FDJ Has Acquired 1.12% of Kindred’s Outstanding Shares From Veralda at a Price of 122.5 SEK Per Share

March 28 2024 - 1:19PM

Business Wire

Regulatory News:

Following an offer notice received from Veralda to sell 49% of

its shares, 2.4m shares corresponding to 1.12% of the outstanding

shares in Kindred, at 122.5 SEK, FDJ (Paris:FDJ) has decided to

exercise the right of first refusal forming part of Veralda’s

irrevocable undertaking and disclosed at the time of the Kindred

transaction announcement on January 22nd, 2024.

As a result, FDJ has acquired 2.4m shares representing 1.12% of

Kindred’s outstanding shares and Veralda’s irrevocable undertaking

will continue to apply to Veralda’s remaining 1.16% stake in

Kindred.

On January 22nd, 2024, La Française des Jeux SA (“FDJ”),

announced a recommended public offer to the holders of Swedish

depository receipts (the “SDRs”) in Kindred Group plc (together

with its subsidiaries “Kindred” or the “Company”) to tender all

their SDRs in Kindred to FDJ at a price of 130 SEK in cash per SDR

(the “Offer”). For the sake of simplicity and because each SDR

represents a share in Kindred, the SDRs will also be referred to as

“shares” and the holders as “shareholders”.

As previously communicated, FDJ has obtained irrevocable

undertakings to accept the Offer from shareholders representing

27.9% of the outstanding shares. One of these shareholders,

Veralda, representing a 2.3% stake in Kindred, was allowed to sell

50% of its shares after Kindred’s March 15th, 2024, general meeting

amending its bylaws to provide for squeeze-out rights of an

offeror. If Veralda decided to sell its shares, it undertook to

first offer FDJ the possibility to buy the shares at a price not

higher than the price in the Offer of 130 SEK per Share.

On March 18th, 2024, Veralda notified FDJ of its intention to

sell 2.4m of its shares, corresponding to 1.12% of the outstanding

shares in Kindred, at a price of 122.5 SEK per share. FDJ has

decided to exercise the right to buy these shares from Veralda at

such price.

After this purchase, FDJ holds 1.12% of the outstanding shares

in Kindred and the remaining irrevocable undertakings with Corvex

Management LP, Premier Investissement SAS, Eminence Capital, Nordea

and Veralda represent in total 26.82% of the outstanding shares in

Kindred.

The offer documentation, which includes detailed descriptions of

the irrevocable undertakings, is available in English and Swedish

on the FDJ Group website:

https://www.groupefdj.com/en/fdj-launches-a-tender-offer-for-kindred-to-create-a-european-gaming-champion/

About FDJ Group

France's leading gaming operator and one of the industry leaders

worldwide, FDJ offers responsible gaming to the general public in

the form of lottery games (draws and instant games), sports betting

(through its ParionsSport point de vente et ParionsSport en ligne

brands), horse-race betting and poker. FDJ's performance is driven

by a large portfolio of iconic brands, the leading local sales

network in France, a growing market, and recurring investments. The

Group implements an innovative strategy to increase the

attractiveness of its gaming and service offering across all

distribution channels, by offering a responsible customer

experience. FDJ Group is listed on the regulated market of Euronext

Paris (Compartment A – FDJ.PA) and is part of the SBF 120, Euronext

100, Euronext Vigeo 20, EN EZ ESG L 80, STOXX Europe 600, MSCI

Europe and FTSE Euro indices.

For more information, visit www.groupefdj.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240328931072/en/

Media Contact 01 41 10 33 82 |

servicedepresse@lfdj.com

Investor Relations Contact 01 41 04 19 74 |

invest@lfdj.com

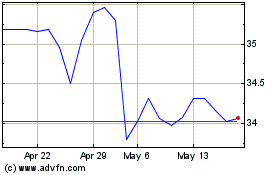

Francaise Des Jeux (EU:FDJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

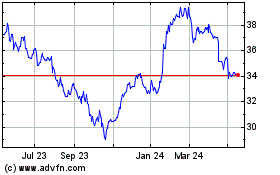

Francaise Des Jeux (EU:FDJ)

Historical Stock Chart

From Apr 2023 to Apr 2024