Form N-CSR - Certified Shareholder Report

October 06 2023 - 1:44PM

Edgar (US Regulatory)

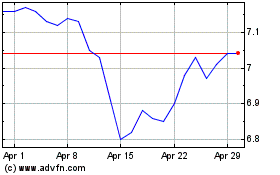

Nuveen Preferred and Inc... (NYSE:JPC)

Historical Stock Chart

From Jun 2024 to Jul 2024

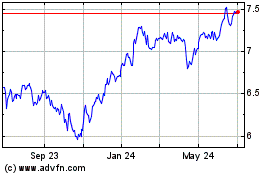

Nuveen Preferred and Inc... (NYSE:JPC)

Historical Stock Chart

From Jul 2023 to Jul 2024