2nd UPDATE: Italy Gas Market Still Dominated By Eni -Regulator

July 14 2009 - 9:01AM

Dow Jones News

Italy's natural gas market is still dominated by

state-controlled company Eni SpA (E), limiting competition and

keeping prices high, said the country's energy regulator

Tuesday.

The Italian gas market needs new liquefied natural gas receiving

terminals and pipelines to offer alternatives to Eni sources, said

the energy regulator, Autorita per l'Energia Elettrica e Gas, or

AEEG, in its annual presentation to parliament.

One problem "is the continuation, especially in the gas sector,

of vertical players that hold dominant positions in the market,"

Alessandro Ortis, head of AEEG, said in his speech to

parliament.

The regulator also urged lawmakers to introduce measures to

split Snam Rete Gas SpA (SRG.MI), Italy's biggest gas grid by

lines, from Eni.

The Italian government controls Eni with a roughly 30.3% stake,

while Eni holds just more than 50% of Snam Rete Gas' capital,

according to filings published on securities regulator Consob's Web

site.

"The government and parliament have already intervened on the

issue [of Snam Rete Gas] with a different opinion" to that of the

AEEG, said Eni Chairman Roberto Poli on the sidelines of the

event.

Gas is particularly important to Italy as a large percentage of

its electricity is generated from the fossil fuel. Italy doesn't

have nuclear power and it coal-fires a small amount of power

plants.

Ortis said 54% of Italian electricity is generated from gas. New

energy infrastructure is limited by too many obstacles, especially

an authorization procedure which is too slow and fraught with

uncertainties, he said in his speech.

Italy's wholesale energy prices are higher than the European

average, although the gap is closing, said Ortis. Gas prices are

about 15% higher if taxes are included, he added.

There are Italian buyers, independent from the main sector

players, willing to acquire strategic energy infrastructure assets,

which would ease concerns about large foreign companies snapping

them up and entering the key sector, Ortis said.

Italy's incentives to the renewables sector may need to be

assessed as the bill faced by energy consumers mounts, said Ortis.

AEEG estimates these incentives will cost EUR3.2 billion in 2010,

or twice the current amount, and climb to EUR7 billion in 2020.

"We have indicated the opportunity to verify the sustainability

over time and a review of the incentives mechanisms" of the

renewables sector, he said.

The regulator also said oil prices are "excessively volatile,"

also due to a "certain type" of speculator. To combat this

volatility, Ortis proposes setting up a European oil exchange and

rules that boost transparency.

Regulator Web site: http://www.autorita.energia.it

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

(Guglielmo Valia, MF-Dow Jones, contributed to this

article.)

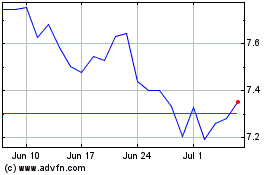

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From May 2024 to Jun 2024

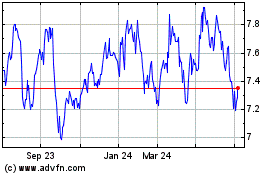

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From Jun 2023 to Jun 2024