The Scary Impact of Cybersecurity on the Financial Industry

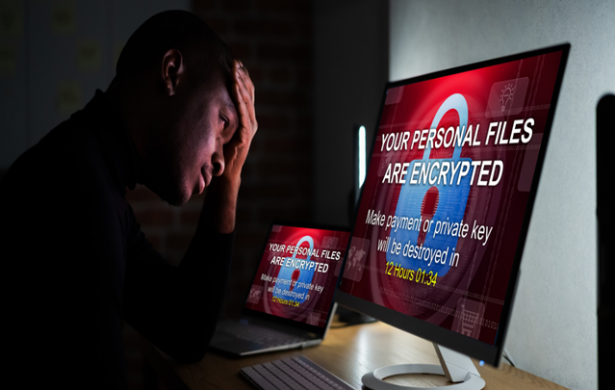

Cybersecurity is essential to maintaining protected and resilient operations for organizations of all sizes in the modern digital world. Cybersecurity threats are a significant threat not just to individual businesses but to the economy as a whole.

In the first quarter of 2022, the global total ransomware payout was more than 236 Million USD. And the total cost of cybercrime in 2022 was estimated 8.4 trillion USD(Source: statista).

An expert from RedNode(A Fast-growing Global Cybersecurity Services Provider) stated that cyber intrusions’ economic impact could be devastating, particularly for small and medium-sized enterprises. All businesses, regardless of scale, must take proactive measures to safeguard themselves.

Cybersecurity events can devastate the economy by disrupting business operations, resulting in financial losses, reputational damage, and disruption of business functions. Cybersecurity incidents may also result in the loss of sensitive data that can be utilized for fraud and other illegal acts, such as financial and personal information.

Several high-profile cybersecurity events have significantly impacted the economy in recent years. For instance, the 2017 Equifax data breach cost over $575 million to resolve and exposed the personal data of over 140 million individuals.

The ransomware attack on the 2021 Colonial Pipeline temporarily suspends a significant petroleum pipeline, emphasizing cybersecurity’s importance in vital infrastructure sectors. The event cost $4.4 million in ransom money, resulting in fuel shortages in numerous regions.

Cybersecurity events can also affect the economy by eroding customer confidence in e-commerce and online transactions. If customers worry that their financial and personal information is in danger, they could be reluctant to purchase online.

Governments and regulatory organizations are taking action to reduce these risks after realizing the enormous economic impact of cybersecurity disasters. For instance, the General Data Protection Regulation (GDPR) of the European Union imposes severe fines for data breaches and mandates the adoption of suitable cybersecurity measures by enterprises.

To decrease the economic impact of cybersecurity disasters, businesses need to proactively identify and remedy any vulnerabilities they discover. Implementing comprehensive cybersecurity solutions, conducting regular vulnerability assessments and penetration tests, and ensuring that staff employees are taught cybersecurity best practices are all ways to accomplish this goal.

Financial Industry is a Prime Target For Cyber Criminals

In this day and age of digital technology, the banking sector has emerged as a primary target for online fraudsters. Cyberattacks directed against financial institutions are getting more prevalent and sophisticated as time goes on. Attackers employ various strategies to steal critical information, disrupt operations, and extort money from their victims.

Because of the highly confidential nature of the information it maintains, the massive amount of financial transactions it performs, and the interconnection of the global financial system, the financial industry is particularly susceptible to cyber-attacks. Attacks on financial institutions carried out via cyberspace can have far-reaching repercussions, affecting not just the institution that was attacked but also the financial system in general and the economy as a whole.

Recent research conducted by the World Economic Forum identified the threat posed by cyber attacks as the primary concern for the global financial system. The study underscores the growing threat presented by cyber assaults to financial stability and asks for better collaboration between the public and private sectors to strengthen cybersecurity in the financial industry. The report also advocates for greater cooperation between the public and commercial sectors to enhance cybersecurity in the healthcare business.

Because of the potentially significant financial gains that may be made through successful assaults, the financial industry has long been a primary target for cybercriminals. Information regarding customers, records of financial transactions, and data from payment cards are some examples of critical data held by financial institutions. In the hands of cybercriminals, this information might be used to perpetrate fraud, steal money, or sell data on the dark web.

Cybercriminals may attack financial institutions for reasons of political or ideological motivation in addition to financial gain. It’s possible that hacktivist groups may attack financial institutions as a form of protest against perceived injustices or to push a political goal. Nation-state actors may also attack financial institutions for political or strategic objectives, such as to disrupt a rival nation’s economy or fund covert activities. This could be done for several different reasons.

Phishing scams, malware infections, distributed denial of service assaults, and threats from within are some of the online dangers that financial institutions must contend with. Hackers frequently employ phishing attacks to get login passwords and other sensitive information from consumers or employees of financial institutions. Infections with malware can be used to steal data, interfere with operations, or obtain control of systems for use in future attacks.

DDoS assaults are another prominent type of threat that financial institutions face. These attacks involve the deployment of massive networks of compromised devices by attackers in order to flood the servers of their targets with traffic and make them unavailable to legitimate users. Another significant security risk for financial institutions is posed by insider threats, which occur when employees or contractors use their access to critical information or systems to perpetrate fraud or sabotage.

To protect themselves against these dangers, financial institutions need to implement a comprehensive cybersecurity strategy that addresses both the technological and organizational aspects of the problem. Firewalls, anti-virus software, intrusion detection systems, and encryption technologies are all examples of technical steps that might be taken. Measures taken by an organization could include:

- Providing regular security training for staff.

- Establishing security rules and procedures.

- Formulating incident response plans.

In conclusion, businesses and governments alike must take cybersecurity incidents seriously because they can substantially impact the economy as a whole. Organizations may preserve their assets and contribute to the protection of the economy by investing in cybersecurity solutions and keeping abreast of the most recent threats and vulnerabilities.

Hot Features

Hot Features