Current Report Filing (8-k)

January 05 2016 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 31, 2015

CLEAN ENERGY FUELS CORP.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

|

001-33480 |

|

33-0968580 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

4675 MacArthur Court, Suite 800

Newport Beach, CA |

|

92660 |

|

(Address of Principal Executive Offices) |

|

Zip Code |

(949) 437-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.02. Termination of a Material Definitive Agreement.

On December 31, 2015, Clean Energy Fuels Corp. (the “Company”) terminated, in accordance with their respective terms, (i) the Credit Agreement, dated as of November 7, 2012 (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”) by and among GE Capital EFS Financing, Inc., in its capacity as successor administrative agent, successor collateral agent and successor lender (“GE US”), on the one hand, and Clean Energy Tranche A LNG Plant, LLC and Clean Energy Tranche B LNG Plant, LLC, (each a “Borrower” and collectively the “Borrowers”), each a wholly owned subsidiary of the Company, on the other hand, and (ii) the other financing documents relating to the Credit Agreement, including the Equity Contribution Agreement between the Company and GE US and the Guaranty executed by the Company in favor of GE US.

The Credit Agreement permitted the Company, through the Borrowers, to borrow from GE US up to an aggregate of $200 million to finance the development, construction and operation of two liquefied natural gas production facilities. The Company had not drawn any loans under the Credit Agreement as of its termination and the Company did not incur any early termination penalties in connection with such termination. Further, the Company expects that terminating the Credit Agreement will result in the Company saving approximately $1.0 million in commitment fees during 2016 that would have otherwise been owed pursuant to the terms of the Credit Agreement.

Concurrently with the execution of the Credit Agreement the Company issued to GE US a warrant (as amended, restated, supplemented or otherwise modified from time to time, the “GE Warrant”), which entitled GE US to purchase up to an aggregate of 5.0 million shares of the Company’s common stock. As a result of the termination of the Credit Agreement, 4.0 million of the shares subject to the GE Warrant will not vest and will not become exercisable.

As described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, the 5.0 million shares subject to the GE Warrant were measured by the Company at a fair value of $56.2 million and recorded as additional paid-in capital and other long-term assets as a deferred financing cost. In connection with the cancellation of the Credit Agreement, the Company expects that all related unamortized deferred financing costs that were to be amortized to interest expense in future periods will be eliminated from the balance sheet in full through a noncash charge to earnings of approximately $54.9 million in the fourth quarter of 2015. The Company has not completed its preparation and review of its consolidated financial statements for the fourth quarter or year ended December 31, 2015 and, as a result, the information and monetary values reported in this paragraph are preliminary and are subject to the completion of such financial statements and their audit by the Company’s independent registered public accounting firm.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks, uncertainties and assumptions, including without limitation statements about the commitment fees the Company expects to save and the noncash earnings charge the Company expects to incur as a result of the termination of the Credit Agreement. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of many factors, including without limitation the completion and audit of the Company’s consolidated financial statements for its 2015 fiscal year. The forward-looking statements made herein speak only as of the date hereof and, unless otherwise required by law, the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. Additionally, the reports and other documents the Company files with the Securities and Exchange Commission (available at www.sec.gov) contain risk factors, which may cause actual results to differ materially from the forward-looking statements contained in this Current Report on Form 8-K.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: January 5, 2016 |

Clean Energy Fuels Corp. |

|

|

|

|

|

|

|

|

|

By: |

/s/ Robert M. Vreeland |

|

|

|

Name: Robert M. Vreeland |

|

|

|

Title: Chief Financial Officer |

3

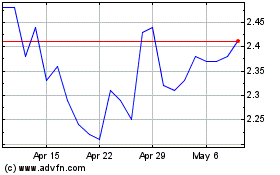

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

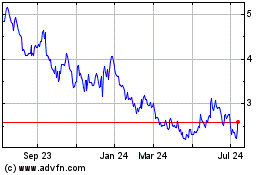

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Apr 2023 to Apr 2024