Advertising revenue: €1,137.4 m,

up 16.0%

Profit from recurring operations (EBITA):

€346.7 m, up 28.0%

Net profit: €280.8 m

Operating margin: 24.9% (23.5% excluding

non-recurring items)

Regulatory News:

M6 Metropole Television (Paris:MMT):

(€ millions)

2021

2020

% change

2019

% change Consolidated revenue1

1 390,4

1 273,6

+9,2%

1 456,1

-4,5%

Group advertising revenue

1 137,4

980,5

+16,0%

1 107,9

+2,7% - of which TV advertising revenue

975,0

829,5

+17,5%

930,4

+4,8% - of which other advertising revenue

162,5

151,0

+7,6%

177,5

-8,5%

Group non-advertising revenue

252,9

293,1

-13,7%

348,2

-27,4%

Consolidated profit from recurring operations

(EBITA)2

346,7

270,7

+28,0%

284,4

+21,9% Operating margin from recurring operations

24,9%

21,3%

+3,7pp

19,5%

+5,4pp Capital gains and losses on asset disposals

55,2

123,5

-55,3%

1,0

n.a Operating income and expenses related to business

combinations

(11,3)

(13,2)

+14,1%

(10,5)

-7,6%

Operating profit (EBIT)

390,5

381,0

+2,5%

274,9

+42,1% Net financial income/(expense)

(1,4)

(4,9)

n.a

(4,6)

n.a Share of profit/(loss) of joint ventures and associates

(30,9)

(11,1)

n.a

4,5

n.a Income tax

(77,4)

(88,5)

+12,5%

(101,5)

+23,7%

Net profit from continuing operations

280,8

276,6

+1,5%

173,3

+62,1% Net profit/(loss) from discontinued operations

0,0

0,0

n.a

(1,4)

n.a

Net profit for the period

280,8

276,6

+1,5%

171,9

+63,4% Net profit for the period - Group share

280,9

276,7

+1,5%

171,9

+63,4%

In 2021, M6 Group achieved consolidated revenue of €1,390.4

million, up 9.2% or €116.8 million compared with 2020.

Multimedia advertising revenues increased 16.0% (up

€157.0 million) and exceeded their pre-pandemic levels (by 2.7%),

reaching record highs and demonstrating the appeal of the Group’s

media, notably Television, against a backdrop of economic recovery

and stronger consumer spending. TV advertising revenues (live and

on-demand) grew 17.5% in relation to 2020 and 4.8% in relation to

2019.

Restated for changes in the consolidation scope (Home Shopping

Service and iGraal contributed to revenues in 2020),

non-advertising revenues increased by 7.7% (up €18.1

million).

Consolidated profit from recurring operations (EBITA)

totalled €346.7 million, an increase of 28.0% (up €75.9

million) in relation to 2020, reflecting the growth in

advertising revenues and the continued strict control of

programming and structure costs. It includes €20.2 million in

exceptional government support granted in 2020, €7.1 million in

compensation relating to the favourable ruling by the law court –

the Tribunal Judiciaire de Paris, in the dispute with Molotov, as

well as €8.5 million in non-recurring costs relating to the

proposed merger between M6 and TF1. Excluding these non-recurring

items, M6 Group EBITA reached a record high, standing at €327.8

million (vs. €270.7 million in 2020 and €284.4 million in

2019).

The Group’s operating margin stood at 24.9% (23.5%

excluding non-recurring items), compared with 21.3% in 2020 and

19.5% in 2019.

The Group recorded a revaluation capital gain of €52.4 million

following its acquisition of a majority shareholding in Stéphane

Plaza Immobilier. The acquisition of 2% of the share capital on 31

December 2021 effectively valued this company at €125 million.

In addition, in 2021 the Group continued to strengthen its

investments in streaming technologies, by financing its share of

the losses in Salto (SVOD service) and Bedrock (development of

technical streaming platforms), which explains the increase in

losses recorded by the equity-accounted companies.

The income tax charge for the year benefited from a favourable

settlement in relation to the 2020 financial year and the fall in

the corporation tax rate.

Net profit for the period totalled €280.8 million and

reached a record high, excluding the 2006 financial year which was

notable for the sale of TPS (capital gains of €256.8 million).

In accordance with IFRS 8, the segment reporting of the Group is

based on 4 operating segments, whose contribution to consolidated

revenue and EBITA was as follows:

9 months Q4 FY (€ millions)

2021

2020

%

2019

%

2021

2020

%

2019

%

2021

2020

%

2019

% TV

745,1

597,8

+24,6%

695,2

+7,2%

346,6

330,1

+5,0%

318,4

+8,9%

1 091,8

927,9

+17,7%

1 013,6

+7,7% Radio

106,3

97,1

+9,4%

118,5

-10,3%

50,8

49,5

+2,6%

52,5

-3,2%

157,1

146,6

+7,1%

171,0

-8,1%

Production & Audiovisual Rights

42,5

46,1

-7,9%

52,1

-18,5%

18,1

16,2

+11,8%

23,0

-21,2%

60,6

62,4

-2,8%

75,1

-19,3%

Other diversification

58,3

114,4

-49,0%

143,1

-59,3%

21,6

21,3

+1,0%

53,0

-59,3%

79,9

135,8

-41,2%

196,1

-59,3%

Other revenue

0,7

0,6

+25,0%

0,2

n.a

0,3

0,3

+2,3%

0,1

n.a

1,0

0,9

+17,6%

0,3

n.a

Consolidated revenue

953,0

856,1

+11,3%

1 009,1

-5,6%

437,4

417,5

+4,8%

446,9

-2,1%

1 390,4

1 273,6

+9,2%

1 456,1

-4,5%

TV

-

-

-

-

-

-

-

-

286,2

225,6

+26,9%

223,6

+28,0% Radio

-

-

-

-

-

-

-

-

35,8

21,9

+63,6%

30,1

+18,9% Production & Audiovisual Rights

-

-

-

-

-

-

-

-

16,4

13,8

+19,6%

14,8

+10,9% Other diversification

-

-

-

-

-

-

-

-

11,1

13,0

-14,3%

25,3

-56,0%

Eliminations and unallocated revenues

-

-

-

-

-

-

-

-

(2,9)

(3,4)

+16,0%

(9,4)

+69,5%

Consolidated profit from recurring operations (EBITA)

223,5

138,3

+61,5%

182,4

+22,5%

123,2

132,4

-7,0%

102,0

+20,9%

346,7

270,7

+28,0%

284,4

+21,9%

*

* *

Television

Individual TV viewing time remained at a high level in 2021,

standing at 3 hours 41 minutes per day on average3.

In 2021, M6 Group’s four free-to-air channels consolidated their

power and attracted an average 25.1 million viewers per day.

They recorded a 14.3% audience share amongst over 4s (down 0.3

pp vs. 2020) and 22.8% on the commercial target of women

under 50 responsible for purchases (up 0.1 pp):

M6 remained the second most popular national channel

amongst WRP<50, with an audience share that grew 0.3 pp,

reaching 14.7%.

A notable achievement for the channel was its progression in the

strategic primetime slot to a healthy level on the

commercial target (18.6%, up 1.3 pp). It recorded many successes,

helping its leading entertainment brands (La France a un Incroyable

Talent, Le Meilleur Pâtissier, Top Chef, L’Amour est dans le pré,

etc.) to grow, while leveraging its ability to show events-based

programmes (11 Euro 2020 matches, including the final, Chernobyl,

Appel à témoins, Legacy, etc.).

In access primetime, M6 has achieved a nine year high

with audiences under 50, recording a 15.6% audience share. The

channel benefited from the relevance of its programme scheduling

and the success of Scènes de ménages, the most popular daily drama

in France.

W9 consolidated its position as the second largest DTT

channel on the commercial target, with a stable audience share of

3.8%. Its programmes include some of the most popular reality TV,

drama and magazine brands in its space and it is also the channel

that offers the most sport, broadcasting more than 52 hours in

2021.

6ter remained the leading new generation DTT channel on

the commercial target (2.6% audience share), thanks to its varied

range of programmes for the whole family.

Gulli, the leading children’s channel for 4-10 year olds,

posted growth amongst its target audience in daytime (6am – 8pm)

with its audience share standing at 15.3%, a year-on-year increase

of 0.5 pp.

By continuing its development in AVOD with a range of exclusive

programmes, 6play’s appeal continued to grow in 2021. As

such, the platform recorded 28.5 million active users and 530

million hours viewed last year.

Following the upturn seen in the first half-year, the TV

advertising market continued on this positive trajectory until the

end of the year, as a result of sustained consumer spending,

notably during the key festive period. Against this backdrop, the

TV division’s advertising revenues increased 17.5%

(up €145.5 million) in 2021, including a 4.4% rise in the fourth

quarter and exceeding 2019 levels.

TV programming costs stood at €516.6 million, compared

with €433.7 million in 2020 (meaning a year-on-year increase of

€82.9 million) and €501.3 million in 2019. The Group resumed its

investments in programmes, notably with the broadcast of the UEFA

Euro 2020 Final and numerous new dramas over the second half of the

year, while continuing to optimise management of its various

schedules.

The TV division’s EBITA totalled €286.2 million, compared

with €225.6 million in 2020 (representing an increase of €60.6

million), including €14.5 million in non-recurring items.

Margin from recurrent operations for the Group’s core

business stood at 24.9% excluding non-recurring items (compared

with 24.3% in 2020 and 22.1% in 2019).

Radio

During 2021, radio continued to be very popular with the French

population, attracting more than 40 million listeners each

day, with a still significant daily listening time of 2 hrs 43

mins4.

Over the latest November-December 2021 wave, the Radio Division

consolidated its status as France’s leading private radio

group with an audience share of 18.5% among listeners aged 13

and over (up 0.2 pp). Its stations attract more than 10 million

listeners each day.

RTL, the leading private radio station in France, saw its

audience share grow by 0.7 pp to 13.3%, the second highest in its

history.

RTL2, which recorded its best ever year, achieved an

audience share of 2.7% in November-December 2021.

Fun Radio, which gained 207,000 listeners in a year,

recorded an audience share of 2.5%.

The Radio division, which continued to invest in producing

content for on-demand listening, is France’s leading private

podcast group. The flagship show Les Grosses Têtes was the top

podcast in France, with 17.3 million listens in one month5.

In 2021, the Group’s revenues from the Radio division

totalled €157.1 million, an increase of 7.1% (including 2.6% in

the fourth quarter) in comparison with the 2020 financial year,

driven by the recovery in advertising spend.

EBITA was €35.8 million, compared with €21.9 million in

2020. It includes €3.4 million in exceptional government support

(audiovisual tax credit + broadcast support grant).

The Radio division’s margin from recurring operations stood

at 20.6% excluding non-recurring items, compared with 14.9% in

2020 and 17.6% in 2019. This performance reflects the optimisation

of its costs and the synergies developed with the Group’s other

divisions.

Production and audiovisual rights

Revenue from the Production and Audiovisual Rights division

stood at €60.6 million in 2021, a year-on-year decline of

2.8%.

EBITA was €16.4 million, compared with €13.8 million in

2020.

During a year that continued to be affected by public health

restrictions (legal closure of cinemas in the first half-year,

health pass in the second, etc.), the films distributed by

SND totalled 6.2 million admissions6. Adapted from M6’s

popular comedy series, Kaamelott: Premier volet achieved 2.7

million admissions, making it the most successful French film last

year.

Thanks in particular to this success, SND was the leading French

film distributor in 2021.

Diversification

Excluding changes to the consolidation scope, Diversification

revenues and EBITA recorded year-on-year growth, driven in

particular by the improvement in the activity of M6 Digital

Services’ special interest websites (CuisineAZ.com,

PasseportSanté.net, Turbo.fr, etc.).

It should be noted that iGraal and Home Shopping Service, which

were deconsolidated in 2020, contributed €58.3 million to revenues

and €3.1 million to EBITA in the same year.

Since the contribution and merger of iGraal in 2020, the Group

has been the leading shareholder in Global Savings Group (with

42%), the European leader in couponing and cashback which posted

strong growth in 2021.

Financial position

The Group had shareholders’ equity of €1,156.4 million at

31 December 2021, compared with €1,060.3 million at 31 December

2020.

The Group had a positive net cash position, standing at

€248.4 million7, compared with €87.2 million at 31 December

2020, thus reflecting the cash generation from the Group’s

operating activities and the payment of a dividend of €189.4

million (i.e. €1.50 per share) for the 2020 financial year.

Dividend

Against this background, at the Combined General Meeting called

for 26 April 2022 the Executive Board will propose the payment of a

dividend of €1.00 per share. The ex-dividend date will be 4 May and

dividends will be paid on 6 May 2022.

Governance

At its meeting of 15 February 2022, the Supervisory Board

approved the agenda for the next General Meeting, which notably

includes:

- the amendment of the Articles of Association to increase the

age limit for holding responsibilities on the Executive Board to 75

years. This provision will enable Nicolas de TAVERNOST to

continue his term of office as Chairman of the Executive Board;

- the renewal of the terms of office of 4 members of the

Supervisory Board: Bj�rn BAUER, CFO of RTL Group, Marie

CHEVAL, independent member and CEO and Chair of Carmila,

Nicolas HOUZÉ, independent member, member of the Executive

Board of Groupe Galeries Lafayette and CEO of both Galeries

Lafayette and BHV Marais, and Jennifer MULLIN, CEO of

Fremantle.

Outlook

Advertising activity is continuing on the right trajectory in

early 2022, against a public health backdrop that remains

uncertain, and with the upcoming French presidential election

period traditionally offering reduced visibility for the

advertising market.

In 2022, the Group plans to continue its work in developing its

streaming platforms, through both its AVOD (6play) and SVOD (Salto)

services. The expected impact of Salto on the Group’s net profits

in 2022 should be similar to that seen in 2021.

Lastly, the regulatory review of the proposed merger between TF1

Group and M6 Group is continuing in line with the schedule

announced.

Results will be presented to financial analysts

in a webcast starting at 6.30pm (CET), 15 February 2022, on the

Group’s website at www.groupem6.fr Details on how to access the

webcast are available at www.groupem6.fr/Finance Both the slideshow

and annual consolidated financial statements will be available

online at 6pm (CET), it being specified that the audit procedures

have been carried out and the Statutory Auditors’ report on the

financial statements is being prepared.

Next release: First quarter 2022 financial

information: 26 April 2022 before start of trading

M6 Métropole Télévision is listed on Euronext

Paris, Compartment A Ticker: MMT, ISIN Code: FR0000053225

1 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue includes TV

advertising revenue (advertising revenue of free-to-air channels

M6, W9, 6ter and Gulli, and the platforms 6play and Gulli Replay,

as well as the share of advertising revenue from pay channels), the

advertising revenue of radio stations RTL, RTL2 and Fun, and the

share of advertising revenue generated by diversification

activities (mainly Internet).

2 Profit from recurring operations (EBITA) is defined as

operating profit (EBIT) before amortisation and impairment of

intangible assets (excluding audiovisual rights) related to

acquisitions and capital gains and losses on the disposal of

financial assets and subsidiaries.

3 Source: Médiamétrie

4 Source: Médiamétrie

5 In December

6 Source: CBO Box Office

7 The net cash position does not take into account lease

liabilities resulting from the application of IFRS 16 – Leases from

1 January 2019

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220215005953/en/

INVESTOR RELATIONS Guillaume Couturié +33 (0)1 41 92 28

03 / guillaume.couturie@m6.fr

PRESS Paul Mennesson +33 (0)1 41 92 61 36

/ paul.mennesson@m6.fr

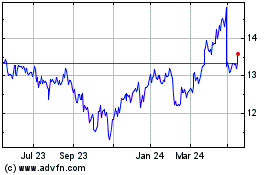

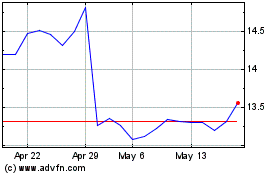

M6 Metropole Television (EU:MMT)

Historical Stock Chart

From Apr 2024 to May 2024

M6 Metropole Television (EU:MMT)

Historical Stock Chart

From May 2023 to May 2024