Ukog, Hur, Hnt, Lgo rumors and more.

Hur tipped on 15/5/2015 at 16.50pps to buy. Hur is now 17.5pps to buy UP

Ukog I tipped on twitter at 1.1pps then again on 15/5/2015 2.645pps. Ukog is now 2.3pps to buy UP on first tip down on second

Hnt I tipped on twitter at 38pps and then again at 40pps. Hnt is now 46pps to buy and also gives dividends. UP

HUR

From the last few months we have found something fundamental about the trading chart pattern of HUR.

It has shown a very definite support of around the 14.5pps mark meaning that a buy under 14.5-15pps is a good entry.

It has shown also that the share price has legs for rising back up form its base and has done so four times already.

The share price has yet to recover after its fall during the oil price crash and as a result has potential for much more once oil price recovers fully.

HNT

HNT recently issued a script dividend at 41.975 pence. This was a great bonus for the current shareholders, currently it equates to a 4.025pps divi should you take your full allowance.

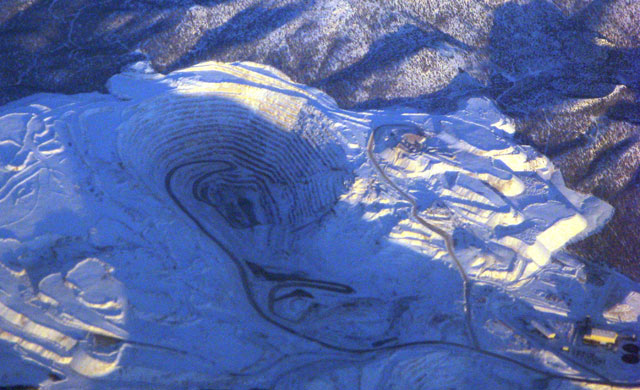

UKOG

UKOG almost hit 4pps after an update on HH-1 by Schlumberger on the 5/6/15. The price then ebbed back down after placement news landed. UKOG then released more news, this time about IOW and an extension of the offshore license.

On the 18/6/15 UKOG released news on HH-1 once again. This was from Nutech advising on the OIP figures. The P50 for (most commonly used for planning purposes) was 9245MMBO or in other words 9.245 billion barrels of oil. The effect on the share price was a temporary rise of 20%.

For some reason, Ukog is failing to hold its gains for long periods of time. This could be to do with the placements (although the price and dilution was fair) or to do with doubt of HH potential. Either way the likely hood is these are short term anchors and will not hold the price down for very long.

LGO

Lgo have started their drilling campaign again and are once again showing true skill and drive as they drill pads in record time and move onto the next pad faster than almost any other oil company I have seen. They have increased the oil sales capacity at the Goudron field from 2,750 barrels to over 12,000 barrels.

I fully expect that the flow tests from pad 4 will be some of the best so far and that many other wells might soon be reduce choked increasing production further.

Rumors damaged the share price when an alleged leek of CPR figures landed, THIS RUMOR WAS NOT TRUE. I emailed and called the LGO team and confirmed that LGO had not prepared the CPR let alone leaked anything price sensitive. David Lengas later tweeted secondary confirmation.

One this is sure, Lgo’s share price will keep moving north bit by bit, finding new base support along the way. Keep watching and if your already invested then watch for the spikes and sell before the winter slump as this offers the best options to trade in out and back in for some lovely free shares.

As a foot note.

PHE has still not released news on the completion of the waste to energy unit.

What people thought was 30 days could have meant 30 week days i.e Monday – Friday.

Either way, news is very much imminent and most importantly PHE is constantly hunting for more contracts and will no doubt win plenty (10-15 I would say would be reasonable) over the next 12 months.

The money PHE could potentially make is astounding and I would strongly recommend keeping an eye on this undervalued gem.

That’s all for today, all the best to all my readers.

I hope you have all enjoyed this little update.

As always:

All in my opinion and not to be taken as fact nor advice.

Always seek professional advice before investing in any company.

Hot Features

Hot Features