UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2015

Applied Materials, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-06920 |

|

94-1655526 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 3050 Bowers Avenue

P.O. Box 58039 Santa

Clara, CA |

|

95052-8039 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 1-408-727-5555

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(b) and (e)

On August 7, 2015, Applied Materials, Inc. (“Applied” or the “Company”) and Dr. Randhir Thakur entered into a separation

agreement (the “Agreement”) in connection with Dr. Thakur’s departure from the Company, which is expected to occur on or about October 30, 2015 (the “Departure Date”). Prior to his departure, Dr. Thakur will

work to facilitate a smooth transition of his role and responsibilities.

Subject to certain conditions set forth in the Agreement, Dr. Thakur will

be entitled to receive (i) cash payments of $1,000,000 within 45 days following the Departure Date, on March 15, 2016, and within 45 days following the one-year anniversary of the Departure Date, and (ii) accelerated vesting of a

total of 168,750 shares and $1,293,750 of cash-settled performance units, which otherwise would have vested in December 2015. His right to receive or retain the cash payments payable on March 15, 2016 and on the one-year anniversary of his

departure will end if, prior to the applicable payment date, he engages in a disqualifying activity (as defined in the Agreement), or otherwise breaches certain non-solicitation, confidentiality, non-disparagement or other obligations under the

Agreement. Dr. Thakur also will be entitled to receive benefits under the Agreement if he is terminated by Applied without cause prior to the Departure Date, subject to certain conditions set forth in the Agreement.

The description of the Agreement set forth herein does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is

filed as Exhibit 10.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

| 10.1 |

|

Separation Agreement and Release, dated as of August 7, 2015, by and between Randhir Thakur and Applied Materials, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Applied Materials, Inc. |

|

|

|

|

(Registrant) |

|

|

|

|

| Dated: August 10, 2015 |

|

|

|

By: |

|

/s/ Thomas F. Larkins |

|

|

|

|

|

|

Thomas F. Larkins |

|

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Separation Agreement and Release, dated as of August 7, 2015, by and between Randhir Thakur and Applied Materials, Inc. |

Exhibit 10.1

RANDHIR THAKUR SEPARATION AGREEMENT AND RELEASE

This Separation Agreement and Release (“Agreement”) is made by and between Randhir Thakur (“Executive”) and Applied

Materials, Inc. (the “Company”) (jointly referred to as the “Parties” and each individually referred to as a “Party”).

RECITALS

WHEREAS,

Executive is currently employed by the Company as its Executive Vice President, General Manager, Silicon Systems Group;

WHEREAS,

Executive signed the standard Employee Agreement with the Company dated May 22, 2008 (the “Employee Agreement”);

WHEREAS,

Executive’s employment with the Company will terminate on a date (the “Termination Date”) that will not be later than October 30, 2015;

WHEREAS, Executive holds stock-settled equity awards granted under, and subject to the terms and conditions of the Company’s Employee

Stock Incentive Plan (the “Plan”) and the related equity award agreements (collectively with the Plan, the “Stock Agreements”);

WHEREAS, Executive holds an award of cash-settled performance units (the “Cash-Settled Performance Units”) granted under, and

subject to the terms and conditions of the Company’s Employee Stock Incentive Plan (the “Plan”) and the related performance units agreements (collectively with the Plan, the “Cash-Settled Units Agreements”); and

WHEREAS, the Parties wish to resolve any and all disputes, claims, complaints, grievances, charges, actions, petitions, and demands that the

Executive may have against the Company and any of the Releasees as defined below, including, but not limited to, any and all claims arising out of, or in any way related to Executive’s employment with, or separation from, the Company;

NOW, THEREFORE, in consideration of the mutual promises made herein, the Company and Executive hereby agree as follows:

COVENANTS

a. Continuing Employment. The Company will continue to employ

Executive on an at-will basis in his role as Executive Vice President, General Manager, Silicon Systems Group up to and including the Termination Date, and will continue to pay Executive his base salary in accordance with the Company’s regular

payroll practices up to and including the Termination Date. Prior to the Termination Date, Executive will perform the reasonable duties assigned to him by Gary Dickerson, the Company’s President and Chief Executive Officer, or

Mr. Dickerson’s delegate, to effectuate a smooth and orderly transition of his roles and responsibilities. Executive will continue to comply with his Employee Agreement as well as all other Company policies provided or made available to

Executive in writing. During his employment with the Company, Executive will continue to be eligible to participate in all benefits and incidents of employment, including the Company’s health insurance plan, and he will continue to accrue paid

time off (PTO). In addition, Executive will continue to vest in Executive’s outstanding stock-settled equity awards and Cash-Settled Performance Units on the same terms, schedule and conditions as set forth in the Stock Agreements or the

Cash-Settled Units Agreements, as applicable, governing such awards. The Company and Executive may terminate Executive’s employment with the Company prior to October 30, 2015, for any reason or no reason; provided, however, if the Company

terminates Executive’s employment prior to October 30, 2015, without Cause (as defined below), Executive will be eligible for the payments and benefits described in this Agreement (such a termination without Cause prior to October 30,

2015, and Executive’s termination on October 30, 2015 are each referred to as a “Qualifying Termination” and the date of any such Qualifying Termination is referred to as the “Qualifying Termination Date”).

b. Cash. If Executive incurs a Qualifying Termination, then provided: (i) Executive

executes this Agreement within 21 days of receiving this Agreement, and does not revoke his execution of this Agreement within seven (7) days thereafter; (ii) Executive does not breach this Agreement; and (iii) if this Agreement is

executed prior to his Qualifying Termination Date, then not earlier than his Qualifying Termination Date, and not later than 21 days after his Qualifying Termination Date, Executive executes and provides to the Company, and within seven

(7) days thereafter does not revoke his execution of, a Supplemental Release of Claims (the “Supplemental Release”) in the form set forth as Appendix B to this Agreement (together, the “Release Requirements”), the Company

will pay to Executive a total of $3,000,000.00 as cash severance, less applicable payroll tax and other required withholdings. This cash severance will be paid to Executive, subject to Section 29 below, as follows: $1,000,000.00 within

forty-five (45) days following the Termination Date (the “45-Day Payment”); $1,000,000.00 on March 15, 2016 (the “2nd Payment”) and $1,000,000.00 on, or within forty-five (45) days following, the one (1)-year

anniversary of the Qualifying Termination Date (the “1-Year Payment”), in each case payable less applicable payroll taxes and other required withholdings. Notwithstanding the foregoing, if Executive engages in a Disqualifying Activity (as

defined in Section 14 below) or breaches Section 9, 10, 11, 14 or 15 below during the period from his Termination Date through and including the one (1)-year anniversary of the Termination Date (the “Disqualifying Activity

Period”), if they are not yet paid, the obligation to pay to Executive any and all portions of the 2nd Payment and the 1-Year Payment not yet paid to Executive will immediately cease and no further payments of the 2nd Payment or 1-Year Payment

will be paid; and if they already are paid, Executive will be obligated to repay to the Company any and all portions of the 2nd Payment and the 1-Year Payment. Notwithstanding the foregoing, the Company will be obligated to pay the 45-Day Payment

and Executive will be entitled to retain the 45-Day Payment.

c. Benefits. Executive’s health insurance benefits will cease on

the last day of the month in which his Termination Date occurs, subject to Executive’s right to continue his health insurance benefits under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”). Except as

otherwise provided herein, Executive’s participation in all benefits and incidents of employment, including, but not limited to, the accrual of bonuses, PTO, and vesting (including, but not limited to, vesting of equity awards), will cease as

of the Termination Date.

2

d. Retention Bonus. Pursuant to the terms of the Retention Bonus and Equity Award

Amendments letter between the Company and Executive, effective October 18, 2013, as amended by the Amendment to the Retention Bonus and Equity award Amendments, effective December 19, 2014 (together, the “Retention Agreement”),

Executive is eligible to earn the Retention Bonus (as defined in the Retention Agreement) if Executive remains employed by the Company through October 27, 2015. Executive will remain eligible to earn the Retention Bonus in accordance with the

terms of the Retention Agreement, and any earned Retention Bonus will be paid at the time specified in, and in accordance with the terms of, the Retention Agreement. Notwithstanding the foregoing, however, if prior to October 27, 2015,

Executive incurs a Qualifying Termination, then subject to Executive’s satisfaction of the Release Requirements, the Company will pay to Executive any unpaid portion of the Retention Bonus, less applicable payroll tax and other required

withholdings, within forty-five (45) days following the Termination Date.

| |

2. |

Equity Compensation and Cash-Settled Performance Units. |

a. Equity Compensation.

If Executive incurs a Qualifying Termination then, subject to Executive’s satisfaction of the Release Requirements, the vesting of the number of shares of Executive’s restricted stock and performance shares agreements shown on Appendix A

will accelerate. Such accelerated shares, if any, will be delivered to Executive, less applicable payroll tax and other required withholdings, within sixty (60) days following the Qualifying Termination Date in accordance with the terms of the

Stock Agreements related to the applicable equity award and subject to Section 29 below. Except as provided in this Section 2(a), any stock-settled performance shares, restricted stock units, shares of restricted stock and stock options

will cease vesting as of the Termination Date and any unearned or unvested shares subject thereto will be immediately forfeited. Except as provided herein, all of Executive’s stock-settled performance shares, restricted stock units, shares of

restricted stock and stock options will continue to be governed by the terms and conditions of the applicable Stock Agreements.

b.

Cash-Settled Performance Units. If Executive incurs a Qualifying Termination then, subject to Executive’s satisfaction of the Release Requirements, the vesting of $1,293,750.00 of the Cash-Settled Performance Units will accelerate. Such

amount, if any, will be delivered to Executive, less applicable payroll tax and other required withholdings, within sixty (60) days following the Termination Date in accordance with the terms of the Cash-Settled Units Agreements and subject to

Section 29 below. Except as provided in this Section 2(b), all of the Cash-Settled Performance Units will cease vesting as of the Termination Date and any unearned or unvested portions thereof will be immediately forfeited. Except as

provided herein, Cash-Settled Performance Units will continue to be governed by the terms and conditions of the applicable Cash-Settled Units Agreements.

3. Fiscal Year 2015 Bonus. If Executive remains employed by the Company through October 25, 2015 (the last day of the

Company’s Fiscal Year 2015), Executive will remain eligible to receive a Fiscal Year 2015 bonus under the Company’s Senior Executive Bonus Plan (the “SEBP”) in accordance with its terms. Any bonus payable under the SEBP will be

payable at the time(s) provided under, and in accordance with the terms of, the SEBP. Management will recommend to the Committee (as defined in the SEBP) that, subject to funding of the bonus pool based on achievement of applicable Company

performance goals, Executive be awarded a bonus under the SEBP assuming a 1.0 multiplier for his individual performance goals. However, Executive acknowledges and agrees that pursuant to the terms of the SEBP, the Committee retains discretion to

determine the amount of any bonuses under the SEBP in accordance with its terms. Executive will not be eligible for any bonus or incentive payment other than as described in this Section 3, and Executive acknowledges that he will not

participate in the SEBP for Fiscal Year 2016.

3

4. Payment of Salary. Executive acknowledges and represents that, other than the

consideration set forth in this Agreement, the Company has paid or provided all salary, wages, bonuses, accrued vacation/PTO, housing allowances, relocation costs, interest, severance, outplacement costs, fees, reimbursable expenses, commissions,

stock, stock options, vesting, and any and all other benefits and compensation due to Executive through the date hereof.

5. Release of

Claims. Executive agrees that the consideration set forth in this Agreement represents settlement in full of all outstanding obligations owed to Executive by the Company and its current and former officers, directors, Executives, agents,

investors, attorneys, shareholders, administrators, affiliates, divisions, and subsidiaries, and predecessor and successor corporations and assigns (collectively, the “Releasees”). Executive, on his own behalf and on behalf of his

respective heirs, family members, executors, agents, and assigns, hereby and forever releases the Releasees from, and agrees not to sue concerning, or in any manner to institute, prosecute or pursue, any claim, complaint, charge, duty, obligation,

or cause of action relating to any matters of any kind, whether presently known or unknown, suspected or unsuspected, that Executive may possess against any of the Releasees arising from any omissions, acts, facts, or damages that have occurred up

until and including the Effective Date of this Agreement, including, without limitation:

| |

a. |

any and all claims relating to or arising from Executive’s employment relationship with the Company and the termination of that relationship; |

| |

b. |

any and all claims relating to, or arising from, Executive’s right to purchase, or actual purchase of shares of stock of the Company, including, without limitation, any claims for fraud, misrepresentation, breach

of fiduciary duty, breach of duty under applicable state corporate law, and securities fraud under any state or federal law; |

| |

c. |

any and all claims for wrongful discharge of employment; termination in violation of public policy; discrimination; harassment; retaliation; breach of contract, both express and implied; breach of covenant of good faith

and fair dealing, both express and implied; promissory estoppel; negligent or intentional infliction of emotional distress; fraud; negligent or intentional misrepresentation; negligent or intentional interference with contract or prospective

economic advantage; unfair business practices; defamation; libel; slander; negligence; personal injury; assault; battery; invasion of privacy; false imprisonment; conversion; and disability benefits; |

4

| |

d. |

any and all claims for violation of any federal, state, or municipal statute, including, but not limited to, Title VII of the Civil Rights Act of 1964; the Civil Rights Act of 1991; the Rehabilitation Act of 1973; the

Americans with Disabilities Act of 1990; the Equal Pay Act; the Fair Labor Standards Act, except as prohibited by law; the Fair Credit Reporting Act; the Age Discrimination in Employment Act of 1967; the Older Workers Benefit Protection Act; the

Employee Retirement Income Security Act of 1974; the Worker Adjustment and Retraining Notification Act; the Family and Medical Leave Act, except as prohibited by law; the Sarbanes- Oxley Act of 2002; the California Family Rights Act; the California

Labor Code, except as prohibited by law; the California Workers’ Compensation Act, except as prohibited by law; and the California Fair Employment and Housing Act; |

| |

e. |

any and all claims for violation of the federal or any state constitution; |

| |

f. |

any and all claims arising out of any other laws and regulations relating to employment or employment discrimination; |

| |

g. |

any claim for any loss, cost, damage, or expense arising out of any dispute over the non-withholding or other tax treatment of any of the proceeds received by Executive as a result of this Agreement; and

|

| |

h. |

any and all claims for attorneys’ fees and costs. |

Executive agrees that the release set forth in this

section will be and remain in effect in all respects as a complete general release as to the matters released. This release does not extend to any obligations incurred under this Agreement. This release does not release claims that cannot be

released as a matter of law, including, but not limited to: (1) Executive’s right to file a charge with, or participate in a charge by, the Equal Employment Opportunity Commission or comparable state agency against the Company (with the

understanding that any such filing or participation does not give Executive the right to recover any monetary damages against the Company; Executive’s release of claims herein bars Executive from recovering such monetary relief from the

Company); (2) claims under Division 3, Article 2 of the California Labor Code (which includes California Labor Code section 2802 regarding indemnity for necessary expenditures or losses by Executive); and (3) claims prohibited from release

as set forth in California Labor Code section 206.5 (specifically “any claim or right on account of wages due, or to become due, or made as an advance on wages to be earned, unless payment of such wages has been made”). In addition,

Executive is not waiving or releasing under this Agreement any indemnification rights to which Executive may be entitled under the Company’s Articles of Incorporation, by contract, or as a matter of law for acts taken within the course and

scope of his employment with Company.

6. Acknowledgment of Waiver of Claims under ADEA. Executive acknowledges that he is

waiving and releasing any rights he may have under the Age Discrimination in Employment Act of 1967 (“ADEA”), and that this waiver and release is knowing and voluntary. Executive agrees that this waiver and release does not apply to any

rights or claims that may arise under the ADEA after the Effective Date of this Agreement. Executive acknowledges that the consideration given for this waiver and release is in addition to anything of value to which Executive was already entitled.

Executive is advised to consult with an attorney about this Agreement prior to executing this Agreement. Executive acknowledges (a) he has twenty-one (21) days from receipt of this Agreement to consider this Agreement; (b) he has

seven (7) days after his execution of this Agreement to revoke his execution of this Agreement; (c) this Agreement will not be effective until after the revocation period has expired; and (d) nothing in this Agreement prevents or

precludes Executive from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties, or costs for doing so, unless specifically authorized by federal law.

In the event Executive signs this Agreement and returns it to the Company in less than the 21-day period identified above, Executive hereby acknowledges that he has freely and voluntarily chosen to waive the time period allotted for considering this

Agreement. Executive acknowledges and understands that revocation must be accomplished by a written notification to Gary Dickerson, the Company’s President and Chief Executive Officer, that is received prior to the Effective Date.

5

7. California Civil Code Section 1542. Executive acknowledges that he has been

advised to consult with legal counsel and is familiar with the provisions of California Civil Code Section 1542, a statute that otherwise prohibits the release of unknown claims, which provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING

THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

Executive, being aware of said code

section, agrees to expressly waive any rights he may have thereunder, as well as under any other statute or common law principles of similar effect.

8. No Pending or Future Lawsuits. Executive represents that he has no lawsuits, claims, or actions pending in his name, or on behalf of

any other person or entity, against the Company or any of the other Releasees. Executive also represents that he does not intend to bring any claims on his own behalf or on behalf of any other person or entity against the Company or any of the other

Releasees.

9. Trade Secrets and Confidential Information/Company Property. Executive reaffirms and agrees to observe and abide by

the terms of his Employee Agreement, specifically including the provisions therein regarding nondisclosure of the Company’s trade secrets and confidential and proprietary information. Executive’s signature below constitutes his

certification that he has returned or prior to his Termination Date will return to the Company all documents, electronic media and other items provided to Executive by the Company, developed or obtained by Executive in connection with his employment

with the Company, or otherwise belonging to the Company. Executive hereby grants consent to notification by the Company to any new employer about Executive’s obligations under this section.

6

10. No Cooperation. Executive agrees that he will not knowingly encourage, counsel, or

assist any attorneys or their clients in the presentation or prosecution of any disputes, differences, grievances, claims, charges, or complaints by any third party against any of the Releasees, unless under a subpoena or other court order to do so.

Executive agrees both to immediately notify the Company upon receipt of any such subpoena or court order, and to furnish, within three (3) business days of its receipt, a copy of such subpoena or other court order to the Company. If approached

by anyone for counsel or assistance in the presentation or prosecution of any disputes, differences, grievances, claims, charges, or complaints against any of the Releasees, Executive will state no more than that he cannot provide counsel or

assistance.

11. Non-Disparagement. Executive agrees to refrain from any disparagement, defamation, libel, or slander of any of the

Releasees, and agrees to refrain from any tortious interference with the contracts and relationships of any of the Releasees. The Company will instruct Gary Dickerson, Gino Addiego, Steve Ghanayem, Prabu Gopalraja, Bob Halliday, Tom Larkins, Om

Nalamasu, Charles Read and Ali Salehpour not to disparage, defame, libel, or slander Executive in any manner likely to be harmful to Executive or to Executive’s personal reputation; provided, however, that both Executive and the Company may

respond accurately and fully to any question, inquiry or request for information when required by legal process. Executive will direct any inquiries by potential future employers to Madonna Bolano, the Company’s Group Vice President of Global

Human Resources, who will use her best efforts to provide only the Executive’s last position and dates of employment. The Parties further agree that each Party will have the opportunity to review and approve any press release or other

publicly-distributed communication regarding Executive’s departure from the Company prior to publication or release of such communication.

12. Breach. Executive acknowledges and agrees that any material breach of this Agreement (including Sections 9, 10, 11, 14 and 15) or

his Employee Agreement will entitle the Company immediately to recover and/or cease providing the 2nd Payment or 1-Year Payment provided or scheduled to be provided to Executive under Section 1(b) of this Agreement. Legal action by Executive in

good faith challenging or seeking a determination of the validity of the Executive’s release of claims under the ADEA will not constitute a material breach of the Agreement. In the event of any other breach of this Agreement, the aggrieved

Party will be entitled to all remedies provided by applicable law.

13. No Admission of Liability. Executive understands and

acknowledges that this Agreement constitutes a compromise and settlement of any and all actual or potential disputed claims by Executive. No action taken by the Company hereto, either previously or in connection with this Agreement, will be deemed

or construed to be (a) an admission of the truth or falsity of any actual or potential claims or (b) an acknowledgment or admission by the Company of any fault or liability whatsoever to Executive or to any third party.

14. Disqualifying Activities. During the Disqualifying Activity Period, the following are “Disqualifying Activities”: working

as an employee, officer, director, consultant, contractor, advisor, or agent for the companies, or any of their subsidiaries or affiliates, listed on Appendix C of this Agreement, without the prior express written permission of the Company’s

President and Chief Executive Officer.

7

15. Non-Solicitation. Executive agrees that for the duration of the Disqualifying Activity

Period, Executive will not directly or indirectly solicit, induce, or recruit any of the Company’s employees to leave their employment at the Company.

a. Cause. For purposes of this Agreement, “Cause” means

(i) Executive’s material failure to reasonably perform the duties assigned to him by the Company’s President and Chief Executive Officer, or his delegate (ii) Executive’s act of material personal dishonesty in connection

with his responsibilities as an employee and intended to result in Executive’s substantial personal enrichment, (iii) Executive being convicted of, or pleading no contest or guilty to, (A) a misdemeanor that has had or will have a

material detrimental effect on the Company, or (B) any felony, (iv) Executive’s willful act that constitutes gross misconduct, or (v) Executive’s material violation of any material Company employment policy or standard of

conduct that has been provided or made available to Executive in writing. For avoidance of doubt, a termination of Executive’s employment with the Company due to Executive’s death or disability will not be deemed a termination by the

Company without Cause.

b. Deferred Compensation Separation Benefits. For the purposes of this Agreement, “Deferred

Compensation Separation Benefits” means any severance pay or benefits to be paid or provided to Executive (or Executive’s estate or beneficiaries) pursuant to this Agreement and any other severance payments or separation benefits payable

to Executive (or Executive’s estate or beneficiaries), that in each case, when considered together, are considered deferred compensation under Section 409A.

17. Costs. The Parties will each bear their own costs, attorneys’ fees, and other fees incurred in connection with the

preparation, negotiation and execution of this Agreement.

18. Arbitration. Any controversy or claim between the Parties or between

Executive and any director, officer, employee, or corporate affiliate of the Company, including but not limited to any controversy or claim arising from or related to Executive’s employment with the Company or termination of employment, the

formation, interpretation or alleged breach of this Agreement, or any claims not released by this Agreement, will be finally settled by binding arbitration, employing a single, neutral arbitrator, and administered by JAMS, Inc. (“JAMS”),

under its Employment Arbitration Rules & Procedures (available at http://www.jamsadr.com), in Santa Clara County, California. Judgment upon any award rendered in an arbitration proceeding may be entered in any court having jurisdiction of

the matter. The same remedies will be available in arbitration as they otherwise would have been if the claim had been filed in a court of law. The Company will pay all costs of JAMS to administer the arbitration and the costs for the arbitrator;

provided, however, that if Executive initiates the arbitration, he will be required to contribute an amount equal to the filing fee in the Superior Court of California in and for Santa Clara County. In any arbitration commenced pursuant to this

agreement to arbitrate, depositions may be taken and discovery obtained to the reasonable amount necessary for both sides to be able to present their claims and defenses, taking into account the Parties’ mutual desire to have a speedy,

cost-effective dispute-resolution mechanism. The arbitrator will determine and apply reasonable discovery limits in the arbitrator’s discretion. Any award by the arbitrator(s) will be reasoned and accompanied by a statement of the factual and

legal bases for the award. Nothing in this agreement to arbitrate will prevent any party from seeking from a court provisional relief in aid of arbitration, including temporary restraining orders, temporary protective orders, evidence-preservation

and return orders, and preliminary injunctive relief. Except as so provided, both Parties are waiving their rights to proceed in a court of law, including a trial by jury, in exchange for arbitration.

8

19. Tax Consequences. The Company makes no representations or warranties with respect to

the tax consequences of the payments and any other consideration provided to Executive or made on his behalf under the terms of this Agreement. Executive agrees and understands that he is responsible for payment, if any, of local, state, and/or

federal taxes on the payments and any other consideration provided hereunder by the Company and any penalties or assessments related to such taxes (including but not limited to under Section 409A). Executive further agrees to indemnify and hold

the Company harmless from any claims, demands, deficiencies, penalties, interest, assessments, executions, judgments, or recoveries by any government agency against the Company for any amounts claimed due on account of (a) Executive’s

failure to pay or the Company’s failure to withhold, or Executive’s delayed payment of, federal or state taxes, or (b) damages sustained by the Company by reason of any such claims, including attorneys’ fees and costs.

20. Authority. The Company represents and warrants that the Company’s President and Chief Executive Officer has the authority to

act on behalf of the Company and to bind the Company and all who may claim through it to the terms and conditions of this Agreement. Executive represents and warrants that he has the capacity to act on his own behalf and on behalf of all who might

claim through him to bind them to the terms and conditions of this Agreement. Each Party warrants and represents that there are no liens or claims of lien or assignments in law or equity or otherwise of or against any of the claims or causes of

action released herein.

21. No Representations. Executive represents that he has had an opportunity to consult with an attorney,

and has carefully read and understands the scope and effect of the provisions of this Agreement. Executive has not relied upon any representations or statements made by the Company that are not specifically set forth in this Agreement.

22. Severability. In the event that any provision or any portion of any provision hereof becomes or is declared by a court of competent

jurisdiction or arbitrator to be illegal, unenforceable, or void, this Agreement will continue in full force and effect without said provision or portion of provision, except that if Section 1.b, 5 or 14 of this Agreement or the Supplemental

Release when executed are held to be illegal, unenforceable or void as a result of legal action initiated by Executive or a defense raised by Executive in response to legal action initiated by the Company, then at its election the Company may cease

making any cash severance payments to Executive and recover from Executive any cash severance payments already made, with the exception of the 45-Day Payment.

23. Attorneys’ Fees. Except with regard to a legal action challenging or seeking a determination in good faith of the validity of

the waiver herein under the ADEA, in the event that either Party brings an action to enforce or effect its rights under this Agreement, the prevailing Party will be entitled to recover its costs and expenses, including the costs of mediation,

arbitration, litigation, court fees, and reasonable attorneys’ fees incurred in connection with such an action.

9

24. Entire Agreement. This Agreement, the Employee Agreement, the Stock Agreements, and

the Supplemental Release when executed represent the entire agreement and understanding between the Company and Executive concerning the subject matter of this Agreement and Executive’s employment and termination with the Company and the events

leading thereto and associated therewith, and supersede and replace any and all prior agreements and understandings concerning the subject matter of this Agreement and Executive’s relationship with the Company. To the extent that there is any

conflict or inconsistency between this Agreement and the Employee Agreement, this Agreement will govern.

25. No Oral Modification.

This Agreement may be amended only in a writing signed by Executive and the Company’s President and Chief Executive Officer.

26.

Governing Law. This Agreement will be governed by the laws of the State of California, without regard to choice-of-law provisions.

27. Effective Date. Executive understands that this Agreement will be null and void if not executed by Executive within twenty-one

(21) days after his receipt of this Agreement. Each Party has seven (7) days after that Party signs this Agreement to revoke it. This Agreement will become effective on the eighth day after it has been signed by both Parties, provided that

it has not been revoked by either Party before that date (the “Effective Date”).

28. Counterparts. This Agreement may be

executed in counterparts and by facsimile, and each counterpart and facsimile will have the same force and effect as an original and will constitute an effective, binding agreement on the part of each of the undersigned.

29. Internal Revenue Code Section 409A.

a. Notwithstanding anything to the contrary in this Agreement, no Deferred Compensation Separation Benefits will become payable under this

Agreement until Executive has a “separation from service” within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and the final regulations and guidance promulgated thereunder and

any applicable state law equivalent, as each may be amended or promulgated from time to time (collectively, “Section 409A”). Similarly, no severance payable to Executive, if any, pursuant to this Agreement that otherwise would be exempt

from Section 409A pursuant to Treasury Regulation Section 1.409A-1(b)(9) will be payable until Executive has a “separation from service” within the meaning of Section 409A. Further, if Executive is a “specified

employee” within the meaning of Section 409A at the time of Executive’s separation from service (other than due to death), then if and to the extent necessary to avoid subjecting Executive to an additional tax under Section 409A,

any Deferred Compensation Separation Payments that are otherwise payable within the first six (6) months following Executive’s separation from service will become payable on the date that is six (6) months and one (1) day

following the date of Executive’s separation of service. All subsequent Deferred Compensation Separation Benefits, if any, will be payable in accordance with the payment schedule applicable to each payment or benefit. Notwithstanding anything

herein to the contrary, if Executive dies following his separation from service but prior to the six (6) month anniversary of his separation from service, then any payments delayed in accordance with this Section 29(a) will be payable in a

lump sum as soon as administratively practicable after the date of Executive’s death and all other Deferred Compensation Separation Benefits will be payable in accordance with the payment schedule applicable to each payment or benefit. Each

payment and benefit payable under this Agreement is intended to constitute a separate payment for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations. See Section 19 of this Agreement regarding Executive’s responsibility

for the payment of taxes.

10

b. Any amount paid under this Agreement that satisfies the requirements of the “short-term

deferral” rule set forth in Section 1.409A-1(b)(4) of the Treasury Regulations will not constitute Deferred Compensation Separation Benefits for purposes of Section 29(a) above.

c. Any amount paid under this Agreement that qualifies as a payment made as a result of an involuntary separation from service pursuant to

Section 1.409A-1(b)(9)(iii) of the Treasury Regulations that does not exceed the “Section 409A Limit” (as defined below) will not constitute Deferred Compensation Separation Benefits for purposes of Section 29(a) above. For

purposes of this Section 29(c), “Section 409A Limit” will mean the lesser of two (2) times: (i) Executive’s annualized compensation based upon the annual rate of pay paid to Executive during the Executive’s taxable

year preceding the Executive’s taxable year of Executive’s termination of employment as determined under Treasury Regulation 1.409A-1(b)(9)(iii)(A)(1) and any Internal Revenue Service guidance issued with respect thereto; or (ii) the

maximum amount that may be taken into account under a qualified plan pursuant to Section 401(a)(17) of the Code for the for the year in which Executive’s separation from service occurred.

d. Executive and the Company agree to work together in good faith to consider amendments to this Agreement and to take such reasonable actions

that are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior to actual payment to Executive under Section 409A. In no event will the Company reimburse Executive (or Executive’s estate

or beneficiaries) for any taxes that may be imposed on Executive (or Executive’s estate or beneficiaries) as a result of Section 409A. The provisions of this Section 29 are intended to comply with the requirements of Section 409A

so that none of the severance payments and benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities or ambiguous terms herein will be interpreted to so comply.

30. Voluntary Execution of Agreement. Executive understands and agrees that he executed this Agreement voluntarily, without any duress

or undue influence on the part or behalf of the Company or any third party, with the full intent of releasing all of his claims against the Company and any of the other Releasees. Executive acknowledges that:

| |

a. |

he has read this Agreement; |

| |

b. |

he has been represented in the preparation, negotiation, and execution of this Agreement by legal counsel of his own choice or has elected not to retain legal counsel; |

11

| |

c. |

he understands the terms and consequences of this Agreement and of the releases it contains; and |

| |

d. |

he is fully aware of the legal and binding effect of this Agreement. |

IN WITNESS WHEREOF, the Parties have

executed this Agreement on the respective dates set forth below.

|

|

|

|

|

|

|

|

|

|

|

RANDHIR THAKUR, an individual |

|

|

|

|

| Dated: August 7, 2015. |

|

|

|

|

|

/s/ Randhir Thakur |

|

|

|

|

|

|

Randhir Thakur |

|

|

|

|

|

|

|

APPLIED MATERIALS, INC. |

|

|

|

|

| Dated: August 7, 2015. |

|

|

|

By: |

|

/s/ Gary Dickerson |

|

|

|

|

|

|

Gary Dickerson |

|

|

|

|

|

|

President and Chief Executive Officer |

12

APPENDIX A

Performance Shares and Restricted Stock Accelerated on the Qualifying Termination Date*

|

|

|

|

|

|

|

|

|

| Grant ID |

|

Grant Date |

|

Grant Type |

|

Number of Shares |

|

| AMIP 745610 |

|

12/05/2011 |

|

Performance Shares |

|

|

58,250 |

|

| TSRP 745610 |

|

12/05/2011 |

|

Performance Shares |

|

|

11,650 |

|

| AMIP 756318 |

|

12/05/2012 |

|

Performance Shares |

|

|

62,500 |

|

| TSRP 756318 |

|

12/05/2012 |

|

Performance Shares |

|

|

31,250 |

|

| AMIP 745628 |

|

12/05/2011 |

|

Restricted Stock |

|

|

4,250 |

|

| TSRP 745628 |

|

12/05/2011 |

|

Restricted Stock |

|

|

850 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

168,750 |

|

|

|

|

|

|

|

|

|

|

| * |

Subject to satisfaction of the Release Requirements. |

A-1

APPENDIX B

SUPPLEMENTAL RELEASE OF CLAIMS

YOU ARE ADVISED TO CONSULT WITH AN ATTORNEY ABOUT THIS SUPPLEMENTAL RELEASE OF CLAIMS PRIOR TO EXECUTING IT.

1. For valuable consideration which I hereby acknowledge, I, Randhir Thakur, on behalf of myself and my heirs, family members, executors,

agents, and assigns, hereby and forever release Applied Materials, Inc. (the “Company”), and its current and former officers, directors, employees, agents, investors, attorneys, shareholders, administrators, affiliates, divisions, and

subsidiaries, and predecessor and successor corporations and assigns (collectively, the “Releasees”) from, and agree not to sue concerning, or in any manner to institute, prosecute or pursue, any claim, complaint, charge, duty, obligation,

or cause of action relating to any matters of any kind, whether presently known or unknown, suspected or unsuspected, that I may possess against any of the Releasees arising from any omissions, acts, facts, or damages that have occurred up until and

including the Effective Date of this Supplemental Release of Claims (“Supplemental Release”), including, without limitation:

| |

a. |

any and all claims relating to or arising from my employment relationship with the Company and the termination of that relationship; |

| |

b. |

any and all claims relating to, or arising from, my right to purchase, or actual purchase of shares of stock of the Company, including, without limitation, any claims for fraud, misrepresentation, breach of fiduciary

duty, breach of duty under applicable state corporate law, and securities fraud under any state or federal law; |

| |

c. |

any and all claims for wrongful discharge of employment; termination in violation of public policy; discrimination; harassment; retaliation; breach of contract, both express and implied; breach of covenant of good faith

and fair dealing, both express and implied; promissory estoppel; negligent or intentional infliction of emotional distress; fraud; negligent or intentional misrepresentation; negligent or intentional interference with contract or prospective

economic advantage; unfair business practices; defamation; libel; slander; negligence; personal injury; assault; battery; invasion of privacy; false imprisonment; conversion; and disability benefits; |

| |

d. |

any and all claims for violation of any federal, state, or municipal statute, including, but not limited to, Title VII of the Civil Rights Act of 1964; the Civil Rights Act of 1991; the Rehabilitation Act of 1973; the

Americans with Disabilities Act of 1990; the Equal Pay Act; the Fair Labor Standards Act, except as prohibited by law; the Fair Credit Reporting Act; the Age Discrimination in Employment Act of 1967; the Older Workers Benefit Protection Act; the

Employee Retirement Income Security Act of 1974; the Worker Adjustment and Retraining Notification Act; the Family and Medical Leave Act, except as prohibited by law; the Sarbanes-Oxley Act of 2002; the California Family Rights Act; the California

Labor Code, except as prohibited by law; the California Workers’ Compensation Act, except as prohibited by law; and the California Fair Employment and Housing Act; |

| |

e. |

any and all claims for violation of the federal or any state constitution; |

B-1

| |

f. |

any and all claims arising out of any other laws and regulations relating to employment or employment discrimination; |

| |

g. |

any claim for any loss, cost, damage, or expense arising out of any dispute over the non-withholding or other tax treatment of any of the proceeds received by me as a result of this Supplemental Release; and

|

| |

h. |

any and all claims for attorneys’ fees and costs. |

2. I agree that this Supplemental

Release will be and remain in effect in all respects as a complete general release as to the matters released. This Supplemental Release does not extend to (1) my right to the consideration provided to me under my Separation Agreement and

Release; (2) my right to file a charge with, or participate in a charge by, the Equal Employment Opportunity Commission or comparable state agency against the Company (with the understanding that any such filing or participation does not give

me the right to recover any monetary damages against the Company; my release of claims herein bars me from recovering such monetary relief from the Company); or (3) claims that as a matter of law cannot be released without judicial or

governmental supervision. In addition, I am not waiving or releasing under this Agreement any indemnification rights to which I may be entitled under the Company’s Articles of Incorporation, by contract, or as a matter of law for acts taken

within the course and scope of my employment with Company.

3. I acknowledge that I am waiving and releasing any rights I may have under

the Age Discrimination in Employment Act of 1967 (“ADEA”), and that this waiver and release is knowing and voluntary. I agree that this waiver and release does not apply to any rights or claims that may arise under the ADEA after the

Effective Date of this Supplemental Release. I acknowledge that the consideration given for this waiver and release is in addition to anything of value to which I was already entitled. I acknowledge that I am being advised to consult with an

attorney about this Supplemental Release before I execute it. I acknowledge that (a) I have twenty-one (21) days after my Qualifying Termination Date to consider this Supplemental Release; (b) I have seven (7) days after

execution of this Supplemental Release to revoke my execution of this Supplemental Release; (c) this Supplemental Release will not be effective until after the revocation period has expired (the “Effective Date” of this Supplemental

Release); and (d) nothing in this Supplemental Release prevents or precludes me from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties, or

costs for doing so, unless specifically authorized by federal law. In the event I execute this Supplemental Release and return it to the Company in less than the 21-day period identified above, I hereby acknowledge that I have freely and voluntarily

chosen to waive the time period allotted for considering this Supplemental Release. I acknowledge and understand that revocation must be accomplished by a written notification to Gary Dickerson, President and Chief Executive Officer, that is

received prior to the Effective Date of this Supplemental Release.

4. I acknowledge that I have been advised to consult with legal

counsel and am familiar with the provisions of California Civil Code Section 1542, a statute that otherwise prohibits the release of unknown claims, which provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING

THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

B-2

Being aware of said code section, I agree to expressly waive any rights I may have thereunder, as well as under

any other statute or common law principles of similar effect.

5. I acknowledge and represent that, other than the consideration for this

Supplemental Release, the Company has paid or provided me with all salary, wages, bonuses, accrued paid time off, housing allowances, relocation costs, interest, severance, outplacement costs, fees, reimbursable expenses, commissions, stock, stock

options, vesting, and any and all other benefits and compensation due to me.

|

|

|

|

|

|

|

| Dated: , 2015. |

|

|

|

|

|

RANDHIR THAKUR, an individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Randhir Thakur |

B-3

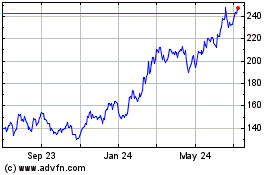

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

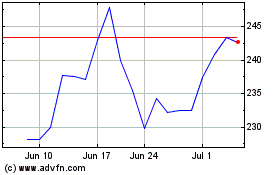

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024