UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2015

BORGWARNER INC.

________________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-12162 | | 13-3404508 |

State or other jurisdiction of | | Commission File No. | | (I.R.S. Employer |

Incorporation or organization | | | | Identification No.) |

|

| | |

3850 Hamlin Road, Auburn Hills, Michigan | | 48326 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (248) 754-9200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On October 29, 2015, BorgWarner Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purpose of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filings.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits are being furnished as part of this Report.

|

| |

Exhibit Number | Description |

| |

99.1 | Press release regarding earnings issued by BorgWarner Inc. dated October 29, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| BorgWarner Inc. |

| | |

Date: October 29, 2015 | By: | /s/ John J. Gasparovic |

| | Name: John J. Gasparovic |

| | Title: Secretary |

|

| |

EXHIBIT INDEX |

| |

Exhibit Number | Description |

| |

99.1 | Press release regarding earnings issued by BorgWarner Inc. dated October 29, 2015 |

|

|

Immediate Release |

Contact: Ken Lamb |

248.754.0884 |

BORGWARNER REPORTS THIRD QUARTER 2015 U.S. GAAP NET EARNINGS OF $0.70 PER DILUTED SHARE, OR $0.73 PER DILUTED SHARE EXCLUDING NON-COMPARABLE ITEMS

ADJUSTS FULL YEAR NET SALES AND NET EARNINGS GUIDANCE

Auburn Hills, Michigan, October 29, 2015 – BorgWarner Inc. (NYSE: BWA) today reported third quarter results.

Third Quarter Highlights:

| |

• | U.S. GAAP net sales of $1,884 million, down 7% compared with third quarter 2014. |

| |

◦ | Excluding the impact of foreign currencies, net sales were up 3% compared with third quarter 2014. |

| |

• | U.S. GAAP net earnings of $0.70 per diluted share. |

| |

◦ | Excluding the $(0.04) per diluted share impact of restructuring, the $(0.02) per diluted share impact of M&A expense and the $0.02 per diluted share impact of tax adjustments, net earnings were $0.73 per diluted share. |

| |

• | U.S. GAAP operating income of $237 million. |

| |

◦ | Excluding the $9 million pretax impact of restructuring expense and the $4 million pretax impact of M&A expense, operating income was $250 million, or 13.3% of net sales, up from 12.5% in third quarter 2014. |

2015 Guidance: The company has adjusted its 2015 full year guidance. Net sales growth is now expected to be within a range of -6.0% to -5.0% compared with 2014. Excluding the impact of foreign currencies, net sales growth is expected to be approximately 4.5%. Net earnings per share, excluding non-comparable items, is expected to be within a range of $2.95 to $3.00 per diluted share. Operating income, as a percentage of net sales, excluding non-comparable items, is expected to be approximately 13%.

Financial Results: Net sales were $1,884 million in third quarter 2015, down 7% from $2,032 million in third quarter 2014. Net earnings in the quarter were $157 million, or $0.70 per diluted share, compared with $167 million, or $0.73 per diluted share, in third quarter 2014. Third quarter 2015 net earnings included net non-comparable items of $(0.03) per diluted share. Third quarter 2014 net earnings included non-comparable items of $(0.06) per diluted share. These items are listed in a table below as reconciliations of non-U.S. GAAP measures, which are provided by the company for comparison with other results, and the most directly comparable U.S. GAAP measures. The impact of foreign currencies decreased net sales by approximately $214 million and decreased net earnings by approximately $0.08 per diluted share in third quarter 2015 compared with third quarter 2014.

Net sales were $5,900 million for the first nine months of 2015, down 7% from $6,313 million in the first nine months of 2014. Net earnings in the first nine months of 2015 were $484 million, or $2.14 per diluted share, compared with $516 million, or $2.25 per diluted share, in the first nine months of 2014. Net earnings in the first nine months of 2015 included net non-comparable items of $(0.12) per diluted share. Net earnings in the first nine months of 2014 included non-comparable items of $(0.25) per diluted share. These items are listed in a table below as reconciliations of non-U.S. GAAP measures, which are provided by the company for comparison with other results, and the most directly comparable U.S. GAAP measures. The impact of foreign currencies decreased net sales by approximately $684 million and decreased net earnings by approximately $0.26 per diluted share in the first nine months of 2015 compared with the first nine months of 2014.

The following table reconciles the company's non-U.S. GAAP measures included in the press release, which are provided for comparison with other results, and the most directly comparable U.S. GAAP measures:

|

| | | | | | | | | | | | | | | | |

Net earnings per diluted share | Third Quarter | | First Nine Months | |

| 2015 | | 2014 | | 2015 | | 2014 | |

| | | | | | | | |

Non – U.S. GAAP | $ | 0.73 |

| | $ | 0.79 |

| | $ | 2.26 |

| | $ | 2.50 |

| |

| | | | | | | | |

Reconciliations: | | | | | | | | |

Restructuring expense | (0.04 | ) | | (0.05 | ) | | (0.16 | ) | | (0.24 | ) | |

Merger and acquisition expense | (0.02 | ) | | — |

| | (0.02 | ) | | — |

| |

Gain on previously held equity interest | — |

| | — |

| | 0.05 |

| | — |

| |

Pension settlement | — |

| | (0.01 | ) | | — |

| | (0.01 | ) | |

Tax adjustments | 0.02 |

| | — |

| | 0.01 |

| | — |

| |

| | | | | | |

|

| |

U.S. GAAP | $ | 0.70 |

| * | $ | 0.73 |

| | $ | 2.14 |

| | $ | 2.25 |

| |

| | | | | | | | |

*Column does not add due to rounding | | | | | | | | |

Net cash provided by operating activities was $470 million in the first nine months of 2015 compared with $546 million in first nine months of 2014. Investments in capital expenditures, including tooling outlays, totaled $419 million in the first nine months of 2015, compared with $398 million in the first nine months of 2014. Balance sheet debt increased by $469 million and cash increased by $236 million at the end of third quarter 2015 compared with the end of 2014. The company's net debt to net capital ratio was 17.0% at the end of third quarter 2015 compared with 12.8% at the end of 2014.

Engine Segment Results: Engine segment net sales were $1,309 million in third quarter 2015 compared with $1,412 million in third quarter 2014. Excluding the impact of foreign currencies, primarily the Euro, net sales were up 4% from the prior year's quarter. Adjusted earnings before interest, income taxes and non-controlling interest ("Adjusted EBIT") were $212 million in third quarter 2015, down 5% from $223 million in third quarter 2014. Excluding the impact of foreign currencies, Adjusted EBIT was $233 million, up 4% from third quarter 2014.

Drivetrain Segment Results: Drivetrain segment net sales were $584 million in third quarter 2015 compared with $627 million in third quarter 2014. Excluding the impact of foreign currencies, primarily the Euro, net sales were up 2% from the prior year’s quarter. Adjusted EBIT was $70 million in third quarter 2015, up 3% from $68 million in third quarter 2014. Excluding the impact of foreign currencies, Adjusted EBIT was $76 million, up 12% from third quarter 2014.

Recent Highlights:

| |

• | BorgWarner produces S-Series turbochargers for Mercedes-Benz Actros heavy-duty trucks powered by its new engine, now produced in Brazil. BorgWarner received a 2014 Mercedes-Benz Brazil Supplier Award in the Innovation Technology category for its successful turbocharger launch for the new Mercedes-Benz Euro V engine families in South America. |

| |

• | BorgWarner celebrated its plant opening in Oroszlány, Hungary, on July 28, 2015. The wholly-owned campus provides production capacity for advanced all-wheel drive (AWD) solutions such as transfer cases, feeder pumps, valves and AWD couplings for global automakers. |

| |

• | BorgWarner produces 2-speed Torque-On-Demand® transfer cases for the recently launched Foton Motor’s Sauvana SUV. BorgWarner's Torque-On-Demand technology automatically redistributes torque from the rear wheels to the front wheels without driver intervention for improved traction, increased stability and enhanced dynamics. |

| |

• | BorgWarner received a 2015 General Motors Supplier IMPACT Award for demonstrating top performance in the Diversity Spend Percentage to Goal category and excelling in the Significantly Improved category. General Motors' annual Supplier IMPACT meeting highlighted strategic Tier 1 suppliers that have made a strong impact on their company’s supply chain with certified, diverse suppliers. BorgWarner ranked as one of General Motors' Top 20 Tier 1 suppliers for 2014. |

| |

• | BorgWarner received a 2014 World Excellence Award in the Aligned Business Framework category for exemplifying the Ford Motor Company’s principles of quality, value and innovation. During the 17th annual awards ceremony, Ford also presented BorgWarner’s facility in Rzeszów, Poland, with a Gold Award for consistently demonstrating superior quality, delivery and cost performance, ranking it in the top 5 percent of qualifying suppliers. |

| |

• | BorgWarner supplies silent engine timing chains for a wide variety of Yamaha vehicles, including motorcycles, snowmobiles, all-terrain vehicles, recreational off-highway vehicles and personal watercrafts. BorgWarner’s silent engine timing chains deliver low noise and proven durability. |

Recent Highlights (continued):

| |

• | BorgWarner supplies Eco-Launch™ stop/start accumulator technology and multi-segment wet friction plates for the new 8-speed rear-wheel drive automatic transmission (8L45) from General Motors. To enable the transmission’s stop/start functionality, BorgWarner’s Eco-Launch hydraulic accumulator and solenoid valve provide rapid, quiet and smooth engagements during engine restarts. BorgWarner’s advanced friction plate technology reduces drag and enhances shift feel. Improving fuel economy up to 5 percent compared with similar 6-speed automatic transmissions, the 8L45 transmission will debut on the 2016 Cadillac CT6 and will also drive the 2016 Cadillac CTS and ATS. |

| |

• | BorgWarner produces its mini direct-acting variable force solenoid (VFS) for the 2016 Chevrolet Volt, Chevrolet Malibu hybrid and Cadillac ELR as well as future General Motors (GM) vehicle applications powered by the same transmission. Designed to deliver increased accuracy with significantly lower leakage, the advanced solenoid reduces parasitic losses from the transmission oil pump, saving battery power to propel the vehicle. |

At 9:30 a.m. ET today, a brief conference call concerning 2015 third quarter results will be webcast at: http://www.borgwarner.com/en/Investors/default.aspx.

BorgWarner Inc. (NYSE: BWA) is a product leader in highly engineered components and systems for powertrains around the world. Operating manufacturing and technical facilities in 57 locations in 18 countries, the company delivers innovative powertrain solutions to improve fuel economy, reduce emissions and enhance performance. For more information, please visit borgwarner.com.

# # #

Statements contained in this news release may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act that are based on management’s current outlook, expectations, estimates and projections. Words such as “anticipates,” “believes,” “continues,” “could,” “designed,” “effect,” “estimates,” “evaluates,” “expects,” “forecasts,” “goal,” “initiative,” “intends,” “outlook,” “plans,” “potential,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “would,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and uncertainties include: the failure to complete or receive the anticipated benefits from BorgWarner’s acquisition of Remy International Inc. ("Remy"), the possibility that the parties may be unable to successfully integrate Remy’s operations with those of BorgWarner, that such integration may be more difficult, time-consuming or costly than expected, revenues following the transaction may be lower than expected, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, or suppliers) may be greater than expected following the transaction; the retention of key employees at Remy may not be achieved, the conditions to the completion of the transaction may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule, the failure to obtain Remy stockholder approval in a timely manner or otherwise, fluctuations in domestic or foreign vehicle production, the continued use by original equipment manufacturers of outside suppliers, fluctuations in demand for vehicles containing our products, changes in general economic conditions, as well as other risks noted in reports that we file with the Securities and Exchange Commission, including the Risk Factors identified in our most recently filed Annual Report on Form 10-K. We do not undertake any obligation to update or announce publicly any updates to or revision to any of the forward-looking statements.

|

| | | | | | | | | | | | | | | |

BorgWarner Inc. | | | | | | | |

Condensed Consolidated Statements of Operations (Unaudited) | | | | |

(millions, except per share amounts) | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Net sales | $ | 1,884.0 |

| | $ | 2,032.1 |

| | $ | 5,900.1 |

| | $ | 6,313.2 |

|

Cost of sales | 1,485.8 |

| | 1,607.6 |

| | 4,643.9 |

| | 4,970.1 |

|

Gross profit | 398.2 |

| | 424.5 |

| | 1,256.2 |

| | 1,343.1 |

|

|

| |

| |

| |

|

Selling, general and administrative expenses | 148.0 |

| | 174.5 |

| | 483.6 |

| | 529.5 |

|

Other expense, net | 13.1 |

| | 12.3 |

| | 33.4 |

| | 62.1 |

|

Operating income | 237.1 |

| | 237.7 |

| | 739.2 |

| | 751.5 |

|

|

| |

| |

| |

|

Equity in affiliates’ earnings, net of tax | (8.7 | ) | | (14.8 | ) | | (28.3 | ) | | (35.8 | ) |

Interest income | (2.0 | ) | | (1.4 | ) | | (5.3 | ) | | (4.3 | ) |

Interest expense and finance charges | 15.0 |

| | 9.0 |

| | 42.6 |

| | 26.2 |

|

Earnings before income taxes and noncontrolling interest | 232.8 |

| | 244.9 |

| | 730.2 |

| | 765.4 |

|

|

| |

| |

| |

|

Provision for income taxes | 66.9 |

| | 71.9 |

| | 219.2 |

| | 225.3 |

|

Net earnings | 165.9 |

| | 173.0 |

| | 511.0 |

| | 540.1 |

|

| | | | | | | |

Net earnings attributable to the noncontrolling interest, net of tax | 8.5 |

| | 6.4 |

| | 26.6 |

| | 24.2 |

|

Net earnings attributable to BorgWarner Inc. | $ | 157.4 |

| | $ | 166.6 |

| | $ | 484.4 |

| | $ | 515.9 |

|

| | | | | | | |

| | | | | | | |

Earnings per share — diluted | $ | 0.70 |

| | $ | 0.73 |

| | $ | 2.14 |

| | $ | 2.25 |

|

| | | | | | | |

Weighted average shares outstanding — diluted | 225.991 |

| | 228.668 |

| | 226.565 |

| | 229.222 |

|

| | | | | | | |

Supplemental Information (Unaudited) | | | | | | | |

(millions of dollars) | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Capital expenditures, including tooling outlays | $ | 133.8 |

| | $ | 140.6 |

| | $ | 418.8 |

| | $ | 397.9 |

|

| | | | | | | |

Depreciation and amortization: | | | | | | | |

Fixed assets and tooling | $ | 74.0 |

| | $ | 74.9 |

| | $ | 223.3 |

| | $ | 226.3 |

|

Intangible assets and other | 4.3 |

| | 6.9 |

| | 13.0 |

| | 20.7 |

|

| $ | 78.3 |

| | $ | 81.8 |

| | $ | 236.3 |

| | $ | 247.0 |

|

|

| | | | | | | | | | | | | | | |

BorgWarner Inc. | | | | | | | |

Net Sales by Reporting Segment (Unaudited) | | | | | | |

(millions of dollars) | | | | | | | |

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 1,308.9 |

| | $ | 1,412.4 |

| | $ | 4,102.8 |

| | $ | 4,322.0 |

|

Drivetrain | 583.7 |

| | 627.0 |

| | 1,821.8 |

| | 2,016.4 |

|

Inter-segment eliminations | (8.6 | ) | | (7.3 | ) | | (24.5 | ) | | (25.2 | ) |

Net sales | $ | 1,884.0 |

| | $ | 2,032.1 |

| | $ | 5,900.1 |

| | $ | 6,313.2 |

|

| | | | | | | |

| | | | | | | |

Adjusted Earnings Before Interest, Income Taxes and Noncontrolling Interest ("Adjusted EBIT") (Unaudited) |

(millions of dollars) | | | | | | | |

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 211.9 |

| | $ | 222.6 |

| | $ | 670.3 |

| | $ | 696.0 |

|

Drivetrain | 70.3 |

| | 68.0 |

| | 213.4 |

| | 237.6 |

|

Adjusted EBIT | 282.2 |

| | 290.6 |

| | 883.7 |

| | 933.6 |

|

Restructuring expense | 9.3 |

| | 13.1 |

| | 41.3 |

| | 67.6 |

|

Merger and acquisition expense | 3.9 |

| | — |

| | 3.9 |

| | — |

|

Gain on previously held equity interest | — |

| | — |

| | (10.8 | ) | | — |

|

Pension settlement | — |

| | 2.7 |

| | — |

| | 2.7 |

|

Corporate, including equity in affiliates' earnings and stock-based compensation | 23.2 |

| | 22.3 |

| | 81.8 |

| | 76.0 |

|

Interest income | (2.0 | ) | | (1.4 | ) | | (5.3 | ) | | (4.3 | ) |

Interest expense and finance charges | 15.0 |

| | 9.0 |

| | 42.6 |

| | 26.2 |

|

Earnings before income taxes and noncontrolling interest | 232.8 |

| | 244.9 |

| | 730.2 |

| | 765.4 |

|

Provision for income taxes | 66.9 |

| | 71.9 |

| | 219.2 |

| | 225.3 |

|

Net earnings | 165.9 |

| | 173.0 |

| | 511.0 |

| | 540.1 |

|

Net earnings attributable to the noncontrolling interest, net of tax | 8.5 |

| | 6.4 |

| | 26.6 |

| | 24.2 |

|

Net earnings attributable to BorgWarner Inc. | $ | 157.4 |

| | $ | 166.6 |

| | $ | 484.4 |

| | $ | 515.9 |

|

|

| | | | | | | |

BorgWarner Inc. | | | |

Condensed Consolidated Balance Sheets (Unaudited) |

(millions of dollars) | | | |

| | | |

| September 30,

2015 | | December 31,

2014 |

Assets | | | |

| | | |

Cash | $ | 1,033.3 |

| | $ | 797.8 |

|

Receivables, net | 1,551.5 |

| | 1,443.5 |

|

Inventories, net | 523.1 |

| | 505.7 |

|

Other current assets | 193.1 |

| | 223.8 |

|

Total current assets | 3,301.0 |

| | 2,970.8 |

|

| | | |

Property, plant and equipment, net | 2,185.2 |

| | 2,093.9 |

|

Other non-current assets | 2,200.9 |

| | 2,163.3 |

|

Total assets | $ | 7,687.1 |

| | $ | 7,228.0 |

|

| | | |

Liabilities and Equity | | | |

| | | |

Notes payable and other short-term debt | $ | 74.6 |

| | $ | 623.7 |

|

Accounts payable and accrued expenses | 1,436.6 |

| | 1,530.3 |

|

Income taxes payable | 28.6 |

| | 14.2 |

|

Total current liabilities | 1,539.8 |

| | 2,168.2 |

|

| | | |

Long-term debt | 1,734.5 |

| | 716.3 |

|

Other non-current liabilities | 624.9 |

| | 652.6 |

|

| | | |

Total BorgWarner Inc. stockholders’ equity | 3,717.0 |

| | 3,616.2 |

|

Noncontrolling interest | 70.9 |

| | 74.7 |

|

Total equity | 3,787.9 |

| | 3,690.9 |

|

Total liabilities and equity | $ | 7,687.1 |

| | $ | 7,228.0 |

|

|

| | | | | | | |

BorgWarner Inc. | | | |

Condensed Consolidated Statements of Cash Flows (Unaudited) |

(millions of dollars) | | | |

| | | |

| Nine Months Ended

September 30, |

| 2015 | | 2014 |

Operating | | | |

Net earnings | $ | 511.0 |

| | $ | 540.1 |

|

Non-cash charges (credits) to operations: | | | |

Depreciation and amortization | 236.3 |

| | 247.0 |

|

Restructuring expense, net of cash paid | 19.9 |

| | 44.2 |

|

Gain on previously held equity interest | (10.8 | ) | | — |

|

Deferred income tax provision | 26.8 |

| | 44.8 |

|

Other non-cash items | 21.7 |

| | 13.8 |

|

Net earnings adjusted for non-cash charges to operations | 804.9 |

| | 889.9 |

|

Changes in assets and liabilities | (334.7 | ) | | (343.7 | ) |

Net cash provided by operating activities | 470.2 |

| | 546.2 |

|

| | | |

Investing | | | |

Capital expenditures, including tooling outlays | (418.8 | ) | | (397.9 | ) |

Payments for businesses acquired, net of cash acquired | (12.6 | ) | | (106.4 | ) |

Proceeds from asset disposals and other | 3.4 |

| | 3.2 |

|

Net cash used in investing activities | (428.0 | ) | | (501.1 | ) |

| | | |

Financing | | | |

Net (decrease) increase in notes payable | (531.0 | ) | | 369.9 |

|

Additions to long-term debt, net of debt issuance costs | 1,027.5 |

| | 107.8 |

|

Repayments of long-term debt, including current portion | (22.4 | ) | | (422.7 | ) |

Payments for purchase of treasury stock | (130.3 | ) | | (90.0 | ) |

Proceeds from stock options exercised, including the tax benefit | 15.1 |

| | 16.2 |

|

Taxes paid on employees' restricted stock award vestings | (13.1 | ) | | (23.5 | ) |

Dividends paid to BorgWarner stockholders | (87.9 | ) | | (86.8 | ) |

Dividends paid to noncontrolling stockholders | (18.4 | ) | | (20.4 | ) |

Net cash provided by (used in) financing activities | 239.5 |

| | (149.5 | ) |

| | | |

Effect of exchange rate changes on cash | (46.2 | ) | | (52.3 | ) |

| | | |

Net increase (decrease) in cash | 235.5 |

| | (156.7 | ) |

| | | |

Cash at beginning of year | 797.8 |

| | 939.5 |

|

Cash at end of period | $ | 1,033.3 |

| | $ | 782.8 |

|

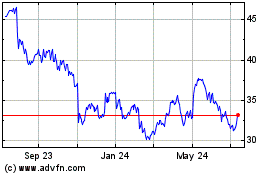

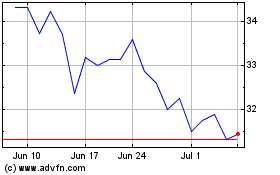

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Apr 2024 to May 2024

BorgWarner (NYSE:BWA)

Historical Stock Chart

From May 2023 to May 2024