true

0001857086

0001857086

2024-04-17

2024-04-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 17, 2024

TruGolf

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40970 |

|

85-3269086 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 60

North 1400 West Centerville, Utah |

|

84014 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (801)

298-1997

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

TRUG |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY

NOTE

This

Amendment No. 1 to the Current Report on Form 8-K/A (the “Amendment”) is being filed with the Securities and Exchange Commission

(“SEC”) to amend the Current Report filed by TruGolf Holdings, Inc. (the “Company”) on February 6, 2024 (the

“Original 8-K”) and to provide certain additional information.

The

Company is filing this Amendment to, among other things, include:

(a)

the audited financial statements of TruGolf, Inc., a Delaware corporation, as of December 31, 2023 and 2022 and

for the years ended December 31, 2023 and 2022 as Exhibit 99.1;

(b)

the Management’s Discussion and Analysis of Financial Condition and Results of Operations of TruGolf, Inc. as Exhibit 99.2;

and

(c)

the unaudited pro forma condensed combined financial information of the Company as Exhibit 99.3.

This

Amendment does not amend any other item of the Original 8-K or purport to provide an update or a discussion of any developments at the

Company or its subsidiaries subsequent to the filing date of the Original 8-K.

| Item

9.01 |

Financial

Statements and Exhibits. |

(a)

Financial statements of businesses or funds acquired.

The

financial statements of TruGolf, Inc. as of December 31, 2023 and 2022, and

for the years ended December 31, 2023 and 2022, and the related notes thereto, are set forth in Exhibit 99.1 attached hereto and are

incorporated by reference herein.

(b)

Pro forma financial information.

The

unaudited pro forma condensed combined financial information of the Company as of December 31, 2023, and for the year

ended December 31, 2023 is set forth

in Exhibit 99.3 hereto and is incorporated herein by reference.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

April 17, 2024 |

TRUGOLF

HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Lindsay Jones |

| |

Name: |

Lindsay

Jones |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

TRUGOLF,

INC

FINANCIAL

STATEMENTS

DECEMBER

31, 2023 and 2022

TABLE

OF CONTENTS

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and

Stockholders

of TruGolf, Inc

Opinion

on the Financial Statements

We

have audited the accompanying balance sheet of TruGolf, Inc (the Company) as of December 31, 2023, and the related statements of

operations, comprehensive loss, stockholders’ deficit, and cash flows for the year then ended December 31, 2023, and the

related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in

all material respects, the financial position of the Company as of December 31, 2023, and the results of its operations and its cash

flows for the year then ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of

America.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB and in accordance with auditing standards generally accepted in the

United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were

we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an

understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of

the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or

fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits

provide a reasonable basis for our opinion.

| /s/

Haynie & Company |

|

| |

|

| We

have served as the Company’s auditor since 2024. |

|

| Salt

Lake City, Utah |

|

| April

17, 2024 |

|

Report

of Independent Registered Public Accounting Firm

To

the Board of Directors of

TruGolf,

Inc.

Centerville,

Utah

Opinion

on the Financial Statements

We

have audited the accompanying balance sheet of TruGolf, Inc. (the “Company”) at December 31, 2022, and the related statements

of operations, changes in stockholders’ deficit, and cash flows for the year ended December 31, 2022, and the related notes (collectively

referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects,

the financial position of the Company at December 31, 2022, and the results of its operations and its cash flows for the year ended December

31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit,

we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or

fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides

a reasonable basis for our opinion.

/s/

CohnReznick LLP

CohnReznick

LLP

We

have served as the Company’s auditor since 2022 (such date takes into account the acquisition of certain people and assets of Daszkal

Bolton LLP by CohnReznick LLP effective March 1, 2023)

Boca

Raton, Florida

July

31, 2023

TRUGOLF,

INC.

BALANCE

SHEETS

AS

OF DECEMBER 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,297,564 | | |

$ | 9,656,266 | |

| Restricted cash | |

| 2,100,000 | | |

| - | |

Marketable investment securities | |

| 2,478,953 | | |

| - | |

| Accounts receivable, net | |

| 2,398,872 | | |

| 1,744,637 | |

| Inventory, net | |

| 2,119,084 | | |

| 2,121,480 | |

| Prepaid expenses | |

| 262,133 | | |

| 147,748 | |

| Other current assets | |

| - | | |

| 17,840 | |

| Total current assets | |

| 12,656,606 | | |

| 13,687,971 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 234,308 | | |

| 165,536 | |

| Right-of-use assets | |

| 972,663 | | |

| 732,877 | |

| Other long-term assets | |

| 1,905,983 | | |

| - | |

| | |

| | | |

| | |

| Total assets | |

$ | 15,769,560 | | |

$ | 14,586,384 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,059,771 | | |

$ | 1,463,337 | |

| Customer deposits | |

| 1,704,224 | | |

| 2,712,520 | |

| Notes payable, current portion | |

| 9,425 | | |

| 105,213 | |

| Notes payable to related parties, current portion | |

| 1,237,000 | | |

| 937,000 | |

| Line of credit, bank | |

| 802,738 | | |

| 545,625 | |

| Margin line of credit account | |

| 1,980,937 | | |

| - | |

| Convertible notes payable | |

| 954,622 | | |

| 578,481 | |

| Accrued interest | |

| 459,872 | | |

| 92,552 | |

| Accrued and other current liabilities | |

| 1,125,495 | | |

| 750,676 | |

| Lease liability, current portion | |

| 334,255 | | |

| 224,159 | |

| Total current liabilities | |

| 10,668,339 | | |

| 7,409,563 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Notes payable, net of current portion | |

| 2,402,783 | | |

| 288,618 | |

| Note payables to related parties, net of current portion | |

| 861,000 | | |

| 1,148,000 | |

| Dividend notes payable | |

| 4,023,923 | | |

| 7,660,784 | |

| Gross sales royalty payable | |

| 1,000,000 | | |

| 1,000,000 | |

| Lease liability, net of current portion | |

| 668,228 | | |

| 510,178 | |

| Other liabilities | |

| 63,015 | | |

| - | |

| Total liabilities | |

| 19,687,288 | | |

| 18,017,143 | |

| | |

| | | |

| | |

| Stockholders’ deficit: | |

| | | |

| | |

| Preferred stock, $0.01 par value, 10 million shares authorized; zero shares issued and outstanding as of December 31,

2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Common stock, $0.01 par value, 190 million shares authorized; 13,098 and 11,308 shares issued

and outstanding as of December 31, 2023 and December 31, 2022, respectively. | |

| 120 | | |

| 100 | |

| Treasury stock at cost, 4,692 shares of common stock held at December 31, 2023 and December

31, 2022, respectively | |

| (2,037,000 | ) | |

| (2,037,000 | ) |

| Additional paid-in capital | |

| 10,479,738 | | |

| 681,956 | |

| Accumulated other comprehensive loss | |

| (1,662 | ) | |

| - | |

| Accumulated losses | |

| (12,358,924 | ) | |

| (2,075,815 | ) |

| Total stockholders’ deficit | |

| (3,917,728 | ) | |

| (3,430,759 | ) |

| | |

| | | |

| | |

| Total liabilities and stockholders’ deficit | |

$ | 15,769,560 | | |

$ | 14,586,384 | |

The

accompanying notes are an integral part of these financial statements.

TRUGOLF,

INC.

STATEMENTS

OF OPERATIONS

FOR

THE YEARS ENDED DECEMBER 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues, net | |

$ | 20,583,851 | | |

$ | 20,227,331 | |

| Cost of revenues | |

| (7,825,768 | ) | |

| (7,018,378 | ) |

| Gross profit | |

| 12,758,083 | | |

| 13,208,953 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Royalties | |

| 709,640 | | |

| 550,963 | |

| Salaries, wages and benefits | |

| 9,681,323 | | |

| 6,973,227 | |

| Selling, general and administrative | |

| 11,027,332 | | |

| 4,952,381 | |

| Total operating expenses | |

| 21,418,295 | | |

| 12,476,571 | |

| | |

| | | |

| | |

| (Loss) income from operations | |

| (8,660,212 | ) | |

| 732,382 | |

| | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | |

| Interest income | |

| 108,011 | | |

| - | |

| Interest expense | |

| (1,730,908 | ) | |

| (1,589,223 | ) |

| Loss on investment | |

| - | | |

| (100,000 | ) |

| Total other expense | |

| (1,622,897 | ) | |

| (1,689,223 | ) |

| Loss from operations before income taxes | |

| (10,283,109 | ) | |

| (956,841 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | |

| Net loss | |

| (10,283,109 | ) | |

| (956,841 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per share attributable to common stockholders | |

$ | (857.35 | ) | |

$ | (84.62 | ) |

| | |

| | | |

| | |

| Basic and diluted weighted average common shares | |

| 11,994 | | |

| 11,308 | |

The

accompanying notes are an integral part of these financial statements.

TRUGOLF,

INC.

STATEMENTS

OF COMPREHENSIVE LOSS

FOR

THE YEARS ENDED DECEMBER 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Net loss | |

$ | (10,283,109 | ) | |

$ | (956,841 | ) |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| | |

| | | |

| | |

| Unrealized loss in fair value of short-term investments | |

| (1,662 | ) | |

| - | |

| | |

| | | |

| | |

| Comprehensive loss | |

$ | (10,284,771 | ) | |

$ | (956,841 | ) |

The

accompanying notes are an integral part of these financial statements.

TRUGOLF,

INC.

STATEMENTS

OF STOCKHOLDERS’ DEFICIT

FOR

THE YEARS ENDED DECEMBER 31, 2023 and 2022

| | |

Preferred Stock | | |

Common Stock | | |

Treasury Stock | | |

Additional | | |

Accumulated Other Comprehensive | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Paid-in Capital | | |

Loss | | |

Losses | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December 31, 2021 | |

| - | | |

$ | - | | |

| 11,308 | | |

$ | 100 | | |

| (4,692 | ) | |

$ | (2,037,000 | ) | |

$ | - | | |

$ | - | | |

$ | (1,118,974 | ) | |

$ | (3,155,874 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair value of warrants granted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 681,956 | | |

| | | |

| | | |

| 681,956 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (956,841 | ) | |

| (956,841 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| - | | |

$ | - | | |

| 11,308 | | |

$ | 100 | | |

| (4,692 | ) | |

$ | (2,037,000 | ) | |

$ | 681,956 | | |

$ | - | | |

$ | (2,075,815 | ) | |

$ | (3,430,759 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock to consultants for services | |

| - | | |

| - | | |

| 821 | | |

| 9 | | |

| - | | |

| - | | |

| 4,493,324 | | |

| - | | |

| - | | |

| 4,493,333 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Issuance

of common stock to employees for services | |

| - | | |

| - | | |

| 252 | | |

| 3 | | |

| - | | |

| - | | |

| 1,379,193 | | |

| - | | |

| - | | |

| 1,379,196 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Issuance

of common stock for conversion of dividend payable

| |

| - | | |

| - | | |

| 717 | | |

| 8 | | |

| - | | |

| - | | |

| 3.925.265 | | |

| - | | |

| - | | |

| 3,925,273 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized loss in fair value of short-term investments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,662 | ) | |

| - | | |

| (1,662 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| | | |

| (10,283,109 | ) | |

| (10,283,109 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

| - | | |

$ | - | | |

| 13,098 | | |

$ | 120 | | |

| (4,692 | ) | |

$ | (2,037,000 | ) | |

$ | 10,479,738 | | |

$ | (1,662 | ) | |

$ | (12,358,924 | ) | |

$ | (3,917,728 | ) |

The

accompanying notes are an integral part of these financial statements.

TRUGOLF,

INC.

STATEMENTS

OF CASH FLOWS

FOR

THE YEARS ENDED DECEMBER 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (10,283,109 | ) | |

$ | (956,841 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating

activities: | |

| | | |

| | |

| Depreciation and amortization expense | |

| 58,641 | | |

| 60,667 | |

| Amortization of convertible notes original issue discount | |

| 97,111 | | |

| 240,048 | |

| Amortization of right-of-use asset | |

| 298,208 | | |

| 165,535 | |

| Fair value of warrants in excess of fair value of debt | |

| 93,530 | | |

| 445,032 | |

| Bad debt expense | |

| 681,479 | | |

| - | |

| Loss on equity investment | |

| - | | |

| 100,000 | |

| Stock issued for services | |

| 5,872,529 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

Marketable investment securities | |

| 12,530 | | |

| - | |

| Accounts receivable, net | |

| (1,335,714 | ) | |

| (244,355 | ) |

| Inventory, net | |

| 2,396 | | |

| (265,615 | ) |

| Prepaid expenses | |

| (114,385 | ) | |

| 210,335 | |

| Other current assets | |

| 17,840 | | |

| (140 | ) |

| Other assets | |

| (1,905,983 | ) | |

| - | |

| Accounts payable | |

| 596,434 | | |

| 786,084 | |

| Customer deposits | |

| (1,008,296 | ) | |

| 118,172 | |

| Accrued interest payable | |

| 615,582 | | |

| 92,552 | |

| Accrued and other current liabilities | |

| 374,819 | | |

| 208,515 | |

| Other liabilities | |

| 63,015 | | |

| - | |

| Lease liability | |

| (269,848 | ) | |

| (168,110 | ) |

| Net cash (used in) provided by operating activities | |

| (6,133,221 | ) | |

| 791,879 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (127,413 | ) | |

| (41,430 | ) |

| Purchase of short-term investments | |

| (2,493,145 | ) | |

| - | |

| Net cash used in investing activities | |

| (2,620,558 | ) | |

| (41,430 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from line of credit | |

| 1,980,937 | | |

| - | |

| Proceeds from notes payable | |

| 2,433,059 | | |

| - | |

| Repayments of notes payable | |

| (107,569 | ) | |

| (125,511 | ) |

| Repayments of notes payable - related party | |

| (37,000 | ) | |

| (287,000 | ) |

| Proceeds from convertible notes | |

| 185,500 | | |

| 575,357 | |

| Repayment of line of credit | |

| | | |

| | |

| Dividends paid | |

| 40,150 | | |

| (1,965,706 | ) |

| Net cash provided by (used in) financing activities | |

| 4,495,077 | | |

| (1,802,860 | ) |

| | |

| | | |

| | |

| Net change in cash, cash equivalents, and restricted cash | |

| (4,258,702 | ) | |

| (1,052,411 | ) |

| | |

| | | |

| | |

| Cash, cash equivalents, and restricted cash, beginning of period | |

| 9,656,266 | | |

| 10,708,677 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash, end of period | |

$ | 5,397,564 | | |

$ | 9,656,266 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid for interest | |

$ | 1,115,332 | | |

$ | 602,255 | |

Conversion

of dividend noted payable and accrued interest | |

$ | 3.925,273 | | |

| - | |

Conversion

of note payable to line of credit | |

$ | 257,113 | | |

| - | |

Warehouse

lease | |

$ | 537,994 | | |

| - | |

The

accompanying notes are an integral part of these financial statements.

TRUGOLF

INC.

NOTES

TO FINANCIAL STATEMENTS

| 1. |

ORGANIZATION

AND NATURE OF OPERATIONS |

For

over 40 years, TruGolf, Incorporated (or “the Company”, “we”, “us”, or “our”) has been

creating indoor golf software and hardware and are focused on both the residential and commercial golf simulation industries. We design,

develop, manufacture and sell golf simulators for residential and commercial applications. We offer portable, professional, commercial

and custom simulators. In addition, to bundling our software with our simulators, we offer our E6 Connect software and gaming software

on a standalone basis. We have leveraged the power of our hardware and software platform to create a collection of multi-sport games

including football, soccer, soccer golf, frisbee golf, zombie dodgeball, and cowboy target practice.

As

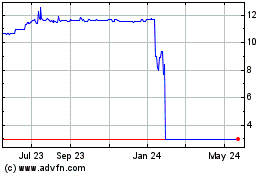

described in Note 20 – Subsequent Events, on January 31, 2024, subsequent to the fiscal year ended December 31, 2023, we

completed the previously announced business combination pursuant to the terms of the Business Combination Agreement, dated as of July

21, 2023, which provided for, among other things with TruGolf Nevada being the surviving corporation of the merger and having become

a direct, wholly owned subsidiary of Deep Medicine Acquisition Corp. (“DMAC”), a Delaware corporation and our predecessor

company (“DMAQ”) as a consequence of the merger (together with the other transactions contemplated by the Business Combination

Agreement). In connection with the consummation of the Business Combination, DMAQ changed its name to TruGolf Holdings, Inc. TruGolf

Holdings, Inc.’s Class A common stock commenced trading on The Nasdaq Capital Market LLC under the ticker symbol “TRUG”

on February 1, 2024.

| 2. |

SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES |

Basis

of Presentation

We

prepare our financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”).

The

Company’s financial statements are prepared on a going concern basis, which contemplates the realization of assets and the satisfaction

of obligations in the normal course of business. Continuation as a going concern is dependent upon continued operations of the Company,

which in turn is dependent upon the Company’s ability to meets its financial requirements, raise additional capital, and the success

of its future operations.

Under

the rules of ASC Subtopic 205-40 “Presentation of Financial Statements-Going Concern” (“ASC 205-40”), the Company

is required to evaluate whether conditions and/or events raise substantial doubt about its ability to meet its future financial obligations

as they become due within one year after the date that these interim financial statements are issued or available to be issued. This

evaluation takes into account the Company’s current available cash and projected cash needs over the one-year evaluation period

but may not consider things beyond its control.

In

2022 and prior years, the Company has reported operating income and positive operating cash flows. However, for 2023, the Company has

experienced operating losses due primarily to expensing consulting fees and issuing common stock associated with the services provided

by third-party consultants related to the propose DMAC business combination (See Note 20 – Subsequent Events), used cash

from operations, and relied on the capital raised from related parties and institutional financing to continue ongoing operations. We

may or may not be able to raise additional capital or obtain additional institutional financing due to future economic conditions. In

particular, the lending criteria are currently tightening in the United States, and we have experienced a decline in demand for our products,

which are in the category of “lifestyle purchases”. These factors, when considered in the aggregate, raise substantial doubt

about the Company’s ability to continue as a going concern within one year of the date these financial statements are issued. In

response to these conditions, the Company’s management has prepared the following financing plan, which we believe mitigates the

going concern uncertainty:

We

project that we will be able to meet our debt service and other cash obligations for at least the next 12 months. Our significant projected

cash commitments relate primarily to debt service and operating expenses. We anticipate the cash required to service our debt to be between

$900,000 to $2,300,000. The $2,300,000 assumes (1) the convertible notes are retired by cash payment rather than conversion into our

stock at maturity and (2) the note payable – ARJ Trust (See Note 10 – Related Party Notes Payable) are retired at

maturity. These notes are controlled by the Company’s Chief Executive Officer and have historically been extended (13 times) in

one-year increments. The Morgan Stanley margin line of credit account is 100 percent secured with the short-term investments held in

the brokerage account. The Morgan Stanley margin line of credit account would be retired through liquidation of the investments. At December

31, 2023, the Company had an additional $341,544 in availability on the Morgan Stanely margin line of credit account.

Our

significant projected cash requirements related primarily to operating expenses for the next 12 months include $7,000,000 to $8,000,000

for employees’ salaries, wages and benefits, $950,000 to $1,200,000 for installation and customers service, and $1,000,000 to $1,200,000

for development of software and hardware. For the year ending December 31, 2023, we spent an average of six percent of total sales on

our marketing and business development efforts. For the next twelve months (through December 2024), we anticipate spending seven to nine

percent of total projected sales, or $2,100,000 to $2,700,000 on marketing and business development. Upon closing the business combination,

we anticipate our marketing and business development spend to be closer to fifteen percent and as high as twenty percent. Due to the

timing of our sales and cash receipts, we project to generate sufficient recurring cash flow to cover our selling, general and administrative

expenses each period. No assurances can be given that the results anticipated by our projections will occur. With respect to long-term

liquidity requirements, approximately $7,400,000 of our debt matures in years 2025 to 2033.

In

the event the projected results do not occur, we may have to significantly delay, scale back or discontinue the development and commercialization

of one or more product offerings and other strategic initiatives. Additionally, we would reduce the number of new hires planned in 2024,

and implement cost reduction measures such as a reduction in headcount, reducing the planned sales and marketing expense among other

cost reduction measures. We may also issue common stock to potential investors to increase our liquidity.

Management

believes the plan outlined above provides an opportunity for the Company to continue as a going concern.

Use

of Estimates

We

prepare our financial statements in accordance with accounting principles generally accepted in the United States of America. The application

of many accounting principles requires us to make assumptions, estimates and/or judgments that affect the reported amounts of assets,

liabilities, revenues and expenses in our financial statements. We base our estimates and judgments on historical experience and other

assumptions that we believe are reasonable under the circumstances. These assumptions, estimates and/or judgments, however, are often

subjective and they and our actual results may change based on changing circumstances or changes in our analyses. If actual amounts are

ultimately different from our estimates, the revisions are included in our results of operations for the period in which the actual amounts

first become known. Estimates and assumptions include collectability of our accounts receivable, net realizable value of our inventory

and valuation of warrants.

Revenue

Recognition

We

recognize revenue in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)

standards - Topic 606 “Revenue from Contracts with Customers” (“Topic 606”). When entering into contracts with

our customers, we review the following five steps of Topic 606:

| |

i. |

Identify

the contract with the customer. |

| |

ii. |

Identify

the performance obligation. |

| |

iii. |

Determine

the transaction price. |

| |

iv. |

Allocate

the transaction price to the performance obligation. |

| |

v. |

Evaluate

the satisfaction of the performance obligation. |

We

account for contracts, with our customers, when we have approval and commitment from both parties, the rights of the parties are identified,

payment terms are established, the contract has commercial substance and collectability of consideration is probable.

Under

Topic 606, we recognize revenue only when we satisfy a performance obligation by transferring a promised good or service to our customer

and completion of all performance obligations. A good or service is considered transferred when the customer obtains control. The standard

defines control as an entity’s ability to direct the use of, and obtain substantially all of the remaining benefits from, an asset.

We recognize revenue once control has passed to the customer. The following indicators are evaluated in determining when control has

passed to the customer:

| |

i. |

We

have a right to a payment for the product or service. |

| |

ii. |

The

customer has legal title to the product. |

| |

iii. |

We

have transferred physical possession of the product to the customer. |

| |

iv. |

The

customer has the risk and rewards of ownership of the product. |

| |

v. |

The

customer has accepted the product. |

Revenue

Recognition for Golf Simulators. Revenues from the sale of golf simulators are recognized with the selling price to the customer

recorded as revenues and the acquisition cost of the product recorded as cost of revenues. We recognize revenue from these transactions

when control has passed to the customer and the performance obligations have been satisfied. Control is considered to have passed to

the customer when the simulators has been delivered, installed and accepted by the customer. Golf simulators are bundled and are comprised

of both hardware and a software license (for the software to operate the simulator). Our simulator contracts with customers generally

do not include multiple performance obligations.

Revenue

Recognition for Content Software Subscriptions. The Company offers content software subscriptions for one and twelve months. We recognize

revenue from these transactions when control has passed to the customer and the performance obligations have been satisfied. Control

is considered to have passed to the customer when the software license has been delivered and accepted by the customer. The content software

subscription revenue is recognized over the term of the contract.

Fair

Value of Financial Instruments

Fair

value is defined as the amount that would be received for selling an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The Financial Accounting Standards Board (“FASB”) fair value measurement

guidance established a fair value hierarchy that prioritizes the inputs used to measure fair value. The three broad levels of the fair

value hierarchy are as follows:

| |

Level

1 – |

Quoted

prices (unadjusted) in active markets for identical assets or liabilities, |

| |

Level

2 – |

Quoted

prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly

or indirectly, |

| |

Level

3 – |

Unobservable

inputs for which little or no market data exists, therefore requiring a company to develop its own assumptions. |

Assets

and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. We review the fair

value hierarchy classification on a quarterly basis. Changes in the observable inputs may result in a reclassification of assets and

liabilities within the three levels of the hierarchy outlined above.

The

carrying amounts of certain financial instruments, such as cash and cash equivalents, accounts receivable, accounts payable, and derivative

liability approximate fair value due to their relatively short maturities. The following

table shows the Company’s cash, cash equivalents, restricted cash and marketable investment securities by significant investment

category as of December 31, 2023 (As of December 31,

2022, there were no marketable investment securities):

| | |

Adjusted Cost | | |

Allowance for Credit Losses | | |

Total Unrealized Gains / (Losses) | | |

| | |

| | |

Marketable Investment Securities | |

| Cash (including restricted cash) | |

$ | 5,342,348 | | |

| | | |

$ | | | |

$ | 5,342,348 | | |

$ | 5,342,348 | | |

$ | - | |

| Level 1: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| Money market funds | |

| 55,216 | | |

| - | | |

| - | | |

| 55,216 | | |

| 55,216 | | |

| | |

| Subtotal | |

| 5,397,564 | | |

| - | | |

| - | | |

| 5,397,564 | | |

| 5,397,564 | | |

| - | |

| Level 2: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Corporate fixed income securities | |

| 449,819 | | |

| - | | |

| 2,863 | | |

| 452,682 | | |

| - | | |

| 452,682 | |

| U.S. treasury securities | |

| 2,030,796 | | |

| - | | |

| (4,525 | ) | |

| 2,026,271 | | |

| - | | |

| 2,026,271 | |

| Subtotal | |

| 2,480,615 | | |

| - | | |

| (1,662 | ) | |

| 2,478,953 | | |

| - | | |

| 2,478,953 | |

| Total | |

$ | 7,878,179 | | |

| - | | |

$ | (1,662 | ) | |

$ | 7,876,517 | | |

$ | 5,397,564 | | |

$ | 2,478,953 | |

| | |

December 31, 2023 | |

| | |

Adjusted Cost | | |

Fair Value | |

| Convertible notes payable (Level 3) | |

$ | 954,622 | | |

$ | 954,622 | |

| | |

December 31, 2022 | |

| | |

Adjusted Cost | | |

Fair Value | |

| Convertible notes payable (Level 3) | |

$ | 578,481 | | |

$ | 578,481 | |

For

our Level 3 unobservable inputs, we calculate a discount rate based on the U.S. prime rate of 10.00% and 7.75% as of December 31, 2023,

and 2022, respectively.

Cash,

Cash Equivalents and Restricted Cash

Cash

primarily consists of cash, demand and savings deposits which are highly liquid. The Company considers highly liquid investments that

are readily convertible to known amounts of cash and with original maturities from the date of purchase of three months or less to be

cash equivalents. Restricted cash is balance pledged to a financial institution as collateral for a $2 million line of credit. See Note

11 – Lines of Credit. The Company maintains its cash in bank deposit accounts which, at times, may exceed federally insured

limits. As of December 31, 2023 and 2022, the amount in excess of federally insured limits was $4,251,124 and $9,198,618, respectively.

Marketable

Investment Securities

The

Company’s marketable investment securities are comprised of investments in corporate fixed income securities and U.S. Treasury

securities. The Company designates investments in debt securities as available-for-sale. Available-for-sale debt securities with original

maturities of three months or less from the date of purchase are classified within cash and cash equivalents. Available-for-sale debt

securities are reported at fair value with the related unrealized gains and losses included in accumulated other comprehensive income

(loss), a component of stockholders’ equity, net of tax. Realized gains and losses on the sale of marketable securities are determined

using the average cost method on a first-in, first-out basis and recorded in total other income (expense), net in the statements of operations

and comprehensive loss.

The

available-for-sale debt securities are subject to a periodic impairment review. For investments in an unrealized loss position, the Company

writes down the amortized cost basis of the investment if it is more likely than not that the Company will be required or will intend

to sell the investment before recovery of its amortized cost basis. For investments not likely to be sold before recovery of the amortized

cost basis, the Company determines whether a credit loss exists by considering information about the collectability of the instrument,

current market conditions, and reasonable and supportable forecasts of economic conditions. The Company recognizes an allowance for credit

losses up to the amount of the unrealized loss when appropriate. Allowances for credit losses and write-downs are recognized in total

other income (expense), net, and unrealized losses not related to credit losses are recognized in accumulated other comprehensive loss.

There are no allowances for credit losses recorded for the periods presented.

Accounts

Receivable, net

We

manage credit risk associated with our accounts receivables at the customer level. Because the same customers typically generate the

revenues that are accounted for under both Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (Topic

606) and Accounting Standards Codification Topic 326, Credit Losses (Topic 326)., the discussions below on credit risk and our allowances

for doubtful accounts address our total revenues from Topic 606 and Topic 326.

We

believe the concentration of credit risk, with respect to our receivables, is limited because our customer base is comprised of a number

of geographically diverse customers. We manage credit risk through credit approvals and other monitoring procedures.

Pursuant

to Topic 326 for our accounts receivables, we maintain an allowance for doubtful accounts that reflects our estimate of our expected

credit losses. Our allowance is estimated using a loss rate model based on delinquency. The estimated loss rate is based on our historical

experience with specific customers, our understanding of our current economic circumstances, reasonable and supportable forecasts, and

our own judgment as to the likelihood of ultimate payment based upon available data. We believe our credit risk is somewhat mitigated

by our geographically diverse customer base and our credit evaluation procedures. The actual rate of future credit losses, however, may

not be similar to past experience. Our estimate of doubtful accounts could change based on changing circumstances, including changes

in the economy or in the particular circumstances of individual customers. Accordingly, we may be required to increase or decrease our

allowance for doubtful accounts. Based on management’s evaluation, there is a balance in the allowance for doubtful accounts of

$1,227,135 and $527,136 as of December 31, 2023, and 2022, respectively.

Inventory,

net

All

of our inventory consists of raw materials and are valued at the lower of historic cost or net realizable value; where net realizable

value is considered to be the estimated selling price in the ordinary course of business, less reasonably predictable cost of completion,

disposal and transportation. Historic inventory costs are calculated on an average or specific cost basis. The Company records inventory

write-downs for excess or obsolete inventories based upon assumptions on current and future demand forecasts. As of December 31, 2023,

and 2022, the Company had $429,050 and $304,050, respectively, reserved for obsolete inventory.

Property

and Equipment, net

Our

property and equipment are recorded at cost and depreciated using the straight-line over the estimated useful lives. Ordinary repair

and maintenance costs are included in sales, general and administrative (“SG&A”) expenses on our statements of operations.

However, expenditures for additions or improvements that significantly extend the useful life of the asset are capitalized in the period

incurred. At the time assets are sold or disposed of, the cost and accumulated depreciation are removed from their respective accounts

and the related gains or losses are reflected in the statements of operations in gains from sales of property and equipment, net.

We

periodically evaluate the appropriateness of remaining depreciable lives assigned to property and equipment. Depreciation expense for

the years ended December 31, 2023, and 2022 were $58,641 and $60,667, respectively. Generally, we assign the following estimated useful

lives to these categories:

| Category |

|

Estimated

Useful Life |

| Software

and computer equipment |

|

3

to 10 years |

| Furniture

and fixtures |

|

3

to 15 years |

| Vehicles |

|

5

years |

| Equipment |

|

5

to 10 years |

Impairment

of Long-lived Assets

Our

long-lived assets principally consist of property and equipment and right-of-use assets. We review, on a regular basis, our long-lived

assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

In reviewing for impairment, the carrying value of such assets is compared to the estimated undiscounted future cash flows expected from

the use of the assets and their eventual disposition. If such cash flows are not sufficient to support the asset’s recorded value,

an impairment charge is recognized to reduce the carrying value of the asset to its estimated fair value. The determination of future

cash flows as well as the estimated fair value of long-lived and intangible assets involves significant estimates and judgment on the

part of management. Our estimates and assumptions may prove to be inaccurate due to factors such as changes in economic conditions, changes

in our business prospects or other changing circumstances. Based on our most recently completed reviews, there were no indications of

impairment associated with our long-lived assets.

Leases

Our

lease portfolio is substantially comprised of operating leases related to leases for our corporate headquarters and warehouse.

We

determine whether an arrangement is a lease at the inception of the arrangement based on the terms and conditions in the contract. A

contract contains a lease if there is an identified asset, and we have the right to control the asset for a period of time in exchange

for consideration. Lease arrangements can take several forms. Some arrangements are clearly within the scope of lease accounting, such

as a real estate contract that provides an explicit contractual right to use a building for a specified period of time in exchange for

consideration. However, the right to use an asset can also be conveyed through arrangements that are not leases in form, such as leases

embedded within service and supply contracts. We analyze all arrangements with potential embedded leases to determine if an identified

asset is present, if substantive substitution rights are present, and if the arrangement provides the customer control of the asset.

Operating

lease right-of-use (“ROU”) assets represent our right to use an individual asset for the lease term and lease liabilities

represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at

the commencement date based on the present value of lease payments over the lease term. As most of our leases do not provide the lessor’s

implicit rate, we use our incremental borrowing rate (“IBR”) at the commencement date in determining the present value of

lease payments by utilizing a fully collateralized rate for a fully amortizing loan with the same term as the lease.

Lease

terms include options to extend the lease when it is reasonably certain those options will be exercised. For leases with terms greater

than 12 months, we record the related asset and obligation at the present value of lease payments over the term. Our leases can include

rental escalation clauses, renewal options and/or termination options that are factored into our determination of lease payments when

such renewal options and/or termination options are reasonably certain of exercise.

A

ROU asset is subject to the same impairment guidance as assets categorized as property and equipment. As such, any impairment loss on

ROU assets is presented in the same manner as an impairment loss recognized on other long-lived assets.

A

lease modification is a change to the terms and conditions of a contract that changes the scope or consideration of a lease. For example,

a change to the terms and conditions to the contract that adds or terminates the right to use one or more underlying assets, or extends

or shortens the contractual lease term, is a modification. Depending on facts and circumstances, a lease modification may be accounted

for as either: (1) the original lease plus the lease of a separate asset(s) or (2) a modified lease. A lease will be remeasured if there

are changes to the lease contract that do not give rise to a separate lease.

Cost

of Revenues

Cost

of revenue includes direct materials, labor, manufacturing overhead costs and reserves for estimated warranty cost (excluding depreciation).

Cost of revenue also includes charges to write down the carrying value of the inventory when it exceeds its estimated net realizable

value and to provide for on-hand inventories that are either obsolete or in excess of forecasted demand. As a result of the introduction

new simulator products in late 2022 and the sunsetting of older hardware models, in 2023, management reviewed the inventory and recorded

an additional $721,000 in inventory write-down and an additional $125,000 in allowance for obsolescence. During 2022, the Company announced

upgrades to the current simulators along with the next generation of launch monitors to be available in 2023. In 2022, management reviewed

the inventory and recorded a $991,429 write down and an additional $250,000 allowance for obsolescence.

Royalties

We

have royalty agreements with certain software suppliers to pay royalties based on the number of units and subscriptions sold. The royalty

percentages range between 20% and 30%. During 2023 and 2022, we expensed $709,640 and $550,963, respectively, to our software resell

partners.

Salaries,

Wages, and Benefits

Salaries,

wages and benefits are expenses earned by employees and outside contractors of the Company and are expensed as incurred. Included in

salaries, wages and benefits are employer payroll taxes, health, dental and life insurance costs of $397,995 and $685,144 for the years

ended December 31, 2023, and 2022, respectively. Contract labor was $1,029,412 and $895,868 for the years ended December 31, 2023, and

2022, respectively. As of December 31, 2023 and 2022, we had $326,516 and $278,565, respectively, in accrued salaries, wages and benefits.

In

October 2023, The Board of Directors awarded and authorized the issuance of 126 shares each of TruGolf common stock to two executives

at the estimated fair value. Accordingly, the Company recorded $1,379,196 in employee stock non-cash, compensation expense.

Selling,

General and Administrative

Sales

and marketing costs consist primarily of installation and customer service costs, advertising through social media platforms, the creation

of promotional videos for current and new products, membership industry associations, exhibiting at trade shows and other business development

activities. Sales and marketing costs are expensed as incurred. For the years ended December 31, 2023, and 2022, total sales and marketing

expenses were $2,597,779 and $1,727,293, respectively.

General

and administrative expenses are expensed as incurred and consist primarily of the following:

| | |

For the years ended December 31, | |

| | |

2023 | | |

2022 | |

| Stock

issued to consultants for services (See Note 16 – Stockholders’

Deficit) | |

$ | 4,493,333 | | |

$ | - | |

| Professional fees | |

| 905,204 | | |

| 932,122 | |

| Bad debt | |

| 681,479 | | |

| - | |

| License and association dues | |

| 503,914 | | |

| 516,477 | |

| Facilities including rent and utilities | |

| 595,337 | | |

| 439,717 | |

| Bank and credit card processing fees | |

| 357,535 | | |

| 357,533 | |

| Other general corporate related expenses | |

| 892,751 | | |

| 2,706,532 | |

| | |

$ | 8,429,553 | | |

$ | 4,952,381 | |

Income

Taxes

The

Company, with stockholders’ consent, has elected to be taxed as an “S Corporation” under the provisions of the Internal

Revenue Code and comparable state income tax law. As an S Corporation, we are generally not subject to corporate income taxes and our

net income or loss is reported on the individual tax return of the stockholder of the Company. Therefore, no provision or liability for

income taxes is reflected in the financial statements. Management has evaluated its tax positions and has concluded that the Company

had taken no uncertain tax positions that could require adjustment or disclosure in the financial statements to comply with provisions

set forth in ASC 740, “Income Taxes”.

Income

(Loss) Per Share

Net

income (loss) per share is provided in accordance with FASB ASC 260-10, “Earnings per Share”. Basic net income (loss) per

common share (“EPS”) is computed by dividing income available to common stockholders by the weighted-average number of common

shares outstanding for the period. Diluted earnings per share is computed by dividing net income by the weighted average shares outstanding,

assuming all dilutive potential common shares were issued, unless doing so is anti-dilutive. The weighted-average number of common shares

outstanding for computing basic EPS for the years ended December 31, 2023 and 2022, were 11,994 and 11,308, respectively. Diluted net

loss per share of common stock is the same as basic net loss per share of common stock because the effects of potentially dilutive securities

are antidilutive.

Potentially

dilutive securities as of December 31, 2023, included warrants to purchase 292 shares of commons stock and 140 common shares for the

convertible debt. Potentially dilutive securities as of December 31, 2022, included warrants to purchase 292 shares of commons stock

and 94 common shares for the convertible debt.

Recent

Accounting Pronouncements Not Yet Adopted

Management

has evaluated all recent accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”) and determined

that none of the pronouncements will have a material impact on our financial statements. We will continue to monitor the issuance of

any new accounting pronouncements and assess their potential impact on the financial statements in future periods.

Concentration

of Credit and Supplier Risk

Financial

instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash deposits and trade accounts

receivable. Credit risk can be negatively impacted by adverse changes in the economy or by disruptions in the credit markets.

We

maintain our cash deposits with established commercial banks. At times, balances may exceed federally insured limits. We have not experienced

any losses in such accounts and do not believe that we are exposed to any significant credit risk associated with our cash deposits.

We

believe that credit risk with respect to trade accounts receivable is somewhat mitigated by our large number of geographically diverse

customers and our credit evaluation procedures. We record trade accounts receivables at sales value and establish specific reserves for

certain customer accounts identified as known collection problems due to insolvency, disputes or other collection issues. The amounts

of the specific reserves estimated by management are determined by a loss rate model based on delinquency. We maintain reserves for potential

losses. For each of the years ended December 31, 2023, and 2022, no one customer accounted for more than 10% of our revenues.

We

purchase a significant number of parts we consume in manufacturing our simulators from nationally known original equipment

manufacturers, many of whom we have had over a 10 to 15 years relationship. While we do not have long-term contracts, we do issue

purchase orders based on quoted prices terms. During the year ended December 31, 2023 we purchased approximately 52.9% of our

assembly parts from five manufacturers. During the year ended December 31, 2022, we purchased approximately 50.0% of our assembly

parts from three manufacturers. We believe that while there are alternative suppliers, for the parts and equipment, we purchase in

each of the principal product categories, termination of one or more of our relationships with any of our major suppliers of

equipment could have a material adverse effect on our business.

Warrants

The

fair value of the warrants is estimated on the date of issuance using the Black-Scholes option pricing model, which requires the input

of subjective assumptions, including the expected term of the warrants, expected stock price volatility, and expected dividends. These

estimates involve inherent uncertainties and the application of management’s judgment. Expected volatilities used in the valuation

model are based on the average volatility of the comparable companies publicly traded on recognized stock exchanges. The risk-free rate

for the expected term of the option is based on the United States Treasury yield curve in effect at the time of grant.

| 3. |

ACCOUNTS

RECEIVABLE, NET |

Accounts

receivable and allowance for doubtful accounts consisted of the following as of December 31:

| | |

2023 | | |

2022 | |

| Trade accounts receivable | |

$ | 3,458,625 | | |

$ | 2,140,853 | |

| Other | |

| 167,383 | | |

| 130,920 | |

| | |

| 3,593,625 | | |

| 2,271,773 | |

| Less allowance for doubtful accounts | |

| (1,227,136 | ) | |

| (527,136 | ) |

| Total accounts receivable, net | |

$ | 2,398,872 | | |

$ | 1,744,637 | |

Accounts

receivable as of December 31, 2023, and 2022 are primarily made up of trade receivables due from customers in the ordinary course of

business. Four customers accounted for more than 51.5% of the balance of accounts receivable as of December 31, 2023, and five customers

accounted for 57% of the accounts receivable balance as of December 31, 2022.

The

following summarizes inventory as of December 31:

| | |

2023 | | |

2022 | |

| Inventory – raw materials | |

$ | 2,548,134 | | |

$ | 2,425,530 | |

| Less reserve allowance for obsolescence | |

| (429,050 | ) | |

| (304,050 | ) |

| Inventory, net | |

$ | 2,119,084 | | |

$ | 2,121,480 | |

| 5. |

MARKETABLE INVESTMENT SECURITIES |

In

February 2023, we entered into a brokerage agreement and deposited $2,500,000. During 2023, we purchased $450,751 in corporate fixed

income securities (corporate bonds) and $2,042,384 in government securities (Treasury securities). During 2023, no investments were sold nor matured. See Note 1 – Summary of Significant Accounting Policies

for a discussion of our investment policies, accounting for

investments and summary of fair value of financial instruments. As of December 31, 2023, the marketable

investment securities consisted of the following:

| Corporate fixed income securities, weighted average yield and maturity of 5.39% and

2.38 years, respectively | |

| 452,682 | |

| Government securities, weighted average yield and maturity of 4.91% and

3.25 years, respectively | |

| 2,026,271 | |

| Total marketable investment securities | |

$ | 2,478,953 | |

There were no marketable investment securities in 2022.

| 6. |

OTHER

LONG-TERM ASSETS |

The

following summarizes other long-term assets as of December 31, 2023 (there were no long-term assets as of December 31, 2022):

| Security deposit – Ethos Management loan | |

$ | 1,875,000 | |

| Security deposits – leased facilities | |

| 30,983 | |

| Other long-term assets | |

$ | 1,905,983 | |

As

discussed in Note 9 – Notes Payable and Note 20 – Subsequent Events, as a condition of funding on the Ethos

Management loan, we placed a $1,875,000 security deposit as collateral for the note. Deposits related to the facility leases are generally the last month’s payments.

| 7. |

PROPERTY

AND EQUIPMENT, NET |

The

following summarizes property and equipment as of December 31:

| | |

2023 | | |

2022 | |

| Software and computer equipment | |

$ | 809,031 | | |

$ | 694,560 | |

| Furniture and fixtures | |

| 230,883 | | |

| 217,943 | |

| Vehicles | |

| 59,545 | | |

| 59,545 | |

| Equipment | |

| 15,873 | | |

| 15,873 | |

| | |

| 1,115,332 | | |

| 987,921 | |

| Less accumulated depreciation | |

| (881,024 | ) | |

| (822,385 | ) |

| Property and equipment, net | |

$ | 234,308 | | |

$ | 165,536 | |

Depreciation

expense for the years ended December 31, 2023, and 2022, was $58,641 and $60,667, respectively.

Customer

deposits are advance payments from customers prior to manufacturing and shipping a simulator. The prepayment amounts and timing vary

depending on the product to be manufactured and delivery location. Customer deposits are included in current liabilities until the balance

is applied to an order at the time of invoicing. As of December 31, 2023, and 2022, customer deposits were $1,704,224 and $2,712,520,

respectively.

Notes

payable consisted of the following as of December 31:

| | |

2023 | | |

2022 | |

| Note payable – Ethos Management INC | |

$ | 2,499,999 | | |

$ | - | |

| Note payable - JPMorgan Chase | |

| - | | |

| 349,830 | |

| Note payable – Mercedes-Benz | |

| 29,149 | | |

| 38,017 | |

| Note payable – Zions Bank | |

| - | | |

| 5,984 | |

| | |

| 2,529,148 | | |

| 393,831 | |

| Less deferred loan fees – Ethos Management INC | |

| (116,940 | ) | |

| - | |

| Less current portion | |

| (9,425 | ) | |

| (105,213 | ) |

| Long-term portion | |

$ | 2,402,783 | | |

$ | 288,618 | |

Future

maturities of notes payable are as follows for the years ending December 31:

| 2024 | |

$ | 9,425 | |

| 2025 | |

| 10,001 | |

| 2026 | |

| 9,723 | |

| 2027 | |

| 1,111,111 | |

| 2028 | |

| 1,111,111 | |

Thereafter | |

| 277,777 | |

| Total | |

$ | 2,529,148 | |

The

deferred loan fees are being amortized over the term of the Ethos Management note payable.

Note

Payable – Ethos Management INC

In

January 2023, we entered into a financing agreement with Ethos Asset Management INC (the “Ethos Asset Management Loan”

or “Ethos”) in the principal amount of up to $10 million. Pursuant to the terms of the Ethos Asset Management Loan, we

may draw down financing proceeds equal to $833,333 each month beginning in April 2023, up to the $10 million amount. Interest

associated with the Ethos Asset Management Loan is fixed at 4% per annum and has a three-year grace period for principal and

interest payments. Annual principal ($1,111,111) plus interest payments will commence in 2027 and may continue through 2034 depending on the total amount drawn on the loan. As a

condition to funding, we provided Ethos Management with a $1,875,000 deposit as collateral for the note. Ethos Management informed

the Company in August 2023, that unrelated to TruGolf, Ethos Management is currently undergoing a routine audit of its loan

portfolio, and pending the close of the audit, borrowers may experience delays in drawing on funds when requested. See Note 20

– Subsequent Events.

Note

Payable – JP Morgan Chase

In

June 2021, we entered into a $500,000, 3.00% annual interest rate note payable with JPMorgan Chase Bank, N.A. (“JP Morgan”).

The note matures on June 8, 2026. We make a monthly principal and interest payment in the amount of $8,994. There is no prepayment penalty

if the loan is paid prior to the maturity date.

In

December 2023, we entered into a one-year line of credit facility with JP Morgan. See Note 11 – Lines of Credit. The outstanding

note payable balance of $257,113 was transferred to the new line of credit.

Note

Payable – Mercedes-Benz

In

November 2020, we entered into a $59,545, 5.90% annual interest rate note payable with Mercedes-Benz for a delivery van. The note matures

on November 20, 2026, and is secured by the van. We make a monthly payment of $908.

Note

Payable – Zions Bank

In

April 2018, we entered into a $77,067, 6.75% annual interest rate note payable with Zion Bank, N.A. The note matures on April 16, 2023,

and is guaranteed by the Company’s chief executive officer. We make a monthly payment of $1,517. The note was paid off in 2023.

| 10. |

RELATED

PARTY NOTES PAYABLE |

Related

party notes payable consisted of the following as of December 31:

| | |

2023 | | |

2022 | |

| Notes payable - ARJ Trust | |

$ | 650,000 | | |

$ | 650,000 | |

| Note payable - McKettrick | |

| 1,300,000 | | |

| 1,250,000 | |

| Note payable - Carver | |

| 148,000 | | |

| 185,000 | |

| | |

| 2,098,000 | | |

| 2,085,000 | |

| Less current portion | |

| (1,237,000 | ) | |

| (937,000 | ) |

| Long-term portion | |

$ | 861,000 | | |

$ | 1,148,000 | |

Future

maturities of related party notes payable are as follows for the years ending December 31:

| 2024 | |

$ | 1,237,000 | |

| 2025 | |

| 287,000 | |

| 2026 | |

| 287,000 | |

| 2027 | |

| 287,000 | |

| Total | |

$ | 2,098,000 | |

Note

Payable – ARJ Trust

In

December 2008, we entered into a $500,000, 8.50% annual interest rate note payable with a trust (“ARJ Trust”) indirectly

controlled by the chief executive officer. We make monthly interest-only payments of $3,541. As of December 31, 2023, and 2022, the principal

balance outstanding was $500,000 and accrued interest was $2,911. During 2023, the note’s

maturity was extended one-year to March 31, 2024. In March 2024, the note’s maturity was extended to March 31, 2025.

In

June 2010, we entered into a second $150,000, 8.50% annual interest rate note payable with the ARJ Trust. We make monthly

interest-only payments of $1,063. As of December 31, 2023, and 2022, the principal balance outstanding was $150,000 and accrued

interest was $873. During 2023, the note’s maturity was extended one-year to March 31, 2024. In March 2024, the note’s maturity was extended to March 31, 2025.

The

trustee of the ARJ Trust is a related party to the Company’s chief executive officer.

Note

Payable – McKettrick

In

May 2019, we entered into a $1,750,000, zero interest rate note payable with a former shareholder to repurchase all shares in the Company.

The note is payable in annual installments of $250,000 due on December 21 of each year. The note matures on December 1, 2027. There is

a late fee of 5%, if not paid within 10 days of the due date. In December 2023, the shareholder agreed to extend the December 21, 2023

payment to February 1, 2024, for a $50,000 fee.

Note

Payable – Carver

In

January 2021, we entered into a $222,000, zero interest rate note payable with a former shareholder to repurchase all shares in the Company.

The note is payable in semi- annual installments of $18,500 due on March 31 and September 30 each year and matures on October 1, 2027.

In

December 2023, we entered into a $2,000,000 variable rate line of credit with JP Morgan Chase Bank, N.A. The purpose of the new line

of credit was to consolidate the balances outstanding on both the JP Morgan Chase note payable (See Note 9 – Notes Payable)

and the previous line of credit, which had matured. The line of credit matures on December 31, 2024. The line of credit has an annual

interest rate computed at the Adjusted SOFR (Secured Overnight Financing Rate) Rate and at a rate of 3.00% above the SOFR Rate. The Adjusted

SOFR rate means the sum of the Applicable margin (3.50% per annum) plus the SOFR rate applicable to the interest period plus the Unsecured

to Secured Rate Adjustment.

The

new line of credit is secured by a pledge of $2,100,000 in the Company’s deposit accounts (restricted cash) at JP Morgan Chase.

As of December 31, 2023 the balance outstanding on the new line of credit was $802,738 and $1,197,262 in additional available borrowings.

As of December 31, 2022, the balance outstanding on the earlier line of credit was $545,625.

During

February 2023, the Company entered into a variable rate line of credit with Morgan Stanley which is secured by the marketable securities

held in our brokerage account. As of December 31, 2023, the balance outstanding was $1,980,937, at a rate of 7.21%. As of December 31,

2023, there was approximately $341,544 in available borrowings.

| 12. |

CONVERTIBLE

NOTES PAYABLE |

In

May 2022, we entered into two separate but identical $300,000 (total $600,000), 10.00% annual interest rate convertible notes payable

(“Convertible Notes”) with two individual consultants (“Note Holder”) to assist with services including an initial

public offering preparation and listing to NASDAQ or other national exchange, assist the Company and its counsel in preparing a code

of conduct and employment agreements, franchise development, and valuation increase through growth among other services. The original

terms of each note include a 15% original issue discount (“OID”), 292 warrants, no prepayment penalty and a maturity of February

25, 2023.

The

warrants are exercisable at $4,800 per share for five years and a cashless option and a mandatory exercise over $9,600 with no prepayment

penalty. The warrants are non-exercisable for one year from issuance. The valuation assumptions used in the Black-Sholes model to determine

the fair value of each warrant awarded in 2022: expected stock price volatility ranged from 40.06% to 80.17%; expected term in years

5.00 with a discount for the one-year lockout period; and risk-free interest rate 2.95%.

The

Note Holder has the right, at any time on or after the issuance date and prior to the maturity date, to convert all or any portion of

the then outstanding and unpaid principal plus any accrued interest thereon into shares of the Company’s common stock. The per

share conversion price will be convertible into shares of common stock equal to 70% multiplied by the lower of (i) the volume weighted

average of the closing sales price of the common stock on the date that the Company’s listing on the NASDAQ Global Market or other

national exchange (“Uplisting”) is successfully consummated or (ii) the lowest closing price for the five trading days following

the date of Uplisting, not including the Uplisting day.

In

the event the Company (i) makes a public announcement that it intends to be acquired by, consolidate or merge with any other corporation

or entity (other than a merger in which the Company is the surviving or continuing corporation and its capital stock is unchanged) or

sell or transfer all or substantially all of the assets of the Company; or (ii) any person, group or entity (including the Company) publicly

announces a tender offer to purchase 50% or more of the common stock, then the conversion price will be equal to the lower of the conversion