- Adjusted Net Income: €625 million,

+24,8%

- Strong growth of all of Universal

Music Group’s operations, particularly subscription and

streaming

- Continued growth of Canal+ Group’s

international operations; transformation plan at Canal+ in France

well underway

- Gameloft’s new strategy in

place

- Solid contribution from Telecom

Italia

Regulatory News:

Vivendi (Paris:VIV):

First nine months 2016 key

figures1

Changeyear-on-year

Change at constant currencyand perimeter2

year-on-year

€7,712 M +1.3% +0.6%

IFRS measures

€1,278 M +15.9%

- Earnings from continuing operationsattributable to

Vivendi SA shareowners

€1,177 M x2.1

- Earnings attributable to Vivendi SA shareowners3

€1,175 M -34.3%

Adjusted measures4

€730 M -3.6% -1.4%

€664 M -9.7% -6.9%

€625 M +24.8% Cash

- Cash flow from operations (CFFO)4

€555 M +46.3%

+€2.5bn vs. +€6.4bn as of December 31, 2015

1In compliance with IFRS 5, GVT (sold in 2015), has been

reported as a discontinued operation. In practice, income and

charges from this business have been reported as follows:

- GVT’s contribution, until its effective

divestiture on May 28, 2015, to each line of Vivendi’s Consolidated

Statement of Earnings has been reported on the line “Earnings from

discontinued operations”; and

- the share of net income and the capital

gain recognized as a result of the divestiture have been excluded

from Vivendi’s adjusted net income.

2 Constant perimeter reflects the impacts of the acquisitions of

Dailymotion on June 30, 2015, Radionomy on December 17, 2015,

Alterna’TV on April 7, 2016 and Gameloft on June 29, 2016.3 A

reconciliation of EBIT to EBITA and to income from operations, as

well as a reconciliation of earnings attributable to Vivendi SA

shareowners to adjusted net income, are presented in Appendix IV.4

Non GAAP measures.

Vivendi's Supervisory Board met today under the chairmanship of

Vincent Bolloré and reviewed the Group’s Condensed Financial

Statements for the first nine months of 2016, which were approved

by the Management Board on November 7, 2016.

Revenues increased by 1.3% (+0.6% at constant currency

and perimeter) compared to the first nine months of 2015, reaching

€7,712 million. Revenues were driven by growth across all of

Universal Music Group’s divisions, especially in subscription and

streaming where revenues increased by 64%, as well as by the

growing contribution from operations in emerging markets. Canal+

Group continues to suffer from declining subscriptions to its

pay-TV channels in France1, while its international operations and

free-to-air channels continued their solid performances.

Income from operations amounted to €730 million

(-1.4% at constant currency and perimeter compared to the first

nine months of 2015), an improvement compared to the previous

quarters of 2016. EBITA decreased by 6.9% at constant

currency and perimeter, reflecting the change in income from

operations and the impact of restructuring charges, whereas in the

first nine months of 2015, EBITA notably benefited from litigation

settlement proceeds in the United States at Universal Music Group

and reversals of reserve at Canal+ Group.

Adjusted net income amounted to a profit of

€625 million, up 24.8%. The decline in EBITA was offset by the

increase in income from equity affiliates (+€147 million), the

decrease in income taxes (+€35 million) and the decrease in

minority interests (+€23 million).

In the adjusted statement of earnings, income from equity

affiliates amounted to a €140 million profit, compared to a €7

million loss for the first nine months of 2015. For the first nine

months of 2016, it primarily included Vivendi’s share of Telecom

Italia’s net earnings (+€142 million) for the period from December

15, 2015 to June 30, 2016.

Excluding earnings from discontinued operations, earnings

attributable to Vivendi SA shareowners from continuing

operations, after non-controlling interests (IFRS) amounted to

a profit of €1,177 million, compared to a profit of

€554 million for the same period in 2015. For the first nine

months of 2016, these earnings notably included the capital gain on

the sale of the remaining interest in Activision Blizzard in

January 2016 (€576 million, before taxes) and the net reversal

of reserve related to the Liberty Media litigation

(€240 million, before taxes). For the first nine months of

2015, they primarily included the capital gain on the sale of the

20% interest in Numericable-SFR (€651 million, before taxes).

In addition, income from equity affiliates increased by

€95 million, and provision for income taxes decreased by

€291 million.

For the first nine months of 2016, earnings attributable to

Vivendi SA shareowners amounted to a profit of

€1,175 million, compared to €1,790 million for the same

period in 2015, an unfavorable change of €615 million. In

2015, earnings attributable to Vivendi SA shareowners included

the capital gain on the sale of GVT on May 28, 2015

(+€1,818 million, before taxes of €395 million paid in

Brazil) offset by the capital loss on the sale of Telefonica Brasil

shares (-€294 million). Earnings attributable to Vivendi SA

shareowners per share amounted to €0.92, compared to €1.31 for the

same period in 2015.

As of September 30, 2016, the net cash position increased

to €2.5 billion from €2.1 billion as of June 30,

2016.

5 Canal+, Canal+ Cinéma, Canal+ Sport, Canal+ Séries, Canal+

Family and Canal+ Décalé.

Business Highlights

Universal Music Group signs agreements with

leading streaming players

In music, the kind of strong growth exhibited by subscription

and ad-supported streaming is made possible by a competitive and

healthy market.

Universal Music Group (UMG) plays an active role in fostering

the continued development of new digital services and consumer

offerings. For example, in the third quarter alone, it signed

agreements with streaming players ranging from Pandora (a pure-play

independent digital music company) to iHeartMedia (a leading U.S.

media and entertainment company) to Amazon (a global leader in

e-commerce and cloud-computing). With the addition of these

agreements, UMG has now licensed more than 400 digital services

around the world.

As a result of the continued expansion of streaming, UMG is

developing new opportunities in a number of emerging markets,

including China, Russia, Brazil and Africa. In these territories,

UMG is working closely with Vivendi to grow its presence and

improve the monetization of its library of music-based

entertainment content.

The transformation plan at Canal+ in France

is well underway

To boost its subscriber base, Canal+ Group has redesigned its

offers and its distribution model in France.

It has entered into strategic partnerships with Free and Orange,

as announced by the telecoms operators on September 27, 2016, and

October 5, 2016, respectively, to offer a bouquet of themed

channels to be included in their triple-play packages. This new

distribution strategy enables Canal+ Group to considerably expand

its subscriber base in France while increasing the exposure of the

channels being distributed.

Canal+ Group also introduced completely overhauled offers to be

launched on November 15, 2016. The Canal+ channel will become the

gateway to all new Canal offers. Subscribers will be able to

modularly add themed packages to the Canal+ channel, including

movies and series channels, sports channels and/or the Canal+

channels. All of these offers will be available with or without

commitment. Canal+ Group will also launch a commitment-free premium

offer available only on PCs, tablets and smartphones.

In parallel, Canal+ Group is pursuing the implementation of its

€300 million cost optimization plan for Canal+ in France. The full

effects of the plan are expected to be realized in 2018, with

savings of around €60 to €80 million to be achieved in 2016.

The new Gameloft strategy is in

place

Vivendi successfully completed its public tender offer for

Gameloft shares this summer. An action plan was quickly implemented

in collaboration with Gameloft’s existing teams to maximize the

creative potential of the mobile video games company. An internal

call for projects was opened, resulting in the submission of about

90 proposals. The selected projects will receive the necessary

resources and be allotted the appropriate time to ensure their

development.

Vivendi, which has a long term strategic perspective for

Gameloft, also implemented the practice of “soft launching” the

company’s games. This phase of testing prior to a full-launch is

essential to ensuring that the game will deliver the best possible

user experience.

Gameloft’s strength relies on its large catalog of games,

including approximately 20 titles that account for close to 90% of

smartphone revenues and provide strong resilience in terms of

financial results. Internal licenses as a percentage of sales

continue to grow. The goal is to keep creating new brands every

year and, at the same time, to strengthen the appeal of the

company’s existing brands.

The pace of game releases should accelerate starting in the

fourth quarter of 2016, which should lead to greater sales growth.

In particular, Gameloft recently launched two new games: Zombie

Anarchy and Asphalt Xtreme, at the end of October and early

November, respectively.

Outlook maintained

Universal Music Group’s strong performance over the first nine

months of 2016 enables the confirmation of the outlook announced at

the beginning of the year. The trend toward greater consumption on

streaming and subscription services could lead to a lower

seasonality effect than observed in the past, the impact of which

could be seen in the fourth quarter of 2016.

The important measures undertaken to turn around the Canal+

channels in France (cost optimization plan, launch of new offers on

November 15, 2016) should allow for the attainment of the

objectives set for the channels at the beginning of 2016. The

successfulness of the new offers will be effectively evaluated in

the first half of 2017.

Returns to shareholders

Vivendi’s Management Board has made a commitment to return an

additional €1.3 billion to shareholders by mid-2017 at the latest,

specifying that it would likely take the form of an ordinary

dividend of €1 per share or share repurchases, depending on the

overall economic environment.

Considering the level of share repurchases made between February

18, 2016 and today (41.3 million shares for a total of €722.8

million), the Management Board notified the Supervisory Board that

in 2017 it would propose the payment of an ordinary dividend of

approximately €0.40 per share with respect to 2016, depending on

the overall business performance achieved in 2016. The Group may

undertake share repurchases depending on the overall economic

environment.

Comments on Business Key Financials

Universal Music Group

Universal Music Group’s (UMG) revenues amounted to €3,623

million, up 4.8% at constant currency compared to the first nine

months of 2015 (+3.8% on an actual basis), driven by growth across

all divisions.

Recorded music revenues grew 3.8% at constant currency thanks to

the growth in subscription and streaming revenues (+64.3%), which

more than offset the decline in both download and physical

sales.

Music publishing revenues grew 5.4% at constant currency, also

driven by increasing subscription and streaming revenues, as well

as growth in synchronization and performance income. Merchandising

and other revenues were up 10.8% at constant currency thanks to

stronger touring activity.

Recorded Music best sellers in the first nine months of 2016

included new releases from Drake, Rihanna and Ariana Grande, as

well as carryover sales from Justin Bieber and The Weeknd.

UMG’s income from operations amounted to €391 million, up

42.4% at constant currency compared to the first nine months of

2015 (+40.8% on an actual basis). This favorable performance

reflected the benefit of both revenue growth and overhead cost

savings, as well as a timing-related decline in expenses, which

will pick up with the release schedule.

UMG’s EBITA amounted to €353 million, up 37.4% at constant

currency compared to the first nine months of 2015 (+36.1% on an

actual basis). EBITA included legal settlement income and

restructuring charges in the first nine months of 2016 and

2015.

Canal+ Group

Canal+ Group revenues amounted to €3,902 million, down 3.3%

compared to the first nine months of 2015 (-2.7% at constant

currency and perimeter). Canal+ Group had a total of 11 million

individual subscribers, a year-on-year decrease of 19,000. The

international subscriber base continued to grow strongly, notably

in Africa. In mainland France, the number of subscribers continued

to decline to 5.4 million as of September 30, 2016.

Revenues from pay-TV operations in mainland France were impacted

by the lower subscriber base, despite a slight increase in ARPU.

International pay-TV revenues increased thanks to the growth in the

individual subscriber base, notably in Africa where Canal+ Group

added 505,000 subscribers since September 30, 2015.

Advertising revenues from free-to-air channels, up 9.2% compared

to the first nine months of 2015, benefited from the strong

audiences of C8 (formerly D8) and CStar (formerly D17). At the end

of September 2016, C8 was once again the fourth most watched French

channel with an average share of 4.4% of its primary target

audience of 25-49 year olds.

Studiocanal’s revenues were down compared to the first nine

months of 2015, which notably benefited from the successful

theatrical and video releases of Paddington, Shaun the Sheep and

The Imitation Game. Bridget Jones’s Baby, which has been showing in

theaters in the United Kingdom since September 14, 2016, is

expected to be the country’s biggest box-office movie of 2016.

Canal+ Group’s income from operations amounted to €439 million,

compared to €554 million for the first nine months of 2015, and

EBITA amounted to €427 million (including restructuring charges for

€16 million), compared to €550 million for the first nine

months of 2015. This decline was notably due to the difficulties

faced by the pay-TV operations in mainland France. EBITA from the

Canal+ channels5 in France amounted to a €151 million loss,

compared to €68 million for the first nine months of 2015.

Gameloft

Gameloft’s6 revenues amounted to €63 million for the third

quarter of 2016 and break down as follows: 32% in the EMEA region

(Europe, the Middle East, and Africa), 31% in Asia Pacific, 25% in

North America and 12% in Latin America. As a reminder, Gameloft’s

revenues amounted to €125 million for the first half of

2016.

Gameloft’s sales were up despite the launch of only two new

smartphone games since January 2016: Disney Magic Kingdoms and The

Blacklist: Conspiracy. This solid performance illustrates the

resilience of the business. Disney Magic Kingdoms in particular has

been a stand out since its launch by Gameloft in March 2016,

notably in Japan where the game, which was distributed in

partnership with GungHo, was the most downloaded game on iOS and

Google Play upon its release.

For the third quarter of 2016, Gameloft’s back-catalogue

represented 90% of its sales and benefited from better monetization

of services for existing games and from a more efficient and more

targeted user acquisition policy.

For the third quarter of 2016, Gameloft’s advertising revenues

amounted to €4 million, income from operations amounted to

€4 million and EBITA amounted to €2 million.

Vivendi Village

Revenues generated by Vivendi Village amounted to €78 million,

an increase of 6.6% compared to the first nine months of 2015

(+9.4% at constant currency and -1.8% at constant currency and

perimeter). Over the same period, Vivendi Village’s income from

operations and EBITA amounted to a loss of €9 million. Vivendi

Village aims to serve as an outlet for experimentation and a launch

pad for new projects for the entire Group thanks in particular to

the flexibility offered by small organizational structures.

Watchever launched WatchMusic, a premium music video service for

mobiles, in Brazil on October 6, 2016. It also developed the app

used by Studio+, the first global offer of short premium series for

mobiles operated by Vivendi Content, which was launched in Brazil

on October 17. These two services illustrate the reorientation of

Watchever’s operations towards the development of new global paid

streaming services after the decision was taken to close its

video-on-demand service in Germany by December 31, 2016.

For additional information, please refer to the “Financial

Report and Unaudited Condensed Financial Statements for the first

nine months of 2016” which will be released later online on

Vivendi’s website (www.vivendi.com).

About VivendiVivendi is an integrated media and content

group. The company operates businesses throughout the media value

chain, from talent discovery to the creation, production and

distribution of content. The main subsidiaries of Vivendi comprise

Canal+ Group and Universal Music Group. Canal+ Group is the leading

pay-TV operator in France, and also serves markets in Africa,

Poland and Vietnam. Canal+ Group operations include Studiocanal, a

leading European player in the production, sale and distribution of

films and TV series. Universal Music Group is the world leader in

recorded music, music publishing and merchandising, with more than

50 labels covering all genres. A separate division, Vivendi

Village, brings together Vivendi Ticketing (ticketing in the UK,

the U.S and France), MyBestPro (experts counseling), Watchever

(subscription video-on-demand), Radionomy (digital radio), the

L’Olympia and the Theâtre de L‘Oeuvre venues in Paris, the

CanalOlympia venues in Africa and Olympia Production. With 3.5

billion videos viewed each month, Dailymotion is one of the biggest

video content aggregation and distribution platforms in the world.

Gameloft is a worldwide leader in mobile video games, with 2

million games downloaded per

day.www.vivendi.com, www.cultureswithvivendi.com

Important DisclaimersCautionary Note Regarding

Forward-Looking Statements. This press release contains

forward-looking statements with respect to the financial condition,

results of operations, business, strategy, plans and outlook of

Vivendi, including the impact of certain transactions and the

payment of dividends and distributions, as well as share

repurchases. Although Vivendi believes that such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including, but not limited to, the risks related to

antitrust and other regulatory approvals as well as any other

approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.Unsponsored ADRs. Vivendi

does not sponsor an American Depositary Receipt (ADR) facility in

respect of its shares. Any ADR facility currently in existence is

“unsponsored” and has no ties whatsoever to Vivendi. Vivendi

disclaims any liability in respect of any such facility.

6 Gameloft has been fully consolidated since June 29, 2016.

ANALYST CONFERENCE CALL

Speakers:Arnaud de PuyfontaineChief Executive

OfficerHervé PhilippeMember of the Management Board and

Chief Financial Officer

Date: Wednesday, November 9, 2016

6:00pm Paris time – 5:00pm London time – 12:00pm New York

time

Media invited on a listen-only basis.The conference

will be held in English.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)

Numbers to dial:UK +44 (0) 203 043 2002US

+1 719 325 2453France +33 (0) 1 76 77 22 76

Access Code: 6967507

Numbers for replay:UK +44 (0) 207 984 7568US

+1 719 457 0820France +33 (0) 1 70 48 00 94

Access Code: 6967507

On our website www.vivendi.com will be available dial-in

numbers for the conference call and for replay (14 days), an audio

webcast and the slides of the presentation.

Note: This press release contains unaudited consolidated

earnings established under IFRS, which were approved by Vivendi’s

Management Board on November 7, 2016, reviewed by the Vivendi Audit

Committee on November 8, 2016, and by Vivendi’s Supervisory Board

on November 9, 2016.

APPENDIX IVIVENDICONSOLIDATED

STATEMENT OF EARNINGS(IFRS, unaudited)

Three months endedSeptember 30,

%Change

Nine months endedSeptember 30,

%Change

2016 2015 2016 2015

2,668 2,520 +

5.9% Revenues 7,712 7,615 + 1.3%

(1,629) (1,527) Cost of revenues (4,717) (4,596) (748) (738)

Selling, general and administrative

expenses excluding amortization of intangibleassets acquired

through business combinations

(2,269) (2,219) (14) (36) Restructuring charges (62) (65) (58)

(101)

Amortization of intangible assets acquired

through business combinations

(168) (304) - (1) Impairment losses on intangible assets acquired

through business combinations - (1) - - Reversal of reserve related

to the Liberty Media litigation in the United States 240 - - (7)

Other income 657 711 (3) (34) Other charges (115) (38)

216

76 x 2.9 EBIT 1,278 1,103 +

15.9% 76 - Income from equity affiliates 88 (7) (10) (10)

Interest (27) (24) 6 14 Income from investments 28 35 6 (20) Other

financial income 23 15 (13) (48) Other financial charges (40) (82)

281 12 x 23.6 Earnings from continuing

operations before provision for income taxes 1,350

1,040 + 29.8% (15) (159) Provision for income taxes

(150) (441)

266 (147) na Earnings from

continuing operations 1,200 599 x 2.0 -

(43) Earnings from discontinued operations (2) 1,236

266

(190) na Earnings 1,198 1,835

- 34.7% (2) (11) Non-controlling interests (23) (45)

264 (201) na Earnings attributable to

Vivendi SA shareowners 1,175 1,790 - 34.3%

264 (158) na

of which earnings from continuing

operations attributable to Vivendi SA shareowners 1,177

554 x 2.1 0.21 (0.15) Earnings attributable to

Vivendi SA shareowners per share - basic (in euros) 0.92 1.31 0.18

(0.15) Earnings attributable to Vivendi SA shareowners per share -

diluted (in euros) 0.89 1.31

In millions of euros, except per share

amounts.

Nota:As a reminder, GVT (sold in 2015) has been reported

as a discontinued operation in compliance with IFRS 5. In practice,

income and charges from this business has been reported as

follows:

- GVT’s contribution, until its effective

divestiture on May 28, 2015, to each line of Vivendi’s Consolidated

Statement of Earnings as well as any capital gain recognized has

been reported on the line “Earnings from discontinued operations”;

and

- the share of net income and the capital

gain recognized as a result of the completed divestiture have been

excluded from Vivendi’s adjusted net income.

For any additional information, please refer to the “Financial

Report and Unaudited Condensed Financial Statements for the nine

months ended September 30, 2016“, which will be released online

later on Vivendi’s website (www.vivendi.com).

APPENDIX IIVIVENDIADJUSTED

STATEMENT OF EARNINGS(IFRS, unaudited)

Three months endedSeptember 30,

%Change

Nine months endedSeptember 30,

%Change

2016 2015 2016 2015

2,668 2,520 +

5.9% Revenues 7,712 7,615 + 1.3%

290 257 + 12.8% Income from operations

730 757 - 3.6% 277 219 +

26.5% EBITA 664 735 - 9.7% 102 -

Income from equity affiliates 140 (7) (10) (10) Interest (27) (24)

6 14 Income from investments 28 35 375 223 + 67.3%

Adjusted earnings from continuing

operations before provisionfor income taxes

805 739 + 8.8% (31) (37) Provision for income taxes (149) (184) 344

186 + 84.9% Adjusted net income before non-controlling interests

656 555 + 18.2% (5) (14) Non-controlling interests (31) (54)

339 172

+ 97.3% Adjusted net income 625 501

+ 24.8% 0.27 0.13 Adjusted net income per share -

basic (in euros) 0.49 0.37 0.23 0.13 Adjusted net income per share

- diluted (in euros) 0.45 0.37

In millions of euros, except per share

amounts.

The reconciliation of EBIT to EBITA and to income from

operations, as well as of earnings attributable to Vivendi SA

shareowners to adjusted net income is presented in the Appendix

IV.<

APPENDIX IIIVIVENDIREVENUES,

INCOME FROM OPERATIONS AND EBITABY BUSINESS

SEGMENT(IFRS, unaudited)

Three months ended September 30, (in millions of euros) 2016

2015 % Change

% Change atconstant currency

% Change atconstant currencyand perimeter

(a)

Revenues Universal Music Group 1,308 1,181 +10.8% +11.2%

+11.2% Canal+ Group 1,263 1,300 -2.9% -2.1% -2.3% Gameloft 63 - na

na na Vivendi Village 24 22 +5.8% +12.1% -0.9% New Initiatives 18

17 Elimination of intersegment transactions (8) -

Total Vivendi 2,668 2,520 +5.9%

+6.6% +3.8% Income from operations

Universal Music Group 174 99 +77.0% +74.7% +74.7% Canal+ Group 142

186 -23.5% -23.4% -23.5% Gameloft 4 - na na na Vivendi Village (1)

1 na na na New Initiatives (8) (9) Corporate (21) (20)

Total Vivendi 290 257

+12.8% +11.8% +10.7% EBITA

Universal Music Group 176 88 +98.8% +95.6% +95.6% Canal+ Group 139

162 -14.5% -14.2% -14.4% Gameloft 2 - na na na Vivendi Village (5)

- na na na New Initiatives (11) (9) Corporate (24) (22)

Total Vivendi 277 219

+26.5% +25.2% +25.0%

APPENDIX III

(Cont’d)VIVENDIREVENUES, INCOME FROM OPERATIONS AND

EBITABY BUSINESS SEGMENT(IFRS, unaudited)

Nine months ended September 30, (in millions of euros) 2016

2015

% Change

% Change atconstant currency

% Change atconstant currencyand perimeter

(a)

Revenues Universal Music Group 3,623 3,492 +3.8% +4.8% +4.8%

Canal+ Group 3,902 4,034 -3.3% -2.6% -2.7% Gameloft 63 - na na na

Vivendi Village 78 73 +6.6% +9.4% -1.8% New Initiatives 76 18

Elimination of intersegment transactions (30) (2)

Total Vivendi 7,712 7,615 +1.3%

+2.2% +0.6% Income from operations

Universal Music Group 391 278 +40.8% +42.4% +42.4% Canal+ Group 439

554 -20.8% -20.4% -20.5% Gameloft 4 - na na na Vivendi Village (9)

9 na na na New Initiatives (25) (10) Corporate (70) (74)

Total Vivendi 730 757

-3.6% -2.8% -1.4% EBITA

Universal Music Group 353 259 +36.1% +37.4% +37.4% Canal+ Group 427

550 -22.4% -22.0% -22.1% Gameloft 2 - na na na Vivendi Village (9)

8 na na na New Initiatives (35) (10) Corporate (74) (72)

Total Vivendi 664 735

-9.7% -8.9% -6.9%

na: not applicable.

a. Constant perimeter reflects the impacts of the following

acquisitions:

- Alterna’TV by Canal+ Group (April 7,

2016);

- Gameloft (June 29, 2016);

- Radionomy within Vivendi Village

(December 17, 2015); and

- Dailymotion within New Initiatives

(June 30, 2015).

The reconciliation of EBIT to EBITA and to income from

operations is presented in the Appendix IV.

APPENDIX

IVVIVENDIRECONCILIATION OF NON-GAAP MEASURESIN

STATEMENT OF EARNINGS(IFRS, unaudited)

Income from operations, adjusted earnings before interest and

income taxes (EBITA), and adjusted net income, non-GAAP measures,

should be considered in addition to, and not as a substitute for,

other GAAP measures of operating and financial performance. Vivendi

considers these to be relevant indicators of the group’s operating

and financial performance. Vivendi Management uses income from

operations, EBITA and adjusted net income for reporting, management

and planning purposes because they provide a better illustration of

the underlying performance of continuing operations by excluding

most non-recurring and non-operating items.

Three months endedSeptember 30,

Nine months endedSeptember 30,

(in millions of euros) 2016 2015 2016 2015

EBIT

(a) 216 76 1,278 1,103 Adjustments

Amortization of intangible assets acquired through business

combinations 58 101 168 304 Impairment losses on intangible assets

acquired through business combinations (a) - 1 - 1 Reversal of

reserve related to the Liberty Media litigation in the United

States (a) - - (240) - Other income (a) - 7 (657) (711) Other

charges (a) 3 34 115 38

EBITA 277 219

664 735 Adjustments Restructuring charges (a) 14 36

62 65 Charges related to equity-settled share-based compensation

plans 4 3 9 13 Other non-current operating charges and income (5)

(1) (5) (56)

Income from operations 290 257

730 757

Three months endedSeptember 30,

Nine months endedSeptember 30,

(in millions of euros) 2016 2015 2016 2015

Earnings attributable to Vivendi SA shareowners (a)

264 (201) 1,175 1,790 Adjustments

Amortization of intangible assets acquired through business

combinations 58 101 168 304 Impairment losses on intangible assets

acquired through business combinations (a) - 1 - 1 Reversal of

reserve related to the Liberty Media litigation in the United

States (a) - - (240) - Other income (a) - 7 (657) (711) Other

charges (a) 3 34 115 38 Amortization of intangible assets related

to equity affiliates 26 - 52 - Other financial income (a) (6) 20

(23) (15) Other financial charges (a) 13 48 40 82 Earnings from

discontinued operations (a) - 43 2 (1,236)

Change in deferred tax asset related to

Vivendi SA's French Tax Group and to theConsolidated Global Profit

Tax Systems

1 158 4 104 Income taxes related to the sale of the 20% interest in

Numericable-SFR - - - 124 Non-recurring items related to provision

for income taxes 2 4 46 131 Provision for income taxes on

adjustments (19) (40) (49) (102) Non-controlling interests on

adjustments (3) (3) (8) (9)

Adjusted net income 339

172 625 501

a. As reported in the Consolidated Statement of Earnings.

APPENDIX V

VIVENDI

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(IFRS, unaudited)

(in millions of euros)

September 30,2016(unaudited)

December 31, 2015

ASSETS Goodwill 10,633 10,177

Non-current content assets 2,084 2,286 Other intangible assets 298

224 Property, plant and equipment 671 737 Investments in equity

affiliates 4,213 3,435 Non-current financial assets 2,325 4,132

Deferred tax assets 716 622

Non-current assets 20,940

21,613 Inventories 132 117 Current tax receivables

524 653 Current content assets 1,402 1,088 Trade accounts

receivable and other 2,023 2,139 Current financial assets 873 1,111

Cash and cash equivalents 5,633 8,225

Current assets

10,587 13,333 TOTAL ASSETS

31,527 34,946 EQUITY AND LIABILITIES

Share capital 7,076 7,526 Additional paid-in capital 4,235 5,343

Treasury shares (473) (702) Retained earnings and other 7,960 8,687

Vivendi SA shareowners' equity 18,798 20,854

Non-controlling interests 252 232

Total equity 19,050

21,086 Non-current provisions 1,698 2,679 Long-term

borrowings and other financial liabilities 2,390 1,555 Deferred tax

liabilities 689 705 Other non-current liabilities 105 105

Non-current liabilities 4,882 5,044

Current provisions 333 363 Short-term borrowings and other

financial liabilities 1,626 1,383 Trade accounts payable and other

5,491 6,737 Current tax payables 145 333

Current liabilities

7,595 8,816 Total liabilities

12,477 13,860 TOTAL EQUITY AND

LIABILITIES 31,527 34,946

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161109006038/en/

VivendiMediaParisJean-Louis Erneux, +33

(0)1 71 71 15 84orSolange Maulini, +33 (0) 1 71 71 11

73orInvestor RelationsParisLaurent Mairot, +33 (0) 1

71 71 35 13orJulien Dellys, +33 (0) 1 71 71 13 30orLondonTim

Burt (Teneo Strategy)+44 20 7240 2486

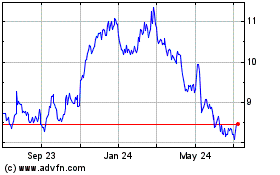

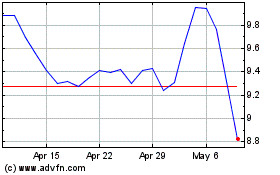

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024