TIDMFRES

RNS Number : 5443B

Fresnillo PLC

18 April 2012

Fresnillo Plc

28 Grosvenor Street

London W1K 4QR

United Kingdom

www.fresnilloplc.com

18 April 2012

Interim Management Statement and Production Report

for the three months ended 31 March 2012

Overview

-- Noche Buena commenced first commercial gold production within time and budget in March.

-- Quarterly attributable gold production above expectations and

an increase of 26.3% to 121,792 ounces compared with 1Q 2011.

-- Quarterly attributable silver production of 9.8 million

ounces, including the Silverstream, on target with a small decrease

of 2.9% when compared with 1Q 2011.

-- Construction of the dynamic leaching plant at Herradura

remains on track to become operational in 2013.

-- Good progress of exploration programme and development

workings at San Julian, Orisyvo and Centauro Deep.

-- Entered into an association agreement with Canadian listed

miner, Orex Minerals to explore and develop as one large project

each company's adjacent mineral concessions in Coneto, Durango.

Jaime Lomelin, Chief Executive Officer, said:

"The strong operational performance that Fresnillo enjoyed in

2011 has continued into 2012. We have delivered another strong

quarter of production with gold beating our expectations, up more

than 26%, and silver production in line. As operators, we

continually manage and adjust our operations to ensure our

production profile is optimised to extract the maximum value from

our portfolio. In the case of our gold production, we optimised our

mine plan in order to take advantage of the high gold prices.

The highlight of the quarter has been the completion and

commissioning of our new gold mine at Noche Buena in the Herradura

district. We are particularly pleased that this was accomplished on

time and within budget. Commercial production began in March and

the mine will produce around 42,000 attributable ounces of gold per

year once it reaches its full capacity which we expect to occur by

the end of this year. This will significantly increase the

proportion of gold production within our portfolio. We believe this

is another strong example of the company delivering on its growth

ambitions and represents a step forward to consolidate Fresnillo's

position as a significant gold producer in its own right."

Total Production - Attributable

1Q 12 1Q 11 % change 4Q 11

--------------- -------- ------- --------- --------

Silver prod'n

(koz) 8,769 9,083 -3.5 9,258

--------------- -------- ------- --------- --------

Silverstream

(koz) 1,027 1,010 1.7 1,088

--------------- -------- ------- --------- --------

Total silver

prod'n (koz) 9,796 10,093 -2.9 10,346

--------------- -------- ------- --------- --------

Gold prod'n

(Oz) 121,792 96,407 26.3 122,621

--------------- -------- ------- --------- --------

Lead prod'n

(t) 6,265 5,245 19.4 5,501

--------------- -------- ------- --------- --------

Zinc prod'n

(t) 6,925 5,864 18.1 5,932

--------------- -------- ------- --------- --------

Quarterly total silver production (including Silverstream) was

in line with the Group's expectations. The anticipated natural

decline in silver grades at the Fresnillo mine was compensated by

the ramp-up of production at Saucito, thus limiting the adverse

effect in silver production when comparing to the first and fourth

quarters of 2011.

Quarterly attributable gold production increased by 26.3%

compared with the same period of 2011 mainly due to increased

throughput at Saucito, Cienega and Herradura. In addition,

commercial production at Noche Buena commenced in March, further

benefiting quarterly attributable gold production. Gold production

remained stable compared to the fourth quarter of 2011.

Quarterly by-product lead and zinc production increased by 19.4%

and 18.1%, respectively, over the first quarter of 2011 as a result

of higher ore grades, recovery rates and tonnage milled at the

Fresnillo mine and increased volumes of ore milled at Saucito.

Fresnillo mine production

1Q 12 1Q 11 % change 4Q 11

-------------- ------ ------ --------- ------

Silver (kOz) 6,748 8,532 -20.9 7,014

-------------- ------ ------ --------- ------

Gold (Oz) 8,731 6,134 42.3 7,678

-------------- ------ ------ --------- ------

Lead (t) 4,277 3,365 27.1 3,475

-------------- ------ ------ --------- ------

Zinc (t) 4,125 3,221 28.1 3,076

-------------- ------ ------ --------- ------

Quarterly silver production at the Fresnillo mine fell by 20.9%

when compared to the first quarter of the previous year due to the

natural and expected decline in silver ore grades from 445 g/t to

335 g/t. This decline was mitigated by the increased volumes of ore

processed at the Fresnillo mill as access to long hole stopes was

regained following backfilling activities carried out in 2011 to

reinforce safety conditions. On a sequential basis, quarterly

silver production declined 3.8% from the fourth quarter of 2011 due

to lower ore grades, in line with the forecast of 330-340 g/t for

2012 as a whole.

The increase in quarterly by-product lead and zinc production

over the first quarter of 2011 was explained by higher volumes of

ore milled, ore grades and improved recovery rates.

Engineering work to expand the milling capacity from 8,000 to

10,000 tonnes per day began in the quarter with site selection and

general layout already defined. This project, combined with

additional mine development will maintain annual silver production

within a range of 26 to 28 million ounces.

Saucito mine production*

1Q 12 1Q 11 % change 4Q 11

-------------- ------- ------ --------- ---------------

Silver (kOz) 1,494 187 >100.0 1,651

-------------- ------- ------ --------- ---------------

Gold (Oz) 11,358 831 >100.0 11,662

-------------- ------- ------ --------- ---------------

Lead (t) 485 59 >100.0 517

-------------- ------- ------ --------- ---------------

Zinc (t) 349 45 >100.0 349

-------------- ------- ------ --------- ---------------

* 1Q11 figures: ore processed as a result of the initial tests

during the commissioning of Saucito.

As expected, the Saucito concentrator milled 2,500 tonnes per

day and silver and gold production was in line with the Group's

outlook. Notwithstanding, quarterly silver, gold and lead

production decreased when compared to the fourth quarter of 2011

which was higher due to the higher throughput from the ore

stockpile as we commenced ramp up. The stockpile has run down and

Saucito continues to ramp up the mine to full capacity of 3,000

tonnes per day which is expected by the end of 2012.

The construction of the Jarillas shaft progressed well over the

period and remains on track to be concluded in late 2012. This new

shaft will have a capacity of 5,000 tonnes per day and will reduce

haulage and hoisting costs of Saucito.

Cienega mine production

1Q 12 1Q 11 % change 4Q 11

-------------- -------- -------- --------- -------

Gold (Oz) 31,546 26,956 17.0 31,157

-------------- -------- -------- --------- -------

Silver (kOz) 466 275 69.5 532

-------------- -------- -------- --------- -------

Lead (t) 1,503 1,822 -17.5 1,509

-------------- -------- -------- --------- -------

Zinc (t) 2,451 2,598 -5.7 2,508

-------------- -------- -------- --------- -------

Quarterly gold production increased by 17.0% over the first

quarter of 2011 due to higher volumes of ore processed after

completion of the expansion of milling capacity to 930,000 tonnes

per year in June 2011. Quarterly silver production increased

significantly over the same period in 2011 as a result of higher

ore grades and throughput. However, lower volumes of ore hauled and

milled from the San Ramon satellite mine affected quarterly silver

production at Cienega when compared to the previous quarter. This

was because we managed production at Cienega to extract the most

value out of the mine and optimise production. To capitalise on

current gold prices we prioritised ore throughput from the Cienega

mine which has higher gold content than that from San Ramon, which

has a higher silver content. As a result we changed the production

balance at Cienega and therefore saw a slight decrease in silver

production at Cienega for the quarter when compared with the fourth

quarter of 2011.

Quarterly lead and zinc production decreased compared to the

same quarter of 2011 as a result of lower ore grades.

Herradura mine production - Attributable

1Q 12 1Q 11 % change 4Q 11

-------------- -------- -------- --------- -------

Gold (Oz) 46,722 41,974 11.3 48,804

-------------- -------- -------- --------- -------

Silver (kOz) 49 76 -35.5 49

-------------- -------- -------- --------- -------

Attributable gold production for the first three months of 2012

increased by 11.3% over the same period in 2011 due to improved

recovery rates and increased ore deposited.

However, the expected lower ore grades caused quarterly

attributable gold production to decrease by 4.3% compared to the

previous quarter. This decline in the ore grade is in line with our

decision to process lower grade ore which is profitable at current

gold prices and thus managing the mine to extract maximum value and

optimise production.

The exploration programme and mine development at the Centauro

Deep project is progressing according to schedule.

In the first quarter, we evaluated an expansion of the Centauro

pit under alternative price scenarios. Results were encouraging

enough to relocate the site of the dynamic leaching plant project

to accommodate an eventual expansion. Additional drilling will

provide further information to confirm the viability of the

project.

Soledad-Dipolos mine production - Attributable

1Q 12 1Q 11 % change 4Q 11

-------------- -------- -------- --------- -------

Gold (Oz) 21,209 20,511 3.4 23,321

-------------- -------- -------- --------- -------

Silver (kOz) 12 14 -14.3 11

-------------- -------- -------- --------- -------

Quarterly attributable gold production was slightly higher

compared to the same quarter of 2011 as a result of increased

volumes of ore deposited and improved recovery rates. As at

Herradura, the decision to treat lower grade ore affected quarterly

attributable gold production when compared to the fourth quarter of

2011.

Noche Buena mine production - Attributable

1Q 12 1Q 11 % change 4Q 11

-------------- ------- ------ --------- ------

Gold (Oz) 2,227 - - -

-------------- ------- ------ --------- ------

Silver (kOz) 1 - - -

-------------- ------- ------ --------- ------

The construction of the Noche Buena gold mine was successfully

concluded on time and within the US$63 million budget. Commercial

production commenced in March with 2,227 gold ounces produced.

Commercial ramp up at Noche Buena is progressing as planned as we

look to produce around 42,000 attributable ounces of gold a year at

full capacity.

Update on development projects

-- Dynamic leaching plant at Herradura

The construction of the dynamic leaching plant at Herradura

remained on track to become operational in 2013. This US$106.8

million project is expected to process high grade ore from the

Herradura and Soledad-Dipolos pits, which will increase gold

production by an average of 51,000 ounces per year over the

2013-2020 period. Due to the possible expansion of the Centauro

pit, the site for the new leaching plant will be relocated without

significant delays and additional costs.

Update on exploration

Exploration drilling continued in the first quarter of 2012 with

52 surface drill rigs at the Herradura, Noche Buena, Cienega and

Fresnillo mines, and the San Julian, Orisyvo, Juanicipio, Lucerito,

Candamena, Tajitos, Guanajuato, Cebadillas, Yesca, and Amata

projects. Deep gold mineralization was extended at both Herradura

and Noche Buena. Interesting gold-silver values were intersected in

new areas on the Shalom and Minas veins at San Julian, and the

Huilota veins in Guanajuato. Exploration cross cuts to obtain

metallurgical samples continue on schedule at San Julian and

Orisyvo.

Several targets for additional study have been identified on our

claims in the Mesa Central and Herradura Corridor gold belts, and

are in the process of being evaluated.

In February Fresnillo signed an association agreement with Orex

Minerals Inc ("Orex"), a Canadian exploration company listed on the

TSX Venture exchange, the US OTC Pink Sheets and the Frankfurt

Exchange. In accordance with the agreement, Fresnillo will invest a

minimum of US$2 million during the first year of exploration and

will have the option to spend an additional US$2 million per year

on exploration for each of the following two years. The agreement

will enable Orex and Fresnillo to explore and develop each

company's respective mineral concessions in the Coneto gold-silver

mining district in Durango, Mexico, together under one large

exploration project. The combined concessions of Orex and Fresnillo

total over 17,600 hectares.

In return for the initial investment of US$6 million over three

years Fresnillo will acquire a 55% stake in the association, and

may increase its participation after the initial three years to 70%

by investing an additional US$21 million or completing a

prefeasibility study. As part of the arrangement, Fresnillo

invested US$2 million in Orex shares, including warrants, at a

fixed price of CAN $0.80 per share.

Safety Performance

As reported in the Preliminary Announcement, one fatality

occurred in January at the Fresnillo mine. A supervisor's failure

to follow safety procedures resulted in the regrettable loss of a

contractor's life. The Group continues to reinforce safety

procedures and programmes and as a result, the accident rate has

decreased in the first quarter of the year. We continue to work

diligently on a behavioural change programme and implementing a

broad awareness campaign across all mine units and contractors.

Fresnillo plc remains committed to improve its safety performance

and achieve its zero fatal accidents target.

There will be a conference call for analysts and investors on

Wednesday 18 April 2012 at 09.00am BST (London time). The dial in

details are as follows:

Participants' dial in number: +44 (0) 1452 542 400

Access code: 71453499

For further information, please visit our website

www.fresnilloplc.com or contact:

Fresnillo plc Tel: +44 (0)20 7399 2470

London Office

Arturo Espinola, Head of Investor

Relations

Mexico City Office Tel: +52 55 52 79 3203

Gabriela Mayor

Brunswick Group Tel: +44 (0)20 7404 5959

Carole Cable

David Litterick

About Fresnillo plc

Fresnillo plc is the world's largest primary silver producer and

Mexico's second largest gold producer, listed on the London Stock

Exchange under the symbol FRES.

Fresnillo has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Cienega, San Ramon, Herradura, Soledad-Dipolos

and Noche Buena; one development project -a dynamic leaching plant

to treat high grade gold ore from the Herradura and Soledad-Dipolos

mine; and five advanced exploration prospects - San Julian,

Centauro Deep, Juanicipio, Orysivo and Las Casas as well as a

number of other long term exploration prospects. In total, has

mining concessions covering approximately 2.1 million hectares in

Mexico.

Fresnillo has a strong and long tradition of mining, a proven

track record of mine development, reserve replacement, and

production costs in the lowest quartile of the cost curve for both

silver and gold.

Fresnillo's goal is to maintain the Group's position as the

world's largest primary silver company, producing 65 million ounces

of silver and 500,000 ounces of gold by 2018.

Forward Looking Statements

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, commodity

prices, changes in regulation, currency fluctuations (including the

US dollar and Mexican Peso exchanges rates), the Fresnillo Group's

ability to recover its reserves or develop new reserves, including

its ability to convert its resources into reserves and its mineral

potential into resources or reserves, changes in its business

strategy and political and economic uncertainty.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGUGCCUPPPPM

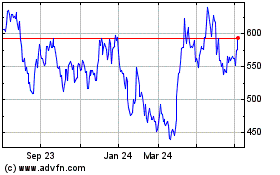

Fresnillo (LSE:FRES)

Historical Stock Chart

From Mar 2024 to Apr 2024

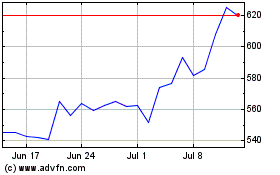

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2023 to Apr 2024