50 Jewelers Say No To Buying Gold From Alaska Pebble Mine

November 02 2010 - 8:30PM

Dow Jones News

Jewelers from the U.K. and France have joined ranks with U.S.

jewelers such as Tiffany & Co. (TIF) to oppose the construction

of a large Alaskan gold and copper mine that could harm one of the

world's largest wild salmon habitats.

Fraser Hart, a leading U.K. independent jewelry retailer, and

Paris-based Boucheron have teamed up with John Hardy and Ingle

& Rhode to become the latest jewelers to sign a pledge not to

buy gold from the proposed Pebble mine in Alaska.

The Pebble project, which is located in southwest Alaska, is

jointly owned in equal measure by global diversified miner Anglo

American PLC (AAL.LN) and Canada-based Northern Dynasty Minerals

Ltd (NDM.T). Anglo-Australian miner Rio Tinto PLC (RIO) owns a

19.8% stake in Northern Dynasty while Mitsubishi Corp. (8058.TO)

owns an 11% stake in the miner.

There are now 50 signatories representing $5.75 billion in

jewelry sales who have signed the pledge. The signatories are

concerned that the Pebble project, one of the world's largest

undeveloped gold and copper deposits, will destroy an important

spawning habitat for wild sockeye salmon and jeopardize the

livelihood of over 5,500 people, according to Earthworks, one of

the groups campaigning against the mine.

The project hasn't been fully designed but it will likely

include an open-pit mine and possibly an underground mine that

could potentially produce 350,000 tons of copper annually and a

significant amount of gold and molybdenum by-products. The

projects' partners envisage such a project would require the

construction of waste-storage facilities, a deep water port,

possibly a power plant, and miles of roads and pipelines.

Earthworks expects the mine would produce 10 billion tons of

waste during the mine's lifetime based on initial resource

estimates from the partnership.

Anglo American has so far invested about $300 million in the

project and said it would commit $1.4 billion to take the project

through various stages of development but only if a mine could be

designed in accordance with Alaska's stringent environmental

standards and to the benefit of the local community.

"Our bottom line remains that, if the project cannot be designed

in a way that provides the proper protections for Alaska's

fisheries and wildlife, or to the livelihoods of Alaskan

communities, then it shouldn't be built," said John Parker, Anglo's

chairman, in April.

Anglo American believes that mining and fishing can co-exist in

the region and acknowledge that it would have to bear the burden to

prove it. A spokesperson for Northern Dynasty urged local

communities to wait for a development plan to be proposed before

commenting on the project's environmental impact.

The jewelers, Earthworks and the Bristol Bay Corporation, which

represents about 8,000 local shareholders, said the mine could harm

Bristol Bay's salmon industry, which supplies a third of the

world's commercial supply of wild sockeye salmon and generates an

average of $400 million a year.

"In Bristol Bay, we believe the extraordinary salmon fishery

clearly provides the best opportunity to benefit Southwestern

Alaskan communities in a sustainable way. For Tiffany &

Co.--and we believe for many of our fellow retail jewelers--this

means we must look to other places to responsibly source our gold,"

said Michael Kowalski, CEO of Tiffany & Co.

Jewelers consumed nearly half of the world's global annual gold

output last year.

But not all of Alaska's communities are opposed to the project.

Five of Alaska's 13 native corporations, which are located closest

to the Pebble project and represent the interests of local

communities, urged caution in jumping to conclusions before

evaluating the full scope of the project.

"We are disappointed in the actions by these groups and

organizations who have taken a stand against Pebble without seeking

the complete picture, especially without any consideration for our

perspective," the five corporations said in a letter to Anglo.

They mentioned that they would evaluate the project fully,

taking into account the project's impact on the fishing industry,

the environment and the region's high unemployment rate.

The Pebble partnership has hired an independent company to

facilitate dialogue with stakeholders about the review of

scientific data and any eventual mine proposal. It expects to

complete a pre-feasibility study in 2011.

-By Alex MacDonald, Dow Jones Newswires; 44 20 7842 9328;

alex.macdonald@dowjones.com

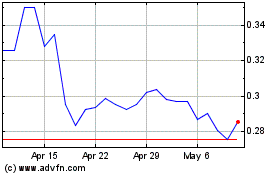

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

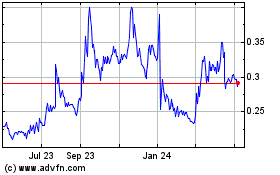

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Apr 2023 to Apr 2024