By Newley Purnell

NEW DELHI -- President-elect Donald Trump doesn't take office in

Washington until Friday, but he is already forcing firms in India's

mammoth $108 billion technology-outsourcing industry to rethink

their hiring practices in the U.S., their largest market.

While Mr. Trump has chastised U.S. firms for offshoring American

jobs, Indian outsourcing firms could be set to see renewed heat for

doing the opposite -- placing foreign workers in the U.S., mainly

through a skilled-worker visa, known as the H-1B. Faced with the

prospect of possible new curbs on those visas from a president who

has pledged to ensure that Americans get their first pick of

available jobs, outsourcers are ramping up hiring both on American

college campuses and at home in India.

"Depending on the nature of the policy, it can have some impact

on the way companies like mine have worked in the past, so we will

have to adjust to that," said Vishal Sikka, chief executive of

Infosys Ltd., one of India's top outsourcing and software

companies, in an interview in Davos, Switzerland.

Nothing that there is a "severe shortage" of people with the

right technical skills in the U.S., Mr. Sikka said Infosys would

still have to "train and hire more locally and work together with

clients in figuring out how to balance that with the global talent

that is outside, using more technology and so forth and use the

visa as necessary and as permitted."

Early this month, prominent Republican lawmaker Rep. Darrell

Issa reintroduced a bill to tighten H-1B rules. But it is still

unclear what action Mr. Trump or his administration might take, if

any, to restrict the visas.

Mr. Trump issued a statement during the campaign vowing to "end

forever the use of the H-1B as a cheap labor program," though at

other times he said he supported highly-skilled immigration. In

addition, his wife, Melania Trump, says she used an H-1B visa to

work in the U.S. as a fashion model, meaning Mr. Trump might be

personally familiar with the program's practical applications.

The demand for H-1B visas, intended to fill jobs for which there

aren't qualified Americans, is high both from U.S. technology firms

like Microsoft Corp. and Intel Corp. and Indian outsourcing

companies such as Infosys, Tata Consultancy Services Ltd. and Wipro

Ltd. Last April, the number of applications surpassed the entire

fiscal year's supply of 85,000 visas within five days, making it

the fourth straight year in which demand surpassed supply in under

a week. Some two-thirds of the visas, allotted by lottery, go to

the tech sector.

U.S. critics of Indian outsourcers say the firms secure

high-skill visas for jobs U.S. workers could do for clients like

banks, retailers and others, but for whom they would have to pay

more. The Indian firms say they have difficulty finding enough U.S.

tech workers to hire.

"We hope we can work together" with the Trump administration,

said Shivendra Singh, who heads global trade development for

India's tech industry body Nasscom, which cut its growth forecast

for the outsourcing industry soon after Mr. Trump's election.

Mr. Singh acknowledged Indian firms grapple with the perception

that they rely excessively on skilled-worker visas. "People mention

visa abuse, low cost labor, the replacement of American workers,"

he said, but he noted that outsourcers work with most of the U.S.'s

largest corporations, contributing to the American economy.

A spokeswoman at TCS, India's largest outsourcer by sales,

didn't immediately respond to questions about the company's

preparations for potential changes to visa rules. A Wipro spokesman

declined to comment, citing the quiet period ahead of its quarterly

results due next week.

Following the U.S. election, Nasscom, which stands for the

National Association of Software and Services Companies, in

November cut its growth forecast for the sector to 8%-10% for the

fiscal year ending March 31. That is down from a previous estimate

of 10%-12% and far below the industry's 16.5% growth for the fiscal

year ended in 2012. The group cited "global, political and economic

and business scenarios" among the factors.

In India, the outsourcing industry employs nearly 3.7 million

people, representing a crucial path to the middle class in the

world's second-most-populous country. The U.S. accounts for about

60% of the Indian outsourcing industry's revenue, according to

Nasscom, and India's outsourcers send tens of thousands of workers

to the U.S. every year.

Hiring more workers in the U.S. could raise costs for Indian

tech firms, said Madhu Baba, an analyst who studies the tech sector

at Mumbai-based brokerage Prabhudas Lilladher, as they would likely

demand higher salaries. Indian staff are also more likely to move

to wherever they are needed in the U.S. and can simply be sent home

when projects end, while workers hired domestically might be less

mobile and may expect longer-term employment, he said.

Outsourcers might look to acquire smaller IT-services firms in

the U.S., which would boost their manpower there but require

financial outlays in the near-term, he said. The companies are also

looking at hiring additional workers in India to do more work for

companies in the U.S. remotely, Mr. Baba said.

The increased scrutiny on outsourcing firms' U.S. hiring

practices comes as they also face challenges due in part to the

rise of new technologies like cloud computing, which require less

labor.

To make matters worse, outsourcers' clients in the critical

financial industry have also been slashing IT budgets amid

macroeconomic uncertainty following the U.K. referendum to leave

the European Union and Mr. Trump's election.

Deborah Ball contributed to this article

Write to Newley Purnell at newley.purnell @wsj.com

(END) Dow Jones Newswires

January 19, 2017 09:35 ET (14:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

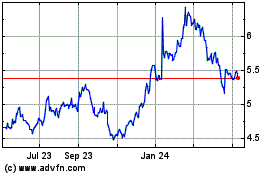

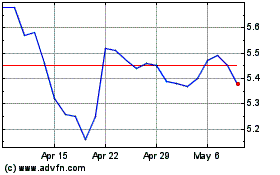

Wipro (NYSE:WIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wipro (NYSE:WIT)

Historical Stock Chart

From Apr 2023 to Apr 2024