Acorda MS Drug To Get Improved Reimbursement From UnitedHealth

October 12 2010 - 3:20PM

Dow Jones News

UnitedHealth Group Inc. (UNH) plans to increase the

reimbursement status of Acorda Therapeutics Inc.'s (ACOR) multiple

sclerosis drug Ampyra, a positive development in an area that has

been a concern for Wall Street.

The move, effective at the beginning of next year, will lower

the out-of-pocket costs to patients taking the drug, typically used

in addition to more mainstream MS therapies, which are among the

most expensive drugs on the market. Ampyra, approved in January, is

a twice-daily pill that improves walking in MS patients and costs

about $18 a pill, or $13,000 a year.

The reimbursement systems at most insurers have three tiers. The

top tier, or tier 1, being the cheapest option consisting mostly of

generics. The next tier is for preferred brands, while tier 3 is

generally non-preferred drugs with higher co-pays that can

discourage usage.

UnitedHealth initially placed Ampyra on tier 3 but decided to

move it up to tier 2 "because of the uniqueness of the drug, it

being a new chemical entity and having new indications that aren't

met by any other medications," said Randy Falkenrath, who leads the

specialty pharmacy business at UnitedHealth.

The move generally decreases the patient copay to $30 a month

from $60. From January to July, 700 UnitedHealth patients have had

at least one prescription of Ampyra filled, Falkenrath said.

The company provides pharmaceutical benefits to 14 million

people, with about 13,000 members being treated for MS.

"This is a particularly big milestone for us," Acorda Chief

Executive Ron Cohen said. "Particularly with Wall Street and

everyone being so focused on reimbursement for any new drug these

days."

Aside from lowering the co-pay, Cohen notes that the decision

sends a message that UnitedHealth believes the drug is important

and should be available to patients. He declined to speculate on

whether more insurers could make similar moves, but said the

decision bolsters its case with other companies.

The reimbursement hurdles for Ampyra, which had about $30

million in second-quarter sales, has been a concern among analysts

since its launch.

A recent survey by J.P. Morgan estimated that 56% of health

plans covering use of the drug have placed it on tier 3. The firm

said that 40% of plans required patients to conduct a timed walk

when starting the drug, followed by subsequent walks to prove that

the drug is working. Such a strict measurement could make it harder

to continue use.

UnitedHealth doesn't have such a requirement at this time, but

it does monitor patients to see if the drug is working and

continues to be safe by having them check-in after the first six

months and then yearly. Before beginning treatment, patients are

required to have prior authorization that Ampyra is appropriate for

them.

Cohen said a "significant minority" of insurers have a walking

requirement, which he believes is unreliable because the effects of

MS can vary over even a short period.

"We are spending all of our effort on educating those plans,"

Cohen said.

Treatments for MS itself aim to slow the disease, which is

marked by the body attacking its own central nervous system. Ampyra

doesn't actually treat the disease but is believed to help conduct

the electric signals that travel through damaged nerves.

The rising cost of drugs has given insurance companies good

reason to scrutinize new treatments, especially in MS. Drugs for

the disease make up about 10% of United Health's specialty drug

spending and the per-patient cost is growing. Over the past three

years, prices for MS drugs have grown by about 65%, Falkenrath

said.

While the most popular MS drugs are on tier 2, the insurer has

been tough on some treatments. It recently decided it wouldn't

cover Extavia, sold by Bayer AG (BAYRY, BAY.XE) and Novartis AG

(NVS, NOVN.VX) and approved last year, after concluding it is no

better than current therapies.

As more MS treatments are expected to hit the market in coming

years, they are also expected to bring down prices.

"I do think we will be in a much better position," said Timothy

Heady, chief executive of UnitedHealth Pharmaceutical Solutions.

"Our experience tells us that we will be able to put some pressure

on those price points."

-By Thomas Gryta, Dow Jones Newswires; 212-416-2169;

thomas.gryta@dowjones.com

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

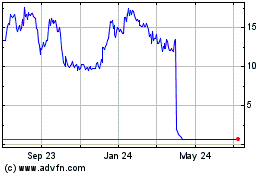

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Apr 2023 to Apr 2024