|

|

|

|

|

Free Writing Prospectus

(To the prospectus dated April 4, 2011, as supplemented by

the preliminary prospectus supplement dated April 24, 2012)

|

|

Filed Pursuant to Rule 433

Registration Statement No. 333-173299

April 26, 2012

|

HOME :: AUCTION #5616

AUCTIONS DIRECTORY ISSUERS

AUCTIONS UNIVERSITY DEMOS

ABOUT PRODUCTS & SERVICES AUCTIONS BOND STORE TRADING UNIVERSITY THINK

CUSTOMER SERVICE

OPEN ACCOUNT LOGIN

1.800.524.8875

Results

Auction Status: CLOSED

Auction Start: 4/25/2012 4:30 PM EDT

Auction End: 4/26/2012 3:00 PM EDT

Last Update:

4/26/2012 3:48:16 PM EDT

Security Type: Corporate Bonds

Issue Type: Primary

Coupon: 4.500%

Maturity Date: 3/27/2017

Offering Documents

4.50% 03/27/17 Sr Unsecured | S&P: BBB- | Fitch: BBB- | DBRS: BBB(low) | CUSIP: 989701BB2

Auction Details

Bids Final Market-Clearing Price:

Final Market-Clearing Yield*: 4.442% 100.249372

Bidder Units Price Yield Timestamp Awarded Principal Accrued

Interest

Amount

Due

#30251 25 101.500000 4.158% 4/25/2012 4:39:52 PM 25 units $ 25,062.34 $ 106.25 $ 25,168.59

#30327 400 101.500000 4.158% 4/25/2012 5:06:09 PM 400 units $ 400,997.49 $ 1,700.00 $ 402,697.49

#13196 500 101.500000 4.158% 4/26/2012 10:32:36 AM 500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

#23152 10 101.500000 4.158% 4/26/2012 12:16:28 PM 10 units $ 10,024.94 $ 42.50 $ 10,067.44

#30368 45 101.500000 4.158% 4/26/2012 1:30:41 PM 45 units $ 45,112.22 $ 191.25 $ 45,303.47

#30329 1,000 101.092928 4.250% 4/26/2012 10:29:36 AM 1,000 units $ 1,002,493.72 $ 4,250.00 $ 1,006,743.72

#30339 5 101.092928 4.250% 4/26/2012 10:50:15 AM 5 units $ 5,012.47 $ 21.25 $ 5,033.72

#30340 15 101.092928 4.250% 4/26/2012 11:00:58 AM 15 units $ 15,037.41 $ 63.75 $ 15,101.16

#23639 440 101.092928 4.250% 4/26/2012 12:30:48 PM 440 units $ 441,097.24 $ 1,870.00 $ 442,967.24

#29171 500 101.092928 4.250% 4/26/2012 2:46:39 PM 500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

#24582 5 100.916503 4.290% 4/26/2012 11:25:36 AM 5 units $ 5,012.47 $ 21.25 $ 5,033.72

Zions Bancorporation / 5 Year Corporates

Notice: The auction has been extended until 4/26/2012 3:00:33 PM EDT.

#29955 1 100.872453 4.300% 4/26/2012 11:48:33 AM 1 unit $ 1,002.49 $ 4.25 $ 1,006.74 #29824 750 100.750000 4.328% 4/26/2012 11:53:35 AM 750 units $ 751,870.29 $ 3,187.50 $ 755,057.79

#13264 5 100.542797 4.375% 4/26/2012 2:43:44 PM 5 units $ 5,012.47 $ 21.25 $ 5,033.72 #29978 40 100.500000 4.385% 4/25/2012 4:32:15 PM 40 units $ 40,099.75 $ 170.00 $ 40,269.75 #30021 10,000 100.500000 4.385% 4/26/2012 10:38:03 AM 10,000 units $

10,024,937.20 $ 42,500.00 $ 10,067,437.20 #29959 300 100.500000 4.385% 4/26/2012 1:15:48 PM 300 units $ 300,748.12 $ 1,275.00 $ 302,023.12 #29859 25 100.500000 4.385% 4/26/2012 2:39:34 PM 25 units $ 25,062.34 $ 106.25 $ 25,168.59 #21545 200

100.433193 4.400% 4/26/2012 12:56:43 PM 200 units $ 200,498.74 $ 850.00 $ 201,348.74 #29955 5 100.433193 4.400% 4/26/2012 1:16:19 PM 5 units $ 5,012.47 $ 21.25 $ 5,033.72 #30359 25 100.433193 4.400% 4/26/2012 1:42:40 PM 25 units $ 25,062.34 $ 106.25

$ 25,168.59 #25696 20 100.433193 4.400% 4/26/2012 2:50:59 PM 20 units $ 20,049.87 $ 85.00 $ 20,134.87 #28702 1,000 100.375000 4.413% 4/26/2012 2:58:41 PM 1,000 units $ 1,002,493.72 $ 4,250.00 $ 1,006,743.72 #19560 5 100.345610 4.420% 4/26/2012

11:17:47 AM 5 units $ 5,012.47 $ 21.25 $ 5,033.72 #23424 94 100.279982 4.435% 4/26/2012 2:59:27 PM 94 units $ 94,234.41 $ 399.50 $ 94,633.91 #28825 10 100.279982 4.435% 4/26/2012 2:59:47 PM 10 units $ 10,024.94 $ 42.50 $ 10,067.44 #30297 2,000

100.260000 4.440% 4/26/2012 2:59:07 PM 2,000 units $ 2,004,987.44 $ 8,500.00 $ 2,013,487.44 #19560 10 100.258117 4.440% 4/26/2012 11:17:47 AM 10 units $ 10,024.94 $ 42.50 $ 10,067.44 #24507 60 100.253745 4.441% 4/26/2012 2:59:09 PM 60 units $

60,149.62 $ 255.00 $ 60,404.62 #30065 35,000 100.250000 4.442% 4/25/2012 4:37:39 PM 35,000 units $ 35,087,280.20 $ 148,750.00 $ 35,236,030.20 #29773 5,025 100.250000 4.442% 4/26/2012 10:35:04 AM 5,025 units $ 5,037,530.94 $ 21,356.25 $ 5,058,887.19

#27035 10 100.250000 4.442% 4/26/2012 10:44:41 AM 10 units $ 10,024.94 $ 42.50 $ 10,067.44 #30128 500 100.250000 4.442% 4/26/2012 11:39:07 AM 500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

Page 1 of 3

#29773 2,500 100.250000 4.442%

4/26/2012 1:18:28 PM 2,500 units $ 2,506,234.30 $ 10,625.00 $ 2,516,859.30

#30136 10,000 100.250000 4.442%

4/26/2012 2:58:33 PM 10,000 units $ 10,024,937.20 $ 42,500.00 $ 10,067,437.20

#30352 500 100.250000 4.442%

4/26/2012 2:58:54 PM 500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

#30298 500 100.250000 4.442% 4/26/2012

2:59:00 PM 500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

#28214 500 100.250000 4.442% 4/26/2012 2:59:12 PM

500 units $ 501,246.86 $ 2,125.00 $ 503,371.86

#29773 3,000 100.250000 4.442% 4/26/2012 2:59:51 PM 3,000 units

$ 3,007,481.16 $ 12,750.00 $ 3,020,231.16

#25702 150 100.250000 4.442% 4/26/2012 2:59:55 PM 150 units $

150,374.06 $ 637.50 $ 151,011.56

#21117 100 100.250000 4.442% 4/26/2012 2:59:55 PM 100 units $ 100,249.37 $

425.00 $ 100,674.37

#23425 10 100.250000 4.442% 4/26/2012 3:00:15 PM 10 units $ 10,024.94 $ 42.50 $ 10,067.44

#30343 200 100.250000 4.442% 4/26/2012 3:00:19 PM 200 units $ 200,498.74 $ 850.00 $ 201,348.74

#30094 40,000 100.249372 4.442% 4/26/2012 2:57:48 PM 24,510 units $ 24,571,121.08 $ 104,167.50 $ 24,675,288.58

#17667 9 100.214404 4.450% 4/26/2012 12:51:00 PM Rejected: Price

#29955 24 100.214404 4.450% 4/26/2012 2:05:13 PM Rejected: Price

#21117 100 100.200000 4.453% 4/26/2012 2:59:13 PM Rejected: Price

#30080 1,500 100.125000 4.470% 4/26/2012 2:55:30 PM Rejected: Price

#19253 15 100.110000 4.474% 4/26/2012 1:40:00 PM Rejected: Price

#19253 25 100.100000 4.476% 4/26/2012 10:38:03 AM Rejected: Price

Auction Totals: 100,000 units $ 100,249,372.01 $ 425,000.00 $ 100,674,372.01

Zions Bancorporation has filed a registration statement (Registration Statement No. 333-173299, including a

prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should

read the prospectus dated April 4, 2011 contained in that registration

statement, the preliminary

prospectus supplement dated April 24, 2012 and other documents Zions Bancorporation has filed with the SEC for more

complete information about Zions Bancorporation and this offering. You may get these documents and other documents Zions Bancorporation

*The current Market-Clearing Yield/Final Auction Yield is calculated as Yield to Worst (YTW) which is the lowest yield of yield to maturity, yield to call, yield to put, or

other yields when a bond is callable, puttable, exchangeable, or has other features. If a bond is called, put or exchanged

before maturity, the bondholder only earns

interest on the time that has elapsed between purchasing the bond

and its early redemption. The resulting yield is less than what would have been earned had the

bond been held

until maturity.

has filed for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, you

may request these documents by calling Deutsche

Bank Securities Inc. toll-free at 1-800-503-4611.

Our Affiliates:

Investment Products: Not FDIC Insured • No Bank Guarantee • May Lose Value

Bank Deposits and Certificates of Deposit (CDs) are FDIC Insured up to Applicable Limits

Securities products and services offered by Zions Direct, Member FINRA / SIPC, a non-bank subsidiary of Zions Bank.

Affiliates of Zions Bank or other issuers may purchase CDs or securities through the auction process. The market clearing yield may be lower due to the participation of an affiliate in the

auction

which may benefit the affiliated issuer.

NEWSLETTER Get market information, auction updates, new-issue alerts, and more. It’s weekly and it’s free! Email

Address

OTHER PRODUCTS CONTACT US ABOUT US SITE MAP PRIVACY POLICY TERMS AND CONDITIONS

Please direct questions regarding the website or bidding procedures to the Auction Administrator.

You may also call our Investment Center at 800-524-8875 from 8am to Midnight Eastern Time.

Results

Auction Status: CLOSED

Auction Start: 4/25/2012 4:30 PM EDT

Auction End: 4/26/2012 3:00 PM EDT

Last Update:

4/26/2012 3:53:43 PM EDT

Security Type: Corporate Bonds

Issue Type: Primary

Coupon: 4.500%

Maturity Date: 3/27/2017

Offering Documents

4.50% 03/27/17 Sr Unsecured | S&P: BBB- | Fitch: BBB- | DBRS: BBB(low) | CUSIP: 989701BB2

Auction Details

Bids Final Market-Clearing Price:

Final Market-Clearing Yield*: 4.442% 100.249372

Bidder Units Price Yield Timestamp Awarded Principal Accrued

Interest

Amount

Due

#30365 25 100.100000 4.476% 4/26/2012 11:57:24 AM Rejected: Price

#30370 3 100.100000 4.476% 4/26/2012 1:47:11 PM Rejected: Price

#30344 200 100.100000 4.476% 4/26/2012 1:56:17 PM Rejected: Price

#21117 100 100.100000 4.476% 4/26/2012 2:58:42 PM Rejected: Price

#28825 10 100.083399 4.480% 4/26/2012 1:58:48 PM Rejected: Price

#27846 100 100.080000 4.481% 4/26/2012 1:55:24 PM Rejected: Price

#29981 2,250 100.062500 4.485% 4/26/2012 12:59:47 PM Rejected: Price

#29981 46 100.062500 4.485% 4/26/2012 1:58:40 PM Rejected: Price

#21117 100 100.050000 4.488% 4/26/2012 12:47:00 PM Rejected: Price

#18480 165 100.039775 4.490% 4/26/2012 10:25:41 AM Rejected: Price

#19560 10 100.039775 4.490% 4/26/2012 11:17:47 AM Rejected: Price

Zions Bancorporation / 5 Year Corporates

Notice: The auction has been extended until 4/26/2012 3:00:33 PM EDT.

#30353 100 100.030000 4.492% 4/26/2012 2:34:45 PM Rejected: Price #29120 28 100.017972 4.495% 4/26/2012 10:38:25 AM Rejected: Price #28923 10 100.017972 4.495% 4/26/2012 1:46:23 PM

Rejected: Price #21363 10 100.010000 4.497% 4/26/2012 12:24:50 PM Rejected: Price #30367 100 100.010000 4.497% 4/26/2012 2:03:30 PM Rejected: Price #18373 15 100.004892 4.498% 4/26/2012 11:31:54 AM Rejected: Price #30369 10 100.004892 4.498%

4/26/2012 1:47:41 PM Rejected: Price #16668 10 100.000533 4.499% 4/26/2012 10:57:23 AM Rejected: Price #29893 8 100.000533 4.499% 4/26/2012 12:36:50 PM Rejected: Price #29978 50 100.000000 4.499% 4/25/2012 4:32:15 PM Rejected: Price #30298 1,000

100.000000 4.499% 4/25/2012 4:34:13 PM Rejected: Price #29773 4,500 100.000000 4.499% 4/25/2012 4:43:29 PM Rejected: Price #30342 250 100.000000 4.499% 4/25/2012 4:48:28 PM Rejected: Price #30341 250 100.000000 4.499% 4/25/2012 4:49:58 PM Rejected:

Price #29772 1,000 100.000000 4.499% 4/25/2012 5:12:46 PM Rejected: Price #30323 40 100.000000 4.499% 4/26/2012 10:13:38 AM Rejected: Price #30094 56,000 100.000000 4.499% 4/26/2012 10:27:36 AM Rejected: Price #23152 20 100.000000 4.499% 4/26/2012

11:53:12 AM Rejected: Price #30365 25 100.000000 4.499% 4/26/2012 11:53:52 AM Rejected: Price #30080 2,000 100.000000 4.499% 4/26/2012 12:48:54 PM Rejected: Price #24773 5 100.000000 4.499% 4/26/2012 1:11:01 PM Rejected: Price #24773 5 100.000000

4.499% 4/26/2012 1:11:01 PM Rejected: Price

Page 2 of 3

#23425 10 100.000000 4.499% 4/26/2012

2:59:38 PM Rejected: Price

#30339 5 99.996174 4.500% 4/25/2012 4:32:05 PM Rejected: Price

#30340 20 99.996174 4.500% 4/25/2012 4:36:26 PM Rejected: Price

#23639 440 99.996174 4.500% 4/25/2012 4:48:27 PM Rejected: Price

#29171 1,000 99.996174 4.500% 4/25/2012 5:25:09 PM Rejected: Price

#18226 10 99.996174 4.500% 4/25/2012 5:39:46 PM Rejected: Price

#7863 25 99.996174 4.500% 4/25/2012 5:41:44 PM Rejected: Price

#23534 5 99.996174 4.500% 4/25/2012 5:44:59 PM Rejected: Price

#30359 25 99.996174 4.500% 4/25/2012 6:03:49 PM Rejected: Price

#27821 1 99.990000 4.501% 4/26/2012 3:28:23 AM Rejected: Price

#27514 250 99.700000 4.568% 4/26/2012 9:16:49 AM Rejected: Price

#14269 10 99.565721 4.599% 4/26/2012 10:19:23 AM Rejected: Price

#29978 175 99.500000 4.614% 4/25/2012 4:32:15 PM Rejected: Price

#30276 7,000 99.500000 4.614% 4/25/2012 4:43:30 PM Rejected: Price

#30080 2,000 99.500000 4.614% 4/26/2012 8:58:33 AM Rejected: Price

#27514 100 99.300000 4.660% 4/26/2012 9:19:14 AM Rejected: Price

#29773 9,100 99.250000 4.672% 4/25/2012 4:38:48 PM Rejected: Price

Auction Totals: 100,000 units $ 100,249,372.01 $ 425,000.00 $ 100,674,372.01

Zions Bancorporation has filed a registration statement (Registration Statement No. 333-173299, including a

prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should

read the prospectus dated April 4, 2011 contained in that registration

statement, the preliminary

prospectus supplement dated April 24, 2012 and other documents Zions Bancorporation has filed with the SEC for more

complete information about Zions Bancorporation and this offering. You may get these documents and other documents Zions Bancorporation

*The current Market-Clearing Yield/Final Auction Yield is calculated as Yield to Worst (YTW) which is the lowest yield of yield to maturity, yield to call, yield to put, or

other yields when a bond is callable, puttable, exchangeable, or has other features. If a bond is called, put or exchanged

before maturity, the bondholder only earns

interest on the time that has elapsed between purchasing the bond

and its early redemption. The resulting yield is less than what would have been earned had the

bond been held

until maturity.

has filed for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, you

may request these documents by calling Deutsche

Bank Securities Inc. toll-free at 1-800-503-4611.

Our Affiliates:

Investment Products: Not FDIC Insured • No Bank Guarantee • May Lose Value

Bank Deposits and Certificates of Deposit (CDs) are FDIC Insured up to Applicable Limits

Securities products and services offered by Zions Direct, Member FINRA / SIPC, a non-bank subsidiary of Zions Bank.

Affiliates of Zions Bank or other issuers may purchase CDs or securities through the auction process. The market clearing yield may be lower due to the participation of an affiliate in the

auction

which may benefit the affiliated issuer.

NEWSLETTER Get market information, auction updates, new-issue alerts, and more. It’s weekly and it’s free! Email

Address

OTHER PRODUCTS CONTACT US ABOUT US SITE MAP PRIVACY POLICY TERMS AND CONDITIONS

Please direct questions regarding the website or bidding procedures to the Auction Administrator.

You may also call our Investment Center at 800-524-8875 from 8am to Midnight Eastern Time.

Results

Auction Status: CLOSED

Auction Start: 4/25/2012 4:30 PM EDT

Auction End: 4/26/2012 3:00 PM EDT

Last Update:

4/26/2012 3:54:14 PM EDT

Security Type: Corporate Bonds

Issue Type: Primary

Coupon: 4.500%

Maturity Date: 3/27/2017

Offering Documents

4.50% 03/27/17 Sr Unsecured | S&P: BBB- | Fitch: BBB- | DBRS: BBB(low) | CUSIP: 989701BB2

Auction Details

Bids Final Market-Clearing Price:

Final Market-Clearing Yield*: 4.442% 100.249372

Bidder Units Price Yield Timestamp Awarded Principal Accrued

Interest

Amount

Due

#27514 250 99.250000 4.672% 4/26/2012 9:19:14 AM Rejected: Price

#25702 200 99.010000 4.728% 4/26/2012 10:03:02 AM Rejected: Price

#21470 25 99.000000 4.730% 4/25/2012 7:36:26 PM Rejected: Price

#27514 100 99.000000 4.730% 4/26/2012 9:19:14 AM Rejected: Price

#30358 10 98.913350 4.750% 4/25/2012 5:48:38 PM Rejected: Price

#13264 5 98.913350 4.750% 4/25/2012 6:46:04 PM Rejected: Price

#18373 20 98.913350 4.750% 4/25/2012 11:52:58 PM Rejected: Price

#16791 25 98.913350 4.750% 4/26/2012 2:04:06 AM Rejected: Price

#30139 10,000 98.910000 4.751% 4/26/2012 8:22:07 AM Rejected: Price

#16612 25 98.820000 4.772% 4/25/2012 10:36:15 PM Rejected: Price

#25702 300 98.810000 4.774% 4/26/2012 10:03:02 AM Rejected: Price

Zions Bancorporation / 5 Year Corporates

Notice: The auction has been extended until 4/26/2012 3:00:33 PM EDT.

Page 3 of 3

#15178 50 98.800000 4.776% 4/25/2012

5:11:30 PM Rejected: Price

#28519 5 98.800000 4.776% 4/25/2012 7:06:58 PM Rejected: Price

#16805 50 98.784338 4.780% 4/25/2012 5:02:59 PM Rejected: Price

#23104 19 98.780000 4.781% 4/26/2012 8:44:32 AM Rejected: Price

#23085 10 98.762855 4.785% 4/25/2012 6:19:52 PM Rejected: Price

#26795 50 98.760000 4.786% 4/26/2012 10:25:04 AM Rejected: Price

#27105 10 98.754263 4.787% 4/25/2012 5:35:12 PM Rejected: Price

#14796 16 98.754263 4.787% 4/25/2012 7:34:17 PM Rejected: Price

#27180 125 98.750000 4.788% 4/25/2012 4:35:29 PM Rejected: Price

#17916 1,000 98.750000 4.788% 4/25/2012 4:53:37 PM Rejected: Price

#30192 6,000 98.750000 4.788% 4/25/2012 5:29:27 PM Rejected: Price

#29224 1 98.750000 4.788% 4/25/2012 5:57:55 PM Rejected: Price

#27491 10 98.750000 4.788% 4/25/2012 8:11:57 PM Rejected: Price

#27514 100 98.750000 4.788% 4/26/2012 9:23:42 AM Rejected: Price

#29824 1,500 98.750000 4.788% 4/26/2012 9:37:05 AM Rejected: Price

#30101 35,000 98.750000 4.788% 4/26/2012 10:38:16 AM Rejected: Price

Auction Totals: 100,000 units $ 100,249,372.01 $ 425,000.00 $ 100,674,372.01

Zions Bancorporation has filed a registration statement (Registration Statement No. 333-173299, including a

prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should

read the prospectus dated April 4, 2011 contained in that registration

statement, the preliminary

prospectus supplement dated April 24, 2012 and other documents Zions Bancorporation has filed with the SEC for more

complete information about Zions Bancorporation and this offering. You may get these documents and other documents Zions Bancorporation

has filed for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, you may request these documents by

calling Deutsche

Bank Securities Inc. toll-free at 1-800-503-4611.

*The current Market-Clearing Yield/Final Auction Yield is calculated as Yield to Worst (YTW) which is the lowest yield of yield to maturity, yield to call, yield to put, or

other yields when a bond is callable, puttable, exchangeable, or has other features. If a bond is called, put or exchanged

before maturity, the bondholder only earns

interest on the time that has elapsed between purchasing the bond

and its early redemption. The resulting yield is less than what would have been earned had the

bond been held

until maturity.

Our Affiliates:

Investment Products: Not FDIC Insured • No Bank Guarantee • May Lose Value

Bank Deposits and Certificates of Deposit (CDs) are FDIC Insured up to Applicable Limits

Securities products and services offered by Zions Direct, Member FINRA / SIPC, a non-bank subsidiary of Zions Bank.

Affiliates of Zions Bank or other issuers may purchase CDs or securities through the auction process. The market clearing yield may be lower due to the participation of an affiliate in the

auction

which may benefit the affiliated issuer.

NEWSLETTER Get market information, auction updates, new-issue alerts, and more. It’s weekly and it’s free! Email

Address

OTHER PRODUCTS CONTACT US ABOUT US SITE MAP PRIVACY POLICY TERMS AND CONDITIONS

Please direct questions regarding the website or bidding procedures to the Auction Administrator.

You may also call our Investment Center at 800-524-8875 from 8am to Midnight Eastern Time.

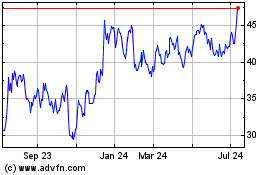

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

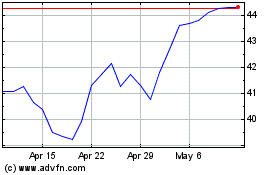

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024