Azerion successfully places EUR 165 million of senior secured floating rate bonds

September 14 2023 - 10:17AM

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES OF AMERICA OR TO ANY U.S. PERSON (AS

DEFINED IN REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS

AMENDED (THE "U.S. SECURITIES ACT")) OR IN ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

Azerion successfully places EUR

165 million of senior secured floating

rate bonds

Amsterdam, 14

September 2023 – Azerion Group N.V. (the

“Company”) has, following a bookbuilding process,

successfully placed EUR 165 million of senior secured floating rate

bonds under a framework of EUR 300 million to qualified

institutional investors internationally (the “New

Bonds”). The New Bonds will have a 3-year tenor, will

carry a floating rate coupon of 3 months EURIBOR plus 6.75 per cent

per annum and were issued at 98.5 per cent of par.

Proceeds from the New Bonds in combination with

current cash holdings of the Company will be used to fully redeem

the Company’s outstanding EUR 200 million senior secured fixed rate

bonds (ISIN SE0015837794) (the “Existing Bonds”)

and to finance general corporate purposes of the Company, including

capital expenditure and transaction costs.

Ben Davey, CFO Azerion:

“We are delighted with the successful placement

of the New Bonds and the strong support we have received from

existing and new bond investors across the Nordics, Europe and the

U.S. Achieving this target milestone strengthens our balance sheet

and at the same time supports our continued focus on growing our

Platform and the execution of our consolidation and integration

strategy.”

Notice of redemption of the Existing Bonds is

expected to be sent to bondholders on 15 September 2023 for

redemption on 30 October 2023 at a price of 100.725 per cent of the

nominal amount plus accrued unpaid interest in accordance with the

terms and conditions of the Existing Bonds.

Settlement of the New Bonds is expected to take

place on 2 October 2023 (the "First Issue Date").

The Company shall use its best efforts to ensure that the New Bonds

will be listed on a Regulated Market within 60 days (with an

intention to complete such listing within 30 days) and on Frankfurt

Stock Exchange Open Market as soon as practically possible after

the First Issue Date.

Pareto Securities AB acted as Sole Bookrunner

and Roschier Advokatbyrå acted as legal advisor in connection with

the bond issue.

About Azerion

Founded in 2014, Azerion (EURONEXT: AZRN) is one

of Europe’s largest digital advertising and entertainment media

platforms. We bring global scaled audiences to advertisers in an

easy and cost-effective way, delivered through our proprietary

technology, in a safe, engaging, and high quality environment,

utilizing our strategic portfolio of owned and operated content

with entertainment and other digital publishing partners. Having

its roots in Europe and with its headquarters in Amsterdam, Azerion

has commercial teams based in over 26 cities around the world to

closely support our clients and partners to find and execute

creative ways to make a real impact through advertising.

For more information visit: www.azerion.com

Contact:Andrew BuckmanHead of

Investor Relationsir@azerion.com

Media

press@azerion.com

Disclaimer

This press release relates to the disclosure of

information that qualified, or may have qualified, as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

This communication does not constitute an offer to sell, or a

solicitation of an offer to buy, any securities or any other

financial instruments.

This communication does not constitute or form

part of any offer or invitation to sell or issue, or any

solicitation of any offer to purchase or subscribe for any New

Bonds or any other securities nor shall it (or any part of it) or

the fact of its distribution, form the basis of, or be relied on in

connection with or act as an inducement to enter into, any contract

or commitment whatsoever.

In particular, this communication does not

contain or constitute an offer of, or the solicitation of an offer

to buy or subscribe for, or form part of any offer, invitation or

solicitation to purchase, securities to any person located or

resident in the United States or to any U.S. Person (as defined in

Regulation S under the U.S. Securities Act). The securities

referred to herein have not been, and will not be, registered

pursuant to U.S. Securities Act or any securities laws in any state

or other jurisdiction in the United Sates and may not be offered,

sold, accepted, exercised, re-sold, renounced, transferred or

delivered, whether directly or indirectly, in the United States,

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the U.S. Securities

Act. No public offering of securities is being, has been, or will

be made in the United States.

This communication is made accessible on the

basis that any offers of securities referred to herein in any

Member State of the EEA will be made pursuant to an exemption under

the Prospectus Regulation from the requirement to publish a

prospectus for offers of such securities. The New Bonds have, with

respect to persons in Member States of EEA, only been offered to

persons who are qualified investors within the meaning of Article

2(1)(e) of the Prospectus Regulation and Section 1:1 of the Dutch

Financial Supervision Act. The expression "Prospectus Regulation"

means Regulation No. 1129/2017.

In the United Kingdom, the material is made

accessible on the basis that any offers of securities referred to

herein will be made pursuant to an exemption under the UK

Prospectus Regulation from the requirement to publish a prospectus

for offers of such securities. The New Bonds have, with respect to

persons in the United Kingdom, only been offered to persons who are

qualified investors within the meaning of Article 2(1)(e) of the UK

Prospectus Regulation. The expression “UK Prospectus Regulation”

means Regulation (EU) 2017/1129 as it forms part of retained EU law

as defined in the EU (Withdrawal) Act 2018.

The release, publication or distribution of the

material may be restricted by law and persons in such jurisdictions

in which a release, publication or distribution of the material

should therefore inform themselves about, and observe, any such

restrictions.

This press release may include projections and

other "forward-looking" statements within the meaning of applicable

securities laws. Any such projections or statements reflect the

current views of the Company about future events and financial

performance. No assurances can be given that such events or

performance will occur as projected and actual results may differ

materially from these projections.

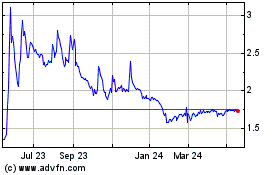

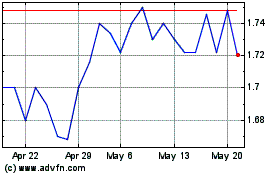

Azerion Group NV (EU:AZRN)

Historical Stock Chart

From Oct 2024 to Oct 2024

Azerion Group NV (EU:AZRN)

Historical Stock Chart

From Oct 2023 to Oct 2024