Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 09 2015 - 5:03PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement dated

July 9, 2015 and the Prospectus dated March 6, 2015

Registration Nos. 333-202586 and 333-202586-01

VENTAS REALTY, LIMITED PARTNERSHIP

Fully and unconditionally guaranteed by Ventas, Inc.

Terms applicable to

$500,000,000 4.125% Senior Notes due 2026

|

Issuer: |

Ventas Realty, Limited Partnership |

|

|

|

|

Guarantor: |

Ventas, Inc. |

|

|

|

|

Aggregate Principal Amount: |

$500,000,000 |

|

|

|

|

Final Maturity Date: |

January 15, 2026 |

|

|

|

|

Public Offering Price: |

99.218%, plus accrued interest, if any, from July 16, 2015 |

|

|

|

|

Coupon: |

4.125% |

|

|

|

|

Yield to Maturity: |

4.218% |

|

|

|

|

Benchmark Treasury: |

2.125% due May 15, 2025 |

|

|

|

|

Benchmark Treasury Yield: |

2.298% |

|

|

|

|

Spread to Benchmark Treasury: |

T+192 bps |

|

|

|

|

Interest Payment Dates: |

January 15 and July 15, commencing January 15, 2016 |

|

|

|

|

Optional Redemption: |

The redemption price for notes that are redeemed before October 15, 2025 will be equal to (i) 100% of their principal amount, together with accrued and unpaid interest thereon, if any, to (but excluding) the date of redemption, plus (ii) a make-whole premium (T+30 bps). The redemption price for notes that are redeemed on or after October 15, 2025 will be equal to 100% of their principal amount, together with accrued and unpaid interest thereon, if any, to (but excluding) the date of redemption, and will not include a make-whole premium. |

|

|

|

|

Joint-Book-Running Managers: |

UBS Securities LLC |

|

|

Citigroup Global Markets Inc. |

|

|

Credit Agricole Securities (USA) Inc. |

|

Senior Co-Managers: |

Barclays Capital Inc. |

|

|

Credit Suisse Securities (USA) LLC |

|

|

Goldman, Sachs & Co. |

|

|

Morgan Stanley & Co. LLC |

|

|

Wells Fargo Securities, LLC |

|

|

|

|

Co-Managers: |

BBVA Securities Inc. |

|

|

Mitsubishi UFJ Securities (USA), Inc. |

|

|

PNC Capital Markets LLC |

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC |

|

|

Capital One Securities, Inc. |

|

|

Fifth Third Securities, Inc. |

|

|

SMBC Nikko Securities America, Inc. |

|

|

Stifel, Nicolaus & Company, Incorporated |

|

|

Williams Capital Group, L.P. |

|

|

|

|

CUSIP / ISIN: |

92277G AG2/ US92277GAG29 |

|

|

|

|

Denominations: |

$1,000 x $1,000 |

|

|

|

|

Trade Date: |

July 9, 2015 |

|

|

|

|

Settlement Date: |

July 16, 2015 (T+5) |

|

|

|

|

|

It is expected that delivery of the notes will be made to investors on or about July 16, 2015, which will be the fifth business day following the date hereof (such settlement being referred to as “T+5”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in three business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on the date of pricing of the notes or the next succeeding business day will be required, by virtue of the fact that the notes initially will settle T+5, to specify an alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors. |

|

|

|

|

Form of Offering: |

SEC Registered (Registration No. 333-202586) |

2

Additional Changes to the Preliminary Prospectus Supplement:

On an as adjusted basis, after giving effect to the sale of the notes offered hereby and the application of the net proceeds therefrom, as if each had occurred on March 31, 2015, we would have had approximately $12.1 billion of outstanding indebtedness (excluding unamortized fair value adjustment and unamortized discounts).

Ventas, Inc. and the issuer have filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents that Ventas, Inc. and the issuer have filed with the SEC, including the prospectus supplement, for more complete information about Ventas, Inc., the issuer and this offering. You may get these documents for free by visiting the SEC Web site at www.sec.gov. Alternatively, Ventas, Inc., the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the accompanying prospectus supplement if you request it by contacting: UBS Securities LLC, Attention: Prospectus Specialist, 1285 Avenue of the Americas, New York, NY 10019, telephone: 888-827-7275; Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: 800-831-9146; Credit Agricole Securities (USA) Inc., Attention: Debt Syndicate, 1301 Avenue of the Americas, New York, New York 10019, telephone: 212-261-3678.

3

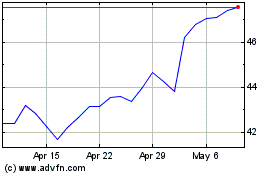

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

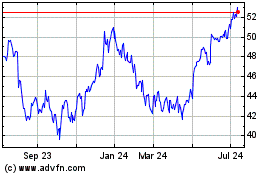

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024