0001437925false00014379252024-05-092024-05-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 9, 2024

Golden Matrix Group, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 001-41326 | | 46-1814729 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (IRS Employer Identification No.) |

3651 Lindell Road, Suite D131

Las Vegas, NV 89103

(Address of principal executive offices)(zip code)

Registrant’s telephone number, including area code: (702) 318-7548

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.00001Par Value Per Share | | GMGI | | The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 9, 2024, the Board of Directors of Golden Matrix Group, Inc. (the “Company,” “Golden Matrix”, “we,” “our,” or “us”), with the recommendation of the Compensation Committee of the Board of Directors of the Company, approved the grant of:

(a) 250,000 Restricted Stock Units (“RSUs”), to Zoran Milošević, who serves as Chief Executive Officer of each of the Company’s recently acquired subsidiaries, Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia; Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro; Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta; and Meridian Gaming (Cy) Ltd, a company formed and registered in the republic of Cyprus (collectively, the “Meridian Companies”);

(b) 125,000 RSUs to Snežana Božović, the Corporate Secretary of the Meridian Companies; and

(c) 50,000 RSUs to William Scott, the Chairman of the Board of Directors of Company.

The RSUs granted to Mr. Milošević and Ms. Božović, were issued in consideration for services rendered as employees of the Meridian Companies and the RSUs granted to Mr. Scott were issued in consideration for services rendered to the Board of Directors. Each of the grants (and the Employee RSU grants discussed below) were required pursuant to the terms of that certain Sale and Purchase Agreement of Share Capital originally entered into on January 12, 2023 (as amended from time to time, the “Purchase Agreement”), pursuant to which the Company acquired the Meridian Companies effective April 1, 2024, from Aleksandar Milovanović, Mr. Milošević and Ms. Božović (collectively, the “Sellers”).

The RSUs described above vest at the rate of 1/2 of such RSUs based on (1) the Company meeting certain revenue, and (2) Adjusted EBITDA targets for the year ended December 31, 2024, as discussed below, to be settled in shares of common stock. Specifically, the RSUs vest, to the extent and in the amounts set forth below, to the extent the following performance metrics are met by the Company as of the dates indicated, and to the extent such persons are still providing services to the Company or the Meridian Companies on the applicable vesting dates:

| | Revenue Targets | | | Adjusted EBITDA Targets | |

Performance Period | | Target Goal | | | RSUs Vested | | | Target Goal | | | RSUs Vested | |

Year ended December 31, 2024 | | $ | 48,591,457 | | | | (1 | ) | | $ | 2,637,004 | | | | (1 | ) |

(1) The total RSUs vested for the revenue and Adjusted EBITDA targets will vary by recipient as follows: (A) William Scott (25,000 RSUs will vest upon meeting each of the revenue and Adjusted EBITDA targets (50,000 in total); (B) Zoran Milošević (125,000 RSUs will vest upon meeting each of the revenue and Adjusted EBITDA targets (250,000 in total); and (C) Snežana Božović (62,500 RSUs will vest upon meeting each of the revenue and Adjusted EBITDA targets (125,000 in total).

For purposes of the calculations above, (a) “Adjusted EBITDA” means net income before interest, taxes, depreciation, amortization and stock-based compensation; and (b) “Revenue” means annual revenue of the Company. Both Revenue and EBITDA, and the determination of whether or not the applicable Revenue and EBITDA targets above have been met are to be determined based on the audited financial statements of the Company filed with the Securities and Exchange Commission in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and determined on the date such Annual Report is filed publicly with the Securities and Exchange Commission (the “Date of Determination”). The Revenue and Adjusted EBITDA targets for 2024 discussed above are defined herein as the “2024 Revenue and Adjusted EBITDA Targets”.

The Company also entered into a Restricted Stock Grant Agreement with each of the RSU recipients above to evidence such grants of the RSUs.

The RSUs discussed above, and Employee RSUs discussed below (collectively, the “Meridian RSUs”), were granted pursuant to, and subject in all cases to, the terms of the Company’s 2022 Equity Incentive Plan. The Company had originally anticipated making the grants under the recently approved 2023 Equity Incentive Plan; however, as the Company has not yet filed a Form S-8 Registration Statement in connection with such 2023 Equity Incentive Plan, the Board of Directors decided to make the grants under the 2022 Equity Incentive Plan instead. Notwithstanding the above, the Board of Directors anticipates taking action prior to the next automatic increase of available shares under the 2023 Equity Incentive Plan, which will occur on April 1, 2025 pursuant to the terms of that plan, to reduce the automatic increase which would have otherwise occurred on April 1, 2025 in the amount of 5 million shares, by the total number of Meridian RSUs which were granted and remain outstanding as of such date.

Also on May 9, 2024, the Board of Directors, with the recommendation of the Compensation Committee of the Board of Directors approved the grant of RSUs to 67 employees of the Meridian Companies (including Ms. Božović, who received an additional time based grant of 75,000 RSUs) in consideration for services rendered to the Meridian Companies (the “Employee RSUs”). The Employee RSUs were granted under the Company’s 2022 Equity Incentive Plan, and are subject to time based vesting with vesting periods of between two and four years, with such applicable RSUs vesting in equal amounts every six months over such vesting periods. The RSUs granted to Ms. Božović vest in eight equal six month installments.

Finally, on May 9, 2024, the Board of Directors approved the amendment of the following unvested RSUs, so that such unvested RSUs will vest, if at all, at the rate of ½ of such RSUs upon the Company meeting the 2024 Revenue and Adjusted EBITDA Targets as of December 31, 2024, respectively, to be determined as of the Date of Determination (which unvested RSUs previously provided for vesting as of October 31, 2024, but as a result of the Company’s change in fiscal year from October 31st to December 31st, no filing for the period ended October 31, 2024 will be made):

Recipient | Position with Company | Number of RSUs Remaining Outstanding and Unvested |

Anthony Brian Goodman | President, Chief Executive Officer (Principal Executive Officer), Secretary, Treasurer, and Chairman of the Board of Directors | 250,000 |

Weiting ‘Cathy’ Feng | Chief Operating Officer and Director of the Company | 125,000 |

Murray G. Smith | Director | 50,000 |

Thomas E. McChesney | Director | 50,000 |

| | 475,000 |

The Company plans to enter into a First Amendment to RSU Award Agreement with each of the above individuals to evidence and document the amendments.

The descriptions of the RSUs and Restricted Stock Grant Agreements above are not complete and are qualified in their entirety to the full text of the form of Restricted Stock Grant Agreements and First Amendment to RSU Award Agreement, a copy of which are filed as Exhibits 10.1 through 10.3 hereto, and are incorporated into this Item 5.02 by reference in their entity.

Item 8.01. Other Events.

The description of the RSUs granted to William Scott and the Employee RSUs, each as set forth in Item 5.02 above, is incorporated by reference into this Item 8.01 in its entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

* Filed herewith.

*** Indicates management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| GOLDEN MATRIX GROUP, INC. | |

| | |

Date: May 10, 2024 | By: | /s/ Anthony Brian Goodman | |

| | Anthony Brian Goodman | |

| | Chief Executive Officer | |

nullnullnull

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

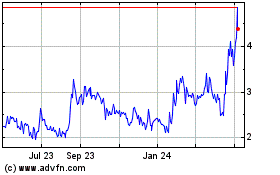

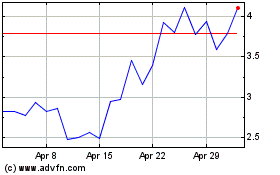

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Oct 2024 to Oct 2024

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Oct 2023 to Oct 2024