) |

|

___________

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code: |

|

(714) 427-3000 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

As previously disclosed in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “Commission”) on November 20, 2014, Corinthian Colleges, Inc. (the “Company”) and various of the Company’s direct and indirect subsidiaries entered into an Asset Purchase Agreement (the “Purchase Agreement”), dated November 19, 2014, with Zenith Education Group, Inc., a nonprofit Delaware corporation (“Purchaser”), whose sole member is ECMC Group, Inc., a nonprofit Delaware corporation (“ECMC”), and ECMC, as a guarantor of Purchaser’s obligations under the Purchase Agreement. On January 5, 2015, Purchaser and the Company executed an amendment to the Purchase Agreement in order to extend the Outside Date (as defined in the Purchase Agreement) to February 5, 2015.

The parties currently expect to conduct an initial closing on February 2, 2015, which closing will include a substantial majority of the schools covered by the Purchase Agreement, subject to the satisfaction of conditions to closing. The parties anticipate conducting a second closing after the remaining pre-closing educational consents have been obtained for the remaining schools.

Although the Company and the Purchaser have made substantial progress towards the satisfaction of conditions to closing, and expect to satisfy the remainder soon, not all of such conditions were satisfied in time to conduct an initial closing on January 12, 2015 as the parties had previously anticipated. Since the Purchase Agreement provides that if a closing is to occur on or after the fifteenth day of the month, the closing would instead take place on the first business day of the immediately following month, the parties determined to pursue a February 2, 2015 initial closing.

Safe Harbor

Certain statements in this Current Report on Form 8-K may be deemed to be forward-looking statements under the Private Securities Litigation Reform Act of 1995. The Company intends that all such statements be subject to the “safe-harbor” provisions of that Act. Such statements include, but are not limited to, those regarding the closing of the transactions contemplated by the Purchase Agreement. Many factors may cause the Company’s actual results to differ materially from those discussed in any such forward-looking statements or elsewhere, including: delays in or failure to satisfy required closing conditions in the Purchase Agreement, including the receipt of required regulatory approvals; failure to consummate or delay in consummating the transactions contemplated by the Purchase Agreement for other reasons, including the failure by the Company to obtain and maintain the necessary liquidity to operate its business until the closing of the transactions contemplated by the Purchase Agreement; the potential for further action by the U.S. Department of Education (“ED”) to limit the Company’s ability to receive regular disbursements under Title IV to fund its operations; the Company’s possible inability to comply with the terms of its Operating Agreement with ED; the Company’s effectiveness in its regulatory and accreditation compliance efforts; the outcome of ongoing reviews and inquiries by accrediting, state and federal agencies, including ED, various attorneys general, and the Consumer Financial Protection Bureau; the outcome of pending litigation against the Company, including the civil complaints filed by the Consumer Financial Protection Bureau and by certain state attorneys general; the uncertainty of counterparty decisions in the waiver of events of default in the Company’s credit agreement; and the other risks and uncertainties described in the Company’s filings with the Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CORINTHIAN COLLEGES, INC. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 12, 2015 |

By: |

/s/ Stan A. Mortensen |

|

|

|

|

Stan A. Mortensen |

|

|

|

|

Executive Vice President and |

|

| |

|

General Counsel |

|

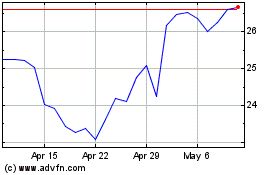

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

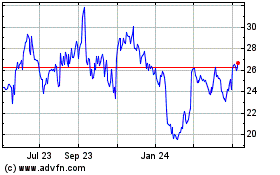

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024