Intesa Sanpaolo Plans Dollar 3-Year, 5-Year Bond

January 07 2013 - 9:50AM

Dow Jones News

By Serena Ruffoni

Italian lender Intesa Sanpaolo SpA (ISP.MI) plans a dual-tranche

dollar-denominated bond, said one of the banks on the deal

Monday.

The bonds will be senior unsecured, benchmark-sized and have a

maturity of three and five years.

Banca IMI, Goldman Sachs, JPMorgan and Morgan Stanley are lead

managers on the deal, which will be priced Monday.

Intesa Sanpaolo is not a frequent issuer in dollars.

Ratings are Baa2 by Moody's Investors Service Inc., BBB+ from

Standard & Poor's and A- by Fitch Ratings.

Write to Serena Ruffoni at serena.ruffoni@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

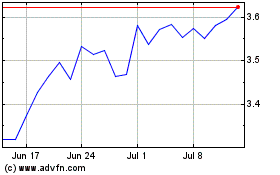

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

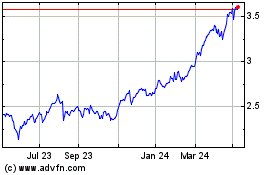

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024