The LGL Group, Inc. (NYSE MKT: LGL) (the “Company”), announced

results for the three and six months ended June 30, 2015.

Summary of Q2 2015 Results:

- Revenues of $5.5 million, a decrease of

6.5% compared to Q2 2014

- Gross margin of 32.7%

- Net loss of ($0.08) per diluted share

vs. ($0.49) per diluted share in Q2 2014

- Adjusted EBITDA of $0.2 million, a

year-over-year improvement of $0.7 million

- Backlog improves to $8.9 million at

6/30/2015 vs. $8.7 million at 3/31/2015

Total revenues for Q2 2015 were approximately $5.5 million, a

decrease of 6.5% compared to revenues of $5.9 million for the

comparable period in 2014. The Company reported a net loss of

($0.2) million, or ($0.08) per share for Q2 2015, compared with a

net loss of ($1.3) million, or ($0.49) per share for the comparable

period in 2014, which included a one-time non-cash restructuring

charge of ($0.4) million. Adjusted EBITDA, which excludes non-cash

stock-based compensation and one-time non-cash restructuring

charges, was $0.2 million, or $0.08 per share, for Q2 2015,

compared to a loss of ($0.5) million, or ($0.21) per share, for the

comparable period in 2014.

Total revenues for the six months ended June 30, 2015, were

approximately $10.9 million, a decrease of 9.2% compared to

revenues of $12.0 million for the comparable period in 2014. The

Company reported a net loss of (0.4) million, or ($0.14) per share

for the six months ended June 30, 2015, compared with a net loss of

($2.1) million, or ($0.80) per share for the comparable period in

2014, which included a one-time non-cash restructuring charge of

($0.4) million. Adjusted EBITDA, which excludes non-cash

stock-based compensation and one-time non-cash restructuring

charges, was $0.3 million, or $0.10 per share, for the six months

ended June 30, 2015, compared to a loss of ($1.4) million, or

($0.54) per share, for the comparable period in 2014.

Gross margin for Q2 2015 was 32.7%, which was an increase of 9.4

percentage points from 23.3% for the comparable period in 2014

which included an increase in accrued warranty expense of $344,000

related to two isolated product defects. Excluding the increase in

accrued warranty expense, the quarter over quarter improvement in

gross margin was primarily due to a favorable product mix and

continued margin improvement initiatives. Gross margin for the six

months ended June 30, 2015 was 33.0% compared to 24.7% for the

comparable period in 2014.

The Company’s Executive Chairman and CEO, Michael Ferrantino,

Sr., said, “While we have much to be pleased about with the

reduction in losses, positive EBITDA and increase in cash, we are

not content. The work ahead of us continues. We have begun to shift

our focus from rationalizing operations and our cost structure

towards growing the top line. More time is being spent to

understand our markets and develop value added products, which are,

and will continue to become, a larger portion of our backlog. As we

move away from low margin commodity products to more complex

assemblies, which tend to have a longer build cycle and higher

margins, we expect some short-term variability in the quantity of

shipments. Once this transition is complete and we load our

factories in an optimal way, we will see more consistency and

predictability in our shipments.”

Positive Cash Flows from Operations; Solid Capital

Position

Operating cash flows were positive for Q2 2015, with net cash

provided by operating activities of $302,000 for the quarter ended

June 30, 2015, compared to net cash used in operations of ($36,000)

for the quarter ended June 30, 2014.

Total cash and cash equivalents was $5.4 million, or $2.04 per

share, at June 30, 2015, compared to $5.2 million, or $1.99 per

share, at December 31, 2014. Adjusted working capital (accounts

receivable, net, plus inventory, net, less accounts payable) was

down slightly to $5.6 million as of June 30, 2015, compared to $5.7

million as of December 31, 2014, which reflects the continuing

effort to manage working capital levels to operating activity.

The Company’s Chairman of the Board, Marc Gabelli, stated,

“While management continues to move the Company towards sustainable

growth, we are pleased to see the positive results from the many

initiatives implemented by management over the last year. With a

strong and unlevered balance sheet, including $5.4 million in cash,

a revolving credit facility, and positive operating cash flow, the

Company is positioned to invest in the right opportunities both

internally and externally.”

About The LGL Group, Inc.

The LGL Group, Inc., through its wholly-owned subsidiary

MtronPTI, manufactures and markets highly-engineered electronic

components used to control the frequency or timing of signals in

electronic circuits. These components ensure reliability and

security in aerospace and defense communications, synchronize data

transfers throughout the wireless and internet infrastructure, and

provide low noise and base accuracy for lab instruments.

Headquartered in Orlando, Florida, the Company has additional

design and manufacturing facilities in Yankton, South Dakota and

Noida, India, with local sales offices in Sacramento, California

and Hong Kong.

For more information on the Company and its products and

services, contact Patti Smith at The LGL Group, Inc., 2525 Shader

Rd., Orlando, Florida 32804, (407) 298-2000, or visit

www.lglgroup.com and www.mtronpti.com.

Caution Concerning Forward Looking Statements

This press release may contain forward-looking statements made

in reliance upon the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21 E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and can be identified by the use of

words such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

These forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to us and our current plans or

expectations, and are subject to a number of uncertainties and

risks that could significantly affect current plans, anticipated

actions and our future financial condition and results. Certain of

these risks and uncertainties are described in greater detail in

our filings with the Securities and Exchange Commission. We are

under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a

result of new information, future events or otherwise.

THE LGL GROUP, INC.

Condensed Consolidated Statements of

Operations - UNAUDITED

(Dollars in Thousands, Except Shares and

Per Share Amounts)

Three Months Ended

June 30,

Six Months Ended

June 30,

2015 2014 2015

2014 REVENUES $ 5,471 $ 5,850 $

10,875 $ 11,981 Cost and Expenses: Manufacturing cost

of sales 3,683 4,485 7,288 9,020 Engineering, selling and

administrative 2,121 2,246 4,081 4,656 Restructuring expense

— 397 — 397

OPERATING LOSS (333 ) (1,278 ) (494 ) (2,092 ) Other Income

(Expense): Interest expense, net (4 ) (8 ) (9 ) (16 ) Other income,

net 147 17 135 30

Total Other Income (Expense) 143 9

126 14 LOSS BEFORE INCOME TAXES

(190 ) (1,269 ) (368 ) (2,078 ) Income tax provision (11 )

— (11 ) —

NET LOSS

$ (201 ) $ (1,269 ) $ (379 ) $ (2,078 ) Weighted average number of

shares used in basic and diluted net loss per common share

calculation. 2,637,719 2,594,743

2,627,160 2,594,764

BASIC AND DILUTED NET LOSS PER

COMMON SHARE

$ (0.08 ) $ (0.49 ) $ (0.14 ) $ (0.80 )

THE LGL GROUP, INC.

Condensed Consolidated Balance Sheets –

UNAUDITED

(Dollars in Thousands)

June 30, December 31, 2015 2014

ASSETS Cash and cash equivalents $ 5,431 $ 5,192 Accounts

receivable, less allowances of $38 and $43, respectively 2,962

3,266 Inventories, net 3,765 4,198 Prepaid expenses and other

current assets 222 278 Total current assets

12,380 12,934 Property, plant and equipment, net 3,416 3,547

Intangible assets, net 502 528 Other assets, net 249

253 Total assets $ 16,547 $ 17,262 LIABILITIES AND STOCKHOLDERS’

EQUITY Total Liabilities 2,563 3,025 Stockholders’

Equity 13,984 14,237 Total Liabilities and

Stockholders’ Equity $ 16,547 $ 17,262

Reconciliations of GAAP to Non-GAAP Measures

To supplement our consolidated condensed financial statements

presented on a GAAP basis, the Company uses certain non-GAAP

measures, including Adjusted EBITDA, which we define as net income

(loss) adjusted to exclude depreciation and amortization expense,

interest income (expenses), provision (benefit) for income taxes

and stock-based compensation expense. We believe such non-GAAP

measures are appropriate to enhance an overall understanding of our

past financial performance and also our prospects for the future.

These adjustments to our GAAP results are made with the intent of

providing both management and investors a more complete

understanding of the underlying operational results and trends and

our marketplace performance. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for net earnings or diluted earnings per share prepared

in accordance with generally accepted accounting principles in the

United States.

Reconciliation of GAAP Loss Before Income

Taxes to Non-GAAP Adjusted EBITDA Income (Loss):

For the period ended June 30, 2015

(000’s, except shares and per

share amounts)

Three months Six months Net loss before income

taxes $ (190 ) $ (368 ) Add: Interest expense 4 9 Add: Depreciation

and amortization 207 435 Add: Non-cash stock compensation

174 187 Adjusted EBITDA $ 195 $ 263

Weighted average number of shares used in basic and

diluted EPS calculation 2,594,743 2,594,764

Adjusted EBITDA per share

$ 0.08 $ 0.10

For the period ended June 30, 2014

(000’s, except shares and per

share amounts)

Three months Six months Net loss before income

taxes $ (1,269 ) $ (2,078 ) Add: Interest expense 8 16 Add:

Depreciation and amortization 238 473 Add: Non-cash stock

compensation 96 186 Add: One-time restructuring expense 397

-- Adjusted EBITDA loss $ (530 ) $ (1,403 )

Weighted average number of shares used in basic and diluted

EPS calculation 2,594,743 2,594,764

Adjusted EBITDA loss per share

$ (0.21 ) $ (0.54 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150813006250/en/

The LGL Group, Inc.Patti Smith,

407-298-2000pasmith@lglgroup.com

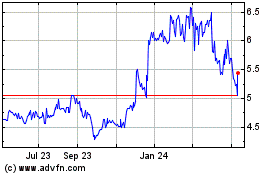

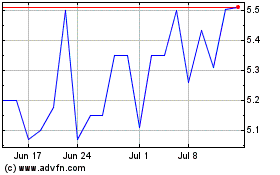

LGL (AMEX:LGL)

Historical Stock Chart

From Aug 2024 to Sep 2024

LGL (AMEX:LGL)

Historical Stock Chart

From Sep 2023 to Sep 2024