Energy Transfer Equity Boss Renounces Hostile Bids

August 11 2016 - 5:51PM

Dow Jones News

By Alison Sider

Veteran pipeline dealmaker Kelcy Warren, chairman of Energy

Transfer Equity, says life is too short for hostile deals.

Mr. Warren told The Wall Street Journal in an exclusive

interview Thursday that was the lesson he took away after months of

wrangling over his plan to buy rival pipeline giant Williams

Cos.

The deal, initially valued at $33 billion, would have created a

100,000-mile network of oil-and-gas pipes, creating one of the

largest systems of fuel-moving arteries around North America. But

its failure doesn't mean Energy Transfer is out of the market.

Mr. Warren still has an acquisitive streak and said deals remain

an important part of the strategy to growing his Dallas-based

energy empire. Energy Transfer is now focused on finding "bolt-on"

deals that complement existing assets, though bigger acquisitions

aren't off the table.

"You know, I wouldn't mind elephant hunting like we did with

Williams. I would actually be very receptive to that," he said.

"But I will never ever do anything again in my career that's

perceived as hostile. I will never do that."

Williams officials wouldn't comment for this article.

Williams rejected Energy Transfer's all-stock offer to buy the

company in June 2015, but Energy Transfer kept pushing the

takeover. Williams's board remained divided over the deal at a

meeting last September; seven directors, including Chief Executive

Alan Armstrong, were opposed to the deal. But the Williams board

eventually approved Energy Transfer's advance in an 8-5 vote.

Only a few months later, Mr. Warren came to see the deal -- and

particularly a $6 billion cash payment his company agreed to give

Williams shareholders -- as a looming disaster that could ripple

throughout his energy-infrastructure juggernaut. Oil prices crashed

after the two companies signed their agreement, freezing pipeline

companies out of capital markets that Energy Transfer needed to tap

to borrow funds to close the deal.

Mr. Warren said Thursday that he tried to renegotiate with

Williams in light of the energy bust but was "stiff-armed" by the

company. Williams has maintained that it fully supported the

merger, but Energy Transfer tried to torpedo the deal.

"When you get into a deal that you do not want to do at some

point because the economics have changed, yet you're obligated

contractually to do it, that's a disruption, a distraction, it's

unhealthy," he said. "That's behind us now."

But Mr. Warren still has work to do convincing investors that

under his leadership Energy Transfer will prosper with stockholders

sharing in the largess, several analysts and investors have

said.

In March, Energy Transfer issued preferred convertible shares to

certain insiders, including Mr. Warren and other company officials,

that effectively insulated them from any future dividend cuts the

company might make. That move upset Williams and its shareholders,

as well as many Energy Transfer investors.

Mr. Warren said the company has no plans to unwind that

transaction, and blamed Williams for not allowing the securities to

be offered to all Energy Transfer investors. He said Energy

Transfer's cash distribution won't be cut, but that the company

would consider offering similar shares to other investors.

The protracted drama hasn't damaged the company's reputation,

Mr. Warren insists.

"I'm not concerned that people will not do business with us

because they think we're not going to deal with them straight up.

Not concerned at all," he said.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

August 11, 2016 17:36 ET (21:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

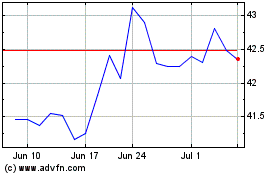

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Aug 2024 to Sep 2024

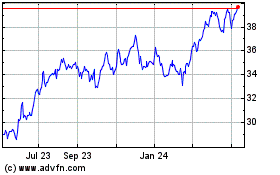

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Sep 2023 to Sep 2024