Soros Fund Cut Stakes In Citi, Wells Fargo, Monsanto - Filing

August 15 2011 - 6:41PM

Dow Jones News

Billionaire investor George Soros's hedge fund reported lower

stakes in big banks Citigroup Inc. (C) and Wells Fargo & Co

(WFC) and slashed its ownership in Monsanto Co. (MON), a former top

holding, according to a regulatory filing late Monday.

In a quarterly filing with the Securities and Exchange

Commission, Soros decreased his holdings of Citigroup by nearly 2.9

million shares to 64,600 at the end of the second quarter. The

stake is now valued at $2.7 million. Citi exercised a 1-to-10

reverse stock split in May.

The fund also cut its stake in Wells Fargo by 3.4 million shares

to 77,700, valued at $2.2 million at June 30.

Soros reduced his stake in Monsanto by 2.6 million shares to

79,400. The position is now valued at $5.8 million.

The overall value of Soros's stock holdings fell to $7.1 billion

at the end of the second quarter, down from $8.4 billion as of

March 31.

In purchases during the quarter, Soros reported a higher stake

in Motorola Solutions Inc. (MSI), a company that split with

Motorola Mobility Holdings Inc. (MMI)--the target of a $12.5

billion bid by Google Inc. (GOOG)--at the beginning of the year.

Soros's ownership in Motorola Solutions climbed to 5.7 million

shares valued at $261 million as of June 30. The position is now

the fund's fourth-largest holding. The fund also disclosed call

options on 357,300 shares of Motorola Solutions.

In another sign of his reported retreat from gold, Soros

reported selling mining company NovaGold Resources Inc. (NG, NG.T).

The fund already had been paring back its stake in the precious

metal in the first quarter.

Soros, who once famously dubbed gold "the ultimate asset

bubble," was one of several big money managers who loaded up on

gold, silver and other metals over the past two years amid weakness

in the U.S. dollar. In May, however, The Wall Street Journal said

Soros and some other leading investment firms sold gold and other

metal stocks.

Monday's report from Soros comes nearly a month after reports

that he decided to turn his hedge fund into a $24.5 billion "family

office," in a move that allows it to avoid a new level of

regulatory oversight facing many hedge funds.

Soros told clients that his firm, Soros Fund Management LLC,

will no longer manage outside investors' money.

Many investors that manage more than $100 million are required

to file with the SEC Form 13-Fs disclosing their stock holdings

within 45 days of the end of a given quarter, giving the public its

freshest possible glimpse into the portfolios of well-known money

managers. The second-quarter deadline was Monday.

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

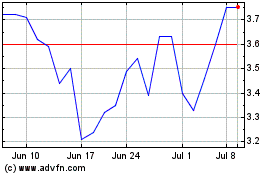

Novagold Resources (AMEX:NG)

Historical Stock Chart

From Mar 2024 to Apr 2024

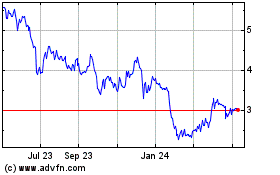

Novagold Resources (AMEX:NG)

Historical Stock Chart

From Apr 2023 to Apr 2024