Alaska Gov Proposes Shipping Natural Gas Overseas Instead Of US

October 29 2011 - 6:15PM

Dow Jones News

Alaska Gov. Sean Parnell suggested Thursday that the state's oil

and natural gas producers should ship Alaska's natural gas overseas

rather than to the U.S.

Gov. Sean Parnell said that Japan and other Asian countries may

be a "better market for Alaska gas" and that he has suggested to

TransCanada Corp. (TRP) and the state's large oil producers that

they focus on building a natural gas export terminal, rather than a

long-distance pipeline to the contiguous U.S.

"If market demand for gas has truly shifted away from the Lower

48 [states] to Pacific Rim markets, then the state of Alaska must

also be willing to move with that, and we are," Parnell said,

speaking at an event in Anchorage held by the Alaska Oil and Gas

Association that was webcast.

In addition to TransCanada, Parnell said he has spoken about

building a natural gas export terminal to representatives of Exxon

Mobil Corp. (XOM), BP PLC (BP.LN, BP) and ConocoPhillips (COP).

Parnell's comments come as U.S. and Canadian natural gas

companies reposition themselves to export gas from North America to

fast-growing markets in Asia and Europe, rather than import gas, as

U.S. gas prices have plunged due to ample supply and slow-growing

U.S. demand.

In one of the first North American gas export deals, Cheniere

Energy Inc. (LNG) signed an $8 billion agreement Wednesday with

U.K.-based BG Group PLC (BG.LN) to sell liquefied natural gas from

a facility in Louisiana. In May, Cheniere obtained a key federal

approval it needs to expand the Louisiana terminal, currently used

for importing gas, to include a facility that could export up to 2

billion cubic feet of gas a day.

Parnell said the current boom in natural gas production from

shale-rock formations in the U.S. and Japan's shift away from

nuclear power, toward gas-fired electricity generation, following

the March earthquake and tsunami that triggered a nuclear crisis

there, as major factors that have shifted the natural gas market

from the U.S. overseas.

TransCanada and Exxon have proposed building a $41 billion,

1,700-mile pipeline from Prudhoe Bay on Alaska's North Slope to

Alberta, Canada, that would connect with TransCanada's existing

pipeline system that carries gas into the U.S. The pipeline would

ship up to 4.5 billion cubic feet a day of gas and could be

expanded to carry 5.9 bcf a day.

TransCanada declined to comment specifically on Parnell's

proposal to switch the pipeline project to an export terminal, but

the company said it was having "regular conversations" with the

state.

"TransCanada is continuing its efforts to advance the Alaska

pipeline project to successfully transport North Slope gas to

market," the company said in a statement.

While the pipeline has received most of the attention, the

companies also have proposed an alternative plan to build an

800-mile pipeline to ship gas from the North Slope to southern

Alaska, where it would be liquefied for transport to Asia and other

foreign markets.

BP and ConocoPhillips had formed a rival joint venture, called

Denali, that had proposed building a $35 billion, 1,700-mile

pipeline from the North Slope to Alberta, but the companies

scrapped that plan last May.

TransCanada has a license and financial backing from the state

of Alaska, obtained during former Gov. Sarah Palin's

administration. The license includes a 10-year guarantee that locks

in tax rates for producers. Producers have complained about the

10-year term, saying it is too short, in part because it doesn't

match up with a pipeline commitment, which would likely be 20 years

or longer.

Denali's project didn't have state backing.

-By Cassandra Sweet, Dow Jones Newswires; 415-439-6468;

cassandra.sweet@dowjones.com

--Ed Welsch in Calgary contributed to this article

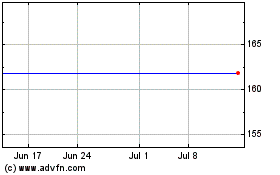

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

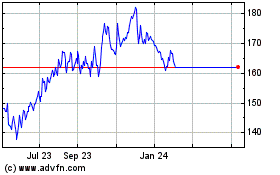

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024