Earnings Preview: Baxter - Analyst Blog

April 17 2012 - 10:00AM

Zacks

Baxter

International (BAX) is slated to report its first-quarter

2012 results on Thursday, April 19. The current Zacks Consensus

Estimate for the quarter is $0.99, representing an estimated 1.38%

annualized increase.

Fourth Quarter

Recap

Baxter reported fourth quarter

adjusted (excluding one-time items) earnings per share of $1.17,

just beating the Zacks Consensus Estimate of $1.16, and surpassing

the year-ago earnings of $1.11. Reported net income increased to

$463 million (or 82 per share) from $423 million (or 72 a share) a

year ago.

Total revenues were $3,594 million,

up 3% year over year, beating the Zacks Consensus Estimate of

$3,578 million. U.S. revenues for the quarter inched up 2% to

$1,466 million while ex-U.S. sales were higher 3% (up 3% in

constant currency) to $2,128 million.

The Plasma Proteins business, where

Baxter had encountered structural problems in the past, did not do

so well with revenues of $397 million, down 4% (down 2% in constant

currency) year over year. Antibody Therapy delivered good results

with sales of $406 million, climbing 5% (up 6% in constant

currency) year over year.

Estimate Revision

Trend

Agreement

The overall trend in estimate

revisions for Baxter demonstrated little activity in the recent

past. Of the 14 analysts covering the stock, only 1 changed his/her

estimate (in the upward direction), for the current quarter, over

the prior week and past month. The same pattern was repeated (by 17

analysts covering the stock), for the current year. The current

Zacks Consensus Estimate for 2012 is $4.54, reflecting an estimated

5.23% year-over-year increase.

Magnitude

Given the general shortage of

estimate revisions, the magnitude of revisions, for the forthcoming

quarter, has hit a plateau over the last week and month. The

estimate for fiscal 2012 has moved up by only a penny over the

prior week and month.

Baxter has produced positive

surprises in three of the previous four quarters and we expect a

similar trend to continue. The company produced an average earnings

surprise of 3.74% over the prior four quarters, meaning that it

beat the Zacks Consensus Estimate by that measure.

Our Take

The news regarding Baxter still

remains mixed. On the positive side, Baxter’s focus on

life-sustaining products, which are not commoditized, partly

insulates it from an economic downturn. The company is able to

generate recurring revenues, and consistent cash flow, due to its

focus on chronic diseases. Among other positive factors, Baxter

retains a strong product pipeline with several products in

late-stage clinical development.

Baxter, in November 2011, completed

its acquisition of Baxa Corporation. The takeover highlights the

company’s continued commitment toward patient safety and nutrition.

It also permits Baxter to provide a wider set of solutions for the

safe preparation and delivery of IV medication. Baxa’s know-how

will benefit patients across the globe.

Moreover, Baxter struck a deal, in

December 2011, to buy Synovis Life Technologies

(SYNO), a well-known provider of mechanical and biological products

for the repair of soft tissue utilized in a large number of

surgical operations. The acquisition will further expand Baxter’s

offerings in the area of biosurgery and regenerative

treatment.

On the flip side, despite

resilience in Plasma Proteins and Antibody Therapy sub-segments, we

are concerned about stagnation in sales, a slightly somber outlook

for hospital spending and tightening of reimbursement. We also

account for the unfavorable impact of foreign exchange translation

and possible dilution associated with the company’s acquisitions of

Baxa and Synovis.

Improved execution has lifted

sentiment somewhat toward Baxter. It is a good bet for value

investors willing to wait as fundamentals improve further. Among

others, the company competes with Becton, Dickinson and

Company (BDX) in certain niches. We currently have a

Neutral long-term rating on Baxter. The stock currently retains a

Zacks #2 Rank, which translates into a short-term “Buy”

recommendation.

BAXTER INTL (BAX): Free Stock Analysis Report

BECTON DICKINSO (BDX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

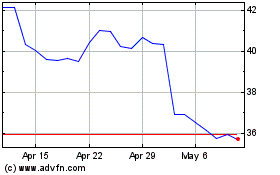

Baxter (NYSE:BAX)

Historical Stock Chart

From Aug 2024 to Sep 2024

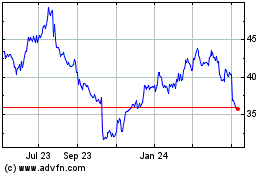

Baxter (NYSE:BAX)

Historical Stock Chart

From Sep 2023 to Sep 2024